While global emissions are at a record high, mitigation options are more competitive than ever before

The latest IPCC report leaves no doubt – global emissions across all major greenhouse gases are higher than ever. What is the background to this latest report?

The IPCC has finalised the third component of its Sixth Assessment Report (AR6), which conveys the findings of Working Group III (WG III). This report, finalised April 4, closely follows the publication of the findings of WG II, released in February, which focused primarily on the observed and projected impacts and risks of climate change. Building on this work, WG III examines emissions trends and drivers, and investigates the current state of play with regard to mitigation options. The findings are alarming and promising in equal measure.

The Grim Reality

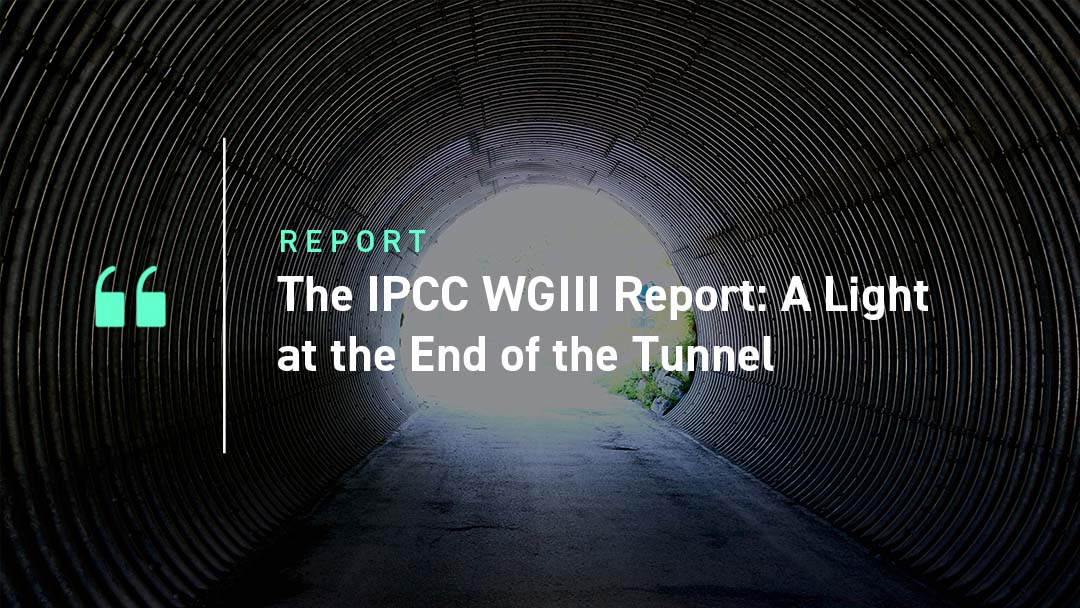

In absolute terms, GHG emissions continued to rise in the years up to 2019. The report states, with high confidence, that “global net anthropogenic GHG emissions during the decade (2010-2019) were higher than any previous time in human history.” While unsurprising, this statement should serve as a wake-up call.

Figure 1: Global net anthropogenic GHG emissions (GtCO2-eq) from 1990 to 2019

Source: IPCC WG III Report

Even if countries fully deliver on their Paris Agreement Nationally Determined Contributions, projected global emissions by 2030 far exceed those needed to limit warming to 1.5°C; in fact, this pathway would not even guarantee warming would stay below 2°C.

To ensure the alarming potential consequences of exceeding 1.5°C of warming (as outlined in the WG II report) are not realised, dramatic emissions reductions are required in the next decade. Fortunately, the outlook for mitigation options has grown considerably brighter.

The responsibility of capital stewards

Though the IPCC has said it before, it seems it must be said again: to keep global warming below 1.5°C or even 2°C, a rapid and substantial reduction in fossil fuel consumption is urgently required.

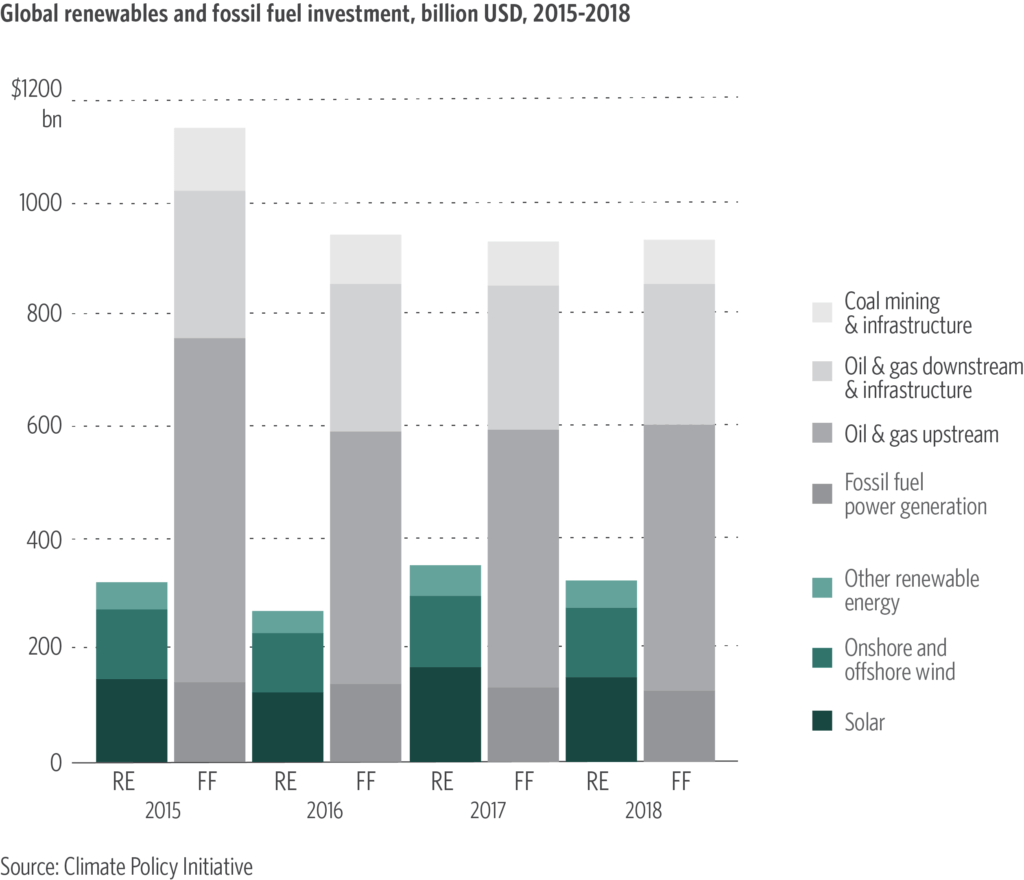

Alarmingly, the report highlights “persistently high levels of both public and private fossil-fuel related financing,” with such fossil fuel investment continuing to far exceed that of renewable generation. Figure 2, sourced from the Climate Policy Initiative, illustrates this trend.

Figure 2: Global renewables and fossil fuel investment, billion USD, 2015-2018

The authors cite the perceived risk-return profile of fossil fuel investments as a key factor in the continued financing of fossil fuels.

In order to communicate the message to stop financing fossil fuels in a language readily understood by the financial world, climate-related risks must be systematically entrenched in the decision-making process. When these risks are properly considered, fossil fuel projects are unlikely to be considered a viable proposition.

WG III notes that climate-related financial risks remain “greatly underestimated by financial institutions and markets.” As a consequence, the pace of capital reallocation is inadequate, with fossil fuel projects retaining ready access to capital.

For some in the financial community, climate-related financial risks are already an evident and critical consideration. The report cites increasing awareness of climate risks among investors, central banks, and regulators. It further notes the potential for this awareness to support broader climate policy development and implementation. However, greater momentum is needed.

Inequity as a climate-related financial risk

The WG III findings highlight another critical risk category which remains almost entirely unaddressed by the financial community: risks relating to national and international equity.

Throughout the reports of both WG II and WG III, notions of finance and equity appear to be inextricably linked. “Fundamental inequities” remain in access to finance, with climate finance flows unevenly distributed across regions and sectors. This remains a key barrier to mitigation in developing nations.

Moreover, while the sustainable finance movement is increasing momentum in some parts of the world, others are being left behind. Though markets for green bonds and ESG products are booming, the report notes that these have limited applicability to many developing countries.

Ensuring that developing nations decarbonise at the same pace as the rest of the world is not only the concern of developing nations. Climate change is an inherently global phenomenon, and achieving decarbonisation in some parts of the world and not others will have disastrous and far-reaching consequences.

It is thus incumbent upon developed nations to support the decarbonisation of developing nations – a notion enshrined in the Paris Agreement. Finance – cited as a key enabling condition for enhancing the feasibility of adaptation and mitigation measures – is a critical component of this support. International financial co-operation will be crucial to ensuring equitable access to capital for mitigation. Without equity, ambitions for a net zero global economy are destined to fail.

While the challenges are large, increasingly favorable economics provide some hope.

The economics are stacking up in favour of the transition

The projected costs of climate inaction are rising, while costs associated with mitigation are falling. The WG III report states, with medium confidence, that “the global economic benefit of limiting warming to 2°C is reported to exceed the cost of mitigation in most of the assessed literature.” In particular, the report identifies sector-specific mitigation options in detail, addressing energy, transport, buildings, industry, agriculture, forestry, and food systems. Crucially, there is an array of viable and affordable decarbonisation options available. It now remains for these solutions to be implemented globally and at scale.

Energy generation:

Mitigation options for energy generation are particularly viable from an economic standpoint, with solar PV and onshore wind now competitive with fossil-based energy generation in many regions. While deployment of wind and solar is rising rapidly, additional growth is needed to push the renewable market share from below 10% today to 100% by 2050. Demand for electricity will also grow as other sectors electrify, augmenting the need for further renewable deployment.

Transport sector:

Decarbonising the transport sector is critical to broader mitigation efforts, with transport emissions failing to fall over the past decade. Electrification of public transport is a critical step and is described in the report as demonstrably “feasible, scalable and affordable.”

Industry:

The industrial sector requires similar attention. Driven by global demand for basic materials, emissions from industry continue to rise. While mitigation is more challenging for this sector than for others, net zero industry emissions are possible, according to the report. Solutions include reducing material demand growth, improving material efficiency, and adopting new processes that rely on low- or no-carbon energy carriers and feedstocks such as electricity, hydrogen, and biofuels.

Building sector:

Significant mitigation potential is identified within the building sector, particularly driven by increased use of energy-efficient technologies and passive housing methods. Promisingly, Net Zero- or low-energy buildings are now achievable in all regions. Conversely, if such measures are not adopted, the risk of lock-in is substantial, given the long lifetime of buildings.

Holistically understanding a portfolio’s climate characteristics

While the stakes in the climate crisis are high and intensifying, more solutions are becoming available – both solutions to decarbonising the real economy and solutions for investors in managing their portfolios. ISS ESG Climate Solutions can support investors in understanding a portfolio’s climate characteristics across key dimensions highlighted by the WG III report. From understanding companies’ capital investments into the expansion of both fossil fuels and renewables, through to detailed company target analysis related to Net Zero and quantifications of transition risks, ISS ESG provides a broad set of solutions to address climate topics. Find all resources related to the Net Zero transition here.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Use ISS ESG Energy & Extractives Screening to assesses companies’ involvement in the extraction of fossil fuels, and the generation of power from fossil fuels, nuclear and renewable sources.

By Emily Faithfull, Climate Analytics Consultant, ISS ESG