A Sustainability Transformation to Strengthen Non-Oil-Based Sectors

With Egypt hosting COP27 last year, and the UAE set to host COP28 this year, the climate and sustainability ambitions of the Middle East are in sharp focus. At COP27 we saw substantial funding commitments, including the Middle East Green Initiative and the Arab Coordination Group, which committed billions in funding to an energy transition in line with Net Zero long-term commitments. At the same time, the Gulf states, which are historically hydrocarbon-reliant economies, noted that the transition has to be realistic in recognizing the need to supply affordable energy to other global economies, as well as considering the need for global energy security.

Transforming existing sectors and diversifying their economies to include non-oil-based sectors such as tourism and healthcare have been a key focus for Middle Eastern countries to attract investments from both domestic and foreign investors, including institutional investors that are looking to expand and diversify their sustainability portfolios. Current mega projects involving solar and wind power plants are showcasing the Middle East’s ambitions in sustainability. Arguably, the G of ESG has been a more prominent historic concern for Middle Eastern investors looking to screen for alcohol, gambling, or tobacco, but the full range of ESG factors is now becoming more and more relevant to both Middle Eastern and global investors investing in the region.

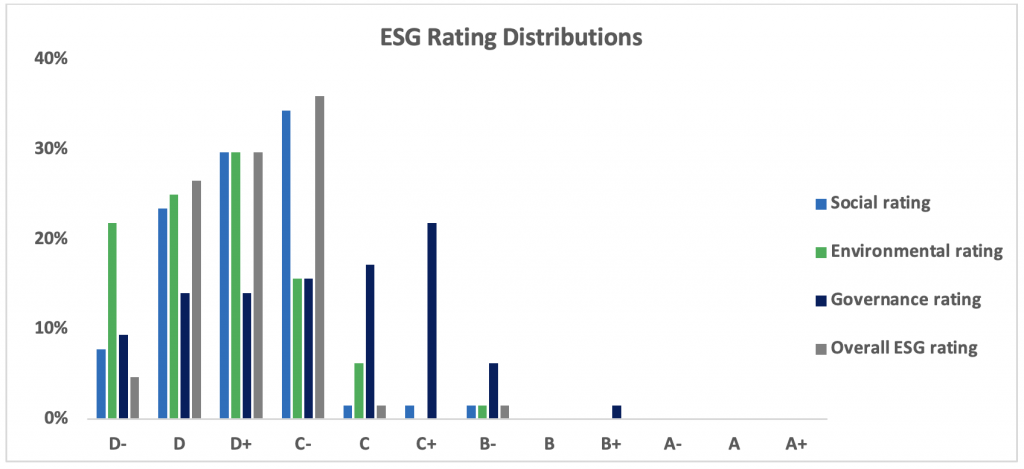

Companies operating in the Middle East, however, tend to have lower Environmental, Social, Governance, and overall ESG scores, as shown in Figure 1. The International Monetary Fund notes that if this trend continues, there is a risk that the region will continue to attract only a small fraction of investments in the global sustainable fund market.

Figure 1: ESG Rating Distributions for Middle Eastern Companies

Notes: Countries included in the analysis are Saudi Arabia, the United Arab Emirates, Qatar, and Türkiye. ISS ESG currently assigns industry-specific Prime thresholds of B-, C+, or C to overall ESGratings. We believe Prime-rated companies are industry leaders, which are well equipped to mitigate the most prevalent ESG risks.

Source: ISS ESG

ESG Reporting and Performance Enabled by the Region’s Stock Exchanges

This piece provides an overview of ESG regulatory developments, specifically those related to enhanced corporate disclosure requirements, in Saudi Arabia, the United Arab Emirates, Qatar, and Türkiye. Most of these countries’ efforts, especially those related to ESG disclosure and guidance, are being led by each country’s stock exchange(s), with all those covered here being members of the UN’s Sustainable Stock Exchanges (SSE) Initiative.

Saudi Arabia

Under Saudi Arabia’s Vision 2030, the country strives to achieve a diverse and sustainable economy. Examples of the country’s efforts in this area include the following:

- In 2017, the Capital Market Authority issued new corporate governance rules which would enhance the rights of shareholders and board members.

- To advance ESG concerns in the Saudi capital market, Saudi Exchange (as at June 29, 2023, listed companies: 227; domestic market cap: $2.8 trillion), encourages listed companies to identify, prioritize, and assess the ESG factors most critical to their business; navigate and make sense of the complex and ever-changing ESG landscape; and refer to the various reporting initiatives and frameworks available for companies.

- The country’s stock exchange has published ESG guidance that includes a list of common ESG themes such as labor management, controversial sourcing, supply-chain labor standards, and tax transparency.

- In 2023, the GCC Exchanges Committee, which is chaired by the Saudi exchange, published a set of ESG disclosure metrics for listed firms in the Gulf region. These metrics comprise 29 standards, are voluntary, and do not replace existing ESG disclosure guidelines for GCC exchanges.

The United Arab Emirates

A significant priority of the UAE’s Vision 2031 is to establish a green economy that promotes sustainable development and infrastructure. The country has made advancements in carrying out its sustainable development strategy within the Dubai Financial Market (DFM, listed companies: 63; domestic market cap: $111 billion) and the Abu Dhabi Securities Exchange (ADX, listed companies: 75; domestic market cap: $433 billion). Both exchanges are required to publish annually sustainability reports aligned with GRI standards, and have provided guidance and training on ESG reporting. With the support and approval of the Securities and Commodities Authority (SCA), the DFM has also developed an ESG stock index specifically for UAE companies that is designed to monitor and evaluate the performance of businesses in the country that adhere to sustainability best practices. The SCA has also supported ESG reporting by encouraging listed companies to disclose a set of 32 ESG metrics and indicators.

Qatar

Qatar’s National Vision 2030 aims to advance Qatar’s society, sustain its development, and provide a high standard of living for its people by making commitments to diversify its local economy and reduce its reliance on hydrocarbons. While the Qatar Stock Exchange (QSE) (listed companies: 51; domestic market cap: $200 billion) does not include ESG reporting as one of its listing rules, a recent corporate governance code introduced by the Qatar Financial Markets Authority (QFMA) describes how listed companies are required to operate within a “comply or explain” framework. The QSE acknowledges that, partly because of the differing risks and opportunities that companies face, it may not be feasible or practical for listed companies to report on all ESG aspects covered in international frameworks or standards. In accordance, the QSE developed their own guidance for ESG reporting that includes social issues such as the rate of ‘Qatarization,’ which measures employment of Qatari nationals in the private and public sectors—an aspect the country considers as impacting sustainability. A sustainability reporting platform is also available, in which listed companies can log in and self-report their data to enable greater transparency.

Türkiye

Türkiye’s 2023 national vision breaks down their targets into categories focusing on the economy, energy, foreign policy, healthcare, transport, and tourism. Borsa Istanbul is the only stock exchange (listed companies: 483; domestic market cap: $332 billion) in Türkiye and has developed written guidance on ESG reporting, including the Sustainability Reporting Guide, the Integrated Reporting Guide, and the Climate Reporting Guide. Sustainability-related initiatives in the country include the following:

- In 2014, the stock exchange introduced the BIST Sustainability Index, comprising listed companies that comply with three specific conditions related to their overall and individual component ESG scores.

- In 2020, ESG reporting was required as a listing rule, with specific principles and metrics expected to be disclosed by listed companies under the “comply or explain” principle.

- In mid-2022, a new Environmental Impact Assessment Regulation was published to set out new procedures and principles with respect to the environmental impact assessment process.

Türkiye’s Capital Markets Board is also a member of the SSE Regulator Working Group, supporting the UN in developing guidance on how securities regulators can support the SDGs.

Key Emerging Themes

Some Middle Eastern countries and their respective stock exchanges are actively working towards a more comprehensive ESG reporting regime, with participation of women on boards and climate-related disclosure requirements being emerging themes.

Participation of Women on Boards

- The region is seeing increased participation from women due to regulatory reforms; however, only one stock exchange – the Abu Dhabi Securities Exchange – requires listed companies to have at least one woman serving on their board. This is not unique to the Middle East, though. Requirements for significant female representation on company boards are present in only some parts of the world: for example, countries such as Germany and France require 30% and 40% of women on boards, respectively. The higher participation of women in Europe highlights the potential impact that regulatory changes can have on corporate boards.

ESG Disclosure Requirements

- ESG reporting is a critical contributor to investors’ understanding of companies, and the level of material data reported by individual companies could impact ESG scores. Mandatory ESG reporting is in the beginning stages in the region, however. Recent findings involving corporations in the region suggest most companies are in the “start-up” phase in terms of ESG strategy and implementation, and companies seem to want more specific government policies and regulations to underpin ESG efforts.

Implications for Investors

As the region’s corporate reporting landscape evolves, investors can expect to see a greater range of data and information on a company’s core business value drivers such as growth, profitability, capital efficiency, reputation, and risk exposure in relation to ESG factors. The ISS ESG Corporate Rating acknowledges these regional differences by applying various measures, including high country standards, and modifying indicator applicability based on the indicator’s materiality. The ISS ESG Country Rating is also a relevant solution for investors wishing to gain a deeper understanding of the efforts and progress made by countries throughout their sustainability journeys.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

Authored by:

Stephanie Aboueid, Sector Lead, Corporate Ratings, Healthcare, ISS ESG

Phillip Blocker, Analyst, Corporate Ratings, Healthcare, ISS ESG