A mandatory standard that allows for comparison between sustainable bonds could outcompete other models.

EU policymakers are currently defining essential details of the EU Green Bond Standard (EU GBS), which could determine the instrument’s position as a leading standard-setter.

The latest EU legislative proposal has shown that the actual shape of the standard, and its possible influence in the global arena, are still up in the air.

After the EU Commission put forward an initial proposal on the EU GBS in July 2021, the European Parliament suggested in turn a draft report with sustainability requirements that were considerably higher at the end of last year. Last month, the EU Committee on the Environment, Public Health and Food Safety (ENVI), which is a committee of the Parliament, submitted its opinion.

The difference between the EU Commission and Parliament’s proposals is so large that it could have a significant bearing on how beneficial the EU GBS could become for investors; and, as a result, on its global influence.

Critics have previously questioned whether the EU GBS will be usable at an international level.

The International Capital Market Association (ICMA), for example, recently noted the risk that the EU GBS may be difficult to apply outside of the bloc. It cited as a reason that non-EU entities follow different development and decarbonisation pathways and “may not be able to report taxonomy alignment information”.

Nevertheless, the same report also highlights that the “EU Taxonomy has created a precedent that many other jurisdictions have followed with around 30 official sector taxonomies now existing or under development”.

While the EU GBS aims to realise the region’s own net-zero transition pathway, it can still function as an international ‘gold standard’.

The argument that the EU GBS’s international usability is expected to be limited – due to reasons such as a lack of investable projects or data availability — may be valid for a certain period of time, in particular the early stages of the economic transition. However, as the transition accelerates, the international usability of the EU GBS may improve given that many nations need to finance their own sustainable finance plans to reach the 2050 net-zero emissions goal.

The future importance of the EU GBS could depend on whether key sustainable features of its concept will or will not be watered down in the upcoming political process, however.

Raising the Status Quo of Standards

ENVI proposes mandatory requirements for all issuers of green or environmentally sustainable bonds, in line with the EU Parliament. The Commission is asked to decide by December 2023 whether to make the EU GBS designation mandatory for all bonds marketed as environmentally sustainable between 2025 and 2028.

Likewise, the committee also suggests credible transition plans for companies and transparency requirements that allow investors to compare the environmental impact of EU GBS bonds with that of other green bonds.

The proposal also sees the European Securities and Markets Authority (ESMA) as a supervisor for registered external reviewers of certified green bonds, and sets out transparency requirements for issuers of other green bonds.

If a proposal similar to ENVI’s is approved, the chances of the EU GBS gaining international influence are likely to be significantly higher. Essentially, it would establish a more trustworthy and credible scheme for the EU GBS at scale, thereby allowing it to outcompete other models and limit greenwashing.

Mandatory usage of the EU GBS would increase investor confidence in a rapidly growing sustainable debt market. It would mean that investors could – in a more liquid market than today – clearly pinpoint and redirect flows to those investments that are likely to be sustainable enough to be able to reach the 2050 net-zero emissions target.

This differs from some existing green bond standards which are voluntary and are more loosely based on principles.

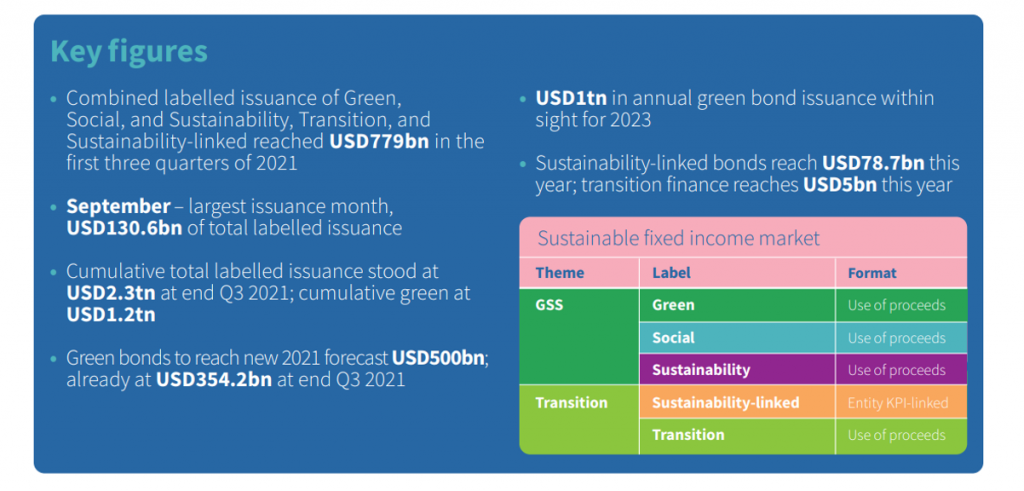

Principle-based standards, such as those from ICMA, have been heralded as practical tools for issuers. They have enabled strong growth of the green, social, sustainability and sustainability-linked bond market, with a cumulative total of $2.3trn at the end of Q3 2021:

Source: Climate Bonds Initiative

Despite this growth, the issuance of green bonds remains at a fraction of the overall bond market. And the extent of their actual environmental benefits remains vague. Investors need to factor in uncertainties that come with voluntary standards, including risks of greenwashing.

Focusing on Sustainable Transition

Whereas principle-based standards provide flexibility to interpret which projects can be deemed sustainable, the EU GBS is more rigid in for example defining the sustainability thresholds that allow for the effective financing of the transformation of economies on their net-zero emissions pathways.

The EU GBS draws on the underlying EU Taxonomy, which provides detailed definitions of what sustainable economic activities of companies are. At the same time, it does not discard those investee companies which are as of today deemed ‘unsustainable’, allowing room for these to transition as well.

ENVI suggests that in line with the previous EU Parliament proposal, companies should issue transition plans. It writes that:

“certified green deal bonds should only be used by issuers that have a credible pathway to reducing their environmental footprint and to becoming sustainable, in particular by aligning their business model with a scenario that maintains global warming under 1,5°C above pre-industrial levels”.

The Parliament’s proposal also excludes the financing of fossil gas-powered energy plants and nuclear power generation, in line with current market practice.

Importantly, ENVI’s approach aims to foster comparability between the EU GBS and other green bonds. The proposal says that “investors should also be provided with the information necessary to evaluate the environmental impact of other green bonds that are marketed as environmentally sustainable”. Such bonds should “disclose the degree to which they contribute to economic activities that qualify as environmentally sustainable”.

On 31 March, the Committee on Economic and Monetary Affairs (ECON) will vote on the proposal and assess whether any of the amendments will be taken into consideration. Once both co-legislators, the EU Parliament and the EU Council, have adopted their positions, they will begin negotiations with the EU Commission.

The EU Green Bond Standard has the potential to evolve into a global premium standard, but only if it establishes a trustworthy model that has clear advantages over existing standards.

Finding the right approach to accomplish that will be crucial and setting mandatory requirements might be key.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG’s Second Party Opinion (SPO) Services to provide sustainability, green and social bonds with a credible and independent assessment of their sustainability quality.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By Elena Johansson, Associate, ESG Consultant, ISS ESG