Executive Summary

- Transition to a Net Zero economy was found to carry a significant additional cost for the UK financial system of about £290 billion in a late-action scenario. The expected drag on profitability was not found to threaten banks and insurers’ solvency, however.

- If transition is not achieved and the anticipated rise in negative climate events plays out, a pronounced reduction in lending and insurance availability is likely to hit end consumers, resulting in escalating losses in the mortgage market.

- Climate risk modelling techniques and methodologies are at an early stage, which contributes to uncertainty. BOE noted the limited scope to critique, calibrate, and validate third-party models’ data and output.

- Scarcity of readily available models that can forecast physical risk beyond flood and cyclone events may lead to corporate loss estimates being understated by up to 40%.

- Reliable data on key factors, such as scope 3 emissions or the location of physical assets, has become a priority for the sector. Lack of data inhibits the ability to fully measure and manage climate risk. BOE will support coordinated initiatives to fill data gaps.

- Clear government climate change policy is paramount: it is in the UK financial system’s and the collective interest to support the transition to a Net Zero economy.

- The CBES was a learning exercise and will not lead to changes in capital requirements. It enabled faster implementation of the Supervisory Statement SS3/19, which requires firms to capture and capitalise for climate-related financial risks, if material.

The outcomes of the CBES will inform the UK Financial Policy Committee’s approach to system-wide issues. It will also drive the committee’s work in supporting the economy’s transition to Net Zero, as well as informing the Prudential Regulation Authority (PRA)’s supervisory policy and approach.

Introduction

The Bank of England (BOE) has recently released the aggregate results from its 2021 Climate Biennial Exploratory Scenario (CBES). The CBES covers the UK’s largest banks and insurers and aims to gauge the magnitude of financial risks the UK financial system could face from the physical effects of climate change, in the context of a transition to a Net Zero economy.

The stress test followed and adapted three 30-year scenario paths designed by the Network for Greening the Financial System (NGFS), which explore transition and physical risks. Two of the scenarios featured alternative pathways to Net Zero UK greenhouse gas emissions by 2050: Early Action (EA) and Late Action (LA). The third scenario, No Additional Actions (NAA), where no further policies are actioned and temperature rise remains unchecked, leads to heightened physical risks.

The CBES was designed as one potential representation of events in various climate paths. It does not have an impact from a supervisory point of view, as it was not devised to set capital requirements. It was intended rather as a learning exercise where good practices and gaps were identified.

OUTCOME OF THE CBES

Scenarios

The EA and LA transition scenarios each achieve Net Zero by 2050. In the EA scenario, global warming is limited to 1.8°C by 2050 and 1.5°C at the end of the century, whereas in the LA scenario the temperature remains limited at 1.8°C after 2050. The NAA scenario focuses on the physical impact of policy responses failing to be enacted worldwide, which involves sea-level and global precipitation changes as well as a rise in extreme weather events.

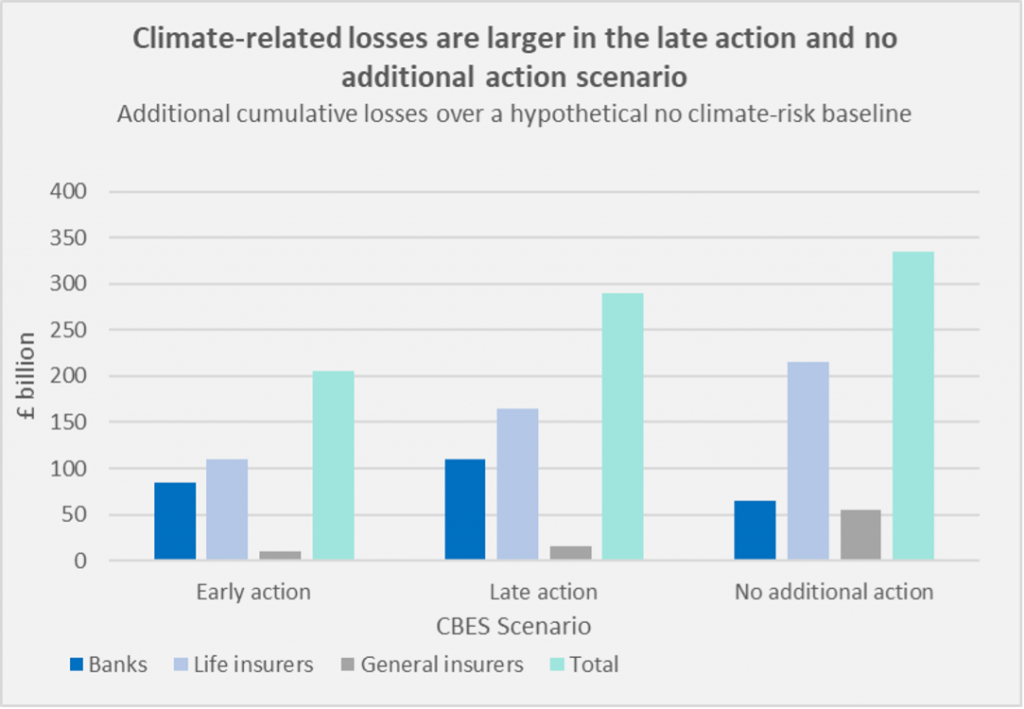

Both banks and insurers identified the same carbon-intensive sectors as being most at risk, and in the NAA the concentration of losses due to floods was also consistent. As expected, the NAA scenario involves the most losses for the system overall (Figure 1). Projections show that climate-related losses will be minimized if action is taken early, as per the EA scenario. The pressure of the LA scenario transition would add £90 billion of costs to the system.

Figure 1: Climate-related losses per scenario and participant type

Source: Bank of England, Results of the 2021 Climate Biennial Exploratory Scenario (CBES)

There is some level of uncertainty in the degree of the risks assessed due to a multiplicity of approaches and assessment techniques.

Banks

Analysis of the impact on banks focused on realized credit losses. The LA scenario resulted in losses that were more than double the baseline (no cost related to climate risk), adding over £110 billion of losses over the period, amounting to a total of £225 billion.

The transition to Net Zero scenarios resulted in substantial corporate losses, around double the baseline loss, as the carbon price increases hit. Mortgage exposures losses, modest in the EA transition scenario, rose significantly in the LA scenario to +160% versus the baseline. This was due to higher unemployment, general house price depreciation, and households having to bear the cost of retrofitting for energy efficiency, leading to pressure on their ability to repay their mortgages.

Aspects of the scenario analysis related to physical risk were found to result in lower corporates losses than those associated with transition costs. Insurance coverage against physical damage was a partial mitigant to losses. BOE suggest this was due to the lack of good tools for the thorough assessment of physical risks. Based on BOE’s own calculations, impairment rates could increase by 40% and be equivalent to a LA impairment level. In contrast, mortgage portfolio losses compared to LA in magnitude and were highly concentrated: 45% of the impairments stemmed from 10% of postcodes, the most flood-prone areas.

Insurers

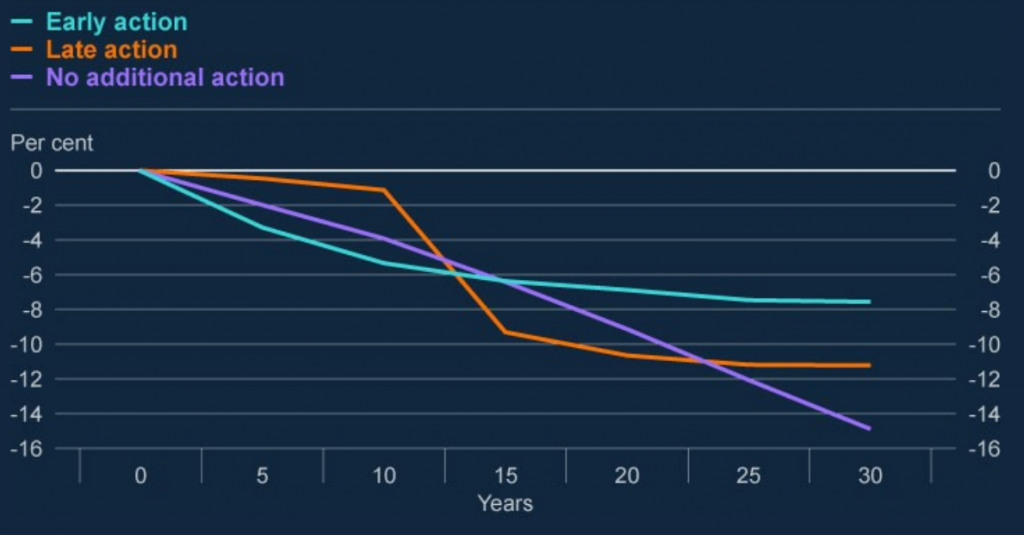

The NAA scenario is likely to generate significantly more losses than the transition scenarios. Insurers’ assets record a cumulative 15% loss in market value, twice the EA rate (Figure 2), a loss mostly borne by life insurers (about 10 times the asset balance of general insurers). General insurers’ losses are due to a rise in physical risks, in particular higher claims for flood and wind-related damage. UK and international general insurers projected a rise in average annualized losses of around 50% and 70%, respectively, by the end of the NAA scenario.

Figure 2: Projected investment losses are largest in the NAA scenario (Change in Market Value of insurers’ invested assets)

Source: Bank of England, Results of the 2021 Climate Biennial Exploratory Scenario (CBES)

Insurers reported that the impact of these increased claims would fall on households and businesses through higher insurance premiums or through lower availability of insurance coverage. Under the stress levels modelled, 7% of households could be left without insurance coverage. Where households are most exposed to physical risks, access to re-mortgage finance would be limited due to falling house prices and unattainable insurance coverage. Similar to the finding for banks, losses were concentrated geographically, with 10% of UK postcodes accounting for two-thirds of total loss increases.

The projected losses are expected to have a varied impact on different finance sector activities. BOE performed its own analysis and concluded losses for life insurers could be up to 50% higher than those submitted in the LA and NAA. For general insurers, projected losses could also be significantly higher, with BOE noting that UK liabilities could be up to four times higher than those projected for some participants.

Qualitative outcomes

The qualitative questionnaire allowed participants to consider climate risk in a holistic and strategic way that examined governance, planning, and opportunities.

Banks and insurers are integrating climate risk into their existing governance and reporting framework. For example, most insurers have already integrated climate scenarios into their own risk and solvency assessment (ORSA). Banks have started implementing the ‘three lines of defense’ risk management approach, which shares accountability and responsibility among business, risk, and audit functions.

Further enhancements are possible, such as providing more quantitative metrics than qualitative statements. This can only happen as more data becomes available and standard metrics are developed, however.

While banks and insurers identified the most at-risk sectors, the capability to measure risk levels differs across the CBES participants. For example, the observed widespread reliance on a small number of third-party models, and the limited scope to validate and adapt such models to the CBES, were limiting factors. Risk appetite is suppressed and assessments are hindered by a lack of standardized data to back the measurement, evaluation, and modeling of climate risk.

Ensuring consistent, quality data and sharing good practices will help climate risk modeling and management to mature.

New opportunities

Most participants have a transition plan in place and are beginning to assess their businesses and operations through a transition lens. Transition offers business opportunities. New products to support the transition have been put forward by participants.

Banks plan to include discounted financing for home energy efficiency, electric vehicle finance, and green mortgages, as well as supporting corporate borrowers with credible transition plans. Growth areas for insurers relate to the insurance of innovative technologies from renewable energy to battery and fuel cell technology. Additional pockets of opportunities would be dependent on improved disclosure. Opportunities may be less profitable if competition to invest in the same greener assets and products intensifies.

The CBES highlights the importance of strategic engagement with counterparties to support transition, instead of simple divestment. Some sectors and corporate borrowers are likely to struggle to raise finance during the transition, and this raises questions about the repercussions on the sector, on consumers, and on the financial system. It therefore requires careful consideration and clear government policy.

Supervisory action

The CBES outcomes will inform the UK Financial Policy Committee’s approach to system-wide issues. It will also drive the committee’s work in supporting the economy’s transition to Net Zero, as well as informing the Prudential Regulation Authority (PRA)’s supervisory policy and approach with its supervised firms.

As highlighted above, continued improvements in governance, risk management, and disclosures can assist in adapting to the climate transition. The CBES has been beneficial in this respect as it facilitated the implementation of the Supervisory Statement SS3/19, which articulates PRA’s expectations of how banks and insurers should incorporate climate risks into their risk management practice, and describes how material climate risks should be included in current capital frameworks. Banks use Pillar 1 and firm-specific add-ons under Pillar 2A. The insurance sector does not have an equivalent Pillar 2A add-on, however.

In its October 2021 Climate Change Adaptation report, PRA recognized that regime gaps may lead to material climate risks not being fully captured. Focusing on a one-year horizon and relying on historical data for calibration will understate the future climate risks for banks and insurers both. The PRA has not formulated specific climate buffers, and climate-specific methodology amendments could require further policy change. Therefore, further analysis by the PRA and BOE is anticipated, to determine if the existing regulatory framework should be amended and to what extent.

CONCLUSION

CBES’ results suggest that the financial system is sufficiently capitalized to adapt to the climate transition. The findings incorporate a degree of uncertainty, something which was to be expected due to the nascent climate risk stress testing field.

Data is the cornerstone of good modeling and risk management. Yet it remains the greatest issue in climate risk methodologies and the barrier to establishing standardized quantitative climate risk metrics within the banks’ risk frameworks.

Physical risk assessments and scope 3 emissions are some of the gaps in data that were noted in the CBES results. Where data or projections are supplied or proxied by third parties, the challenge is to understand and validate the models. Adaptability is thus key. This applies not only to models’ ability to flex scenario parameters, but also to the type of portfolios analyzed and the scope of future stress testing exercises.

How is ISS ESG able to help?

ISS ESG provides a full suite of climate-data analytics and ESG-related services. These include the following:

- Climate and Emissions data: In March 2022 ISS ESG won a competitive tender relating to the supply, usage, and disclosure of climate-related data under a framework agreement developed by the Eurosystem Central Banks.

- Transition value at risk, which measures the cost of transition as a forward-looking, returns-based analysis.

- Physical value at risk, revealing the company value at risk per hazard (six in total included) and per scenario.

- Assistance in developing Net Zero strategies.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By: Patricia Pérez Arias, Climate Stress Test Lead, ISS ESG