Introduction

Together with screening and ESG integration, implementing engagement policies has become a key element of investor strategies to work proactively with companies and improve their ESG disclosures or practices. Increased engagement with investee companies has been driven by new regulation such as the EU’s Shareholder Rights Directive II and Sustainable Finance Disclosure Regulation, along with voluntary initiatives such as stewardship codes or the new Principles for Responsible Investment (PRI) reporting framework.

With engagement being a core component of many Net Zero investor frameworks, transition planning is a priority engagement theme for many responsible investors and has gained even more traction recently. In March 2023, Climate Action 100+ released an updated Net Zero Company Benchmark with a stronger focus on emissions reductions, alignment with 1.5°C pathways, and robustness of transition plans.

In June 2023, the Institutional Investors Group on Climate Change (IIGCC) published the Asset Owner Stewardship Questionnaire to help asset owners develop better visibility on the climate-related engagement activities of their external asset managers. In parallel, documents such as the U.K. Investment Association report Improving Fixed Income Stewardship, published in November 2022, and the IIGCC Net Zero Bondholder Stewardship Guidance, in June 2023, have placed an increased emphasis on engagement by bondholders.

Constructive dialogue with portfolio companies on climate risks may offer investors a way to put their capital to work and build momentum for positive change. As stated in the commitment of the Net-Zero Asset Owner Alliance members, “engagement is an obvious and necessary component to ensure that the global economy, individual sectors and ultimately companies set out on transition pathways which deliver the necessary emission reductions needed to keep global warming to 1.5°C. That is why the Alliance has a strong focus on ‘advocating and engaging on a low carbon transition.’”

As this post explains, companies’ progress towards Net Zero, or opportunities for companies to make such progress, can be overlooked if investors simply reallocate funds to low-emitting sectors. Through engagement, institutional investors can demand and understand the progress companies are making on Net Zero. The ISS ESG Thematic Engagement Solution facilitates such investor dialogues with companies.

Conflicting Objective Timelines within Net Zero Commitments

Net Zero-focused investor initiatives have created considerable new demands on asset managers, not only by requiring ambitious decarbonization of portfolios within medium-term time horizons, but also by requiring demonstrations of increased progress towards alignment and engagement targets, often with a longer timeline.

For example, the IIGCC’s Net Zero Investment Framework is an increasingly popular route being used by asset managers seeking to join the Net Zero Asset Managers Initiative. The Framework contains several requirements, including the following:

- Coverage: “A 5-year portfolio coverage goal for increasing the percentage of AUM [Assets under Management] invested in assets in material sectors that are (i) achieving net zero, or, meeting the criteria to be considered ii) ‘aligned’ to net zero, or iii) ‘aligning’ to net zero.”

- Engagement: “An engagement goal which ensures that at least 70% of financed emissions in material sectors are either assessed as net zero, aligned with a net zero pathway, or the subject of direct or collective engagement and stewardship actions.”

- Decarbonization: Setting interim targets for reducing emissions by 25% by 2025 and by 50% by 2030. This target may be expressed in absolute terms (tCO2e) or intensity terms (tCO2e/million invested or in revenue).

The twin goals of both decarbonizing a portfolio and reaching alignment and engagement targets can be in tension with each other, however. While switching funds to low-emitting sectors can be a tempting route to achieving rapid decarbonization, the negative impact of such a strategy on a portfolio’s alignment progress can be considerable. This is particularly so when existing investments may reside in high-emitting-sector leaders that may also have a highly developed and mature strategic approach not only to mitigating climate change within both their operations and supply chains in the near term (i.e., decarbonization targets), but also to strategically achieving Net Zero (as per the Net Zero Alignment criteria).

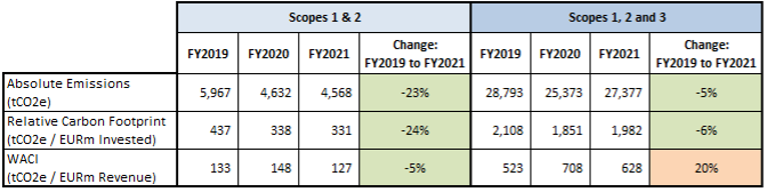

To provide context, in the FY2021 reporting period, High-Impact sectors (as defined by ISS, albeit with a strong alignment to the Net Zero Asset Owner Alliance [NZAOA] definition) represent the following in the STOXX World AC:

- 14% of total weight

- 77% of absolute Scope 1 & 2 emissions

- 51% of Scope 3 emissions

For High Impact sectors between FY2019 and FY2021, reported emissions are mixed depending on the scope and basis of measurement (Table 1). While Scope 1 & 2 emissions show a 23% fall across the period, when including Scope 3 emissions the reduction is only 5%. From an intensity perspective, the Weighted Average Carbon Intensity (WACI) for Scope 1 & 2 intensity is down 5% over the period, but when Scope 3 emissions are included emissions intensity increased by 20% over the period. This mixed emissions data, some of which suggests progress towards Net Zero, would be lost if investors simply divested from these High Impact sectors without considering strategic progress towards Net Zero Alignment.

Table 1: Climate Metrics for High Impact Sectors within STOXX World AC Index

Note: This data is based on an illustrative portfolio of EUR 100m, with Q4 2022 constituents backdated through the timeline. Data coverage in all annual instances is >99%.

Source: ISS ESG

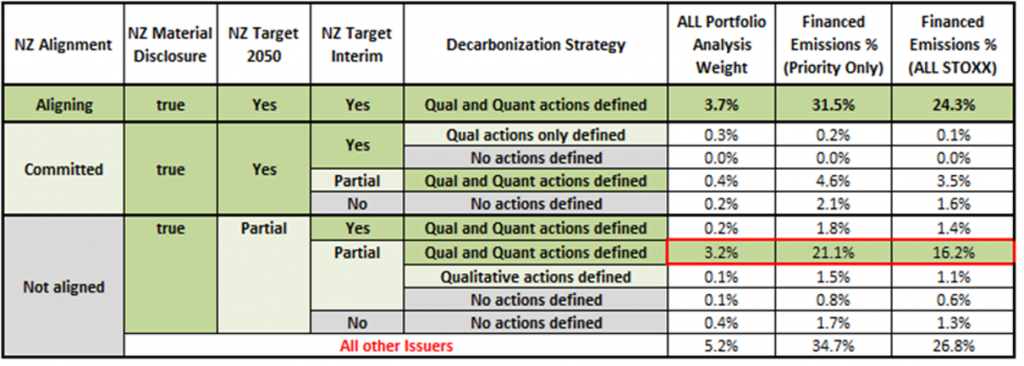

In the aggregate, High Impact sectors show low levels of Net Zero Alignment. However, beneath the highest level of assessment, a significant amount of granular evidence would allow for a targeted engagement within the Index. Table 2 illustrates the variety of factors to be considered within any strategic capital allocation approach to achieving progress against multiple competing Net Zero (NZ) targets.

Table 2: Alignment Metrics for High Impact Sectors within STOXX World AC Index

Source: ISS ESG

At the “Committed” level, there is a further 0.9% of STOXX by weight, which represents 5.2% of all financed Scope 1 & 2 emissions. The “Committed” level also shows evidence of relevant material disclosure, 2050 commitments, and Interim target-setting and/or Decarbonization strategy evidence. To divest, or to implement strategic capital reallocation without considering this evidence, could have a diminishing effect on overall portfolio alignment.

Indeed, the “Not Aligned” level in this aggregation of High Impact sectors shows significant evidence of progress despite the “Not Aligned” overall assessment. For example, a significant tranche of issuers, highlighted in red and representing 3.2% of AUM and 16.2% of all Scope 1 & 2 financed emissions, show progress, as measured by various criteria. Targeted engagement towards these issuers, with a focus on improving the quality and scope of Net Zero commitments and interim targets, may provide a clear route towards enhancing the percentage of financed emissions moving towards alignment.

GICS Sector Focus: Energy and Utilities

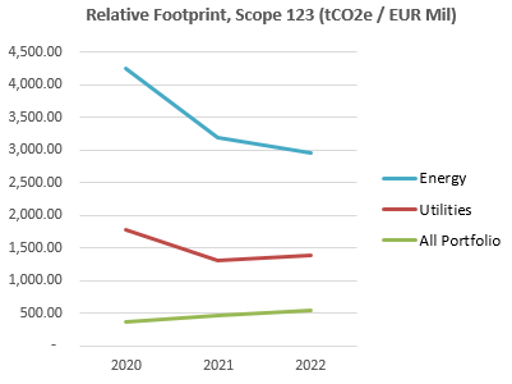

Exploring beneath the aggregated High Impact-sector level reveals further interesting divisions among the most significant contributors to STOXX World AC emissions. Figure 1 shows the Relative Carbon Footprint (Scopes 1, 2, and 3 emissions) for two GICS Sector categories: Energy and Utilities. Despite the overall STOXX World AC emissions rising across the period (2020-2022), both GICS categories show declining relative emissions during this period, albeit to varying degrees.

Figure 1: Relative Footprint Timelines: GICS Sector Categories

Source: ISS ESG

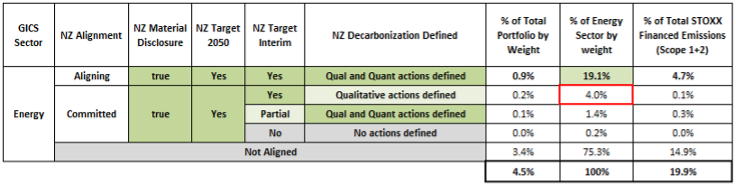

A closer look at the Energy sector reveals that the sector’s relationship to Net Zero is complex. While ESG investors might be inclined to divest from Energy sector issuers or otherwise re-allocate their capital, they may also wish to remain aware of where in the Energy sector significant strategic efforts (such as decarbonization strategies and setting medium- and long-term targets) are underway to achieve Net Zero. While divestment or reallocation might achieve emissions reduction, engagement opportunities to encourage further efforts to Align may be lost.

Table 3 shows that the Energy sector represents 4.5% of the STOXX index by weight and 19.9% of its Scope 1 & 2 financed emissions. “Aligning” Energy sector companies, with all required underlying criteria met, account for 19.1% of the Energy sector by weight, and nearly a quarter of the Energy sector’s Scope 1 & 2 financed emissions.

Table 3: Alignment Metrics for Energy Sector within STOXX World AC Index

Source: ISS ESG

Further granularity within the “Committed” assessment shows evidence of an additional 4% of the sector by weight (highlighted in red), with evidence of everything within their disclosed decarbonization strategy except quantitative actions.

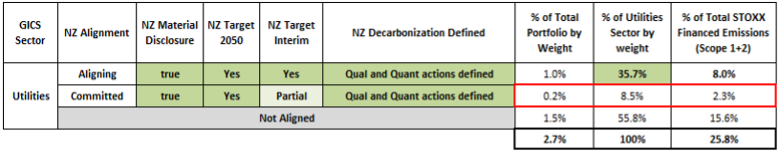

The Utilities sector offers further insight into potential targeted engagement with possibilities for significant progress on financed emissions. The Utilities sector represents 2.7% of the STOXX index by weight, and 25.8% of its Scope 1 & 2 financed emissions. Aligning Utilities sector companies account for 35.7% of the sector by weight or 8% of STOXX World AC Scope 1 & 2 financed emissions. However, in the “Committed” category, 8.5% of the sector by weight and 2.3% of the index’s financed emissions (highlighted in red) require only an enhancement to the disclosed interim target to achieve “Aligning” status.

Table 4: Alignment Metrics for Utilities Sector within STOXX World AC Index

Source: ISS ESG

Progress towards Net Zero through Investor Engagement

Among options available to institutional investors, divestment and strategic asset allocation are available to quickly achieve the rapid near-term decarbonization targets that may have been set. Asset managers and asset owners may also be concerned with progress towards longer-term alignment with Net Zero. However, as has been discussed here, an investment strategy that focuses on diverting funds to a low-emitting set of issuers may interfere with a portfolio capturing the progress being made towards Net Zero. Further, a more granular understanding of the interconnected issuer-level commitments to Net Zero, decarbonization strategies, and target-setting can assist targeted engagement efforts to increase portfolio alignment with Net Zero objectives.

By engaging collaboratively, institutional investors can leverage their scale in discussions on ESG issues, and communicate their concerns to corporate management, using services such as ISS ESG’s Thematic Engagement Solution, which includes an engagement programme dedicated to Net Zero.

ISS ESG facilitates dialogue with companies on behalf of participating investors who aim to improve the practices of 30 of the largest (by market cap) and highest-emitting companies to reach Net Zero by 2050. This effort involves calling for robust long- and medium-term targets and decarbonization strategies.

During the first year of ISS ESG’s Net Zero Thematic Engagement – initiated at the end of March 2022 – ISS ESG has received responses from two-thirds of the 30 target companies, which have shown a willingness to participate in the dialogue and discuss the issues with participating investors. As a result of ISS ESG’s escalation process, the response rate has progressively increased throughout the year. ISS ESG has noted regional differences in response rates, with companies headquartered in North America being more likely to respond than those in Asia.

ISS ESG has observed progress towards all the objectives set at the start of the engagement: the establishment of a 2050 Net Zero greenhouse gas (GHG) emissions target and a medium-term GHG reduction target, as well as a decarbonization strategy. For each of these objectives, around one-third of the target companies which had not fulfilled them at the start of the engagement are now assessed as either having partly or fully achieved the objectives.

The dialogues have also provided insights beyond what is immediately discernible from the proprietary ISS ESG data that is leveraged to track progress. For example, several companies have yet to demonstrate progress in their public disclosures, but through the dialogues they have shared context on their approach to the topic of Net Zero, as well as examples of their plans and initiatives for moving towards carbon neutrality. Examples include possibly taking into account electricity purchased for the company’s own facilities in their long-term carbon neutrality goals, as well as plans to reduce emissions, even if these plans have not yet been formalised as targets. Through the dialogues, some companies have also highlighted challenges regarding decarbonization.

The current cycle of the Net Zero Thematic Engagement will continue until 2024, with ISS ESG facilitating dialogue on behalf of participating investors who aim to drive the change needed to stay within 1.5°C. Facilitating these dialogues will include escalating with companies that have yet to respond.

Explore ISS ESG solutions mentioned in this report:

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with ISS ESG’s Norm-Based Engagement Solution and Thematic Engagement Solution.

By: Chris Monks, Climate Analytics Consultant, ISS ESG

Claire Lambert, Climate Analytics Consultant, ISS ESG

Loïc Dessaint, Senior ESG Engagement Manager, ISS ESG

Rafel Servent, ESG Engagement Manager, ISS ESG