India’s long-term asset management story focuses on its favorable demographics, urbanization, digitalization, rising middle class, and consequently the size of investor wallets. These features have arisen during the past decade and will help propel growth for many years to come. India’s rising economic power and fast evolving investment fund market—which is increasingly being driven by retail sentiment—position it as an opportunity that fund managers looking for expansion simply cannot ignore.

Investment fund managers would do well to listen

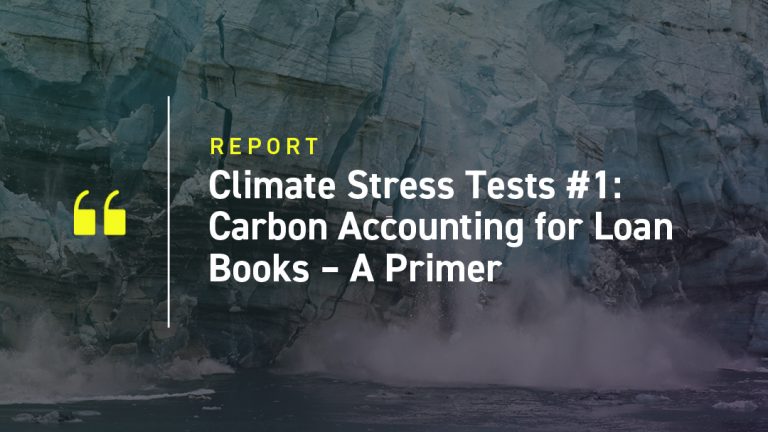

The scene is set for India’s mutual fund industry to roar. India’s evolution over the last decade speaks about its promising future with various metrics trending north. Although the Indian mutual fund industry dates back over 60 years, it is in the last decade that its growth has started to turn heads. Notably, this growth has been driven not just by investment performance, but also by fund flows from an expanding investor base.

Figure 1

Source: ISS MI Simfund

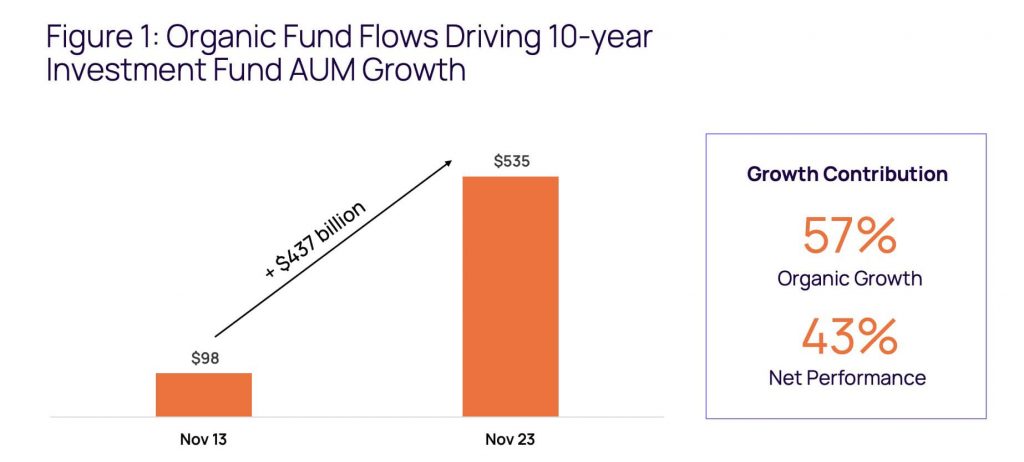

The Indian retail investor has never been more important. Over the past decade, retail investors have seen their share increase to nearly 60% of fund assets under management (AUM) in India. And with the majority of the population still set to reach their peak accumulation years, there is no reason to expect anything except that retail investors will drive further expansion in the business. Directed efforts at financial inclusion, digitalization, government incentives, and a longer-term trend of rising middle-class disposable incomes are also channeling savings to the investment funds industry. Against a backdrop of rising inflation, households are motivated to seek higher returns beyond rates offered by fixed deposits.

Figure 2:

Source: AMFI

Room for one more?

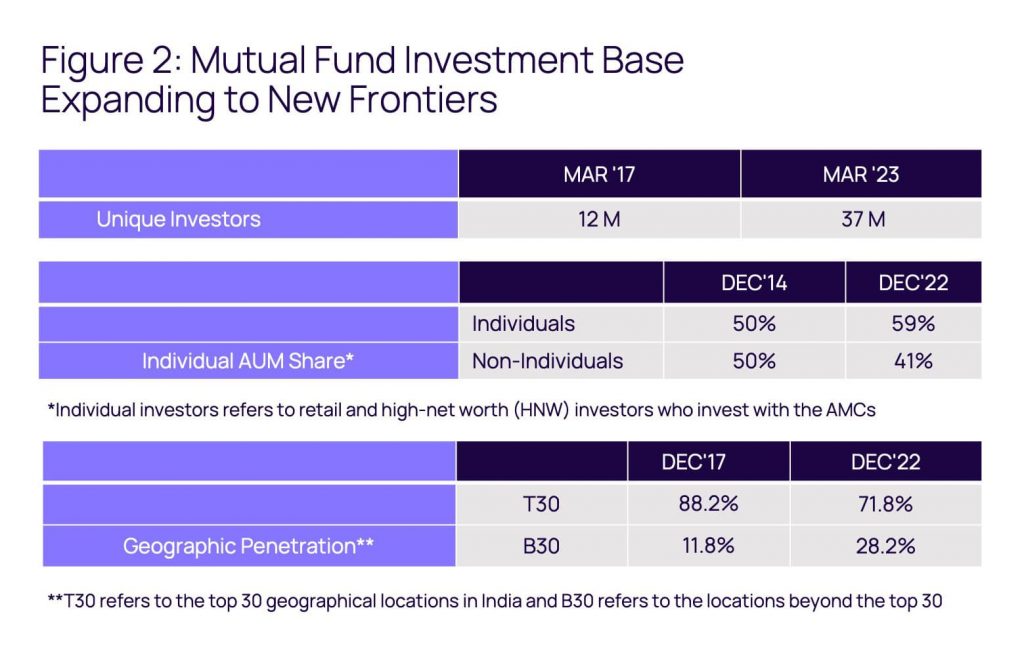

An expanding investor base, however, has not yet shaken up the fund manager leaderboard. For those fund managers yet to make an impact in the Indian market, it is worth noting that it is a concentrated business, with the leading five players accounting for almost 55% of the market share. Mimicking many other markets around the globe, the industry is dominated by a number of bank associated fund managers. Indeed, five of the top 10 fund managers are owned by a related banking entity. That said, there are several international asset management companies that have established their presence through joint ventures, further enriching the domestic industry.

Figure 3

Source: ISS MI Simfund. Data as of November 2023

India, however, has proved a tricky market for many international fund manager stalwarts, though not all have had this experience. Franklin Templeton has built a nearly 20-year track record, whereas others such as Fidelity, Goldman Sachs, and BlackRock have entered and exited at one point.

At the heart of the challenge is distribution.

US-based BlackRock’s decision to re-enter the market following its exit in 2018 from the DSP Group is illustrative. Reemerging as Jio BlackRock, the world’s largest asset manager has joined forces with Reliance Industry’s financial arm Jio Financial Services Limited with a much different strategy aiming to provide digital investment solutions.

Phygital distribution models emerge as advice needs “human touch”

Growing AUM and the entry of more players to tap into untouched potential investors offers a unique opportunity for distributors to penetrate unexplored markets and maximize their distribution coverage. The distribution landscape in India has evolved over the last six decades, resulting in increased competition from online platforms, forcing mutual fund distributors and advisors to revamp their client value proposition.

Figure 4

The advent of online platforms that enabled easy investment in direct mutual fund plans, or those not sold through a distributor, had raised questions about the future of distributors. If you can buy a mutual fund with the click of a button, from the comfort of your home or office, who needs a distributor? But for many retail investors, investing is not just about the ease of transacting; what many investors also want is personalized advice. The question is, in what form does that advice need to be delivered? And that is where mutual fund distributors come in. As per FY23 data from CAMS, a leading transfer agent in India, AUM of mutual fund distributors still accounted for the highest growth in absolute terms vs. other channels.[1]

Having “feet on street”, and physical branches / ATMs, has proved pivotal to the growth of banking sector in India. The advent of online banking and broader digitization efforts has forced many banks to think hard about optimizing their branch networks, although physical branches still exist and continue to service clients who prefer a human touch.

Will fund distribution and advice see a similar trend? Early signs of “co-existence” or emergence of phygital models are already being seen as emotional handholding and complex advice also needs trusted human advisors.

Multiple online platforms which started off as do-it-yourself platforms such as FundsIndia, Scripbox, InCred Money, and the largest distributor NJ India Invest, are already building out an omnichannel offering, allowing for both online and physical channels to thrive. In order to scale up their existing B2B model, FundsIndia will rely on a network of on-ground distributors to sell mutual funds to customers. The firm has also hired Manish Gadhvi, who was previously a senior official at NJ India Invest, India’s largest MF distribution firm by commissions received.

Based on how various actors are positioning themselves, it appears that many are intent on success whether or not investors are looking for a human touch. Regardless of what form of advice Indian retail investors gravitate to most strongly, creating economies of scale will be a necessity if the wealth management business is to accelerate its growth.

Beyond traditional wealth management

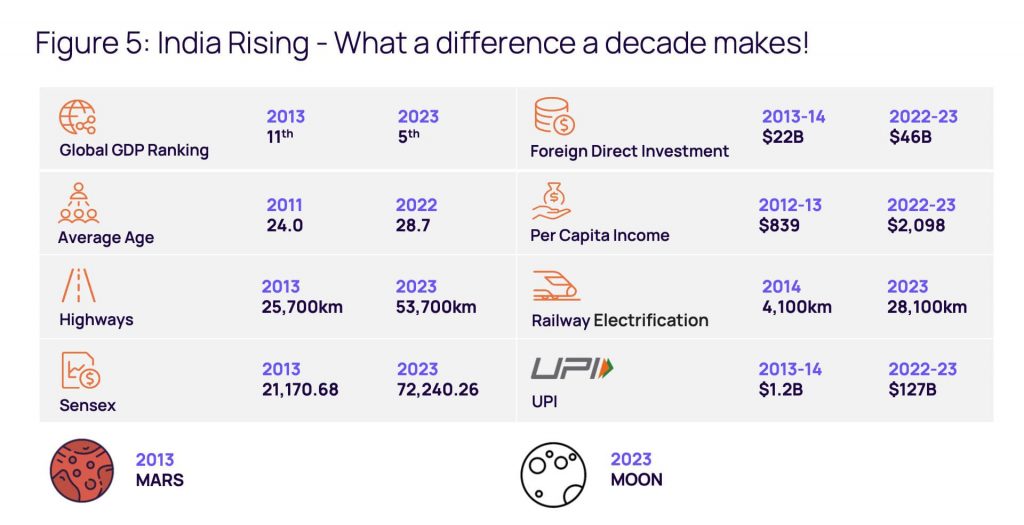

The changes and growth in India of the past decade, however, extend far beyond wealth management and encompass growth in government policies, scientific achievements and sports.

Figure 5

Sources: Government of India, International Monetary Fund, CIA World Factbook and Morgan Stanley

None may be more important though, at least from the perspective of a wealth management firm, than the India stack—a Digital Public Infrastructure (DPI) established through a public-private partnership. DPIs are interoperable digital building blocks with open standards and specifications that institutions and organizations can use to offer different services. With the help of India Stack—a comprehensive digital identity, payment, and data-management system—the country is at the forefront of providing accessible services and drive financial inclusion.

Of particular interest to many internal and external observers is the Account Aggregator (AA) functionality that has been built into the consent layer of the India Stack. This functionality allows investors to easily share their data with chosen financial services providers and thus lowers both the barriers to clients engaging new providers and for service providers to address clients’ needs in a more holistic fashion. Financial advisors, for example, are being able to shift their focus from investment consolidation activities to providing a more personalized, and data driven, investment experience.

The next digital revolution for financial services in India is the adoption of the Open Network Digital Commerce (ONDC) framework. ONDC is a framework that is designed to create a level playing field for product and service providers by setting common standards and creating an open marketplace that will allow for small and upstart players to compete with more established and well capitalised competitors. With the implementation of the ONDC framework and the development of the AA functionality, India’s financial services market, including investment fund distribution, looks set for disruption. More providers will likely be able to access more client data than ever before. Innovation will almost certainly be the result.

Hold on to your hat

While the fundamentals are there for India to become a major investment fund market, challenges remain. Beyond the question of whether India can navigate the well-documented challenges associated with the middle-income trap, there are challenges to India’s investment fund market, chiefly whether households can be persuaded of the benefits of investing in investment funds. Reserve Bank of India’s data suggests that the ball has been set in motion with an average household’s stake in mutual funds on the rise. This stake, measured as the share of household financial assets invested in mutual funds, increased by 150% from 2020-2022.[2]

The regulation of investment funds needs to be on the radar of prospective entrants. Certainly, 2018 proved to be a challenging year for the industry as it restructured itself with a new categorization process followed by the ban of upfront commissions, a measure that has only recently been implemented in developed markets. With upfront commission schemes often associated with the spread of investment funds in more nascent markets, distribution in India will need to be watched closely. Without this line of revenue, will India see the development of a strong non-bank independent advice channel? Regulatory reforms coupled with outflows from Foreign Portfolio Investments (FPIs) the same year, have meant that investment fund flows have yet to reach their 2017 highs. Existing rules limiting the ability of domestic investment funds to investing overseas could serve as an additional constraint on the business, particularly if the performance of India’s equity markets trail off compared to global markets.

India’s mutual fund market may prove to simply be too tempting and too much of a significant opportunity to be ignored. The cat is out of the bag. India’s economic rise is clear for all to see. The question now is whether the tiger’s roar will attract a crowd, or scare off those who have not already entered.

Talk to us today and learn where your next opportunity may lie.

Notes:

[1] For more information see: https://cafemutual.com/news/industry/30451-individual-mfds-report-the-highest-aum-growth

[2] Reserve Bank of India

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader ISS Market Intelligence

Shankar Lakshman, Associate Director, Global Market Intelligence Research