Introduction

As a concept, Net Zero means reducing greenhouse gas (GHG) emissions to as close to zero as possible, with any balance in emissions being absorbed from the atmosphere, by oceans and forests. At the UN Climate Change Conference (COP 21), countries reached an agreement, popularly known as the Paris Agreement, to limit the rise in temperature to 1.5°C above pre-industrial levels.

The Paris Agreement marked the start of various efforts to move the world towards Net Zero emissions. The Agreement was followed by the formation of alliances, such as the Net-Zero Asset Owners Alliance, Net-Zero Banking Alliance, Net-Zero Insurance Alliance, and Glasgow Financial Alliance for Net Zero, to help industry identify actions to be taken in this area.

The Net Zero Investment Framework, published in April 2021, recommended actions to investors. Standards such as the SBTi Corporate Net-Zero Standard, published in October 2021, aimed to help companies set Net Zero targets. This standard also assesses the credibility and comprehensiveness of the targets set by companies. The UN Race to Zero global campaign received immense success in garnering support: as per September 2022 data available on their website, it mobilized a coalition of Net Zero initiatives representing 11,309 non-State actors including 8,307 companies, 595 financial institutions, 1,136 cities, 52 states and regions, 1,125 educational institutions, and 65 healthcare institutions.

The Global edition of Actionable Insights: Top ESG Themes in 2023, briefly addressed the Net Zero landscape and ISS ESG’s offering of Net Zero data. This Insights post presents more detail on assessing Net Zero data for companies, specifically companies in the Asia-Pacific Region.

ISS ESG Assessments of Net Zero Commitments

ISS ESG assessed 2,650 publicly traded top companies worldwide from high GHG-emitting sectors such as Energy, Materials, Utilities, and Industrials. These sectors are referred to as “priority sectors” due to their high emissions footprint, as defined by the Net Zero Asset Owners Alliance (NZAOA), and thus are important for the transition to a low-carbon economy. The companies assessed for Net Zero commitments also included all companies in the Climate Action 100+ list.

ISS ESG assessed these companies for their publicly disclosed Net Zero commitments, intermediate GHG reduction targets, and decarbonization plans. Analysts carefully examined coverage of a company’s Scope 1, Scope 2, and Scope 3 emissions, including sector-specific relevant Scope 3 categories under the Net Zero target, as well as intermediate GHG reduction targets. Any oil and gas company’s Net Zero target, for example, is expected to cover lifetime emissions from all relevant products sold (Category 11 of Scope 3 emissions).

Net Zero Commitments in the Asia-Pacific Region

An assessment of 1,100+ companies from priority sectors based in the Asia-Pacific region reveals that 30% of companies are committed to Net Zero, and the remaining companies are yet to form comprehensive Net Zero commitments (Figure 1).

Figure 1: Net Zero Commitment Declarations among Companies in Asia Pacific (%)

Source: ISS ESG

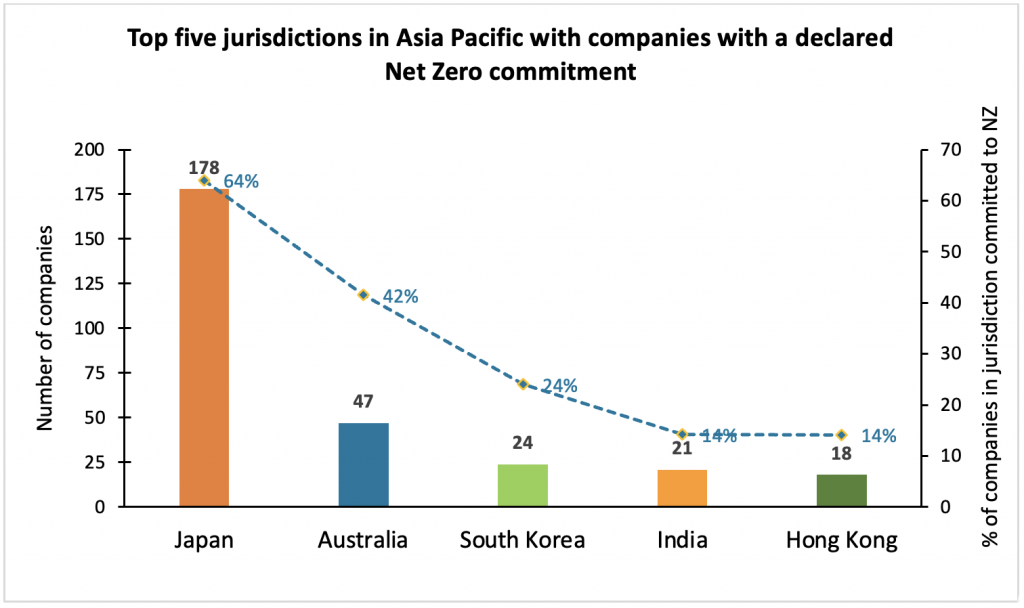

The analysis suggests that two-thirds of the Net Zero-committed companies in Asia-Pacific are from Japan and Australia. This may be due to their governments’ own commitments to Net Zero and the related policy frameworks, which encouraged companies’ commitments. The evaluation found that 64% of Japanese companies assessed were committed to Net Zero, followed by 42% of companies based in Australia that were committed to Net Zero (Figure 2).

Figure 2: Asia-Pacific Companies with Commitments to Net Zero, by Jurisdiction

Source: ISS ESG

China and India are emerging economies in this region that contribute significantly to global GHG emissions. China committed to Net Zero by 2060, and India committed to Net Zero by 2070, both commitments which are 10-20 years beyond the global call for Net Zero by 2050 to limit the global temperature rise to 1.5°C. Given the two countries’ GHG emissions, reaching Net Zero may require companies to set ambitious emissions reduction targets and take robust action to curtail emissions.

Net Zero Commitments among Priority Sector Companies

ISS ESG assessed top companies from high-emissions “priority sectors,” as per the guidance of the NZAOA. These sectors include Energy, Utilities, Transportation, Cement, Aluminum, Steel, and Chemical. ISS ESG also assessed the Capital Goods sector and a limited number of Financial sector companies.

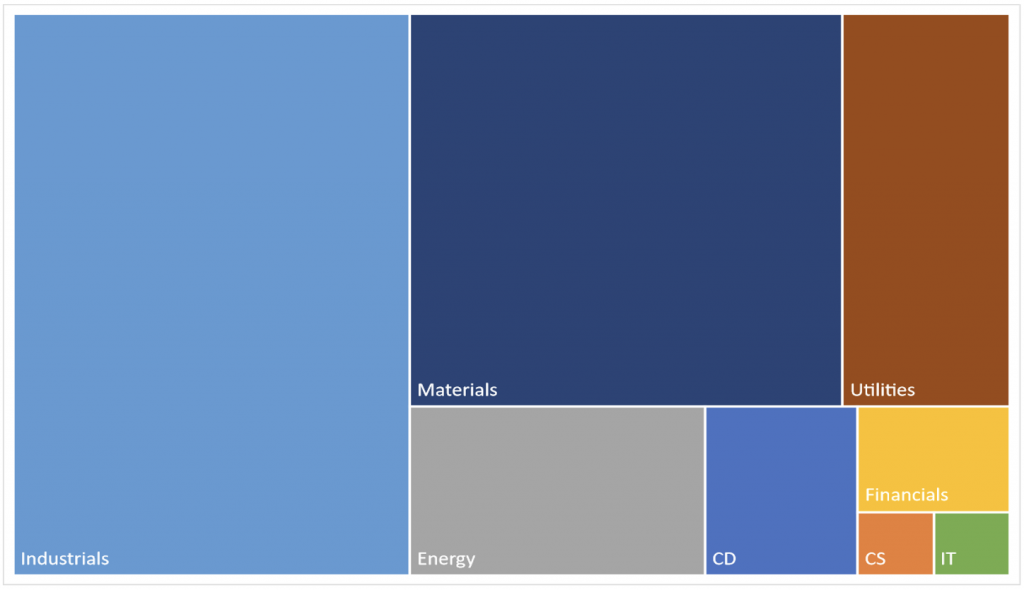

Among Net Zero-committed companies in Asia Pacific, 40% belong to the Industrials sector, 31% to Materials, 12% to Utilities, 9% to Energy, and 8% to other sectors such as Consumer Discretionary, Consumer Staples, Financials, and Information Technology (Figure 3). The companies in these sectors represent approximately 80% of the weighted average carbon intensity (WACI) of global equity indices.

Figure 3: Companies with Net Zero Commitments, by Sector

Note: CD = Consumer Discretionary; CS = Consumer Staples; IT = Information Technology

Source: ISS ESG

The percentages of companies with Net Zero commitments indicate that Energy sector companies are not at the forefront of Net Zero ambition setting, which is a reflection of Asia-Pacific’s reliance on fossil fuels.

Net Zero Commitment Coverage

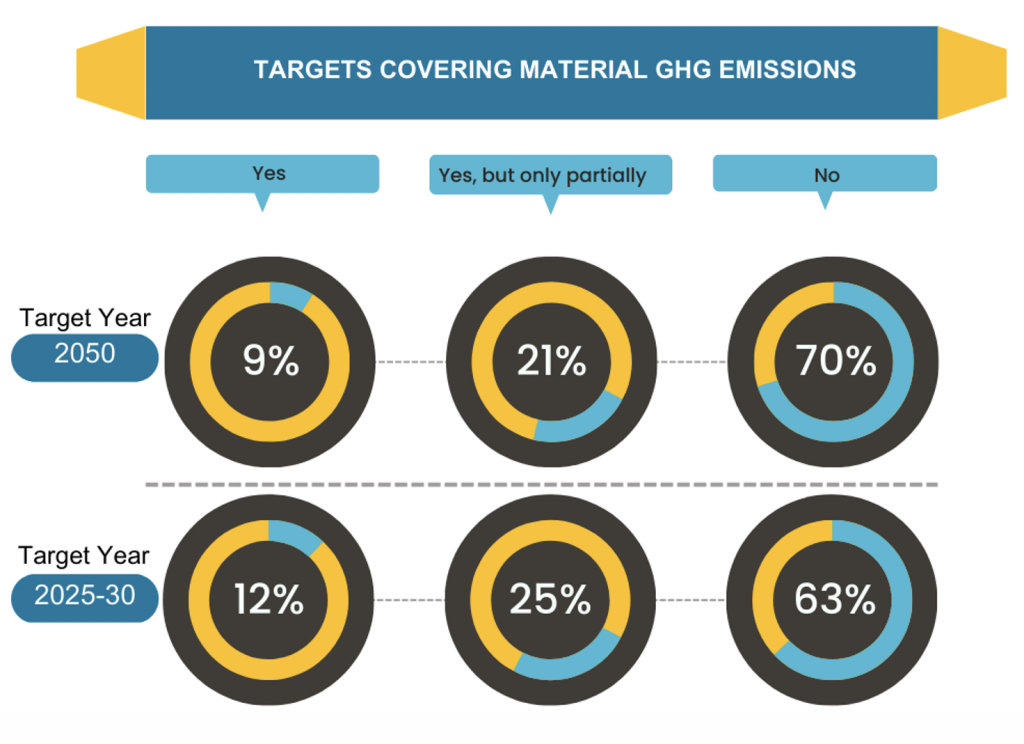

A Net Zero target is considered comprehensive if it covers more than 95% of the Scope 1 and 2 emissions along with those categories of Scope 3 that are material for the sector in which the company is involved. Such a target is in line with the Climate Action 100+ methodology benchmark.

The assessment found 9% (the “Yes” responses in Figure 4 for Target Year 2050) of Net Zero-committed companies covered material GHG emissions associated with their own activities and their value chain, if the latter was required for the sector. In contrast, 21% of companies that are making a Net Zero commitment do not cover most material emissions (“Yes, but only partially” responses in Figure 4). Such commitments are too weak to be considered a serious path towards a low-carbon future. A similar trend was noted in the interim GHG reduction targets of these companies (Figure 4 for Target Year 2025–30).

Figure 4: Companies with Targets Covering Material GHG Emissions

Source: ISS ESG

Decarbonization Strategy to Achieve Net Zero Commitment

Approximately 50% of Net Zero-committed companies disclosed forward-looking statements on decarbonization efforts, such as increased use of renewable energy and reduced use of fossil fuels, identification of energy efficiency projects for product or process innovations, and use of carbon capture projects and carbon offsets for Scope 1 and 2 emissions reduction. Companies also mentioned the use of biomass and hydrogen as alternatives to fossil fuels. For Scope 3 emissions reduction, companies are engaging with their top-tier supply chain partners to promote low carbon practices, assist in sharing best practices, and foster innovation at the industry level.

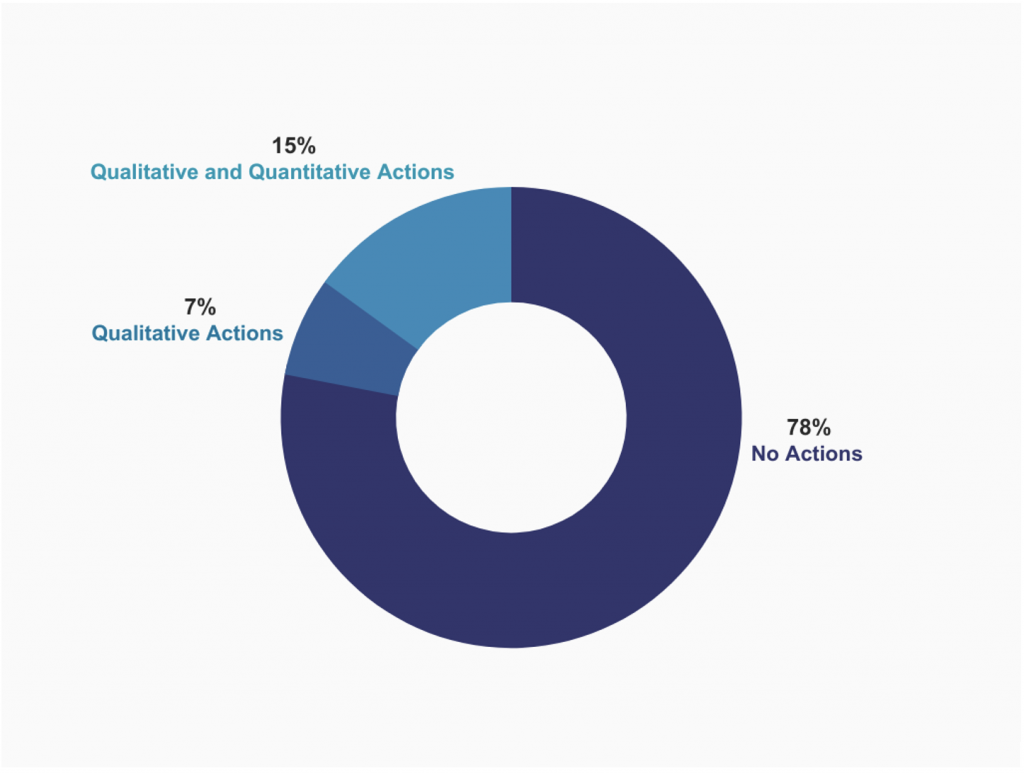

Out of the 1,136 companies assessed from the region, 170 (15%) reported various GHG emissions reduction measures (Figure 5). These companies qualitatively described the reduction measures and provided some quantitative details of the strategy. Another 82 companies (7%) disclosed a few GHG reduction measures and provided only qualitative details related to their strategy. At the same time, 884 (78%) had no Net Zero commitments and thus no clear decarbonization plans.

Figure 5: Net Zero-Committed Companies, with Decarbonisation Strategy Status

Source: ISS ESG

Some companies relied heavily on carbon offsets to show achievement of Net Zero targets. The ISS ESG analysis rejected such claims as inconsistent with Net Zero, however. Under Net Zero, carbon offsets are allowed only for residual emissions, which are hard to abate, as per SBTi methodology.

Net Zero Alignment Status

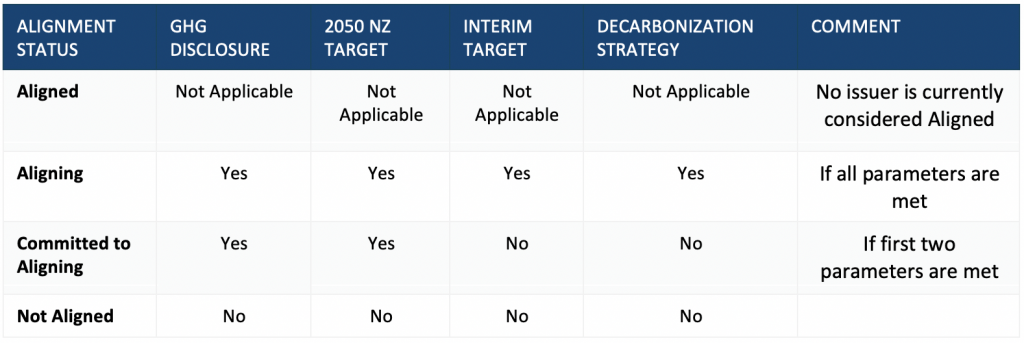

ISS ESG derived the Net Zero Alignment criteria in Table 1 from the Net Zero Investment Framework Implementation Guide (NZIF). The NZIF draws on a company’s disclosure of material GHG emissions, Net Zero ambition by 2050, interim emissions reduction target, and decarbonization strategy. Companies which did not meet these criteria are marked as “Not Aligned.”

Table 1: Net Zero Alignment Status Criteria

Source: ISS ESG

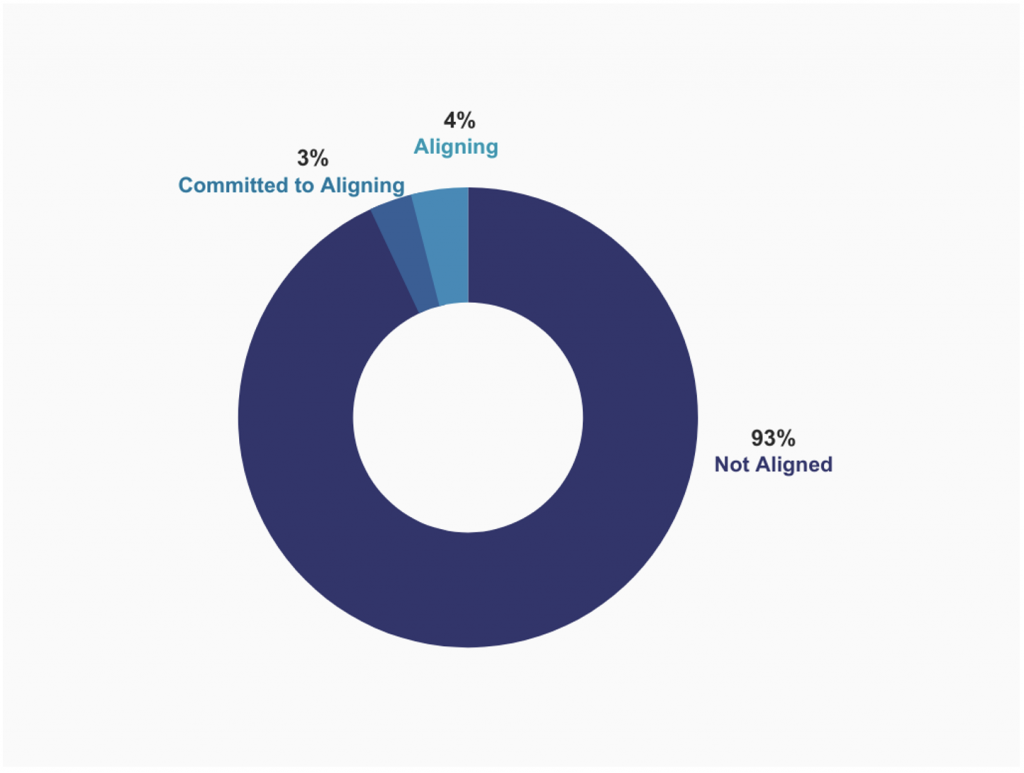

The assessment of Asia-Pacific companies from priority sectors discovered that only 4% of companies are Aligning, 3% are Committed to Aligning (most companies in this alignment are based in Japan), and 93% of companies are Not Aligned (Figure 6).

Figure 6: Asia Pacific: Net Zero Alignment Status of Companies

Source: ISS ESG

When evaluating full Net Zero alignment, ISS ESG has decided to take a conservative approach by not considering any issuer Net Zero Aligned. The current state of corporate disclosure, government policy, and technological development makes it impossible to determine if an issuer fulfills all the criteria necessary to achieve Net Zero Alignment.

Thus, the highest alignment status available to issuers currently is Aligning. This will change as the technological requirements to reach Net Zero become clearer and as issuers start to define clear roadmaps that include specific financial information about how a Net Zero target will be reached.

Conclusion

Analysis of 1,110+ Asia-Pacific-based companies from high GHG-emissions priority sectors shows notable but limited company action to achieve Net Zero. Roughly one-third of assessed companies are committed to Net Zero, with 15% having detailed strategies for reducing emissions. Such information can be useful to ESG investors concerned with climate transition. Tools such as the ISS Net Zero Solutions can support investors as they navigate these issues.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

Authored by:

Amitkumar Vyawahare, Head of ISS ESG Climate Research, India, ISS ESG

Akanksha Chadha, Climate Research Analyst, ISS ESG