Introduction

Sustainability-linked Bonds (SLBs) and Loans (SLLs) are – as the name suggests – finance instruments with financial and/or structural characteristics ‘linked’ to environmental, social and governance (ESG) goals. Such goals can come in many different shapes and sizes, from the now common-place CO2-reduction targets to more novel objectives such as access to medicine or gender diversity. In this article, ISS ESG’s Second-Party Opinion team explores what new issuers of SLBs and SLLs should consider before they make the linkbetween a financial instrument and sustainability goals, specifically: materiality of the Key Performance Indicator (KPI); and level of ambition of the sustainability performance target (SPT).

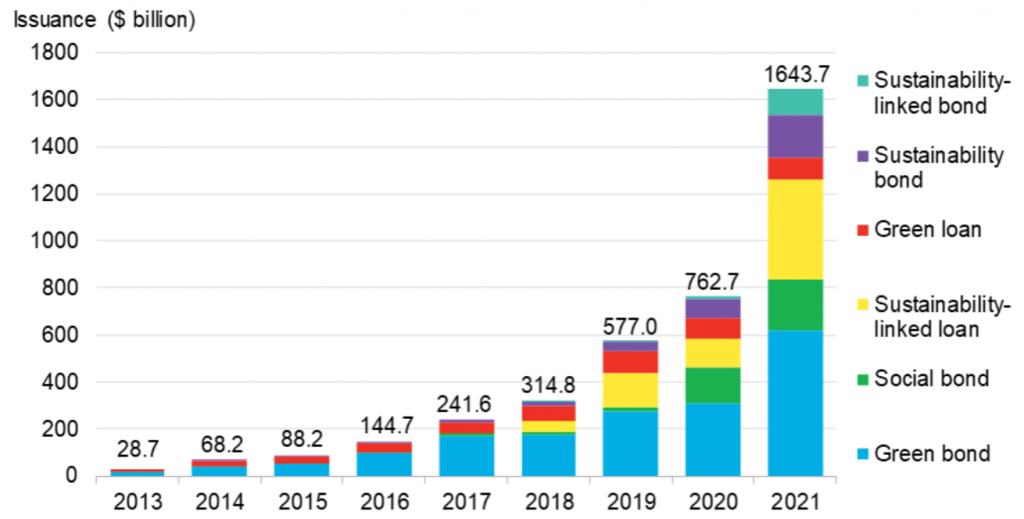

2020 was the birth year of the International Capital Market Association (ICMA)’s Sustainability-Linked Bond Principles (SLBP), and they have been growing rapidly in importance (see Figure 1 below). Unlike more mature instruments such as Green Bonds, the proceeds can be used for general purposes by the issuer. Green Bonds famously link the bond’s proceeds to specific projects. For sustainability-linked financing the issuer defines one or more key performance indicators (KPIs) and corresponding sustainability performance targets (SPTs) that are integrated into the financial and/or structural characteristics of the bond. Whether the SPT is reached or not triggers a financial clause of the bond. Most often, issuers include a penalty clause, meaning that a missed target results in a coupon step-up or a premium payment to investors.

Figure 1: Annual Sustainable Debt Issuance, 2013-2021

Source: BloombergNEF, Bloomberg L.P.

Why are sustainability-linked finance instruments gaining traction? The major advantage is the flexibility caused by the absence of predefined eligible projects. While the issuer commits to reaching their ESG goals, there are no restrictions on how to spend proceeds. Another distinguishing feature is the fact that it is a performance-based instrument, which shows investors where in the company the issuer will try to improve its ESG performance. Moreover, in contrast with the more mature green bond market, where there is a limited number of potential eligible projects which may be considered green, any company can issue an SLB or SLL. Some issuers want to highlight topics that cannot be captured in a specific project, such as improving the share of women on the board. Others want to highlight a relative improvement in the sustainability of their production process that doesn’t yet qualify as sufficient against absolute thresholds. SLBs and SLLs give the issuer this flexibility. Lastly, SLBs and SLLs are in hot demand due to massive appetite in the fixed income space for exposure to ESG and sustainable investing.

Any issuer of SLBs should follow the Sustainability-Linked Bond Principles (SLBP), as published by the International Capital Market Association (ICMA), those of SLLs follow the Sustainability-Linked Loan Principles (SLLP) by the Loan Market Association (LMA) and others. These principles outline the must-have features of the respective sustainability-linked finance instruments. Interpreting a security’s alignment with these principles requires in-depth knowledge and a thorough methodology to assess the robustness of a sustainability-linked finance framework, characteristics possessed by ISS ESG’s Second-Party Opinion (SPO) team.

Two things all issuers should know

1. We live in a material world

One of the most important elements of a selected KPI is that it should be material to the company.

| When is a KPI material? The SLBP clearly state that “the KPIs should be material to the issuer’s core sustainability and business strategy”. This requirement is important to prevent greenwashing. A company should pick a KPI that it has control over, and for which improvement can constitute a significant sustainability outcome. A bad example for a KPI would be Scope 1 emissions for an office-based company that doesn’t manufacture products, because Scope 1 emissions would not make up a significant proportion of its total emissions. We assess the materiality of KPIs according to ISS ESG’s proprietary methodology, which is summarized in the graphic below. |

Specifically, it should take a company-wide commitment to achieve the target(s), as the KPI should have a strong connection with the overall sustainability strategy of the issuer. Materiality of the KPI is the cornerstone to a robust SLB and SLL, especially when that has been confirmed by a SPO provider such as ISS ESG, because it provides comfort to investors that there is a minimal risk of greenwashing or ‘ESG-washing’. The following graph highlights some of the key factors that ISS ESG considers when assessing the materiality of a KPI.

Figure 2: KPI Materiality

Source: ISS ESG

2. Big results require big ambitions

Defining the target(s) is a delicate balancing act. Keep in mind that, while feasibility may be important to the issuer, investors prefer Sustainability Performance Targets (SPTs) that demonstrate ambition against three benchmarks.

Figure 3: Levels of Ambition

Source: ISS ESG

First, issuers should calibrate a target that goes beyond a ‘business-as-usual’ trajectory. In practice, that means selecting a goal (for example a greenhouse gas (GHG)-emissions reduction rate) that shows a higher annual change in the future than it did in the past. The second level of ambition is the comparison with peers. Industry-recognized goals, for example water use in cement production, are easier to benchmark than bespoke targets. When selecting the KPI and calibrating the SPT, the issuer might want to check whether the ability to benchmark with peers isn’t limited, and to what extent they are following industry best practice.

The same holds for international targets. If possible, the issuer should be able to demonstrate the extent to which their SPT aligns with international goals, such as the Paris Climate Accords. If no international targets exists, sector-based or national goals might be used to assess the level of ambition of the SPT. The level of ambition of the SPT is vital in reassuring investors that the issuer is committed to a genuine ESG goal and that there is no ‘greenwashing’ at play.

To find out more about ISS ESG’s approach to Second-Party Opinions on sustainability-linked financing frameworks, check out the following exemplary assessments:

- Holcim: KPIs on Scope 1 emissions and freshwater withdrawal

- EQT: KPIs on, amongst others, gender diversity

- Teva and Sanofi: Access to Medicine KPIs

How ISS ESG can support issuers with their sustainability-linked transactions

Corporates which are structuring their sustainability-linked transaction, bond or loan, can benefit from the analysis provided by a Second-Party Opinion in demonstrating their commitments to the achievement of real-world outcomes, something investors are increasingly calling for. ISS ESG SPOs are transparent and robust assessments that allow the issuer to not only test the solidity of their approach, but also to challenge and improve their initial scope for the project, delivering a stronger sustainable funding concept.

Do get in touch with our SPO-team to have a conversation about the robustness of your KPIs and SPTs!

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG’s Second Party Opinion (SPO) Services to provide sustainability, green and social bonds with a credible and independent assessment of their sustainability quality.

By Leontine Schijf, ESG Consultant, ISS ESG. Giorgio Teresi, ESG Consultant, ISS ESG