The Greenhouse Gas Protocol defines Scope 3 emissions as those in a company’s value chain that are beyond the direct control of its operational and financial authority (also called “other indirect emissions”). ISS ESG anticipates that Scope 3 emissions will be a key topic of interest for the investment community.

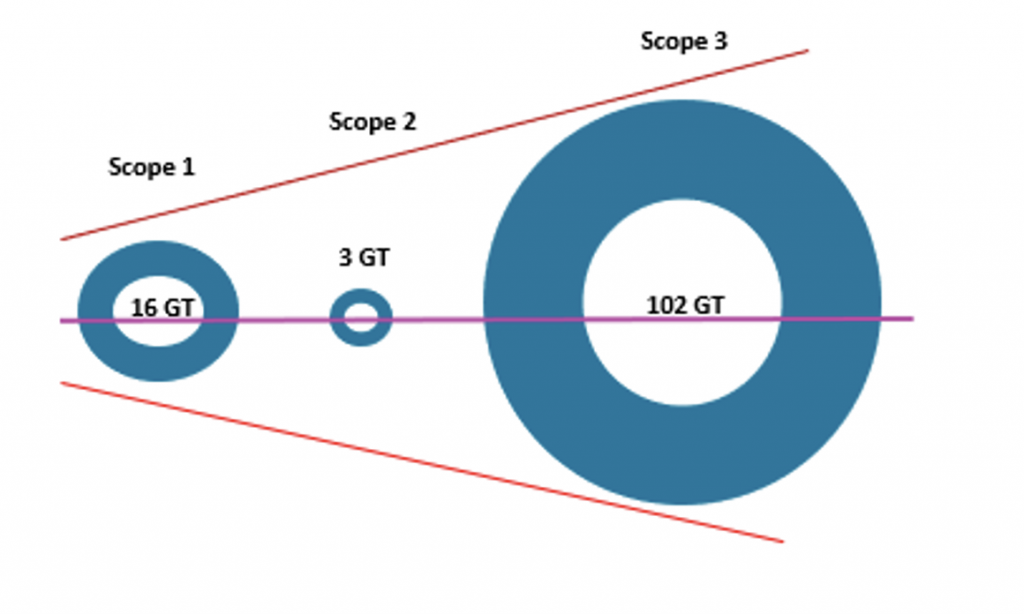

Scope 3 represents the largest emissions category for the majority of companies, including companies from emissions-intensive industries (Figure 1). From a “scale of impact” standpoint, Scope 3 amounts to more than 5 times as much in emissions as combined Scope 1 and Scope 2 emissions for companies in the ISS ESG Climate universe. As a result, Scope 3 presents the most significant opportunity to influence emissions reductions in order to achieve a variety of business objectives – including Net Zero Targets.

Figure 1: Scale of Impacts of Scope 1, 2, and 3 Greenhouse Gas Emissions

Note: GT = giga tonnes.

Source: ISS ESG (15 Feb 2023)

The rate of corporate disclosure for Scope 3 emissions has been very low in comparison to Scope 1 and Scope 2 reported emissions, for a variety of reasons, including the availability of data from corporate value chains. This limited disclosure poses a challenge for investors who view these corporations through the lens of various reporting standards and initiatives that are becoming more important as the world moves towards a low-emissions economy.

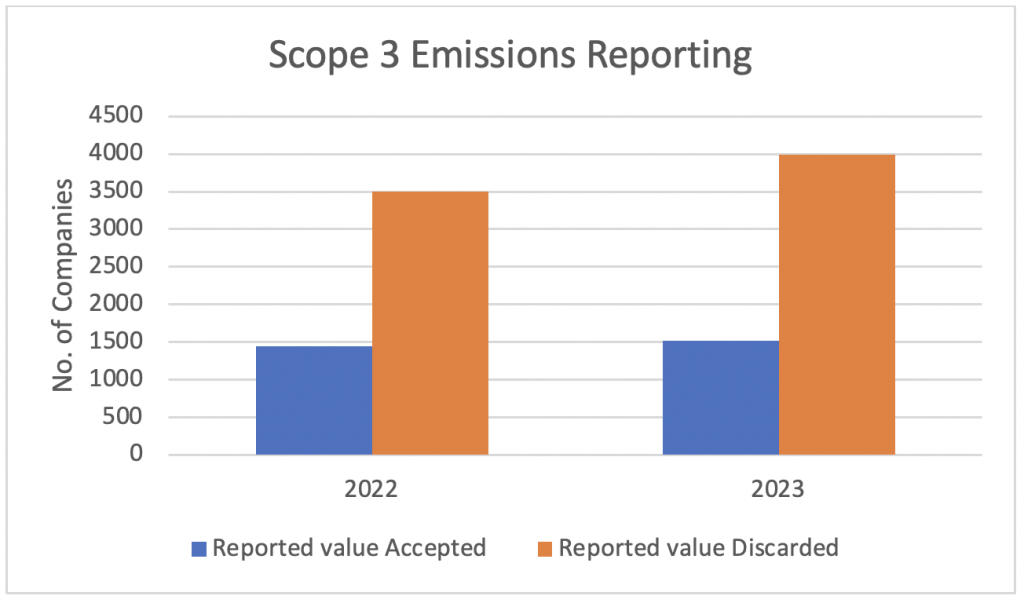

Figure 2 highlights the poor quality and quantity of Scope 3 disclosure, with ISS ESG discarding around 70% of the reported Scope 3 numbers from 2022 and 2023 because of various quality issues, the most common of which is the failure to include all relevant Scope 3 categories. In contrast, the data for company-reported Scope 1 and Scope 2 emissions for both these years has a discard rate of just 1%. Unlike reported figures for Scope 1 and 2 emissions, the quality of Scope 3 data has not improved from 2022 to 2023.

Figure 2: Reported Emissions: Volume and Quality

Source: ISS ESG (15 Feb 2023)

Regulatory Landscape

Over the past decade, investors have become increasingly conscious of the impacts of climate change on their investments, and hence the demand for high-quality emissions data has increased manyfold. This increased demand has led to the creation of initiatives that collectively encourage corporations to publish transparent, granular, and standardized information about the impact of climate change.

ISS ESG’s experience over the last 15+ years has been that the voluntary landscape acts like an incubation facility for the regulatory initiatives that follow, and early adopters of voluntary initiatives are well prepared for regulatory implementation.

2023 will see some key regulatory efforts relevant to the inclusion of Scope 3 reporting come into effect. Table 1 provides a quick overview of a selection of these initiatives and their stance on Scope 3.

Table 1: Frameworks and Scope 3 disclosure recommendations

| Regulatory body | Details about Scope 3 disclosure | Expected timelines | Alignment to TCFD |

| SEC | If Scope 3 emissions are material, or an entity has set a GHG reduction target on its Scope 3 emissions, then the companies are expected to report Scope 3 emissions. | FY23 to FY25 | Yes |

| ISSB (IFRS) | Details are awaited; however, they are expected to align with TCFD recommendations. | TBD | Yes |

| EFRAG | Reported Scope 3 categories should cover approximately 80% of total Scope 3 emissions, including Scope 3 targets for 2025 and 2030. On January 5, 2023, the Corporate Sustainability Reporting Directive (CSRD) entered into force. The draft standards which govern CSRD reporting are being developed by EFRAG. | FY23 | Yes |

| Regional Regulators – U.K., Hong Kong, Japan, and others | In November 2020, the U.K.’s chancellor of the Exchequer announced an intention to mandate climate disclosures in line with TCFD recommendations. This was followed by an announcement from Hong Kong in December 2020 for TCFD-aligned climate disclosures to be made mandatory. Also, the Japanese Stock Exchange published a revised Corporate Governance code, requiring listed companies to improve climate-related disclosures as per TCFD recommendations. | Country-specific timelines; 2025 is seen as a common benchmark | Yes |

Source: ISS ESG

These regulatory advancements signal the provisioning of relief in the form of a safe harbor from liability for Scope 3 emissions and, for smaller companies, exemptions from Scope 3 disclosure requirements. These efforts may prove an important step towards availability of standardized comparable corporate data.

SEC Proposal on Scope 3 Disclosures

The U.S. Securities and Exchange Commission (SEC)’s announcement in March 2022 regarding climate disclosures has been a central topic of discussion among ESG investors, so it may be prudent to dig deeper into the guidance with respect to Scope 3 disclosure. The SEC rules make the following recommendations for the companies:

- Disclose the Scope 3 GHG emissions and intensity, if material, or whether the company has set a reduction target or goal which includes Scope 3 emissions.

- Set a phase-in period, including an additional phase-in period for Scope 3 emissions disclosure owing to its complexity. This implies that for big companies, most reporting requirements kick in for FY 2023, but the Scope 3 disclosures do not have to be included in reporting until FY 2024. (Small reporting companies [SRC] will be exempt from Scope 3 emissions disclosure requirements.)

- Include approximations for the most recent quarter, in addition to actual data for the first three quarters, when the reported data is not readily available for annual disclosure.

- Align with EPA requirements of Scope 3 disclosure for underlying categories, with clear reference to the GHG protocol.

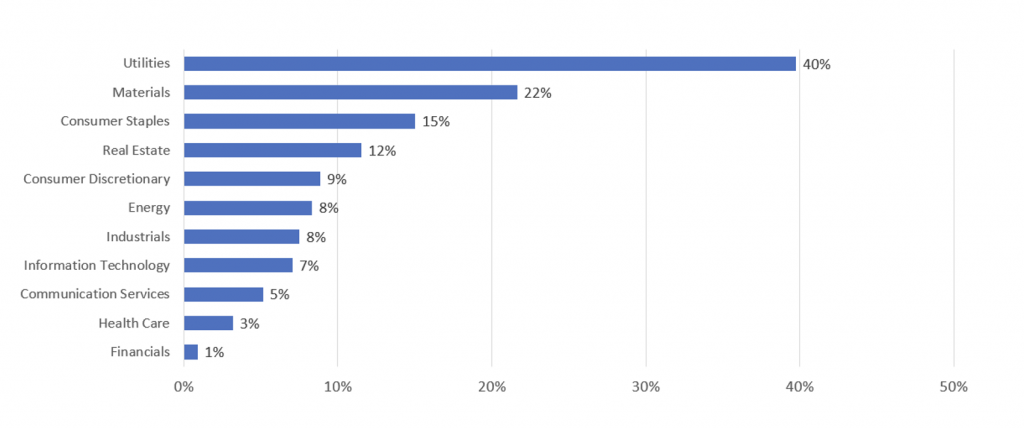

Figure 3 highlights, by sector, the number of U.S. companies that have begun to report Scope 3 emissions. Similar to global trends, the percentage of U.S. companies disclosing Scope 3 emissions is relatively low. For example, in the most recent year of reported emissions data, fewer than 1% of U.S. companies in the Financials sector adequately disclosed Scope 3 emissions in a way that met ISS ESG’s quality control standards.

Figure 3: Reported Scope 3 Emissions for U.S.-Headquartered Companies, by Sector (2023)

Source: ISS ESG

While disclosure standards develop, the regulatory landscape on Scope 3 inclusion continues to expand, with all recent regulations having a common basis in TCFD recommendations. The relevance of Scope 3 is further highlighted by Net Zero initiatives recommending the inclusion of all material GHG emissions (relevant Scope 3 categories in addition to Scope 1 and 2).

Scope 3 – What to Expect in Coming Years

What is expected for Scope 3 emissions disclosures, and what roles can different stakeholders play in these future developments? Regulatory interventions, voluntary initiatives, and an enhanced sense of value chain risks could be crucial in helping various stakeholders step into transparent and standardized Scope 3 reporting. Over the next couple of years, corporations and investors can start navigating Scope 3 reporting parameters, before the milestone year of 2025, when regulatory and voluntary initiatives expect companies and investors to start reporting these values in their public disclosures.

Scope 3 reporting faces challenges but can also benefit from tools and solutions available to address these challenges in the short- and medium-term. Investors may wish to pay particular attention to the following conditions:

- Evolving approaches to disclosure: As more companies start to report on their Scope 3 emissions, investors could see disclosures that include outlier values, partial coverage, and over-simplified approximations or are otherwise deficient. For FY 2021, ISS ESG research indicated that a significant number of companies have restated their Scope 3 reported values for previous years, a practice resulting from methodological changes or the evolution of calculations in response to changing industry standards and guidance. Given the evolving nature of disclosure, investors may wish to rely on quality-checked data from ISS ESG Climate Solutions, which would ensure that questionable values are discarded from the final data set.

- Quantification of Scope 3 emissions would enable companies to establish emissions reduction targets across all scopes. The availability of target information across all scopes will be key for future investment decisions. Investor initiatives such NZAOA require that investors report on and engage with their investee companies in regard to Scope 3 emissions.

- More companies reporting on Scope 3 would provide more data points and enable comparability and standardization of reporting within industry peer groups. The next couple of years offer an important opportunity to standardize (and examine the relevance of) various Scope 3 categories. Once regulatory and compliance requirements kick in, investors can make important investment decisions based on the reported values. Such investor engagement could play a key role in pushing companies further towards transparent reporting across Scope 3 categories.

- Accurate reporting on Scope 3 is difficult and requires long-term engagement with stakeholders across the supply chain. In the near team, companies should accept usage of broader approximation techniques, such as Input Output Models and a Lifecycle Analysis approach, to model Scope 3 emissions. Although these approximations may not be entirely accurate, they provide valuable insights into the scale of Scope 3 emissions’ impact.

The time leading up to FY 2025 reporting may well see numerous discussions regarding the applicability, relevance, and accuracy of Scope 3 emissions, as regulators adopt more definite climate reporting requirements. ISS ESG Climate Solutions can help investors to understand and track the risk associated with non-reporting companies and to make informed choices. ISS ESG further supports investors to engage with investee companies about disclosures and emissions targets through the Net Zero Thematic Engagement Solution.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with ISS ESG’s Norm-Based Engagement Solution and Thematic Engagement Solution.

Authored by:

Harshpreet Singh, Global Head of Climate Research, ISS ESG

Amitkumar Vyawahare, Head of Climate Research, India, ISS ESG

Sam Schrager, Head of US Climate Analytics, ISS ESG