Key Takeaways

- Investors rejected CEO compensation proposals through Say-on-Pay votes at a record rate in the 2021 proxy season, even though pay remained flat in FY 2020

- Proxies filed through early May indicate a strong increase in CEO pay for FY 2021

- CEO pay proposal support continues to decline in S&P 500 universe

For many companies, 2021 signaled a return to normal business after the COVID-19 pandemic upended the economy and significantly disrupted financial forecasts established at the beginning of 2020. Given the difficulty in meeting financial targets set under short- and long-term incentive plans, CEO pay levels remained essentially flat in FY2020 for both S&P 500 and Russell 3000 (excl. S&P 500) companies. Despite the lack of pay increases, investors rejected compensation proposals in Say-on-Pay votes at a historic rate during the 2021 proxy season, with a record 20 companies in the S&P 500 failing to secure majority support for their proposals.

Based on proxies filed through early May, we have observed a strong increase in CEO pay in FY2021 across the S&P 500 and Russell 3000 (excl. S&P 500) universes. Median Total Summary Compensation Table (SCT) CEO pay for S&P 500 companies is up 9 percent for the year and has increased almost 40 percent in the Russell 3000 (excl. S&P 500). Say-on-Pay votes held as of May 9indicate thatinvestor support for CEO packages continues to erode at many companies. Median support for Say-on-Pay at S&P 500 companies is on track to decline for an eighth consecutive year. These results suggest a growing disconnect between board determinations of CEO compensation and what shareholders are willing to accept.

CEO Pay Trends

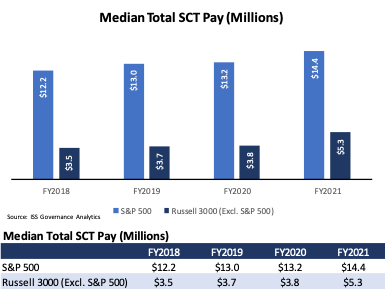

The following chart illustrates median CEO total pay as disclosed in the SCT for S&P 500 and Russell 3000 (excl. S&P 500) companies:

Median CEO total SCT pay rose by 9.2 percent for S&P 500 companies and 39.5 percent for Russell 3000 (excl. S&P 500) companies in FY2021. These increases were largely driven by significantly higher bonus payouts in FY2021 relative to FY2020 and continued increases in Long-Term Incentive grant values for executives.

Say-on-Pay Trends

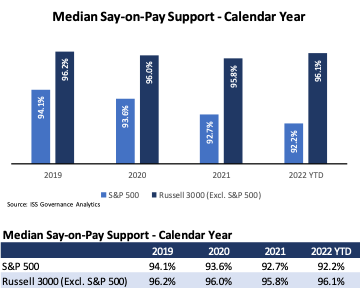

The following chart illustrates the median support for Say-on-Pay proposals since 2019 for S&P 500 and Russell 3000 (excl. S&P 500) companies:

Investor support for Say-on-Pay proposals continues to erode for S&P 500 companies – median support as of mid-May was 92.2 percent, which would represent the lowest level since votes became mandatory in 2011. However, proposals at Russell 3000 (excl. S&P 500) companies continue to receive strong backing from shareholders – median support as of mid-May was 96.1 percent, which is consistent with the levels achieved in 2019 – 2021.

By Brian Johnson, Executive Director, ISS Corporate Solutions