Why Was the European Union Deforestation Regulation Developed and What Are the Latest Updates?

Robust scientific evidence shows that land conversion for the agricultural production of certain commodities is the primary cause of global deforestation. An EU-commissioned Impact Assessment found that the EU’s deforestation footprint is primarily linked to imported palm oil, soy, wood, cocoa, coffee, cattle, and rubber. In light of this analysis, the European Union Deforestation Regulation (EUDR) was created to avoid Europeans buying, using, and consuming products that contribute to deforestation and forest degradation both inside and outside the EU. The inaugural version of the EUDR addresses deforestation and related emissions through the mentioned commodities and their relevant derivatives.

The EUDR has been in and out of the news cycle since its introduction in 2023. In October 2024, the European Commission extended the EUDR’s phasing-in period to address EU Member States and key market EU importers’ concerns. In June 2025, the EC unveiled another update surrounding the country-risk-classification system. The EUDR is expected to officially come into effect December 30th, 2025, for large and medium operators and traders and June 30th, 2026, for small and micro operators and traders.

For a company to be compliant with EUDR it must follow three main provisions:

- All relevant products placed on the EU market or exported from the EU must be deforestation-free (meaning that any products sourced from land that was deforested after December 2020 is not legal under EUDR)

- The relevant products must also be produced in accordance with the national and local laws of the country of production

- Due diligence statements must be completed annually for product batches

Before the EUDR goes into effect, institutional investors may wish to prepare for the regulation’s potential impacts on their portfolio companies.

What’s At Risk?

As commodity-driven deforestation continues to rise, investors can expect nature-related risks also to increase. Nature-related risks fall into three main categories: physical, transition, and systemic risks.

Table 1: Nature-Related Investment Risks

| Nature-Based Risk Category | Description and Forest-Related Examples |

| Physical Risk | Risks that occur when activities with a strong dependency on nature become disrupted due to physical hazards such as flooding. Example: Deforested land is at risk of decreased crop yields and higher prices. |

| Transition Risk | Risks that occur when there is a misalignment of economic actors with actions aimed at protecting, restoring, and/or reducing negative impacts on nature. Example: Consumers decide not to purchase goods from a company linked to deforestation and the issuer loses market share. |

| Systemic Risk | Risks that cause massive, often irreversible ecological and financial chain reactions across the globe. Example: The Amazon Rainforest shifts into a savannah. This new state brings altered ecosystem functioning abilities. |

Source: Financial Stability Board, Taskforce for Nature-related Financial Disclosure

The EUDR is an example of a nature-related transition risk, as the economic actor in question, the European Commission, is acting through this regulation to combat deforestation.

Transition risks also include an array of sub-risks including regulatory, market, litigation, and technological risks. From a regulatory perspective, the EUDR could cause operational costs to temporarily rise as producers, operators, and traders will have to expand their existing due diligence procedures to include geolocational information on their sourced products alongside the volumes of the commodity in question.

Investors may want to delineate exposed companies by small, mid, or large cap, as smaller companies could face a larger challenge in paying the additional due diligence costs.

Depending on the level of non-compliance, penalties can range from a 12-month suspension of public financial assistance to stranded assets, loss of revenue, and, in the worst-case scenario, a fine equivalent to 4% of a company’s annual European Union-related turnover. The biggest risk factor of this transition sub-risk is the uncertainty about how these penalties, financial and non-financial, could escalate into larger indirect costs to exposed issuers.

From a market risk perspective, companies could lose revenue from the potential reputational blowback of not adhering to deforestation-free principles and lose market share as other companies in compliance continue to innovate, streamline their due diligence practices, and fill the space of non-compliant companies.

What Are the Nature-Based Opportunities in EUDR?

While there are financial risks associated with EUDR, there may also be financial opportunities available to certain impacted issuers. The regulation encourages the circular economy by providing exceptions for relevant products that are produced or transformed from recycled materials. Companies that invest in circular economy principles could benefit from lower due diligence costs and material costs, which could open the company to further value creation through new market-based innovations, operational efficiencies, and customer loyalty.

Can These EUDR Transition Risks Change?

There are still six months left before the EUDR goes into effect for large and medium companies. Countries and community groups are still discussing the challenges that could arise from EUDR implementation. Many countries still see the regulation as being too stringent and SMEs worry that they will be disproportionately impacted by the due diligence costs.

There are also debates on whether the EUDR needs to go beyond forests to include savannahs and other high-carbon stock land areas. Further, the newly unveiled country-risk-classification system is seeing pushback because the system contains little-to-no consideration for socioeconomic and governance factors, such as land tenure and indigenous rights, in its final classifications.

The European Commission is expected to request a new study to consider whether to include biofuels, which primarily derive from soy and palm oil, in the next phase and whether to include financial institutions for further compliance. Institutional investors may benefit from understanding how these potential amendments to EUDR scope could increase deforestation transition risk exposure in their portfolios. Higher risk exposure increases the probability of holding issuers in the portfolio whose valuation and market share could experience more volatility.

How Could a Portfolio Be Exposed to EU-Driven Deforestation Risk?

Portfolio- and issuer-level EUDR risk exposure will primarily be dictated by which sectors and supply chain geographies are most connected to the commodities and product derivatives that the regulation deems to be high-risk for deforestation. Industry experts have deemed industries such as Food Products, Auto Components, Chemicals, and Pharmaceuticals & Biotechnology to be impacted the most (for a more in-depth look into industries, see “Deforestation Risk in an Investment Portfolio: The Layers of Potential Exposure” from the 2025 ISS ESG Natural Capital Resource Institute (NCRI) Flagship, The Root Cause of Nature Loss).

Outside of industry relevance, investors should also consider where their portfolio’s main supply chain linkages are located. The European Commission recently released guidance on which countries are classified under EUDR as low, standard, and high risk. This country risk classification will dictate how extensive a company’s due diligence processes must be, which may lead some companies to have a lower transition risk, since they will also have lower due diligence costs than others.

The EUDR country-risk-classification system is purely based on the latest scientific findings about country-level forest data, yet it does not consider illegal deforestation risks, another important consideration for investors. Therefore, investors seeking a more comprehensive deforestation risk analysis may want to consider pairing the EUDR country ratings with datasets that assess illegal deforestation risk. For instance, when countries are evaluated according to the Forest Trends’ Illegal Deforestation risk tool, some countries (Brazil, Cameroon, Malaysia), are at a much higher risk category due to illegal deforestation associations.

Table 2: Deforestation-Related Country-Level Risk, by Commodity

| Commodity | Top Sources of EU Imports (2023) | EUDR Country Risk Classification | Illegal Deforestation and Associated Trade Risk |

| Palm Oil | Indonesia Malaysia | Standard risk Standard risk | Medium risk Higher Risk |

| Soya Beans | United States Brazil | Low risk Standard risk | Low risk Higher risk |

| Rubber | Côte D’Ivoire Indonesia | Standard risk Standard risk | Higher risk Medium Risk |

| Cocoa Beans | Côte D’Ivoire Cameroon | Standard risk Standard risk | Higher risk Higher risk |

| Coffee | Brazil Vietnam | Standard risk Low risk | Higher risk Higher risk |

| Pulp (Wood derivative) | Brazil Sweden | Standard risk Low risk | Higher risk Low risk |

| Cattle (frozen cattle meat) | Poland Germany | Low risk Low Risk | Low risk Low risk |

Source: ISS ESG NCRI adapted from research from EU Observatory on Deforestation and Forest Degradation, EUDR Country Classification List, and Forest Trends

What Is the EUDR-Related Risk Exposure in STOXX Europe 600?

As expressed in NCRI’s recent 2025 Flagship, The Root of Nature Loss, deforestation risk exposure can be assessed through several notable data sources, from biodiversity impact assessments to performance at the issuer level using reported data. These data sources can aid in answering crucial exposure questions: what percentage of the portfolio is most at risk from EUDR implementation?; which high-risk commodities are embedded in a portfolio?; and is there adequate risk mitigation for select high-risk issuers? The Natural Capital Research Institute demonstrates how these questions can be answered through an analysis of EUDR implementation risk exposure for STOXX Europe 600.

Portfolio-Level Exposure to EUDR-Related Risk

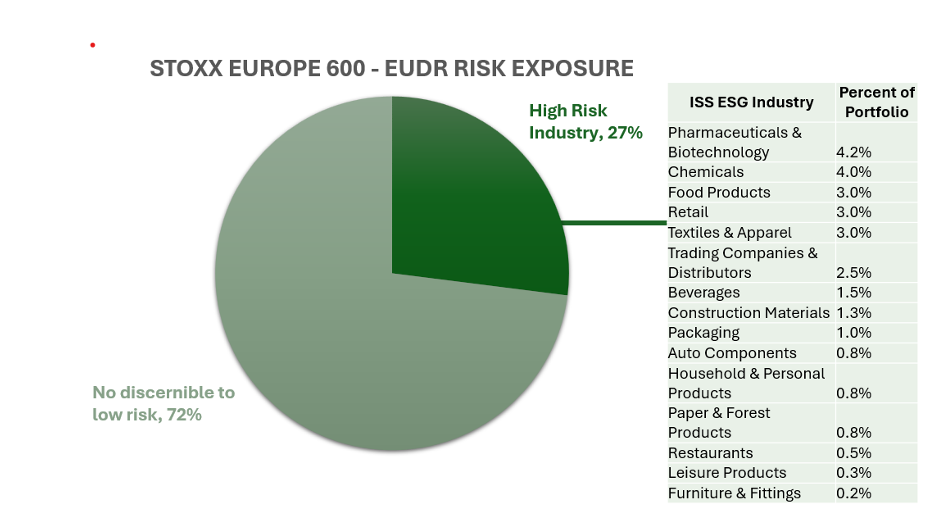

Approximately 27% of the STOXX Europe 600 portfolio could be exposed to EUDR-related transition risks through high-risk industries associated with EUDR commodities.

Figure 1: Exposure to EUDR-Related Transition Risks within STOXX Europe 600

Note: Chart covers STOXX Europe 600 as of Q2 2024

Source: ISS ESG

This exposure was calculated by extracting the amount of the portfolio, equally weighted, that was tied to the most high-risk industries facing EUDR mandates today. While other industries such as renewable energy and financial institutions have financial exposure to deforestation, this analysis does not include them, as the EUDR does not yet contain provisions covering these industries.

High-Risk Industry Mitigation of EUDR-Related Risks

Since the Food Products value chain contains multiple commodities flagged by EUDR, such as cattle, palm oil, soy, and cocoa, an in-depth analysis was carried out to understand whether this sub-universe of issuers would be prepared for EUDR effects later this year (Figure 2).

Figure 2: Deforestation Risk Mitigation Measures among Food Products Companies

Note: Data is for 18 food products companies. For ratings, A+ to B- = Leaders; C+ to C- = Advancers; D+ to D- = Laggards.

Source: ISS ESG NCRI, ISS ESG Corporate Rating, June 2025

To assess preparedness, the ISS ESG Corporate Rating was used. “Measures to prevent deforestation” and “Percent of commodities certified as deforestation or conversion free” indicators were chosen based on their relevancy to performance and management actions needed for effective deforestation risk mitigation.

“Measures to prevent deforestation” is a management indicator that is graded on an issuer’s ability to provide programs, audits, and risk assessments. More than half of the issuers are either leading or at least advancing these measures. Despite issuers’ positive performance on these measures, 55% of issuers are lagging on “commodities certified as deforestation and conversion-free.” For issuers to become leaders in this indicator, a company should disclose that at least half of its commodities are connected to deforestation- and conversion-free certification schemes.

Palm Oil-Specific Exposure and Risk in STOXX Europe 600

As palm oil accounts for the largest segment of the EU’s deforestation footprint, an analysis was performed to establish how much of the STOXX Europe 600 is exposed specifically to palm oil. Applying ISS STOXX’s Sector-Based Screening for palm oil showed that 10% of the portfolio (62 companies) is exposed to the palm oil value chain as a user, producer, distributor, or a combination of the above. Food Products and Chemicals show the highest risk to palm oil in this portfolio.

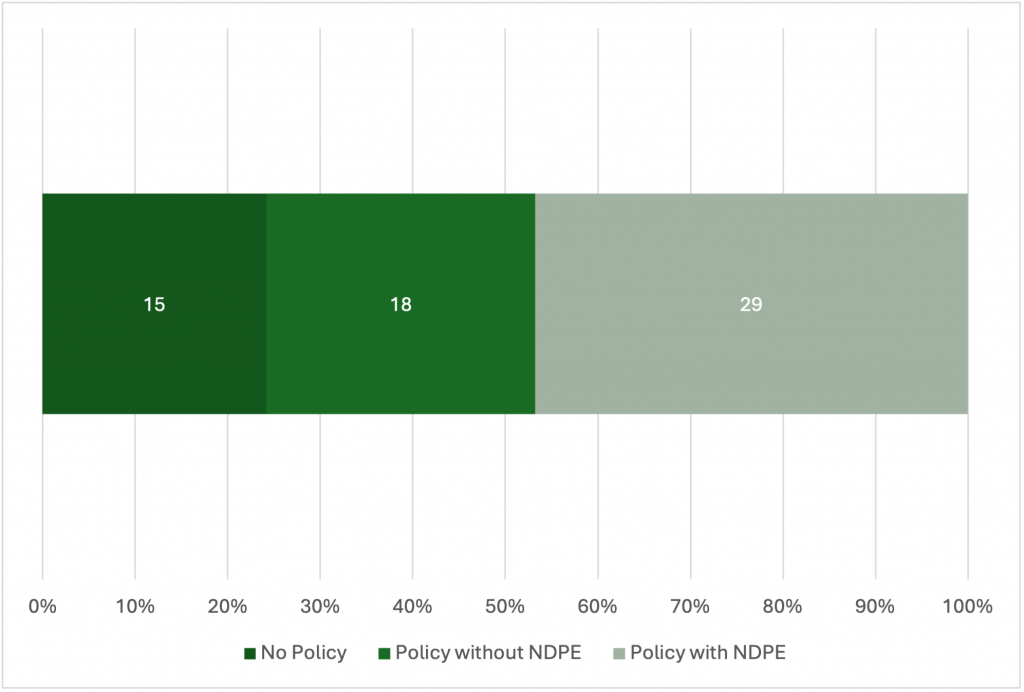

Within ISS STOXX’s Sector-Based Screening, companies with involvement in palm oil are graded on whether they have a relevant palm oil policy. A palm oil commitment that includes “No Deforestation, No Peatland, and No Exploitation Policy” (NDPE) is regarded as a best-in-class policy because it includes provisions for human rights and protection of at-risk biomes such as peatlands (Figure 3).

Figure 3: Deforestation Policy Designations among Palm Oil-Exposed Issuers

Source: ISS STOXX, Sector-Based Screening, June 2025

Twenty-nine out of 62 companies (roughly 47%) have a palm oil policy that includes NDPE and, if followed by appropriate management and due diligence, these issuers would be in compliance with EUDR. In other words, policies are an important first step toward a no-deforestation economy, but management indicators allow an analyst to understand whether adequate risk mitigation is occurring at the issuer level.

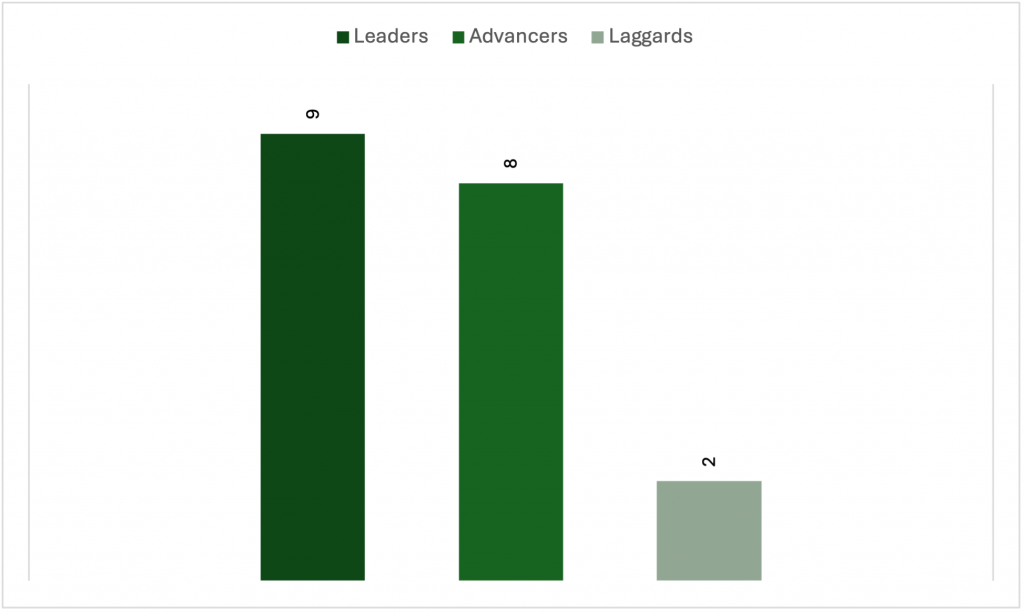

In the case of palm oil policy and management for this universe, analysis shows a positive relation between the two; strong palm oil policies are accompanied by a strong palm oil management indicator. Specifically, looking at the palm-oil policy data from Sector-Based Screening and management data from Corporate Rating shows that 17 out of the 19 issuers with NDPE from Figure 3 (excluding 10 companies where the management indicator is not considered material by the ISS ESG Corporate Rating methodology) are leading or advancing in their percentage of certified palm oil sourced and/or produced (Figure 4).

Figure 4: Certified Palm Oil Management Indicator Performance of Issuers with NDPE Policy

Note: Data is for 19 companies. For ratings, A+ to B- = Leaders; C+ to C- = Advancers; D+ to D- = Laggards.

Source: ISS STOXX, Sector-Based Screening with ISS ESG Corporate Rating, June 2025

Conclusion

The EUDR is expected to drive the largest issuers with connections to the EU trade of palm oil, rubber, cocoa, coffee, cattle, and soy-related products to begin disclosing their no-deforestation due diligence statements in April 2026, a few months after the regulation comes into effect. Issuers found to be non-compliant could face penalties and reputational consequences while compliant issuers could have a greater opportunity to innovate and capture new market share.

In preparation for this, investors can start assessing their transition risk in their portfolios by gathering data on the industries, commodities, and locations through which issuers are connected to deforestation and by comparing mitigation measures in place related to EUDR compliance.

Explore ISS STOXX solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

By:

Caitlin Harris, Sr. Associate, Natural Capital Research Institute

Mirtha Kastrapeli, Managing Director, Natural Capital Research Institute