Many institutional investors have long criticized share pledging by company insiders as a practice that can expose them to significant governance risks. While this has prompted a large number U.S. companies to ban or restrict the activity, it remains an option for many owners and executives.

Share pledging is a practice whereby stock is pledged as collateral for personal loans. For many executives and company founders, a significant portion of their wealth is held in the company’s shares. Share pledging allows them to monetize their securities, for instance to buy a home, without having to sell them. However, pledges of a significant size are thought to pose risks for other shareholders.

For investors, the most significant risk is a forced sale of pledged shares. If an executive with a large pledged ownership position fails to meet the margin call, it could lead to the sale of those shares and possibly trigger a sharp drop in the stock price. That means the practice exposes shareholders to significant stock price risk due to an executive’s personal financing decisions.

Another concern is the misalignment of control rights and economic interest. By pledging shares instead of selling them, an executive can retain the same ownership influence even as they monetize their stock. That can alter the executive’s economic interest in and exposure to the company, potentially leading to a misalignment of interests between the executive and shareholders.

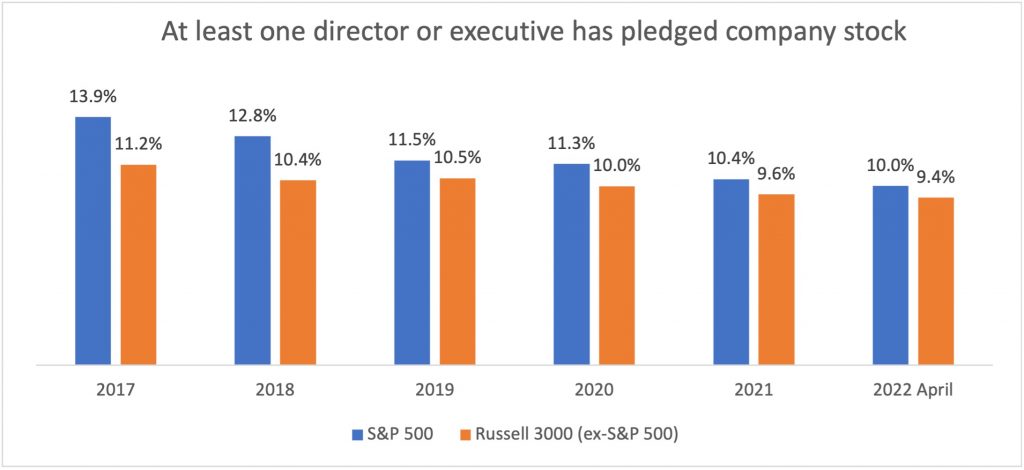

Against this backdrop, pledging by executives and directors has been declining. According to ISS Governance QualityScore, the number of companies in the S&P 500 with at least one director or executive pledging their shares has declined from 13.9% in 2017 to 10% in 2022.

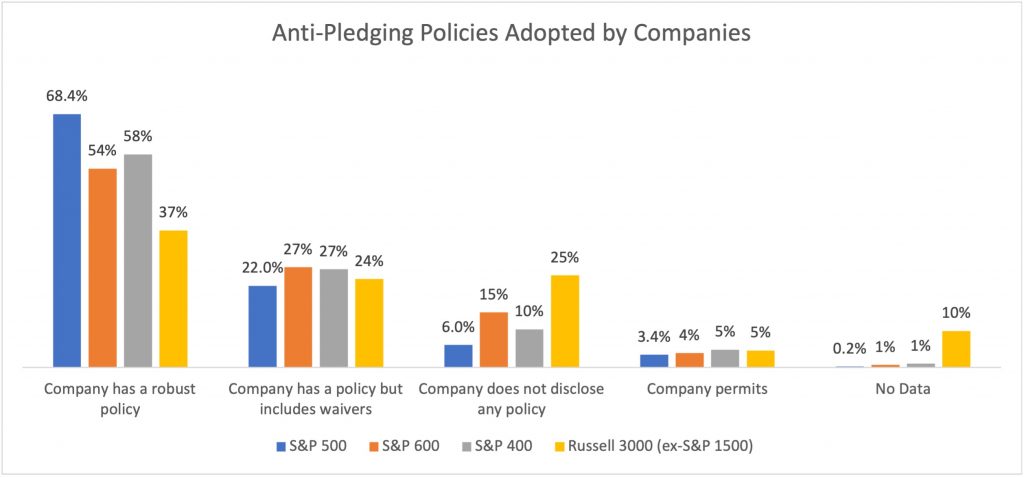

Many companies now have a robust anti-pledging policy that strictly prohibits the practice by executives and directors. Our research shows that 68% of S&P 500 companies ban all forms of pledging, and 22% have adopted an anti-pledging policy that includes certain waivers or exceptions. In total, more than 90% of companies in the index have a policy restricting share pledging by company insiders. However, such restrictions are much less common among smaller companies. Only 37% of companies in the Russell 3000 index (excluding the S&P 1500) have a robust anti-pledging policy and 25% don’t disclose any policy.

By Jun Frank, Managing Director, Advisory, ISS Corporate Solutions