Regulatory Framework for Tobacco Services

Regulation of tobacco products has expanded beyond tobacco production and distribution to also address tobacco services. Tobacco services include licensing, advertising, marketing, and promotion, as well as the manufacture and supply of key components and raw materials necessary for tobacco production (such as flavoring, filters, tobacco roll paper, cigarette manufacturing machines, tobacco packaging, etc).

Tobacco services are considered in key frameworks that responsible investors follow (Table 1). In particular, the World Health Organization Framework Convention on Tobacco Control (WHO FCTC) provides regulation and regulatory guidance on tobacco services such as tobacco packaging and labelling (Article 11) and tobacco advertising, promotion, and sponsorship (TAPS) (Article 13).

Table 1: Key Frameworks for Investors Considering Exclusion of Tobacco Services

| Framework | Objective | Tobacco Coverage | In Relation to Investment |

| WHO Framework Convention on Tobacco Control (WHO FCTC) | To combat tobacco use globally. | This covers advertising bans, packaging regulations, and other public health policies. Article 11: Packaging and Labelling of Tobacco Products: Article requires tobacco packaging to feature multiple clear, visible health warnings covering a significant portion of the packaging, preferably with graphic illustrations, while prohibiting misleading terms such as “light” or “mild” that suggest reduced harm. Article 13: Tobacco Advertising, Promotion, and Sponsorship: Article requires a comprehensive ban on all tobacco advertising, promotion, and sponsorship, including indirect methods such as brand stretching and product placement, while urging strict regulations and public awareness campaigns to counter industry tactics. | Widespread adoption of WHO FCTC measures will likely affect tobacco markets across multiple regions. |

| United States Conference of Catholic Bishops (USCCB) Investment Guidelines | To provide principles on ethical investment based on the Catechism of the Catholic Church, no. 2290. | It discourages investments in companies involved in tobacco production due to health and ethical concerns. | U.S. investors following USCCB guidelines may need to divest from tobacco-related businesses, impacting market valuation. |

| Family Smoking Prevention and Tobacco Control Act (Tobacco Control Act), U.S. | To grant the U.S. FDA authority to regulate tobacco products. | It includes controls of tobacco marketing, mandates easily visible health warnings, and restricts flavored tobacco. | Regulations that limit tobacco advertising and flavored tobacco products may impact industry revenue and long-term stability. |

| Tobacco Products Directive (TPD), European Union | To ensure tobacco control measures across EU member states. | This regulates packaging and labeling, including a ban on misleading elements on packaging. | Stringent restrictions on tobacco products, which impact the profitability and future growth of tobacco companies. |

| Sustainable Finance Disclosure Regulation (SFDR), European Union | To enhance transparency in sustainable investments and ESG disclosures. | This regulation requires financial institutions to disclose how their investments impact sustainability, including exposure to tobacco-related businesses. Article 8: Environmental and social characteristics: The article applies to financial products that promote environmental or social characteristics but do not prioritize sustainability as their core objective. It mandates transparency on how these characteristics are met, integration of sustainability risks, and adherence to good governance practices. These requirements entail consideration of evolving ESG regulations impacting sectors such as the tobacco industry. Article 9: Defining sustainable investment: The article applies to financial products with a strictly defined sustainable investment objective, transparency on how these objectives are met, and adherence to the “Do No Significant Harm” (DNSH) principle. These funds must ensure 100% sustainable investments, track progress through indicators, and report on Principal Adverse Impacts (PAIs). Adherence to DNSH reflects evolving ESG regulations and investor scrutiny, including considerations related to the tobacco industry. | EU financial institutions are following the SFDR Articles 8 and 9 to assess tobacco-related risks in ESG portfolios, influencing capital allocation decisions. |

Source: ISS ESG SBS research

As for European investors, they have implemented the Sustainable Finance Disclosure Regulation (SFDR) since 2019, and companies involved in tobacco cultivation, production, and promotion fall within the scope of SFDR Articles 8 and 9. Portfolios specifically subject to the EU Climate Transition Benchmark and the EU Paris Agreement Benchmark need to exclude tobacco assets. In the United States, a voluntary but significant set of rules for ethical and socially responsible investments is that set by the United States Conference of Catholic Bishops (USCCB). The USCCB Investment Guidelines classify tobacco as an addictive material related to harmful habits and discourage investment in tobacco production.

FCTC Regulation on Tobacco Packaging and Labelling

From a control perspective, printing well-designed health warnings on tobacco product packages is a cost-effective way to increase public awareness of the health effects of tobacco use, reduce tobacco consumption, and prevent related premature morbidity and mortality. Several of the regulations identified above, including the WHO FCTC, address tobacco packaging.

Guidelines for WHO FCTC Article 11 provide specifications for the design of warnings on tobacco unit packaging and labelling. These guidelines also specify that parties to the FCTC should prevent the use of misleading or deceptive packaging that is “likely to create an erroneous impression about the product’s characteristics, health effects, [or] hazards or emissions.”

Following the WHO FCTC guidelines, its member parties have enacted legislation to control and regulate tobacco packaging and labelling services. According to the available information on tobacco control law, 108 jurisdictions implement tobacco packaging and labelling regulations on smoked tobacco products that require warnings to be included on unit packaging, where the proportion of warnings to the unit packaging size must exceed 15% (average of the front and back) (Figure 1). These 108 jurisdictions also prohibit or restrict the use of misleading packaging and labels.

Figure 1: Geographic Spread of Jurisdictions Regulating Size of Warnings on Smoked Tobacco Packages

Note: The selected criteria included “Policy: Packaging & Labelling”; “Size of warnings/messages on unit packaging (average of front and back): Under 30%, 30% to 49%, 50% to 74%, and 75% and larger”; “Pictures Required: Yes and No”; “Product Type: Smoked Tobacco Products”; and “Misleading Packaging and Labelling Banned or Restricted: Yes.”

Source: Institute of Global Tobacco Control at the John Hopkins Bloomberg School of Public Health (extracted on May 2, 2025)

Among these 108 jurisdictions, 19 (including Australia, Canada, Hong Kong, India, Singapore, Thailand, Turkey, and Uruguay) even require unit packaging to contain warning pictures, and the warning content accounts for more than 75% of the unit packaging size.

FCTC Regulation on Advertising

To safeguard public health, multiple international agencies and governments have tried to restrict and regulate tobacco advertising. WHO FCTC Article 13 identifies comprehensive bans on TAPS as reducing consumption of tobacco products and mandates member parties to enforce (consistent with their constitutional principles) comprehensive bans on TAPS within five years of the treaty’s entry into force. Guidelines for Article 13 define tobacco advertising broadly, prohibiting all communications that promote tobacco products or tobacco use in general, including deceptive marketing that misleads consumers about health risks.

While many countries have comprehensive bans, others impose partial restrictions on specific advertising channels. As per WHO, comprehensive bans cover all direct advertising and most indirect promotions and sponsorships, while a partial ban covers only marketing on national television, print media, and radio.

According to a recent finding on tobacco control laws, 126 jurisdictions globally have completely banned direct advertising on domestic TV, radio, newspapers, and magazines. Further, 12 jurisdictions have implemented comprehensive bans on TAPS that go beyond major media sources to include indirect channels such as product placement, brand stretching diversification, and brand sponsorships.

Online and social media policies are evolving to curb digital tobacco promotions. In adapting to the changing marketing tactics, global cooperation would be required to manage loopholes in cross-border advertising.

Screening Tools Help Investors Minimize Regulatory Risk Exposure to Tobacco Services

Tobacco industry services are challenged by increasing regulatory risks as agencies and governments put stringent control on packaging, advertising, and alternative products. Vaping and nicotine pouches are outright banned in regions such as India, for example, while menthol and plain packaging laws restrict youth appeal and brand appeal.

Tobacco services companies face added risk and operational challenges due to sustainability concerns related to waste management laws and disposable e-cigarette bans. At the same time, tracking tobacco products is necessary to comply with prohibitions on illicit trade. Evolving restrictions lead to regulatory risk exposure for tobacco service providers. Companies’ response to this exposure might involve proactive risk management, maintaining stability, and adoption of screening tools to navigate regulations.

To avoid regulatory risk, investors may wish to minimize exposure to the tobacco sector, including tobacco services. ISS ESG Sector-Based Screening (SBS) Solutions provide insights into how companies are involved in an array of tobacco-related activities, covering tobacco services in addition to tobacco production and distribution activities.

The ISS ESG SBS definition of tobacco service activities includes tobacco advertising, marketing, and promotion; licensing a company or brand name to tobacco; manufacturing cigarette vending machines; and supplying key components/raw materials required for tobacco production, such as tobacco flavorings, cigarette filters (acetate tow), tobacco roll papers, cigarette manufacturing machines, tobacco packaging (printing and labelling), specialty cigarette cartons, films, and aluminum foil.

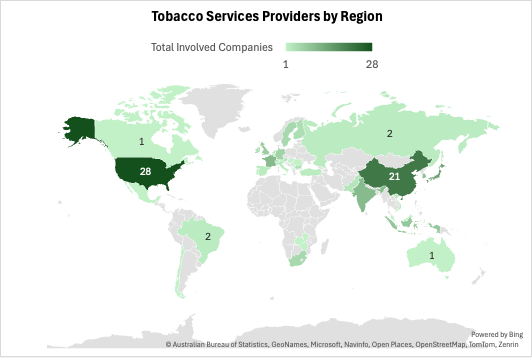

Of 1,097 tobacco-related companies covered by SBS Solutions data, 191 are engaged in tobacco services, with their operations being concentrated in the United States, China, Japan, and India (Figure 2).

Figure 2: Geographic Spread of Companies Involved in Tobacco Services (ISS ESG SBS Universe)

Note: Figure covers 191 tobacco services providers.

Source: ISS ESG SBS Data (extracted on 16 April 2025)

Of these 191 tobacco services providers, 84.3% are pure service providers, while 15.7% are also engaged in production and distribution activities.

Conclusion

The WHO FCTC and its guidelines have shaped global regulation of tobacco packaging and advertising services and highlighted some potential concerns about these services. Investors concerned about regulatory risk may wish to consider the presence of companies involved in tobacco services in their portfolio. ISS ESG’s Sector-Based Screening tool helps investors seeking to investigate companies’ involvement in the tobacco services sector and minimize investing exposure to such risks.

Explore ISS STOXX solutions mentioned in this report:

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

By:

Yuhan Guo, Associate of Sector-Based Screening Research, ISS ESG

Hetanshi Bhavsar, Analyst of Sector-Based Screening Research, ISS ESG