Introduction

The EU Taxonomy, as adopted by the European Commission, establishes criteria for economic activities that can be considered environmentally sustainable, helping companies and investors align with the Net Zero trajectory by 2050 and other broad environmental goals. Through the Taxonomy, the European Union aims to scale up sustainable investment, protect investors from greenwashing, help companies become more climate-friendly, and mitigate market fragmentation.

As highlighted in a previous ISS Insights post on this topic, there was a significant gap between the data reported by investee companies and the granularity of the data required by investors to fulfill their own Taxonomy reporting obligations. Although some current company Taxonomy reporting has an appropriate degree of granularity, the reported data remains limited to a small number of companies, so a significant data gap for investors persists.

ISS ESG’s EU Taxonomy Alignment Solution can help address this data gap. This solution assists in measuring the alignment of investments with eligible Taxonomy activities that substantially contribute to one of the six taxonomy objectives and do not significantly harm any of the other Taxonomy objectives, while being carried out in compliance with minimum social safeguards.

The EU Taxonomy Alignment Solution encompasses both modelled and reported data that help investors to align their investments with the Taxonomy. Modelled data within the solution can be used by investors to align with regulatory requirements in the absence of reported data. The EU Taxonomy Solution data has undergone a rigorous process to ensure data quality and can be a reliable source of information to investors who want to assess a company’s Taxonomy alignment.

Current Regulatory Landscape of the EU Taxonomy

The EU Taxonomy Regulation has six objectives, of which the first two objectives, commonly referred to as ‘climate objectives’—climate change mitigation and climate change adaptation—were adopted through Delegated Acts by the European Commission in June 2021.

The remaining four objectives, commonly referred to as ‘environmental objectives’ include sustainable use and protection of water and marine resources; transition to a circular economy; pollution prevention and control; and protection and restoration of biodiversity and ecosystems. Technical screening criteria for these four objectives were released in June 2023, with reporting mandated from 2024.

The Delegated Act complementing Article 8 of the Taxonomy Regulation mandates non-financial companies, starting from 2023, to use dedicated reporting templates. (In prior years, companies only had to disclose their involvement in activities eligible for the two climate objectives.) As of 2023, ISS ESG collected eligibility and alignment data disclosed by companies via these reporting templates.

While reported information on alignment with the environmental objectives has started to become available only as of 2024, ISS ESG has already enhanced its EU Taxonomy Alignment model to include the remaining four objectives. With this broadened scope of modelled data, ISS ESG assists clients in meeting imminent and medium-term reporting deadlines for their products’ alignment with all six objectives, starting from January 2024. The solution has been expanded to include the recently introduced 45 activities related to the four environmental objectives as well as the amended criteria for 26 existing activities related to the two climate objectives.

Despite this expansion of the EU Taxonomy Alignment model, the analysis presented in this post leverages modelled data from pre-expansion to ensure comparability of reported vs. modelled data. The focus here is thus exclusively on the two climate objectives.

Developing Accurate Estimates, per Key Recommendations

With only a small number of companies currently reporting based on the EU Taxonomy, financial market participants can use estimates in the absence of such reported data to meet Taxonomy alignment reporting standards. Taxonomy regulation recognizes in Recital 21 that where obtaining reliable information proves challenging, stakeholders should be permitted to incorporate data from alternative sources to augment their assessments.

Moreover, under Taxonomy regulation, stakeholders are allowed to make estimations pertaining to limited and specific aspects of the data, resulting in prudent outcomes. The rationale behind their conclusions and the justification for utilizing such supplementary assessments and estimates should be articulated clearly to ensure transparent and accurate disclosure to investors.

The Disclosure Delegated Act elaborates on the use of estimates and specifies that financial undertakings may use estimates to assess the Taxonomy alignment of their exposures in third-country investee companies, except with regards to the Do No Significant Harm (‘DNSH’) criteria. This recommendation to use estimates is further reinstated in the Q&A document by the European Commission.

However, the use of such estimates should be done with caution and data providers must ensure the reliability of their data. This requirement has been reiterated across various recommendations from supervisory authorities.

For instance, the European Supervisory Authorities (ESA) provide guidelines on the practical application of estimates. These guidelines emphasize the need for data with the same content and level of granularity as that provided through companies’ Taxonomy disclosures.

The European Securities and Market Authority (ESMA) also elaborated on the conditions and guidance under which such estimates are permissible in preparing mandatory and voluntary ESG metrics for entities’ compliance with their obligations across various regulations. ESMA also recommends in this report that DNSH criteria should be assessed based on equivalent information while discouraging controversy-based approaches.

Consistent with this cautious approach to working with estimates, the Platform on Sustainable Finance (PSF) states in its Usability Report that data providers should apply the Precautionary Principle. Rooted in Article 191 of the Treaty on the Functioning of the European Union, this principle calls for, when in doubt, erring on the side of the planet rather than the side of commercial interests. This principal aids in not overestimating company alignment with the EU Taxonomy and hence remaining cautious in assessments.

The methodology developed for ISS ESG’s EU Taxonomy Alignment Solution takes into consideration all the guidance and recommendations described above regarding estimates. To offer comprehensive and complete data, the solution comprises not only company-reported data but also modelled assessments for non-reporting companies. By closely following the reporting templates, ISS ESG aims to offer data with similar content and granularity, while applying the Precautionary Principle.

A Reliable Indicator? Comparing ISS ESG Modelled Data to Reported Taxonomy Data

In 2023, the second year of Taxonomy reporting, companies subject to the Non-Financial Reporting Directive (NFRD) were obliged to disclose their share of Taxonomy-eligible and Taxonomy-aligned Revenue, Capex (capital expenditure), and Opex (operational expenditure).

ISS ESG screened over 4,000 European companies (from EU and non-EU member states including Norway, Switzerland, and the United Kingdom and some of its dependencies) and collected company-reported Taxonomy data for approximately 1,845 companies. ISS ESG conducted an analysis of the Taxonomy data reported by non-financial companies and compared it with the data generated through its EU Taxonomy Alignment model for the same companies, focusing the analysis on the Taxonomy-aligned revenue shares.

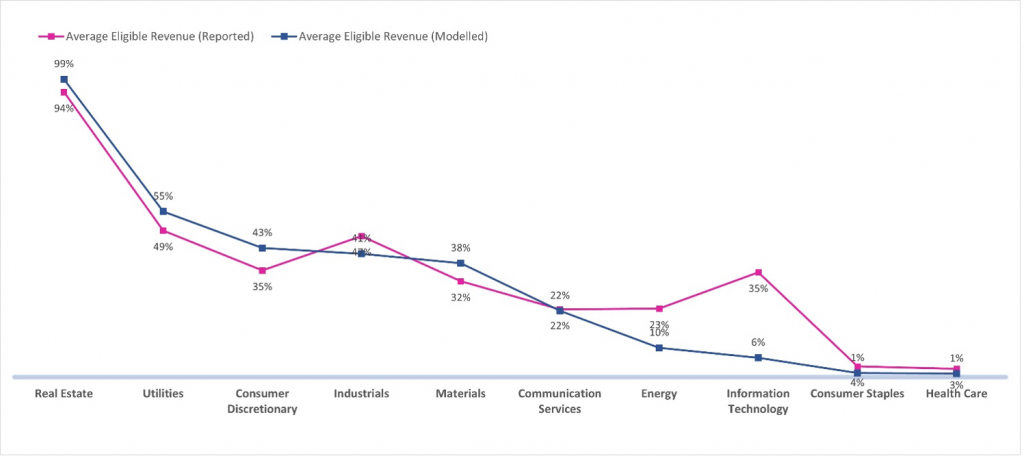

Figure 1 presents the average Taxonomy eligible revenue for different sectors. The pink line represents the average reported Taxonomy-eligible revenue per sector, the blue line represents the average modelled Taxonomy-eligible revenue per sector. Reported and modelled Taxonomy-eligibility data for the sectors show a very high correlation, which is consistent with the findings presented in our 2023 report.

Figure 1: 2022 Average Taxonomy-Eligible Revenue Shares across GICS Sectors: Company-Reported Data and ISS ESG Modelled Data

Source: ISS ESG

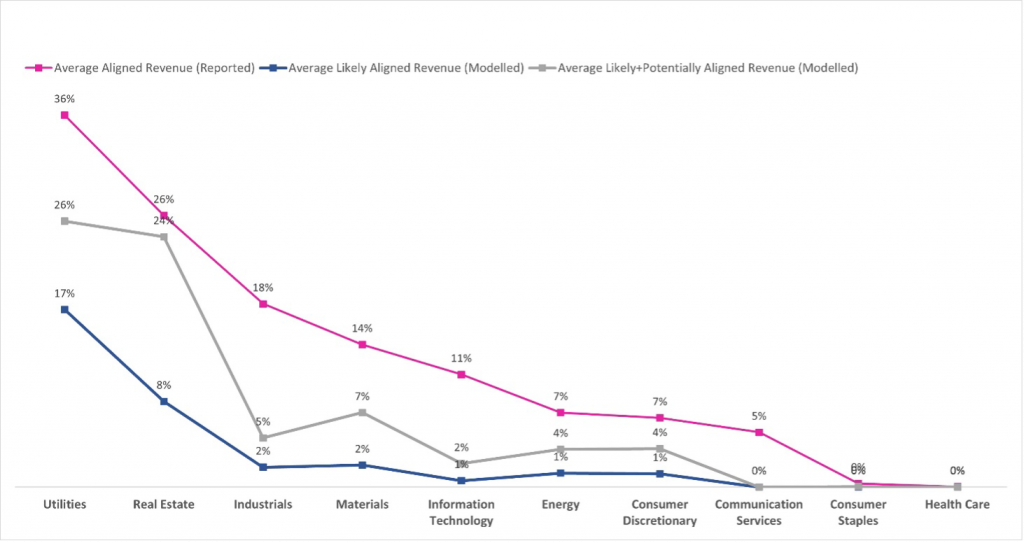

A similar analysis was conducted using the average Taxonomy-aligned revenue share for different sectors (Figure 2).

Figure 2: 2022 Average Taxonomy-Aligned Revenue Shares across GICS Sectors: Company Reported Data and ISS ESG Modelled Data

Source: ISS ESG

Revenue shares are considered “likely aligned” where the modelled outcome for substantial contribution, DNSH, and minimum social safeguards is positive. “Potentially aligned” revenue shares are those where the model finds likely alignment with substantial contribution criteria but likely alignment with DNSH criteria and/or minimum social safeguards could not be established through the model.

ISS ESG modelled data follows the same trend as the company-reported data, with both the Real Estate and Utilities sectors leading in their average Taxonomy revenue alignment share, whereas revenue alignment share is low for the Health Care and Consumer Staples sectors.

ISS ESG’s modelled average likely aligned revenue remains conservative in its assessment across sectors, whereas a high correlation was observed when comparing eligibility figures. This finding is reflective of ISS ESG’s precautionary approach towards alignment assessment that errs on the side of the planet. With the addition of the modelled potentially aligned revenue share, the percentage point difference between modelled and reported data shrinks.

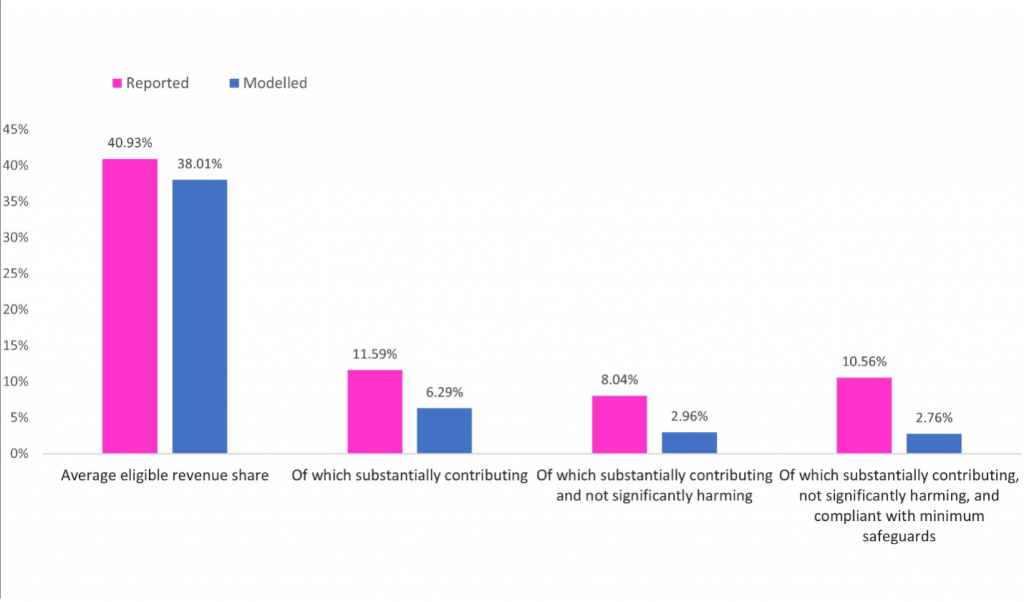

Figure 3 represents a step-by-step comparison between reported and modelled data, replicating the steps followed during assessment. Average reported and modelled eligibility are closely aligned, while modelled outcomes see alignment standing lower than what companies reported.

Figure 3: Step-by-Step Alignment Outcomes: Reported vs Modelled Data, 2022

Notes: Reported average eligibility (leftmost bars) as well as reported overall alignment (rightmost bars) reflect aggregated figures reported by companies. The reported substantial-contribution-aligned share, as well as the share of revenues aligned with substantial contribution and DNSH criteria (two sets of bars in the middle) are derived from companies’ activity-level disclosures. In some instances, company-reported activity-level disclosures are missing or do not match aggregated figures reported by the company.

Source: ISS ESG

The divergence can be explained by the cautious approach applied in ISS ESG’s modelled assessment of compliance, with technical screening criteria for substantial contribution and DNSH. Interestingly, the additional evaluation of respect for minimum social safeguards does not reduce alignment levels to the same extent in either modelled or reported data.

Understanding Data Divergence

ISS ESG conducted in-depth issuer level analysis on a sample set of companies where modelled Taxonomy outcomes diverge significantly from reported figures. Key findings explaining this disparity are presented below:

1.) Strict application of the Precautionary Principle

ISS ESG modelled data incorporates a stricter approach by, if in doubt, underestimating Taxonomy-alignment, as advocated by relevant bodies and regulations. Hence, as presented in Figure 3 above, ISS ESG’s EU Taxonomy model presents a cautious outlook on companies’ alignment with the substantial contribution criteria, DNSH criteria, and/or the minimum social safeguards, leading to the observed divergence.

2.) Lack of proxy data on niche activities

As previously observed in the 2023 report, some niche activities (e.g., ‘data-driven solutions for GHG emissions,’ ‘pre-commercial stages of advanced technologies to produce energy from nuclear processes,’ etc.) in the Taxonomy framework are not commonly captured through the data sets that serve as an input to ISS ESG’s EU Taxonomy model. A lack of proxy data is thus a persistent problem. Companies that derive significant revenues from such activities therefore cannot be accurately assessed at an eligibility or alignment level.

3.) General descriptions of some Taxonomy activities

Some Taxonomy activities have descriptions that are too general or vague, which presents challenges to classifying them accurately. For example, the activity ‘Manufacture of other low carbon technologies’ is defined as follows in the Climate Delegated Act: “Manufacture of technologies aimed at substantial GHG emissions reductions in other sectors of the economy, where those technologies are not covered in Sections 3.1 to 3.5 of this Annex.”

This definition leaves too much room for interpretation on which technologies are considered relevant. Companies may consider themselves aligned with such activities, which could differ from our modelled interpretation.

Conclusion

Derived through a meticulous process that integrates diverse data sources and stringent quality control measures, ISS ESG’s EU Taxonomy Alignment Solution offers not only company-reported Taxonomy data but also a dependable alternative in the absence of reported data. ISS ESG’s modelled data adheres to best practices through the implementation of the Precautionary Principle. This approach makes the data a reliable source of information for investors and other stakeholders seeking to evaluate the alignment with the EU Taxonomy of non-reporting companies or companies outside ISS ESG’s data collection universe.

ISS ESG strives to enhance market transparency with the availability of this modeled data and play a pivotal role in filling the gaps in company reporting. Filling these reporting gaps will enable the EU Taxonomy to effectively fulfill its objectives and maximize its impact in directing capital flows towards environmentally sustainable economic activities.

Explore ISS ESG solutions mentioned in this report:

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By:

Ria Modh, Associate, ESG Methodology, ISS ESG

Rupali Goyal, Analyst, ESG Methodology, ISS ESG

Phuong Anh Nguyen, Associate, ESG Methodology, ISS ESG