The latest IPCC report highlights impacts, vulnerability, and extensive adaptation needs

The Intergovernmental Panel on Climate Change (IPCC) has just released the second component of its Sixth Assessment Report (AR6). Coming in at a whopping 3,000+ pages, the new report communicates the findings of Working Group II (WG II), tasked with examining the challenges of achieving sustainable development in the context of observed climate change risks and impacts, adaptation, and vulnerability. And challenges there are, with irreversible impacts expected if 1.5°C is exceeded – even only temporarily – while nearly half of earth’s population is highly vulnerable to the effects of climate change.

What is the background of the latest IPCC report?

Building on the work of the Fifth Assessment Report (AR5) and the already published Working Group I (WG I) contribution, the latest AR6 instalment provides the most up-to-date scientific consensus on the following climate change topics:

- Observed and Projected Impacts and Risks;

- Adaptation Measures and Enabling Conditions; and

- Climate Resilient Development.

While the WG I contribution to AR6 was primarily focused on the physical science of climate change, WG II’s contribution provides a more holistic insight into the interdependent relationships between climate change, biodiversity, and human society. The report ‘integrates knowledge more strongly across the natural, ecological, social and economic sciences than earlier IPCC assessments,’ exploring climate risks and impacts from a systems-based perspective.

Irreversible impacts are just around the corner

Crucially, the report warns that if global warming exceeds 1.5°C, even temporarily, severe additional risks will be posed for human and natural ecosystems, some of which will be irreversible. Current policies render such a scenario likely.

Impacts, however, are not evenly distributed. As the WG II authors note, the most vulnerable societies are disproportionately affected by climate impacts, with approximately 3.3 to 3.6 billion people considered to be highly vulnerable to climate change. To put this in perspective: that is nearly half of humankind. Perhaps unsurprisingly, where climate hazards and vulnerable populations co-exist, these hazards are contributing to humanitarian crises. Moreover, climate and weather extremes drive displacement in all regions, which in turn exacerbates vulnerability. Climate hazards are already having notable impacts on food security, particularly in parts of Africa, Asia, Central and South America, small island states, and the Arctic, with food production and access expected to be further compromised in already vulnerable regions.

The report also outlines the implications for human health, noting the expected significant increase in ill health and premature deaths arising from climate change and related extreme events. The prevalence of various food, water, and vector-borne diseases is also projected to increase under any warming scenario if additional adaptation measures are not taken.

Further concern is conveyed in relation to biodiversity. Notably, 3-14% of terrestrial species are likely to face very high risk of extinction at warming levels up to 1.5°C, with the higher estimate reaching 18% at 2°C and 29% at 3°C. Ocean and coastal ecosystems are similarly at risk of substantial biodiversity loss under any warming scenario.

With all those dire projections, what can investors do?

A little less conversation, a little more action, please

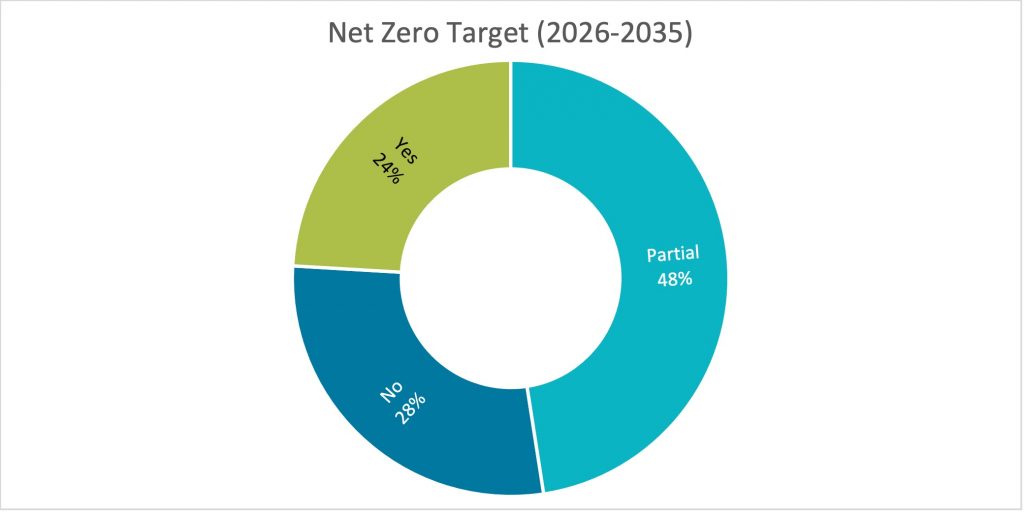

There is much to do. Corporate climate action needs to improve, and quickly. Currently, only 24% of the more than 160 companies that are among the world’s largest emitters of greenhouse gases, and are monitored by the investor initiative Climate Action 100+, have set climate targets for the period 2026-2035 that meet criteria such as compliance with a 1.5°C climate target:

Figure 1: Completeness and ambition of the Net Zero goals (2026-2035) of Climate Action 100+ companies

Source: ISS ESG

Based on such analysis, investors are not only working to decarbonize their portfolios, they are also seeking to engage in dialogue with relevant companies. One avenue for achieving this objective is via collective thematic engagement solutions such as those offered by ISS ESG. This process sees Net Zero-laggards targeted for communication on behalf of the participating investors in order to accelerate their Net Zero ambitions.

While driving mitigation remains key – the impacts of exceeding 1.5°C are looming! – the IPCC’s report makes equally clear that whatever humanity does at this point, we are facing a certain level of unavoidable climate impacts, and these impacts are already affecting global communities.

Tackling the blind spot: Finance for adaptation

Adaptation – defined in the report as ‘reducing climate risks and vulnerability… via adjustment of existing systems’ – is critical in ensuring that communities are able to cope with the consequences of unavoidable climate change.

The WG II report highlights adaptation gaps between current and required efforts, with existing efforts described as ‘fragmented, small in scale, incremental, [and] sector-specific,’ as well as ‘unequally distributed across regions.’ Global adaptation measures are judged to be broadly insufficient and inadequate, leaving already vulnerable populations at increased risk of food and water insecurity, disease, and forced migration, among other consequences.

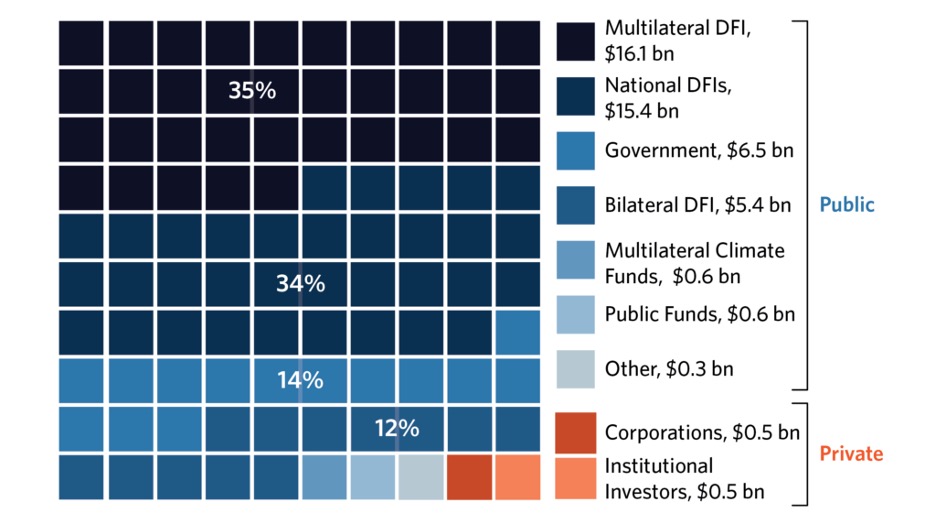

Crucially, the authors point out that these adaptation gaps are partly the consequence of a dearth of finance allocated to adaptation, with the ‘overwhelming majority’ of global finance targeted towards mitigation activities. As noted in a 2021 report from the Climate Policy Initiative (CPI), over 90% of global climate finance is allocated towards mitigation activities, with only 7% targeting adaptation.

The mobilisation of and access to adequate financial resources is one of the ‘enabling conditions’ cited by WG II as essential to improving adaptation efforts. At the same time, the WG II report notes that to date, the vast majority of adaptation finance has come from public sources, a picture confirmed by the Climate Policy Institute:

Figure 2: Sources of adaptation finance – Development Finance Institutions (DFIs) and others

Source: Climate Policy Initiative

New tools are emerging that give investors more visibility into companies’ involvement in adaptation activities. ISS ESG’s EU Taxonomy Alignment Solution, for example, allows investors to screen companies according to their involvement in activities linked to climate change adaptation. Expectations regarding transparency both by and for investors, such as in the context of the various Net Zero initiatives, are increasing.

With so much to be done, there is a significant role to be played by all actors, and myriad opportunities for the private sector to help mobilise the finance required to adapt to the range of social and environmental challenges the world is set to face. Irreversible impacts are just around the corner, and investors will need access to all available tools if they are to be avoided.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Develop engagement strategies, define achievable engagement objectives and manage your engagement process with the ISS ESG Engagement Service.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By Emily Faithfull, Climate Analytics Consultant, ISS ESG Viola Lutz, Head of Climate Solutions, ISS ESG.