KEY TAKEAWAYS

- Faith or religious principles-based investors constitute a significant body of institutional investors in the US and around the world.

- The updated Socially Responsible Investment Guidelines by the United States Conference of Catholic Bishops not only expands the number of social issues covered, but also incorporates a novel exhortation for Catholic investors to take into account environmental impact.

- Implementing impact investing strategies can pose challenges for faith-based investors.

- ISS ESG works with our clients to address faith-based ESG research needs, with a broad-based offering including screening, engagement and impact-focussed services.

Faith and Social Change

The urgency of action on climate change and the immediate social issues arising from the COVID-19 pandemic have elevated the concept of socially responsible investing in recent years. An increasing number of investors are looking beyond a sole focus on financial gain, and are pushing for the incorporation of environmental, social, and governance (ESG), as well as ethical, outcomes in their investment processes. In the US SIF Foundation’s 2020 biennial Report on US Sustainable and Impact Investing Trends, the total US-domiciled assets under management using sustainable investing strategies increased from $12.0 trillion to $17.1 trillion in early 2020. The same report mentions that climate change/carbon emissions, sustainable natural resources/agriculture, and governance issues are among the topics that matter most to investors.

Faith-based investors have played an important role in the development of responsible investment. In the 1900s, Methodists and Quakers integrated religious beliefs and investment guidelines. The Methodists opposed investment in alcohol or gambling, and the Quakers had strong objections to involvement in war and slavery.

Variations on these approaches continue to this day, with Catholic, Protestant, Islamic, and Jewish, values informing investment approaches that continue to avoid investing in the ‘sin stocks’ or in controversial weapons. According to a January 2020 Global Impact Investing Network (GIIN) report, faith-based investors manage trillions of US dollars of global assets under management.

US Catholic Investment Framework

The responsible investment practices of faith-based investors continue to evolve and change with the times. The United States Conference of Catholic Bishops (USCCB) first published a set of investment guidelines in 1991 and then updated those in 2003. These guidelines have recently been updated again, in the ground-breaking Socially Responsible Investment Guidelines for the United States Conference of Catholic Bishops, released in November 2021.

The Socially Responsible Investment (SRI) Guidelines integrate values from Catholic Church teachings, gospel, conference statements, and are also informed by the 1986 USCCB document Economic Justice for All: Pastoral Letter on Catholic Social Teaching and the U.S. Economy. It draws from three major themes:

- the role of the Church (and individual Christian investors) as shareholder and investor;

- Shareholder Responsibility; and

- Church as Economic Advisor.

The framework is guided by the belief that the USCCB should exercise both “responsible financial stewardship over its economic resources” and “ethical and social stewardship in its investment policy”.

Through this framework, the USCCB recommends three primary investment strategies:

- exclusionary screening;

- active participation in discussion with investee companies; and

- supporting activities that promote the common good.

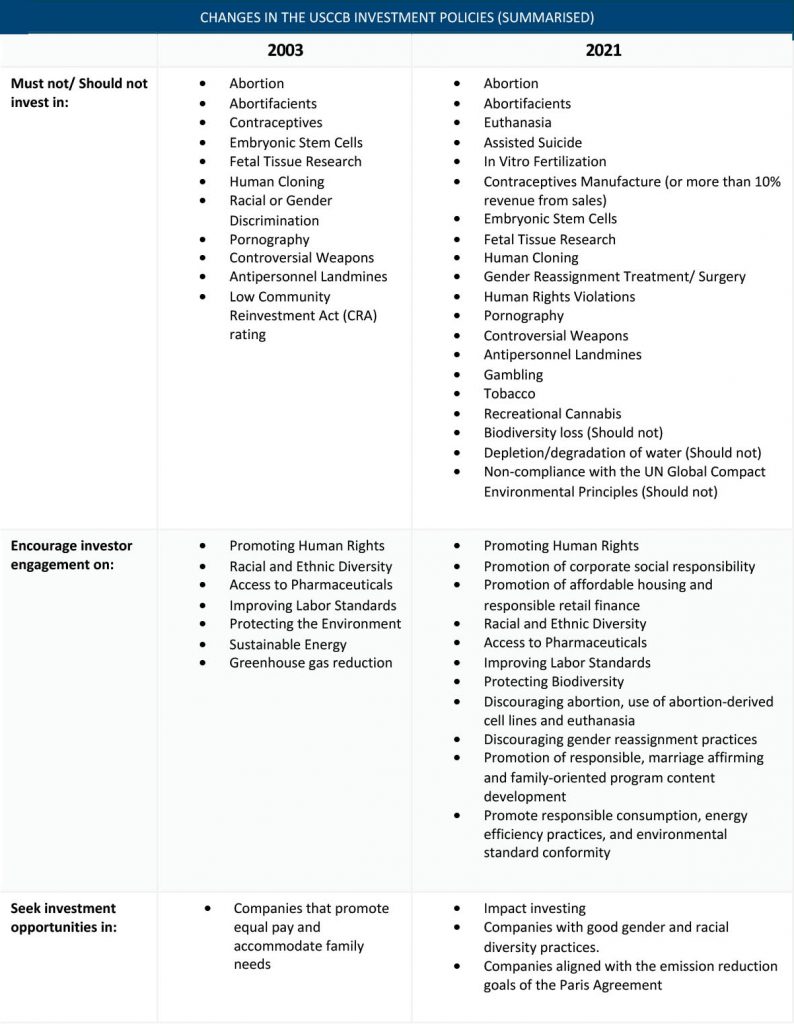

The early versions of the Guidelines focused on social impact in accordance with traditional catholic beliefs, particularly the sanctity of human life. This resulted in a focus on topics such as abortion, contraceptives, embryonic stem cell research, human cloning, and weapons production. 18 years later, however, the USCCB’s updated version incorporates additional elements relating to broader sustainability objectives, particularly environmental impact.

In his 2015 Encyclical Letter Laudato Si, the Catholic leader Pope Francis focused on the need to address a number of environmental and social issues, including pollution and climate change, water, loss of biodiversity, quality of human life, and global inequality. He stressed that:

“The urgent challenge to protect our common home includes a concern to bring the whole human family together to seek a sustainable and integral development, for we know that things can change.”

The USCCB’s expanded 2021 Guidelines reflect these ambitions. While the three main points of avoiding harm, actively working for change, and promoting the common good remain from earlier Guideline versions, significant changes include a new emphasis on environmental issues highlighted in the Pope’s Encyclical Letter, and the expansion of investment policies under USCCB’s five major categories:

- Protecting Human Life;

- Promoting Human Dignity;

- Enhancing the Common Good;

- Pursuing Economic Justice; and

- Saving Our Global Common Home.

The updated Guidelines also put a new focus on shareholder engagement, with an added emphasis on new areas including media, telecommunication, and impact investing. They also highlight several novel controversial issues that the USCCB would like to avoid including euthanasia, assisted suicide, in vitro fertilization, gender reassignment, recreational cannabis, and involvement in practices that lead to biodiversity loss and water degradation. The policy also encourages the meeting of targets in line with the climate goals of the Paris Agreement, and the environmental principles of the UN Global Compact.

Source: ISS ESG

Can Catholic Investors Have an Impact?

The current USCCB SRI guidelines continue a focus on negative screening and shareholder advocacy strategies, but new elements have been added to the mix in terms of investment in climate solutions and impact investing.

According to the January 2020 GIIN Report Engaging Faith-Based Investors in Impact Investing, only 11% of the study’s respondents utilized impact investing strategies. The report identifies factors that make impact investment a challenge for faith-based investors, including:

- a lack of investments with appropriate risk-return profile;

- availability of investments that match their values;

- finding opportunities of the right size; and

- concerns about the exit options/liquidity.

These challenges are significant for faith-based investors who generally pursue low-risk, market rate return investments. Despite this, several initiatives such as the work of the Catholic Impact Investing Collaborative have been endorsed by the USCCB to promote this strategy. The University of Zurich Center for Sustainable Finance and Private Wealth highlighted in its April 2021 Report that:

“The emergence of investing for positive impact and sustainable development often follows a step-by-step journey, starting off with exclusion criteria, transitioning to positive screening and ESG integration, before making the step toward impact investments and innovative and blended finance”.

Implementing a Catholic Values-Based Strategy

ISS ESG continues to provide its clients with leading solutions that support alignment with Catholic values-based investments. The team provides research on most of the relevant controversial issues in the latest set of Guidelines, and will be launching new products to match the updated criteria. The inclusion of impact-focused criteria provides a particular opportunity for ISS ESG clients, with our broad-based service allowing us to support screening, engagement as well as impact investing approaches.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Use ISS ESG Controversial Weapons Research to assesses companies’ involvement in banned or controversial weapons.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Use ISS ESG Energy & Extractives Screening to assesses companies’ involvement in the extraction of fossil fuels, and the generation of power from fossil fuels, nuclear and renewable sources.

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with the ISS ESG Engagement Service.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By Ana Casilda Apacible, Senior Associate, ISS ESG. William Cowper, ESG Product Manager – Regulatory Solutions, ISS ESG