Advisor Pulse is the advisor sentiment research series from ISS Market Intelligence. In the latest edition of Advisor Pulse, which surveyed over 900 advisors, we asked them about their thoughts on branding and how they engage with Asset Management brands.

An Asset Manager’s brand remains a crucial differentiator

In a crowded financial services landscape, asset managers are looking to stand out. While the wealth of available options and the heightened standards for performance pose challenges for asset managers trying to retain customers, an asset manager’s brand remains a critical differentiator. Not only do advisors need to trust any firm they are willing to let manage client money, but they rely on strong brands to guide their decision making in a commodified market.

Trust is the foundation of client relationships

When asked about the importance of various attributes of manager’s brands, 59% of advisors rated trust as “extremely important,” the highest of any metric. A history of superior performance and ease of doing business ranked second and third at 49% and 43%, respectively. Trust is important for both clients and advisors. In describing why they felt asset managers’ brands were important, numerous advisors surveyed said that their clients need to have trust and comfort in a brand and are more likely to do so for well-established companies with sterling reputations.

Winning over Advisors

While client trust is important, advisors will be making the primary investing decisions in these cases, and they are the audience that asset managers need to win over. Managers must in turn ask themselves how best to convey their brand to advisors. Previous editions of ISS MI’s Pulse Research have covered how important it is to have in-person expertise to walk advisors through complex investment discussions. In this most recent survey, advisors cited field wholesalers as the most effective at conveying an asset manager’s brand. 32% of advisors listed them as “extremely effective” at this task, while an additional 25% listed them as “effective.” Thought leadership and the internal wholesaler were tied as the second most effective, with 15% of advisors rating each as “extremely effective.” An asset manager can use their thoughts on capital markets to educate investors about economic concerns while simultaneously promoting their brand.

Channel preferences vary by Advisor type

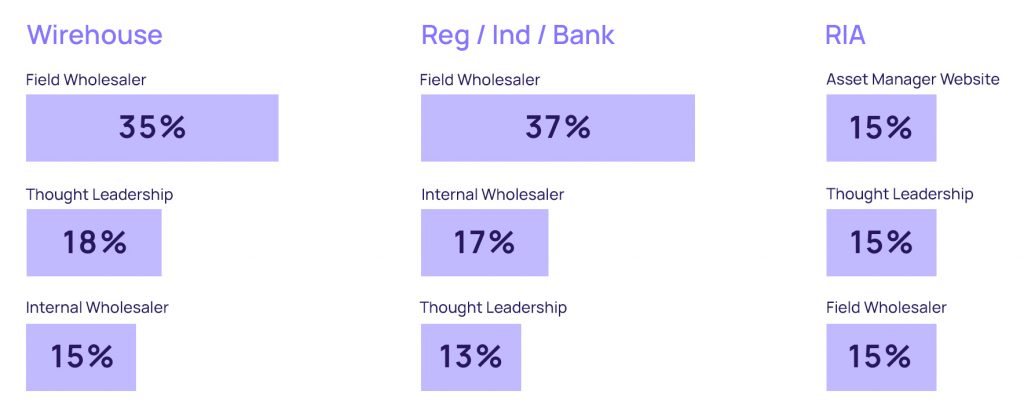

The research revealed a stark divide by channels in what advisors found most effective. Wirehouse and broker-dealer were notably more likely to cite field wholesalers as the most effective at conveying a firm’s brand. RIAs displayed a more balanced set of preferences and leaned more towards material and collateral that they could review on their own schedule, as seen Figure 1 below.

Figure 1: How Effective Are Each Of The Following When It Comes To Conveying An Asset Manager’s Brand?

Field wholesalers widely seen as best brand ambassadors

An equal proportion of advisors in the channel rated an asset manager’s website, thought leadership, and the field wholesaler as extremely effective. Those same channels demonstrated a similar divide in how important they viewed brand. 27% of wirehouse and 28% of broker-dealer advisors cited brand as “extremely important” when recommending products, compared to 18% of RIA advisors.

Six times each year ISS Market Intelligence (ISS MI) surveys Advisors across the country to understand the advisor decision making process and their perceptions of firms across the asset management industry. Download a Summary of the latest issue of Advisor Pulse.

By: Alan Hess, Vice President, ISS Market Intelligence