The Real Estate sector includes companies involved in the management and leasing of real estate properties, ranging from commercial, retail, residential, and industrial buildings to specialized properties (e.g., restaurants, hotels, hospitals, self-storage properties, etc.).

Companies, including those in real estate, have been under pressure in recent years from increasing regulatory oversight to make their operations climate friendly. For example, the European Commission proposed new regulations that require all newly constructed buildings to be Net Zero by 2030 as a part of the EU’s Green Deal. Institutional investors will also soon have to account for the carbon impact of their overall assets according to the U.S. Securities and Exchange Commission’s climate disclosure rules, which are expected to be finalized in 2024. These developments could create further pressure on real estate companies to decarbonize.

The ISS ESG Corporate Rating provides insights into real estate companies’ progress on decarbonization and the advantages offered by such progress. Current research indicates many real estate companies are underperforming on decarbonization and other environmental indicators.

Real Estate Companies’ Performance on Climate Indicators

Being responsible for around 40% of carbon emissions globally, the Real Estate sector is an important lever in global efforts to cut carbon emissions. In a recent update of the GRESB Real Estate Standard, the emphasis on Net Zero increased multifold, with a greater focus on physical and transition climate risk factors.

Efforts to limit the global temperature increase to 1.5oC above pre-industrial levels are accordingly influencing real estate regulation. Governments are raising energy efficiency standards that increase the risk of making buildings illegal to let. In response, top CEOs from real estate industries pledged to reduce buildings-related emissions by at least 50% by 2030 and to achieve Net Zero carbon no later than 2050.

Building owners are under pressure to adapt and stay competitive in this environment. Larger offices are no longer required due to the recent shift toward a work-from-home culture, a change that effectively reduces the building’s energy and resource consumption. Further cyclical factors such as economic downturns and technological advancement lead to greater availability of office space and thus lower climate-related impact.

The risk of ‘stranded assets’ is becoming more pressing in real estate. These developments may encourage real estate companies to develop climate mitigation strategies, including proactive decarbonization plans with well-defined goals and roadmaps for operations, leasing, and capital expenditures. Various indicators can provide a sense of companies’ progress in these areas.

Climate Strategy Standards

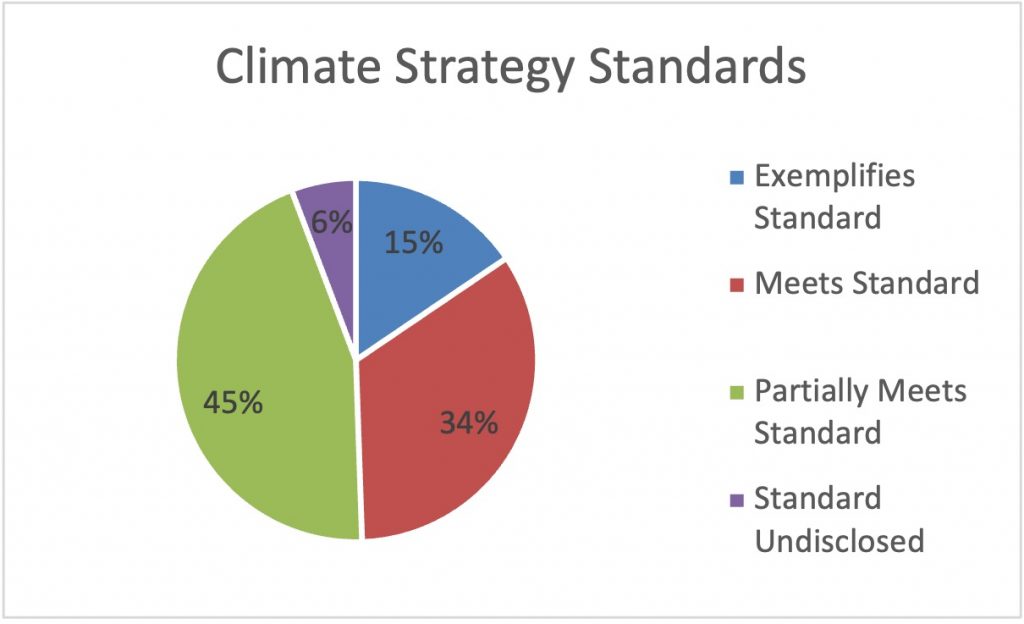

ISS ESG’s research identifies over half of the covered companies in the Real Estate universe as at risk of failing to achieve the targets in their climate change mitigation strategies: 45% are partially aligned and 6% have not disclosed their climate-related strategies (Figure 1).

Figure 1: Distribution of Real Estate Companies, by Climate Strategy Alignment (%)

Source: ISS ESG

Eco-efficiency

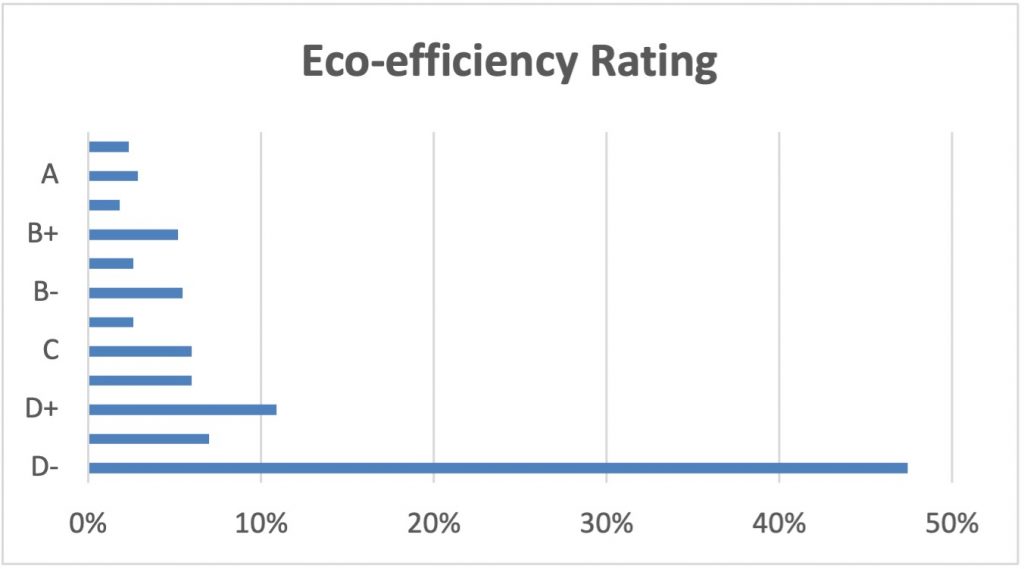

Real estate companies similarly appear to be lagging specifically on their energy, carbon, and water efficiency (eco-efficiency), as measured by their intensity data. Figure 2 depicts the eco-efficiency ratings of the real estate companies in the ISS ESG Corporate Rating universe, with nearly 63% of the companies having a rating of D+ or lower.

Figure 2: Distribution of Real Estate Companies by Eco-efficiency Ratings

Note: A+ = highest rating; D- = lowest rating.

Source: ISS ESG

This distribution signals the high proportion of companies that rate low on energy, carbon, and water efficiency as measured by their intensity data. Only 7% of the universe is rated A or higher, showing the significant task at hand for real estate companies seeking to get their property portfolio aligned with the upcoming increased energy efficiency standards. A higher percentage of D- can also be attributed to a lack of transparency, indicating a low degree of disclosure from most real estate companies.

Energy Efficiency

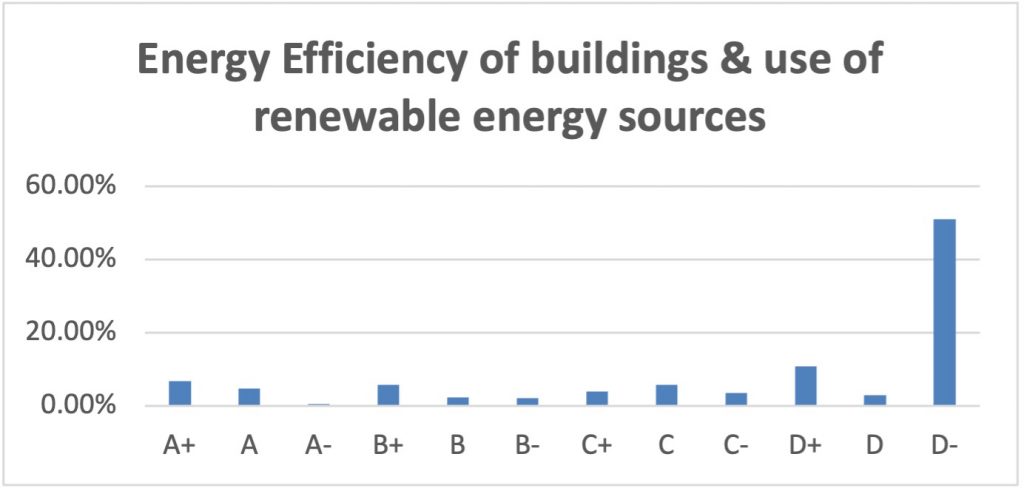

Figure 3 shows the overall scores of companies’ building properties portfolios on both energy efficiency and renewable energy use. More than 31% of the companies have a rating of C or higher.

Figure 3: Distribution of Energy Efficiency Scores of Real Estate Companies’ Building Portfolios

Note: A+ = highest rating; D- = lowest rating.

Source: ISS ESG

However, with 65% of companies having a grade of D+ or lower, more effort is clearly required before portfolio properties become energy efficient. Heating and cooling in buildings contributes to global carbon emissions, with the use of air-conditioning making up 3.94% of total global emissions. Emissions come from other sources, as well: a recent estimate was that approximately 11% of annual global emissions from buildings are caused by building materials and construction processes.

Products & Services

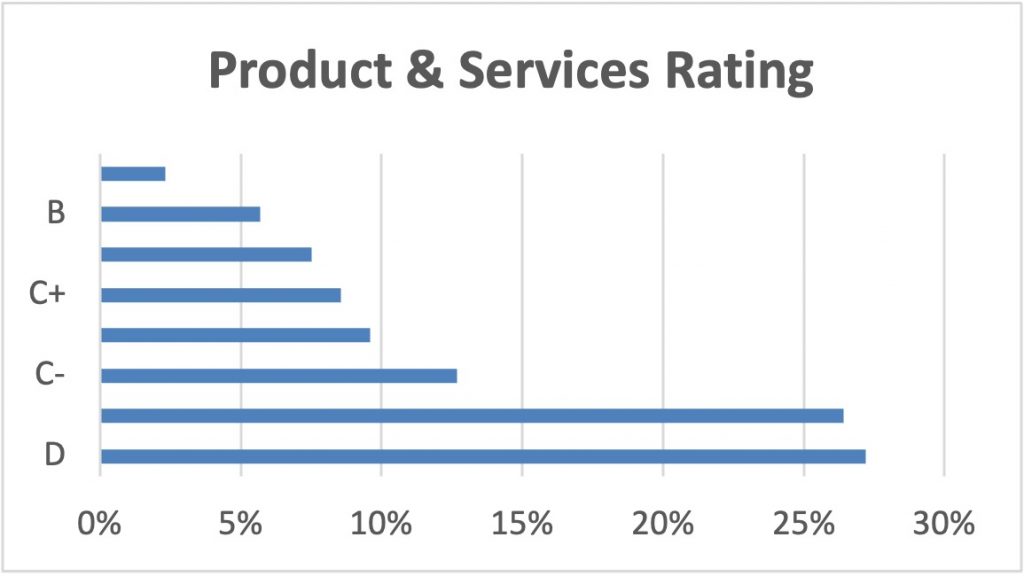

Overall, the Products & Services part of the rating covers the broad environmental impact of a company’s portfolio, including the aforementioned energy efficiency scores. Other important aspects include the company’s site selection and development processes, in particular how land is used, and its biodiversity management. The assessment also includes portfolio characteristics such as the buildings’ construction and refurbishment procurement practices.

ISS ESG’s research illustrates that over 53% of the rated Real Estate universe has a product and services rating of D+ or lower, which further illustrates the significant amount of improvement required to bring properties up to the expected regulatory energy efficiency target.

Figure 4: Products & Services Ratings of Real Estate Companies

Note: A+ = highest rating; D- = lowest rating.

Source: ISS ESG

The Financial Challenges of Meeting Climate-Related Regulation

Financial limitations can affect real estate companies’ ability to meet energy efficiency standards. High vacancy rates impact property owners’ cash flows in the short term. If vacancies remain high and the building requires improvement to meet energy efficiency labels, the risk of the property becoming stranded rises. The building’s low cash generation will impair the owner’s ability to support the capital investment necessary for the building to meet the regulatory requirements to become eligible for rent. (Highly indebted owners will be particularly impaired.)

Because of this pattern, properties in cities such as San Francisco and New York are at risk. For instance, San Francisco’s office vacancy rate rose to a high of 31.8% (from around 4% in early 2020), a new record, while the office vacancy of New York rose 16.1% in the first three months of 2023.

Along with rising vacancy rates, real estate companies have recently faced rising interest rates. Although the global economy is now in the interest rate cycle’s fourth and final stage, in which economic growth is negative, the third stage was characterized by high inflation and peak economic growth, which affected highly leveraged real estate companies. The ability of companies to service debts declines during periods of rising interest rates, making it challenging to refinance existing debts or access new finance to meet growth targets.

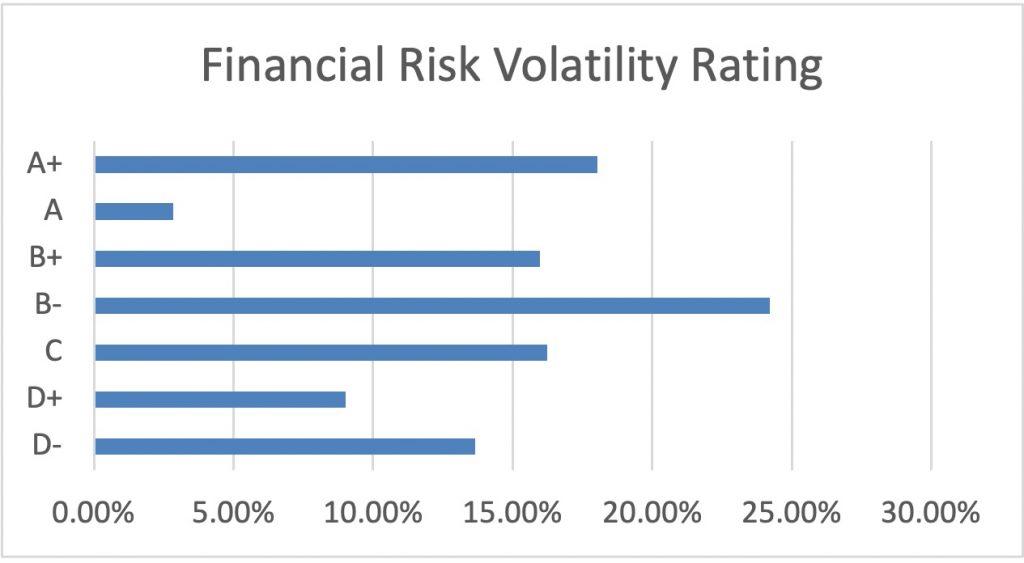

Companies are better able to meet higher regulatory requirements when they are in a strong financial position. An evaluation of the Real Estate universe’s financial risk volatility shows that over 22% of real estate companies have the highest risk profile (D+ and lower), with 21% having the lowest risk profile (A- and higher).

Figure 5: Distribution of Real Estate Companies by Financial Volatility Rating

Note: A+ = highest rating; D- = lowest rating.

Source: ISS ESG

Governance and Regulatory Compliance

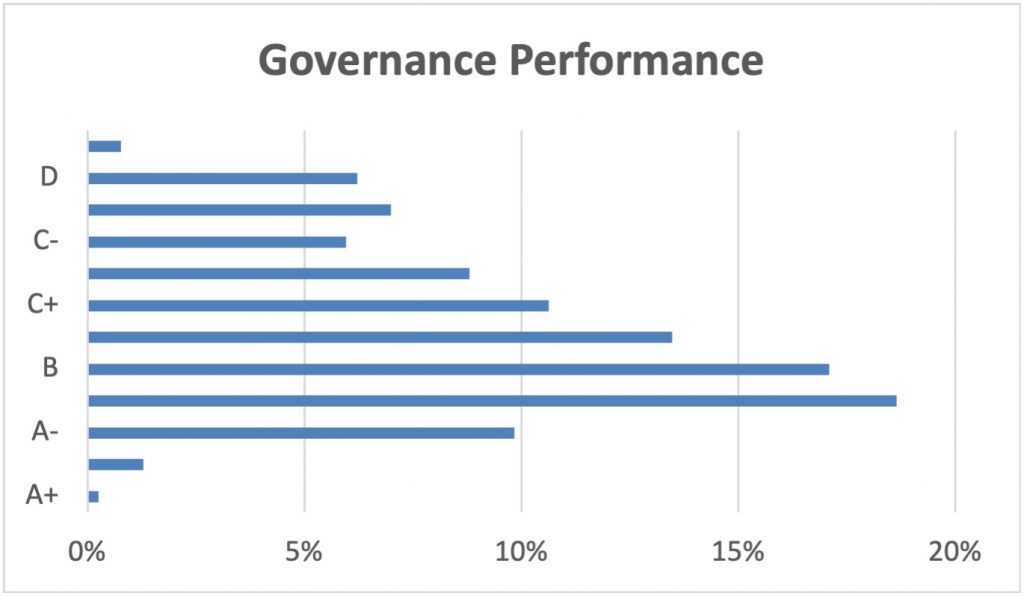

Developing and executing environmental and social policies can be challenging for real estate enterprises due to governance-related issues, including a dependence on public sector regulation and community objectives. Figure 6 highlights the governance performance breakdown of real estate companies from the ISS ESG Corporate Rating universe.

Figure 6: Distribution of Real Estate Companies by Governance Performance Scores

Note: A+= highest rating; D- = lowest rating.

Source: ISS ESG

The Real Estate universe has a high proportion of companies with a good governance structure. ISS ESG’s research shows that over 80% of the universe has a governance performance rating of C or higher.

Good governance practices can support decision-making that benefits the company’s stakeholders (although a mature and developed capability to identify and address stakeholders’ requirements is also needed). Companies with good governance are more likely to focus on the long-term viability of their asset base and pivot their strategy to ensure alignment with regulatory practices.

Conclusion

Decarbonization is not only vital for an effective fight against climate change, but it also provides significant business opportunities for the Real Estate sector; some advantages of decarbonization may include cost savings, environmental benefits, and competitive advantage.

In an environment where the demand for eco-efficient space is on the rise, companies having invested in energy efficiency measures are likely to benefit in coming years, while those lagging may have to sell their top-tier assets to fund their at-risk assets due to balance sheet constraints. It is therefore important to note that companies with good governance and strong financial positions are more likely to focus on the long-term viability of their asset base and to pivot their strategy to ensure alignment with regulatory practices.

ISS ESG Corporate Rating offers a more holistic approach by providing ratings, data, and insights that can help investors identify companies that meet the energy challenge and evaluate how prepared these companies are for the upcoming energy efficiency regulatory change. Granular information on an individual issuer’s decarbonization efforts and other industry-relevant data are also available to help investors and stakeholders make informed assessments.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By:

Gaurav Jagarwal, Senior Associate, Corporate Rating Research, ISS ESG

Roberto Lampl, Managing Director, Sector Head of Industrials, Financials & Real Estate, ISS ESG

Susanne Schwind-Elsner, Vice President, Corporate Rating Research, ISS ESG

Alessandra Jasmine Duco, Associate, Corporate Rating Research, ISS ESG