Fund of funds (FoFs) have outperformed the rest of the UK retail industry both on an asset under management (AUM) growth and absolute flows basis over the past five years, a fact that may seem counterintuitive in an age of instant gratification and mass customisation. FoFs, as long-term diversified all-weather solutions, appear well placed to maintain their popularity with UK retail investors as managing volatility becomes their top priority (read our latest UK-domiciled forecast for more perspective: Mix of Sun and Clouds). FoFs, however, are not alone in offering retail investors a diversified portfolio option, as they must increasingly compete with their unbundled brethren, the model portfolio solution (MPS).

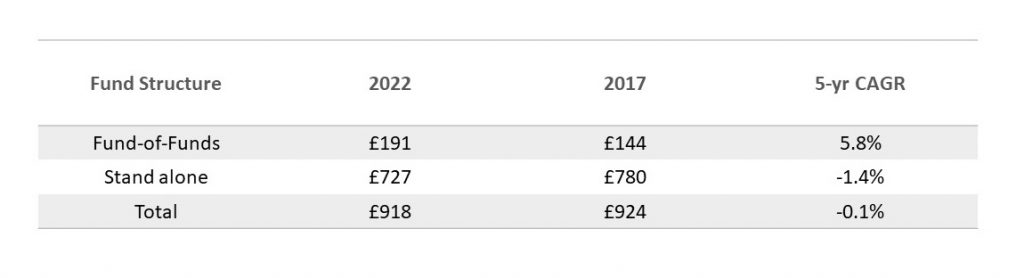

Figure 1: 5-year retail AUM grow by fund structure (in billions)

Source: Simfund, ISS Market Intelligence. Only includes retail share classes of UK domiciled funds.

Rise of the multi-asset solutions

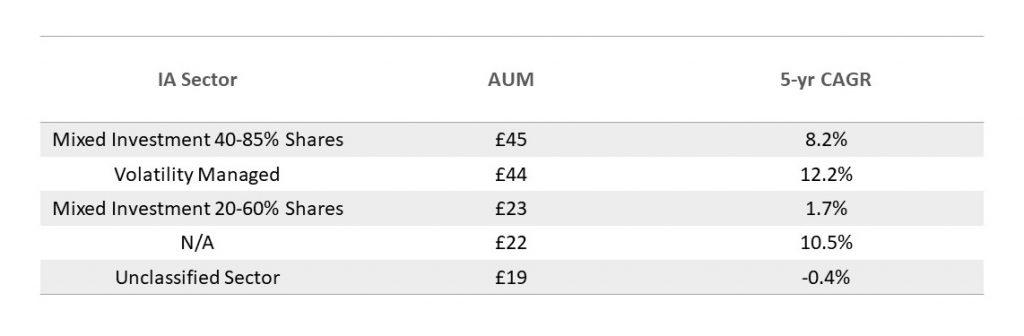

Over the past five years, the mixed investment 40-85% shares sector has grown to become the largest category for FoFs, followed closely by the volatility managed sector. Expect these two sectors to continue to shine as investors consider how to invest for retirement in choppy waters. With retirement and maintaining purchasing power likely top-of-mind for retail investors, growth strategies will be in demand. ISS Market Intelligence’s latest asset class forecast (read the Floor Is Lava article) sees asset allocation funds with higher equity allocations delivering the highest organic growth over the coming months.

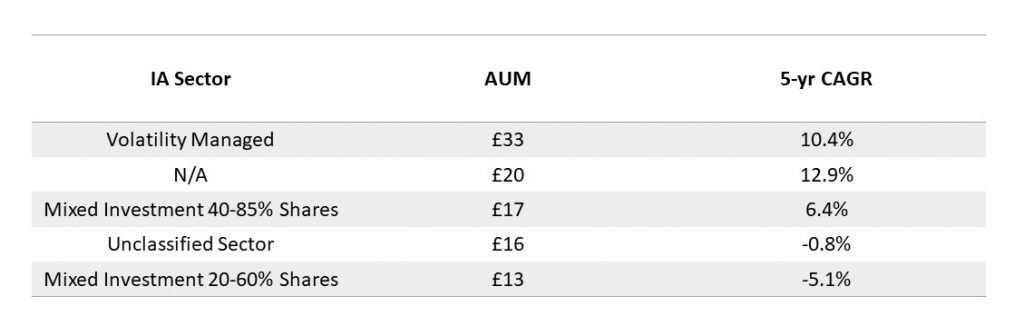

Figure 2: Retail fund of funds asset and 5-year AUM growth by IA sector (in billions)

Source: Simfund, ISS Market Intelligence. Only includes fund of fund retail share classes of UK domiciled funds

While the FoF business remains fairly concentrated with traditional fund managers, there has been significant FoF growth with non-traditional players, including growth in the use of the FoF vehicle among discretionary fund managers (DFMs) as part of their model portfolio services (MPS) and among wealth managers as part of their investment propositions. These two non-traditional players account for the 14% growth in N/A assets over the past five years.

Traditional fund managers should expect to see continued competition for asset allocation and fund selection revenues as these functions migrate from the adviser to insourced or outsourced investment propositions at the firm level. As wealth management firms of all sizes increasingly look to build out their investment propositions, the question will naturally rise as to whether the architecting of the investment solutions and associated revenues can be kept in-house. For many wealth management firms, particularly those with scale, the answer may be a resounding yes. Firms choosing to build their own solutions will look to do this either through their own MPS program (most likely platform based), or through an FoF supported by one of many third-party fund administrators in the UK.

Beyond in-house asset allocation solutions, traditional fund managers FoFs will also see increasing competition for outsourced investment propositions from DFMs MPS programs. DFMs enjoy a long tradition and have built a deep network of relationships in providing bespoke portfolio services (BPS) to advisers’ affluent clients. Such relationships are now being leveraged to offer MPS programs for a less affluent clientele. While models within MPS programs may not be bespoke, they do leverage DFMs’ reputations for portfolio construction and come with a lower asset entry point and management fee. The design of MPS programs therefore makes them a competitor to FoFs and, unsurprisingly, have led many traditional fund managers to respond to their growth by developing their own MPS.

For a deeper discussion on MPS and the trends behind its growth, listen to our recent ISS MI Talks podcast

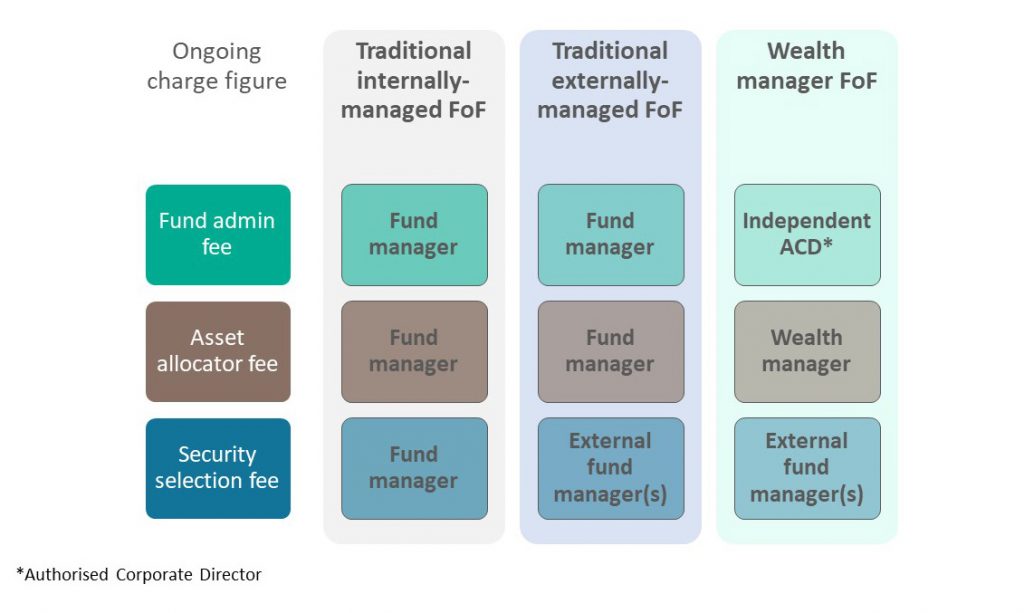

The common thread behind all the business models discussed is that the underlying holdings remain largely fund based. How these underlying holdings are bundled (and by whom) has a direct impact on how asset allocation and fund selection revenues will be shared, however.

Figure 3: Simplified Fund of Funds Model

The FoF growth opportunity is not just limited to the architects of the programs, then, but rather is potentially available to fund managers offering security selection expertise, third-party fund administrators and platforms. Our focus, however, will remain on the fund manager opportunity and the choice facing traditional fund managers in whom to assign security selection responsibilities to. Unlike the non-traditional firms entering the FoF arena, traditional fund managers can assign security selection responsibilities to their own funds and thus keep a larger share of the revenue pie. Keeping it all in-house, however, relies on having competitive internal expertise across a wide range of asset classes, no small task when your competitors can choose from thousands of external options.

Within or without

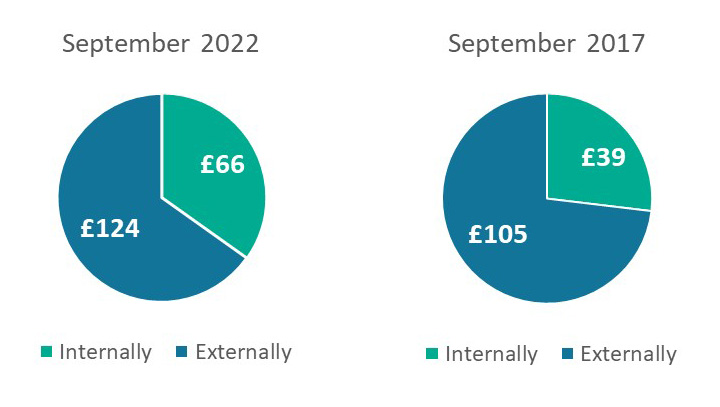

Figure 4: Internally-vs externally managed fund of fund assets (in billions)

Source: Simfund, ISS Market Intelligence. Only includes fund of fund retail share classes of UK domiciled funds.

Externally-managed FoFs accounted for two-thirds of the total assets in retail FoFs as of September 2022. Although still accounting for the majority of the assets, externally-managed FoFs have seen their share decrease from three quarters as of September 2017. Internally-managed FoFs posted a five-year compound annual growth rate (CAGR) of 11.4% compared 3.4% for externally-managed FoFs.

The higher growth rate for internally-managed FoFs, however, belies the fact that internally-managed FoF assets are both heavily concentrated and predominately index-based in nature. The opportunity for managers in this space may therefore be limited. Half of assets are accounted for by Vanguard’s index-based LifeStrategy funds which were launched in 2011. Excluding Vanguard’s LifeStrategy funds, internally-managed FoFs recorded a five-year CAGR of 1.1%, a rate lower than externally-managed FoFs. Beyond the Vanguard LifeStrategy funds, only one of the 10 largest funds is not index-based. Choosing to in-house one’s FoF strategy therefore appears to be a function of index capabilities, if not distribution network, as the UK index giants rule this subgroup.

In comparison, externally-managed FoFs are far less concentrated by fund and manager, with the 10 largest funds accounting for approximately one-fifth of total assets. The subgroup also includes five separate fund managers among the largest 10 funds and 67 managers in the entire subgroup. The externally-managed FoF subgroup further differentiates itself from in-house solutions in being comparatively more concentrated in the volatility managed and N/A sectors. The former observation likely reflects advisors’ and investors’ beliefs that active management both at an asset allocation and security selection level is the best bet to reduce or benefit from volatility. Meanwhile, the latter observation highlights that nearly all DFM or wealth manager funds leverage external managers.

Figure 5: Externally-managed retail fund of funds assets and 5-year AUM growth by IA sector (in billions)

The specialist opportunity

Although externally-managed FoFs have not quite kept pace with their in-house siblings, the subgroup has outperformed the broader UK retail fund market and remains on an expansionary path. Part 2 of our FoF narrative will therefore use ISS MI’s Simfund Global’s unique FoF view to look beneath the hood of externally-managed FoFs to understand who is winning the “security selection” mantle and where tomorrow’s opportunities might lie for external managers.

Keen to learn more about our Simfund Fund of Fund view? Talk to us today to hear how we can help your business.

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader, ISS Market Intelligence