Introduction

Malus and clawback provisions allow companies to recover and/or withhold sums or share awards in specific circumstances[1], such as in situations where values were paid inappropriately or based on inaccurate or misleading information. These policies aim to mitigate excessive risk-taking that certain remuneration plans may incentivize.

All New York Stock Exchange (NYSE) and Nasdaq Stock Market (Nasdaq) listed companies had until December 1, 2023, to adjust their remuneration polices to comply with new clawback rules mandated by the Securities and Exchange Commission (SEC), the SEC Clawback Rules[2].

This report examines how US companies responded to this requirement, as interpretated by the ISS US-Benchmark Research team. The review analyzes the number of companies that had changes in their clawback policies in 2024 compared to what they had in place in 2023.

Regulatory Background

Section 954 of the Dodd-Frank Act requires the SEC to direct national exchanges to prohibit the listing of any security of an issuer that is not in compliance with the SEC’s requirements for recovery of incentive-based compensation received in excess or under an accounting restatement.

In order to implement the provisions of Section 954, the SEC adopted in October 2022 the ‘SEC Clawback Rules’ which were enforced by both NYSE and Nasdaq through a publication of new listing standards in February 2023.

Among the provisions, the main changes proposed by the US exchanges were:

- To adopt a compliant clawback policy by Friday, December 1, 2023[3].

- To disclose their clawback policy in their first annual report filed after December 1, 2023 .

- To disclose in their proxy statements all activity to recover erroneously awarded compensation during the last completed fiscal year.

- To review existing employment contracts considering equity, bonus and other incentive plans and deferred compensation to comply with the new requirements.

- To store data related to current and former executive officers if the recovery of erroneously awarded compensation is necessary.

- To implement internal controls to comply with financial reporting requirements.

These rules are applicable to all listed companies, including foreign private issuers, smaller reporting companies, emerging growth companies, controlled companies, and issuers of debt and other nonequity securities, but it exempts certain registered management investment companies[4].

Failure to comply with NYSE and Nasdaq’s listing requirements could expose the issuers to suspension of trading and delisting.

How US Companies Responded to the SEC Clawback Rules in the 2024 Proxy Season

Important distinction between ISS and the SEC Clawback Rules

This report analyzes how US based companies reacted to the SEC Clawback Rules (in effect since December 2023) with the methodology of the ISS US-Benchmark Research team.

While the SEC’s Clawback rule requires companies to include a clawback provision on all performance-based compensation elements, ISS Benchmark expects inclusion of clawback clauses for time-based incentives[5] as well.

For these reasons, some of the reports analyzed in this review were categorized as “not considered robust” by ISS but would be considered adequate under the SEC Clawback Rules resulting from the Dodd-Frank legislation.

Scope of the Analysis

The scope of this article encompasses the analysis of all Benchmark reports from US-based issuers, available until October 2024[6], that had a resolution to approve executive compensation proposals in both 2023 and 2024 AGMs.

In addition, only reports with disclosures about the clawback clause in the remuneration report section were taken into account.

There were a total of 2298 issuers that fit this selection criteria.

Results

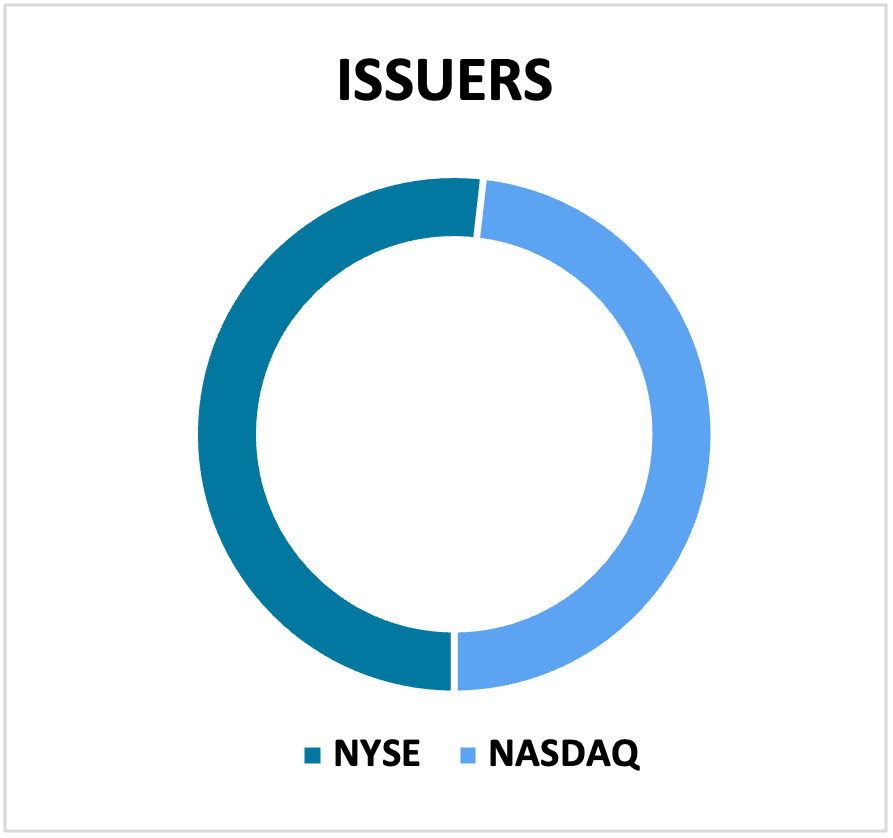

From those 2298 issuers, 51.6% were listed in NYSE and 48.0% in NASDAQ. A very small fraction were from other exchanges (including foreign issuers incorporated in Canada but listed in the United States).

Source: ISS Governance Research & Voting

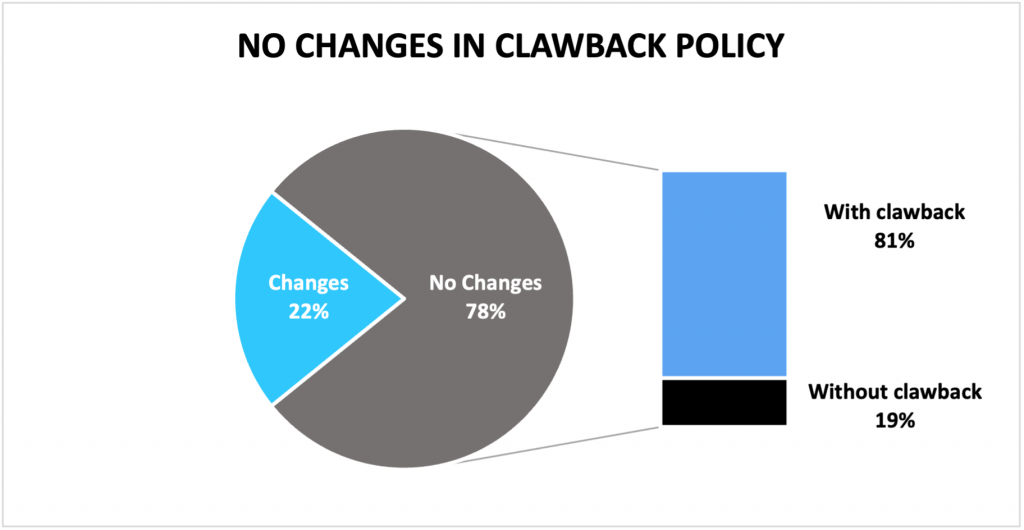

The great majority of the issuers (78%) did not present changes in their clawback policy.

Source: ISS Governance Research & Voting

Among these companies, 81% already had implemented clawback clauses in 2023 and continued to do so in 2024, while 19% did not have clawback provisions in either 2023 or 2024.

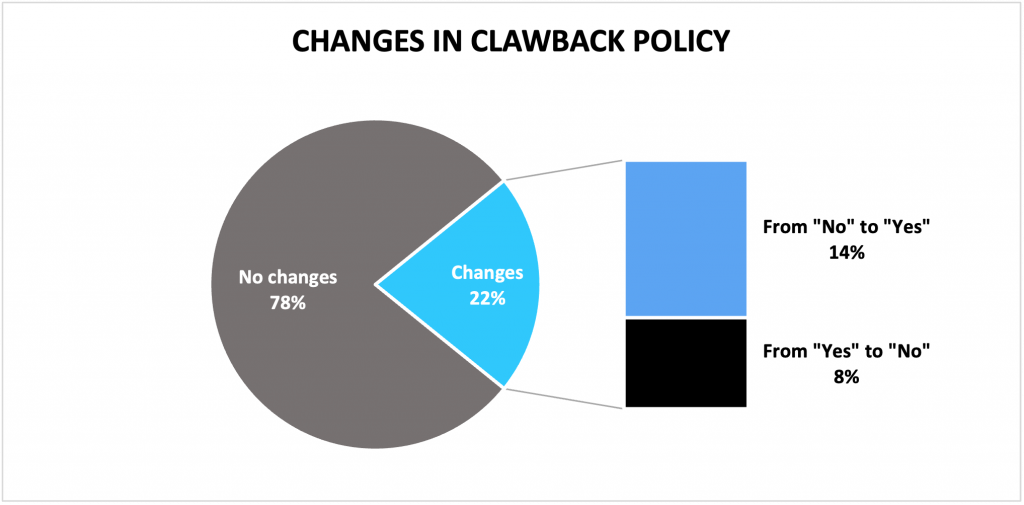

Source: ISS Governance Research & Voting

Among issuers that presented changes in their executive compensation, more than half did not have an robust clawback policy in 2023, but implemented one in 2024. These companies represent 14% of the issuers analyzed in this review.

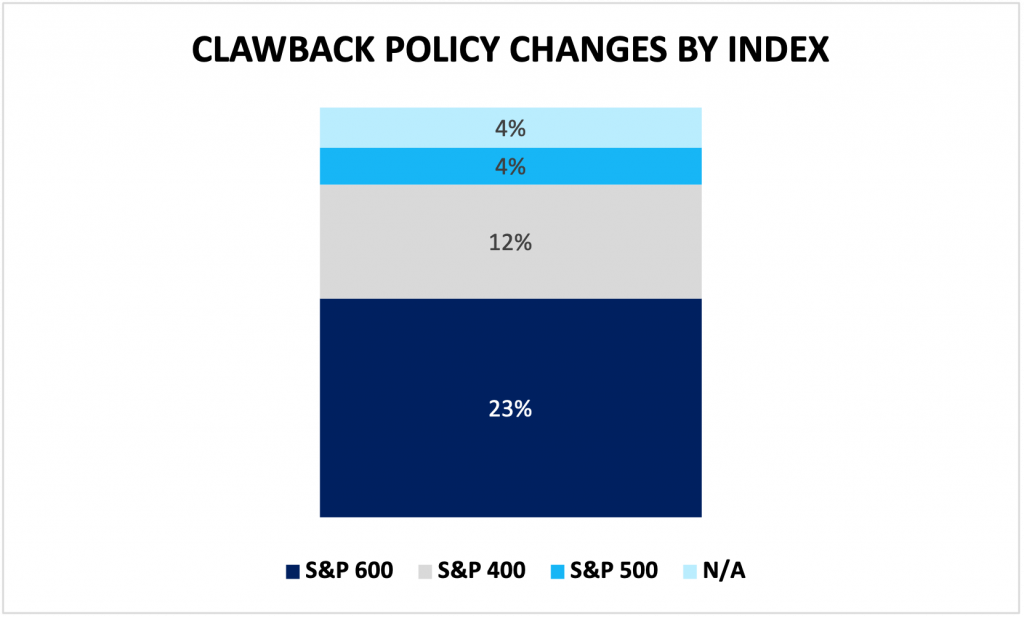

Most of the changes observed were among S&P 600 companies, followed by S&P 400 companies. The most common sectors where the new clawback provisions were implemented were: Biotechnology, Regional Banks and Health Care companies.

Source: ISS Governance Research & Voting

On the other hand, 8% of the issuers where the review identified differences between their 2023 and 2024 policies had a clawback clause in 2023 but did not implement a robust policy in 2024.

A possible explanation for these differences is the ISS US-Benchmark methodology, according to which both time and performance vesting equity awards must be protected by a clawback clause for the clawback policy to be considered sufficiently robust. It could be that these companies implemented new time-based incentive plans in the recent year that were not fully covered by the clawback provisions, which would characterise the negative mark in the ISS Benchmark report.

Conclusion

This review shows that most of the US companies analyzed did not implement changes in their clawback policies. Only 14% of the issuers that did not have an appropriate clawback clause in place in 2023 improved their policies in 2024 under the ISS methodology.

This data could mean that companies are still implementing the regulatory changes, as 23% of all companies analyzed still have not established a robust clawback policy according to ISS. However, it is important to note that the distinction between the regulatory exigences and the ISS Benchmark methodology, which is stricter by checking time-based awards, might have influenced the numbers of the results, since the basis of the data analysis was the ISS Benchmark reports from 2023 and 2024.

Perhaps the 2025 Proxy Season analysis will display different results.

Examples of Clawback Discussions in Other Markets

Some countries have already established hard or soft law provisions regarding the theme[7].

For instance, the 2024 UK Corporate Governance Code provides that the annual report on remuneration should include a description of its malus and clawback provisions, including:

- The circumstances in which malus and clawback provisions could be used;

- A description of the period for malus and clawback and why the selected period is best suited to the organization; and

- Whether the provisions were used in the last reporting period. If so, a clear explanation of the reason should be provided in the annual report.[8]

Another example is the Netherlands, where compensation recovery on the basis of incorrect information, about the realization of the underlying goals or about the circumstances from which the entitlement to the bonus was made dependent, is provided by the Dutch Civil Law.[9]

Clawback provisions have also been in the radar of corporate governance discussions in other markets. In Latin America, B3 (the Brazilian stock exchange) is amending its listing standards for the Novo Mercado segment, and it is also consulting the market regarding the inclusion of clawback and malus clause rules in its regulation[10].

The trend is that more markets will start carrying out discussions regarding clawback and malus provisions in executive compensation.

ISS will continue to monitor further advances in this topic.

[1] Definitions from the UK Corporate Governance Code 2024, page 16.

[2] Available at: https://www.sec.gov/files/rules/final/2022/33-11126.pdf

[3] Meaning disclosures in Form 10-K for US domestic issuers, Form 20-F for FPIs, Form 40-F for filers under the multijurisdictional disclosure system (MJDS), and Form N-CSR for registered management investment companies.

[4] The exemption applies to companies that have not awarded incentive-based compensation to any executive officer of the registered management investment company in any of the last three fiscal years or, in the case of a company that has been listed for less than three fiscal years, since the initial listing (SEC, Listing Standards for Recovery of Erroneously Awarded Compensation, page 12).

[5] “In order to receive credit for a “robust” clawback policy in the “Executive Compensation Analysis” section of the research report, a company’s clawback policy must extend beyond minimum Dodd-Frank requirements and explicitly cover all time-vesting equity awards. A clawback policy that adheres only to minimum Dodd-Frank requirements will not be considered robust, because those requirements generally do not cover all time-vesting equity awards..” Available at: https://www.issgovernance.com/file/policy/active/americas/US-Compensation-Policies-FAQ.pdf?v=2024.12.1

[6] The cut-date for the data analysis of the report.

[7] These are just a few examples; the report does not aim to exhaust the clawback rules of other markets.

[8] Available at: https://media.frc.org.uk/documents/UK_Corporate_Governance_Code_2024_a2hmQmY.pdf

[9] Article 2:135. Available at: http://www.dutchcivillaw.com/civilcodebook022.htm

[10] Available at: https://www.b3.com.br/pt_br/regulacao/regulacao-de-emissores/atuacao-normativa/revisao-dos-regulamentos-dos-segmentos-especiais-de-listagem.htm

By: Elis Benedetti