Israeli banking rules appear to encourage competition for board seats at banks without controlling shareholders. Banks often have unique status as the trustees of public wealth and investments. Consequently, Israel’s major banking regulator, the Supervisor of Banks, imposes particular rules, especially upon banking boards. Most notably, the board of directors must comply with Regulation 301 of the Code of Proper Conduct of Banking Business, which lays out a number of standards for individual directors’ qualifications and independence.

According to Regulation 301, at least one third of the board of directors must consist of external directors, as defined in the Israeli Companies Law, rather than two external directors for other sectors. Additionally, the Supervisor of Banks defines specific responsibilities for bank directors along with a reporting requirement. These include assessing debt collection activities, measuring risks, and setting up guidelines for controlled corporations. This means that ‘independent’ directors are not only accountable to shareholders, but also to the Israeli authorities, further emphasizing the public role of banks in Israel. Compliance with these requirements and the activities of the board in general must be reported regularly to the Supervisor of the Banks; and in the case of an ‘exceptional event’ as defined in the relevant directives, they must be reported immediately.

Further, according to the Banking Law (licensing) of 1981, at banks without a controlling ownership, board nominees are proposed by the Committee for the Appointment of Directors at Banking Corporations in Israel. The Committee is appointed by the Bank of Israel Governor, and at least five of its members are comprised of senior judges, economists, and incumbent directors in the applicable bank. According to its internal regulations, the committee also considers; among various factors, professional fitness for the role; possession of required personal traits, such as integrity, fairness, and manners; lack of a reason to bar the appointment, such as conflicts of interest; the specific needs of the bank; and societal considerations, such as representation of different sectors, genders, and ensuring equality of opportunities.

The Committee’s practice is to nominate more candidates than available seats, thus necessitating a competitive election wherein generally, the candidates who receive the most votes out of the pool of nominees get elected to the board seat. This competitive process has led to many high-profile races, including interviews in front of the Committee, widespread media coverage, and engagement between candidates and institutional shareholders.

With a focus on strong profiles of all proposed candidates, ISS’s Benchmark recommendations rely on a reasoned assessment of the professional qualifications and previous experience of the nominated individuals – especially considering experience accrued at the company itself, in the sector, and at publicly listed companies in general. Further, specific considerations include independence, tenure, conflicts of interests, gender diversity and other corporate governance matters. As part of its 2021 Israel Benchmark Proxy Voting Guidelines updates, ISS has codified this approach.

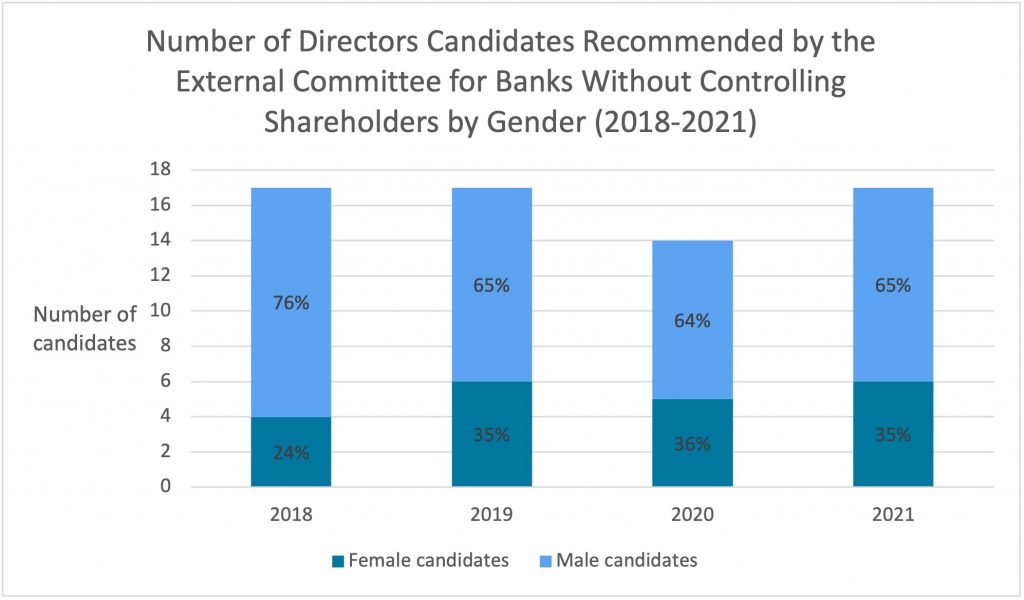

While there is still public concern regarding the level of gender diversity on banking boards, some progress was recently made as the percentage of female candidates has increased from approximately 24 percent in 2018 to approximately 35 percent in the years 2019-2021.

Source: ISS Governance Research & Voting

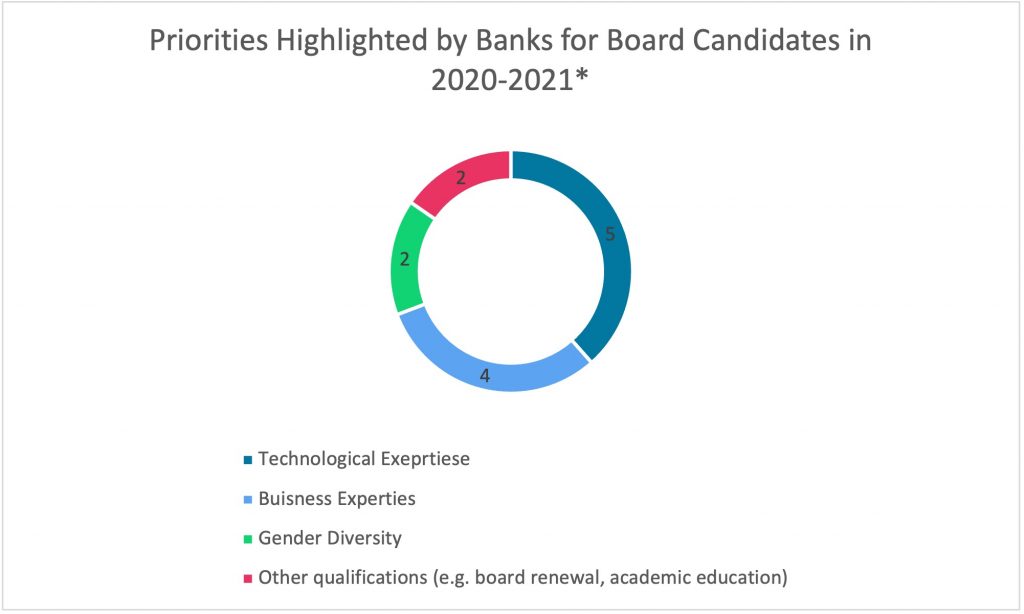

Another new development is that starting from 2020, banks have begun emphasizing their own strategic priorities regarding new board members in applicable meeting materials. This information has increased transparency concerning the selection process which further supports investors with making informed voting decisions in such contests. Notably, banks highlighted technological experience and banking and business experience as important qualifications.

Source: ISS Governance Research & Voting

*Note that banks have often highlighted more than one desirable qualification.

The prominence of technological expertise as a highlighted priority corresponds to a recent call by the Supervisor of Banks to elect more directors with technological expertise so banks will be better able to manage cyber risks and security. This recommendation exceeds the statutory required lone director with technological proficiency.

Banking elections from pools of nominees are expected to be a closely watched topic in the future years, requiring shareholders to pick between diverse sets of talents, candidates, and approaches to the banking sector.

By Dvir Aviam Ezra