There has been a rising tide of net-zero pledges ahead of the upcoming 26th Conference of the Parties (COP26) in Glasgow this November, with over 124 countries already committed. Net-zero action is gaining momentum in the financial world, too. This is the first of a series of pieces exploring the topic. The challenges, opportunities, tools available to investors, and background to the key themes shaping the discussion.

Net-zero is a goal the global community needs to reach quickly. The finance sector, often regarded as the blood supply for the economy, is uniquely positioned to lead this shift and benefit from the opportunities offered by the transition to a low-carbon economy.

Net-zero is beginning to replace “Paris-aligned”, as the main focus, reflecting the shift of aiming to limit temperature increase to 1.5C as opposed to 2C. As the term itself holds a lot of nuances, it is important to understand the science and concepts behind it. The main goal of the Paris Agreement remains the limiting of the catastrophic impacts of climate change. This goal is tied to rapidly halting global temperature rise. As the IPCC’s 2018 special Report on 1.5C stressed, even a 0.5C difference could lead to devastating outcomes for life on earth. Through the modelling of 1.5C consistent pathways, the report showed that achieving this goal with a limited or no overshoot would require global CO2 emissions to reach net-zero by 2050. This means that emissions are reduced to as low as possible, with all remaining unabated emissions removed from the atmosphere.

For investors, the journey starts with commitment. Many net-zero initiatives have developed encompassing all levels of society and industry. The Net-Zero Asset Owner Alliance, the Net-Zero Asset Managers, the Net-Zero Banking Alliance and the anticipated Net-Zero Insurance Alliance form key peer-learning and leadership hubs, importantly, a clear signal to policymakers.

From a practical perspective, net-zero requires accelerated decarbonization across sectors and countries while recognizing that this will happen at different rates. Immense changes are needed both on the demand side of the energy system, transport, industrial, buildings sectors, and on the supply side. The IEA’s long-awaited Net-Zero Emissions by 2050 (NZE2050) scenario, requires that 60% of global car sales are electric by 2030, with no new sales of combustion engine cars by 2035. No new unabated coal power plants approved from now (2021) on. More importantly, both rapid reduction, avoidance and removal are needed as Max Horster, Head of ISS ESG, points out.

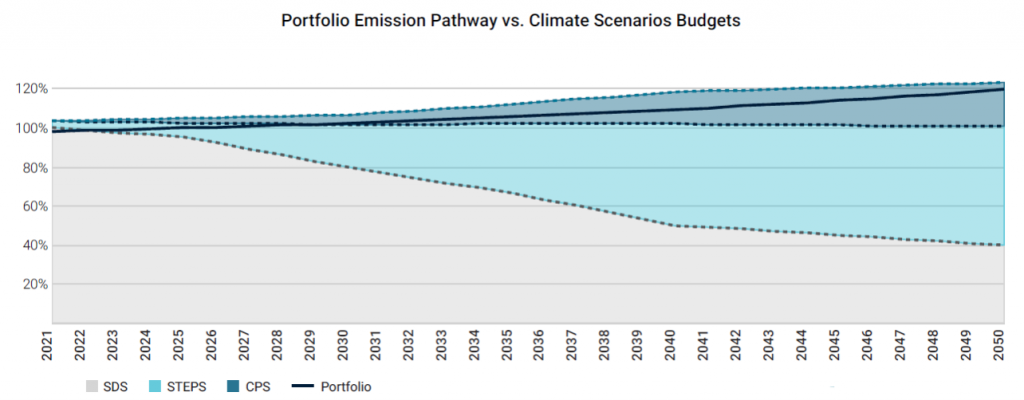

ISS ESG’s scenario alignment analysis provides valuable insight on portfolios positioning in relation to credible decarbonization pathways. Portfolio alignment analysis highlights portfolio temperature trajectories exceeding 1.5C. Granular data is available per issuer, so investors can identify hot spots in their portfolios. As can be seen in Figure 1, a scenario alignment analysis of the Solactive GBS Global Large and Midcap Index, the index is far from net-zero. This type of analysis can be used as a springboard for a net-zero strategy and throughout the investment process. ISS ESG will be including a net-zero by 2050-specific scenario by the end of 2021.

Figure 1, Scenario alignment analysis of Solactive GBS Global Large and Midcap Index, 2021

With such unprecedented transition opportunities, vast investment in climate solutions is needed, with the IMF and the IEA estimating USD +4tn average annual capital investment by the 2030s in cleantech for the energy sector alone. Whilst many mitigation technologies are available at scale, such as solar PV and EVs, others such as industrial carbon capture and storage (CCS) or Direct Air Capture and Storage are in earlier stages. These varying risk-return profiles call for innovation in the financing space including the valuing of future benefits. Quantifying the positive impact through emissions avoidance or reduction is a helpful tool when developing low-carbon and/or climate-friendly products. ISS ESG’s advisory services and product suite, including our EU Taxonomy and Potential Avoided Emissions solutions, can help investors on this journey across asset classes and strategies.

ISS ESG can support investors in identifying the most suitable KPIs, analysis, and data to transition portfolios and set relevant net-zero targets in accordance with the Net-Zero financial sector initiatives. Reaching net-zero has to be underpinned by a credible roadmap of short, medium- and long-term targets in line with the latest science.

In order to ensure that decarbonizing investment and lending portfolios leads to decarbonization in the real economy, net-zero targets need not only focus on GHG reduction alone. The roadmap must include meaningful voting and engagement with both investees and the public domain as the Net-Zero Asset Owner Alliance’s Target Setting Protocol and the Paris-Aligned Initiative’s Net-Zero Investment Framework already stress. Active ownership is a key lever in the investors’ toolkit for achieving net-zero and many are beginning to use it as we have seen with the recent vote at Exxon Mobil. ISS ESG can help investors define and execute climate-specific voting policies based on the ISS Climate Awareness Scorecard (CAS) and comply with net-zero engagement requirements with ISS ESG’s Engagement Solutions.

Credibility is gained through disclosure and transparency which are turning into the norm. The UK Government is bringing forward legislation making climate-related financial disclosure mandatory for both corporates and asset owners. At the same time, the United States’ Securities and Exchange Commission is consulting on incorporating climate and ESG information in standard financial disclosures, in alignment with the TCFD sector-specific recommendations. ISS ESG’s Climate Impact Report provides investors with key metrics and analysis supporting TCFD disclosures. For those new to climate-related financial disclosures, ISS ESG’s Bespoke Analytics team offers a full TCFD report writing service.

As the United Nation’s Race to Zero campaign nicely puts it, Pledge-Plan-Proceed-and-Publish in order to achieve our goal of limiting catastrophic temperature rise. The task at hand is huge, the stakes are high, and we need all hands on deck. Thus, using all the tools available to investors will be key. Wherever you are on the net-zero journey, ISS ESG is able to help.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By Neda Todorova, Associate, ISS ESG, Climate Analytics Consultant. Fredrik Lundin, Vice President, ISS ESG, Head R&D Climate.