The world celebrates the International Day of Peace on September 21 annually. The commemoration was initiated in 1981 by the United Nations (UN) to raise public awareness regarding peace and the issues surrounding it. Peaceful, just, and inclusive societies are embodied in Sustainable Development Goal (SDG) 16 of the 2030 UN Agenda for Sustainable Development. Target 16.1 specifically calls for the reduction of all forms of violence and related death rates everywhere. While the aim of the International Day of Peace is to promote the cessation of ongoing conflicts for a day, peace cannot be achieved simply by foregoing the use of arms. Peace entails the development of a society where every member feels safe and can flourish while maintaining their individuality.

Wars and other conflicts raise considerable financial and sustainability risks for investors. The Russia-Ukraine war has highlighted once more the significant impact of conflicts on the investment community. While investors cannot of course influence whether a country goes to war, the Principles for Responsible Investment (PRI) notes that in case of war investors have a duty to change their risk weightings, and potentially withdraw investments. This offers a potentially powerful tool in terms of influencing the willingness of combatants to initiate or sustain a conflict.

Further, as per a study by the Institute of Economics and Peace, conflicts and violence cost the world more than $14 trillion a year through items such as:

- military and security expenditure;

- UN Peacekeeping missions;

- deaths and destruction associated with conflict and terrorism; and

- the importation of arms.

The report further states that the effects of conflicts on a country include higher unemployment; lower foreign direct investments; and higher interest and inflation rates – important factors for the sustainable development of states and thus relevant from a responsible investors’ perspective.

The Impact of War on Sovereign Debt

Conflicts can have a devastating impact on sovereign debt and default rates. Amidst the ongoing crisis arising from its invasion of Ukraine, Russia defaulted on its sovereign debt for the first time in a century, at least partly driven by Western sanctions. Such defaults are not a recent phenomenon. Further examples include the conflicts between Iran and Iraq from 1980 to 1988, followed by the Gulf War of 1990 to 1991. Iraq accumulated considerable debt during the Iran-Iraq conflict. When it later faced sanctions during the Gulf War, however, the once thriving Iraqi economy was completely isolated from the global economy and by 1994 its debt to GDP ratio was over 1000%.

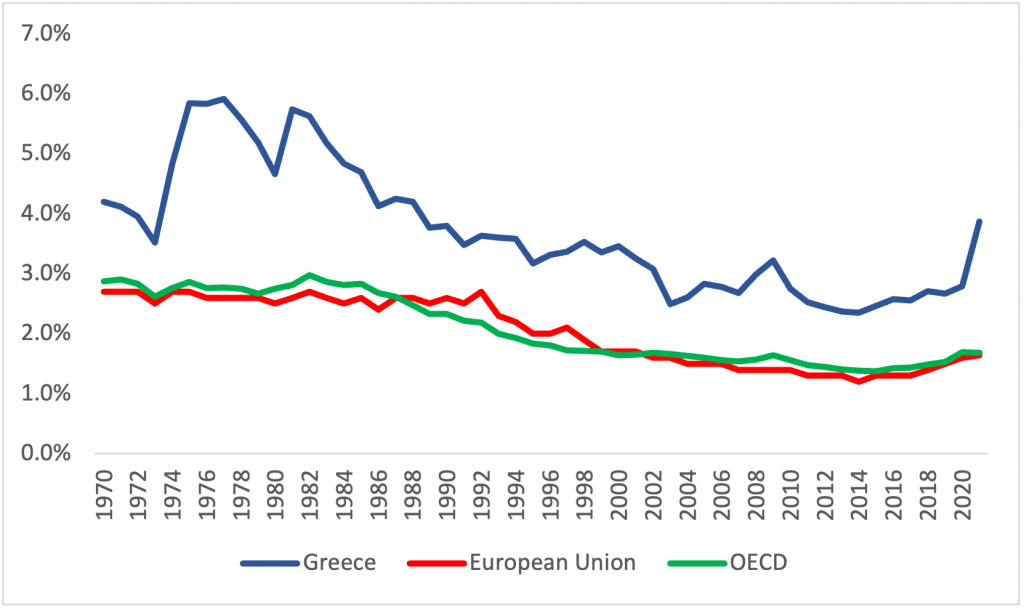

High military spending to fund conflicts can also lead to a negative impact on a country’s economy and society. A more recent example of this is associated with the Greek debt crisis starting in 2010. While military expenditure was by no means the sole contributor to this crisis, it did play a role in raising the sovereign debt of the country over several years before the crisis, particularly through the import of weapons. Greece had been facing economic problems since the 1980s, yet it kept military expenditure high as compared to its peers due to ongoing political conflicts with Turkey. Although its sovereign debt continued to increase, Greece maintained high levels of military expenditures – considerably higher than its peers in the European Union (EU) and Organisation for Economic Cooperation and Development (OECD) – see Figure 1 below.

Figure 1: Military Expenditure of Greece, EU and OECD (% total GDP)

Source: Data from the Stockholm Institute of Peace and Research (SIPRI), 2021

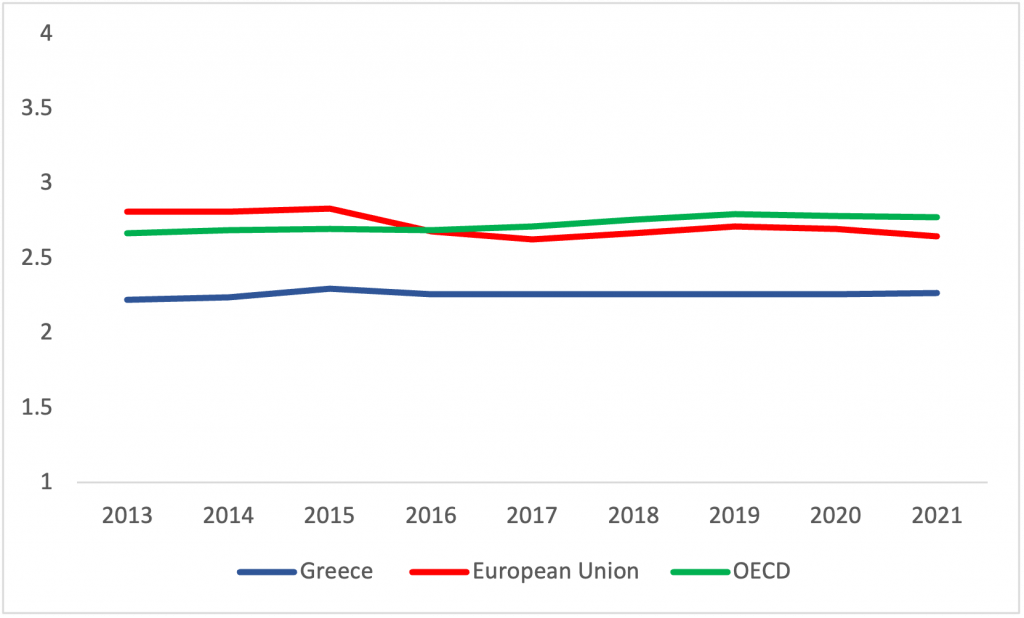

The country visibly reduced its military expenditure as part of austerity measures implemented between 2010-2019, but it still remained much higher than comparable economies. As Figure 2 below shows, Greece’s score in the social pillar of ISS ESG Country Ratings remains persistently lower than that of the EU and OECD, indicating an overall lower quality social security system as well as a greater risk of social inequality.

Figure 2: Greece’s Social Score remains well below the Social Scores of the EU and OECD

Source: ISS ESG Country Ratings Data

While it is impossible to assert with confidence that the country would have fared better had it had lower military expenditures, it is reasonable to ask whether the money spent on arms and the military could have instead supported the failing Greek social security systems.

The Impact of War on Societies

Countries involved in conflicts tend to allocate greater amounts of their national expenditure to defense-related items such as military personnel and equipment. According to the Stockholm International Peace Research Institute, global military expenditure passed the $2 trillion mark for the first time in 2021, despite the ongoing COVID-19 pandemic.

A study by Brown University found that although military spending may have positive short term effects on the economy, there were few spill-over effects into other areas of the economy, and its long-term benefits continue to remain limited. The study found that in the long run the private sector would have benefited significantly more from government investment in public infrastructure, compared to the short-term effects of military expenditure. Military expenditures were found to crowd out government spending on infrastructure as well as on social security systems such as public healthcare.

Another study has recently looked at the impact of high defense expenditures during the pandemic on the US economy. The report found that while defense spending may lead to economic growth in absolute terms, spending on infrastructure would also have boosted US economic growth, as well as improving the country’s ability to generate long term economic growth in order to manage public debt.

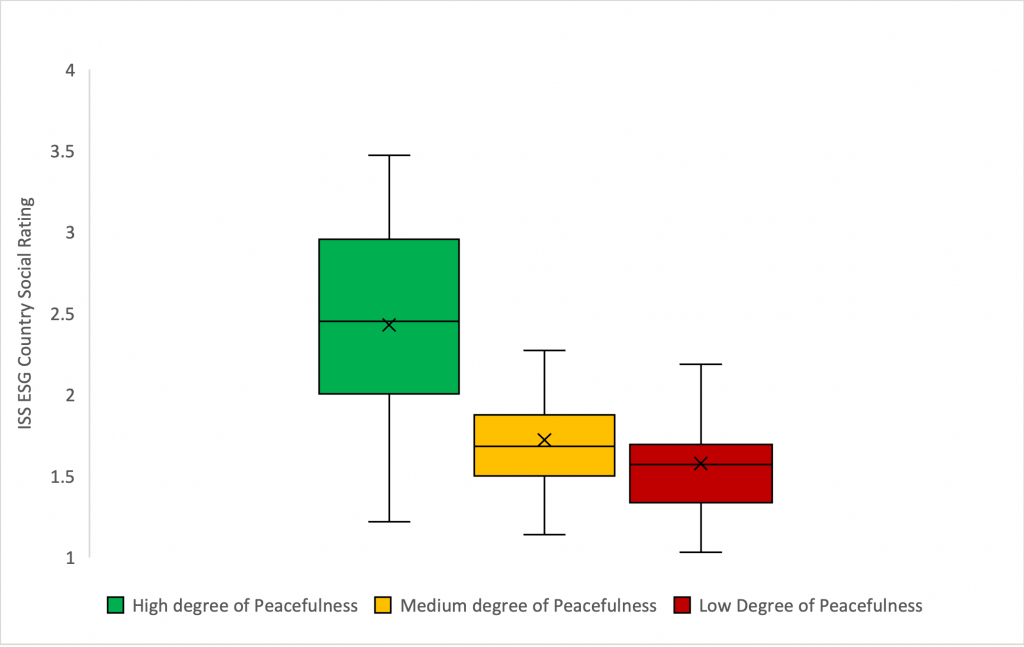

Regions with conflicts often experience significant negative economic and social outcomes: people lose employment and become impoverished; vulnerable groups are excluded or sidelined; and basic needs and civil and political rights are threatened. Figure 3 below demonstrates that countries with higher levels of conflicts as classified by the Global Peace Index generally score lower in the social pillar of the ISS ESG Country Rating.

Figure 3: Countries Involved in Conflicts Score Worse in the ISS ESG Country Social Rating Compared to Countries living in Peace

Source: ISS ESG Country Ratings, Data on Scale of 1 (worst rating grade) to 4 (best rating grade); Global Peace Index

Moving away from conflict and towards more peaceful societies can be seen to have long lasting benefits for the lives of citizens. Research suggests a reduction in arms spending and a pivot to public investment in productive activities such as infrastructure and social safety nets can result in economic as well as social prosperity.

Key Take-Aways for Investors

A country’s involvement in violent and non-violent conflicts may have implications for their investment risks regarding potential sovereign defaults. Further, investors interested in generating impact and supporting positive outcomes associated with the UN-backed Sustainable Development Goals will be interested in fostering peace, as conflicts continue to act as a hinderance to sustainable development.

The global economy will benefit in the long run when states do not need to spend their financial resources on weapons and military personnel, but can instead invest in public infrastructure and an adequate social security system. A more stable geopolitical environment should be high on the priority list for responsible investors – not just on the International Day of Peace, but every day.

Explore ISS ESG solutions mentioned in this report:

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

By: Punkhuri Kumar, Country Rating Analyst, ISS ESG

Shivani Raheja, Country Rating Analyst, ISS ESG