Introduction

With a GDP per capita of $76,330 (PPP) (as of January 2, 2024), Taiwan has established itself as one of the most stable and developed economies in the Asia-Pacific region. With Taiwan boasting a strong semiconductor industry and a range of large financial institutions, the government is now shifting its focus to improving the transparency of its ESG and climate data.

Having set out ‘Taiwan’s Pathway to Net-Zero Emissions in 2050’ in 2022, the government adopted a mission to develop the foundations for climate legislation, as well as policies on carbon pricing. With a sustainable development roadmap set out for all the companies listed on the Taiwan Stock Exchange (TWSE) and the Taipei Exchange (TPEx), ESG investors may be interested in whether Taiwanese companies are prepared for expanded disclosure policies and how these companies compare relative to their international peers.

ESG Performance and Transparency

ESG Performance Score

According to ISS ESG Country Rating, Taiwan ranks 38th out of 179 sovereign entities globally, having particularly impressive governance performance. Further, the performance of Taiwanese companies places them amongst the highest ESG-rated companies globally.

Taiwan’s economy is dominated by the semiconductor industry and financial institutions, with half of all Taiwanese companies having a market cap of >$10 billion belonging to these two industries. These industries not only contain companies that are globally recognised as leaders in their fields, but they boast some of the highest performers in ESG ratings and transparency levels.

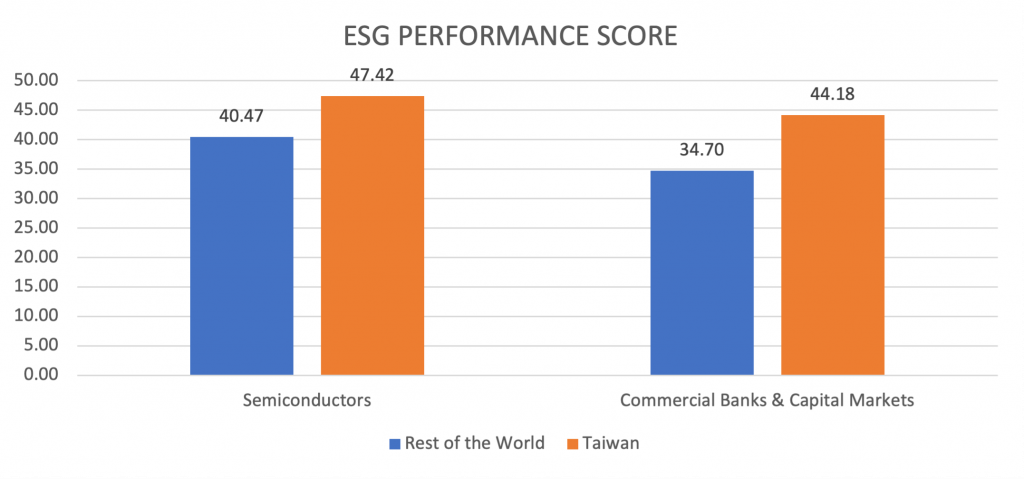

Compared to the rest of the world, these Taiwanese companies significantly outperform the average in both industries. When comparing Taiwanese Semiconductor companies to the global Semiconductor industry, Taiwanese companies on average are 6.95 points above the rest of the world. Taiwanese Commercial Banks & Capital Markets outdo that industry by 9.48 points (Figure 1).

Figure 1: ESG Performance Breakdown of Semiconductor and Commercial Banks & Capital Markets Companies, in Taiwan and the Rest of the World

Notes: Semiconductors: Rest of the World n=78 and Taiwan n=17. Commercial Banks & Capital Markets: Rest of the World n=288 and Taiwan n=12.

Source: ISS ESG

ESG Performance Scores are evaluated on a scale of 1 to 100, with companies scoring 50 or above being considered industry leaders; ‘Prime’ status is awarded to the highest-rated companies in each industry, typically the top 10%-20% of companies.

Beyond outperforming the global Semiconductor and Commercial Banks & Capital Markets industries on average, Taiwanese companies also have a disproportionately large number of Prime status companies in each of these industries. 41% of Taiwanese Semiconductor companies and 25% of Taiwanese Commercial Banks & Capital Markets companies achieve this Prime status. Across all industries, 23% of Taiwanese companies achieved a Prime status. Taiwanese companies also have a significantly higher level of ESG transparency.

Transparency Score

Transparency Scores are based on the ESG disclosure of companies and rated on a 5-point scale from ‘Very Low’ transparency to ‘Very High’ transparency. Higher transparency is generally associated with the recognition of risk exposures across companies’ operations and value chains.

As illustrated by Figure 2, the proportion of Taiwanese companies achieving ‘Very High’ transparency scores in the global Semiconductors and Commercial Banks & Capital Markets industries is notably higher than in the rest of the world.

Figure 2: Percentages of Companies Rated with ‘Very High’ Transparency, in Taiwan and the Rest of the World

Source: ISS ESG

These scores can be partly attributed to the regulatory environment that Taiwan created for its listed entities across the TWSE. The implementation of several voluntary ESG compliance principles dating back to 2004, combined with the mandatory ESG filings in annual and responsibility reports, has indeed laid the foundations for a more transparent economy.

Readiness for Disclosure Requirements

Financial Sector

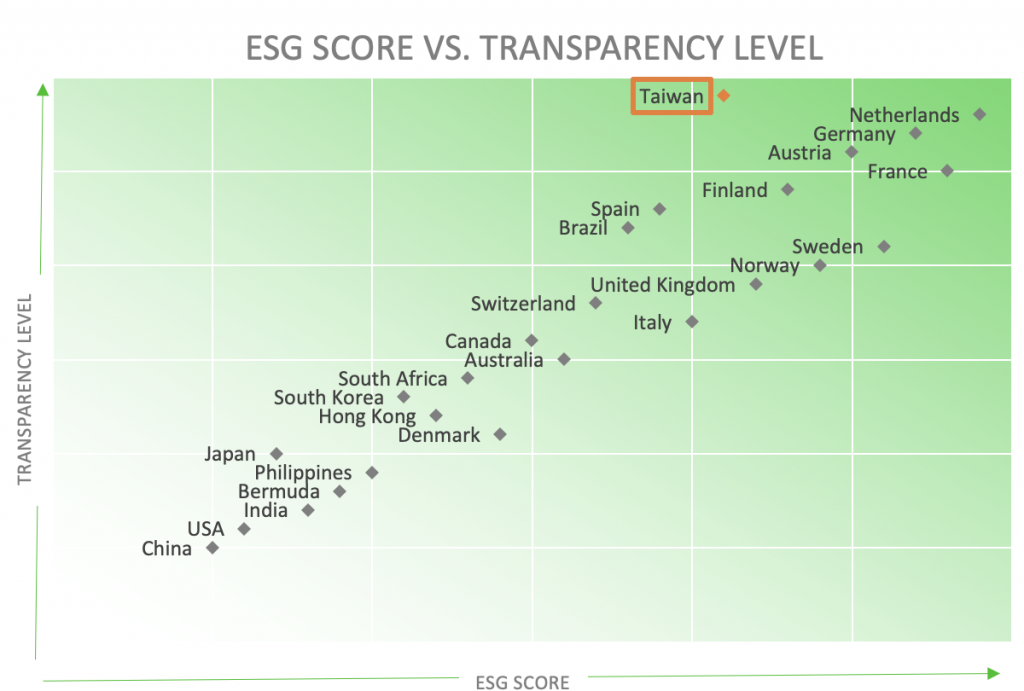

The outperformance in ESG performance and transparency of Taiwanese Commercial Banks and Capital Markets extends across Taiwan’s other financial institutions. When ranking the jurisdictions in the ISS ESG Corporate Rating universe with more than 10 financial institutions incorporated in them, Taiwan ranked 9th for average ESG scores and 1st for transparency. With 83% of its companies within the financial sector achieving ‘Very High’ disclosure levels, it is therefore unsurprising to see Taiwan on par with the Netherlands, Germany, and France (Figure 3).

Figure 3: Jurisdictions Mapped According to ESG Performance and Transparency Level Rankings in the Financial Sectors

Notes: Includes jurisdictions that have >10 incorporated financial institutions

Source: ISS ESG

These scores reflect the ability of Taiwanese companies to deal with the regulatory changes adopted by the Taiwanese Financial Supervisory Commission (FSC) in 2021. Starting from 2023, domestic banks are now required to disclose climate risks in line with Task Force on Climate-related Financial Disclosures reporting, under the ‘comply or explain’ rule.

The aim of the recent regulatory changes was to improve the transparency of ESG and climate risk factors that Taiwanese companies face. This will force companies listed in Taiwan to keep improving their ESG transparency, which might in turn bolster their ESG performance.

Beyond outperforming on general ESG metrics, companies based in Taiwan are also outperforming on the environmental pillar, which is the primary focus for the current ESG regulation. Taiwanese companies have an average environmental performance of 2.25 (out of 4) compared to 1.94 of companies globally.

The regulatory pressure on Taiwanese institutions means they exhibit some of the best environmental practices that are material for banks and insurers. While 30% of companies across all financial institutions disclose some sort of climate mainstreaming in their portfolio, 80% of Taiwanese companies do. This higher percentage reflects the integration of climate analysis into the companies’ general investment, underwriting, and lending processes, including climate stress testing, which became mandatory in Taiwan in 2023.

A similar trend is apparent when comparing Taiwanese companies in terms of calculating the carbon footprints of their portfolios: 80% of Taiwanese financial institutions calculate at least part of their financed emissions, compared to 27% of institutions in the industry as a whole.

Semiconductors Industry

In recent years, Taiwan has emerged as a global powerhouse in the Semiconductor industry, producing more than 60% of all semiconductors and more than 90% of advanced ones. A combination of factors has contributed to Taiwan’s rapid growth in this critical sector, such as strong government support. The Taiwan Ministry of Economic Affairs, for example, has provided financial incentives, tax breaks, and research grants to encourage semiconductor development. The heavy emphasis on research and development (R&D) has ensured that Taiwan is ahead of the technological curve.

Figure 4 illustrates Taiwan’s performance in the Semiconductor industry by comparing the distribution of ESG performance scores in Taiwan to that of the rest of the world. The data reveals a significant concentration of Taiwanese companies within the 40 to 60 range, particularly around the critical Prime Status threshold of 50. In contrast, the rest of the world demonstrates a more balanced distribution across the lower end of the spectrum.

Figure 4: Distribution of ESG Performance Scores for Semiconductor Companies in Taiwan and the Rest of the World

Notes: Semiconductors: Rest of the World n=78 and Taiwan n=17.

Source: ISS ESG

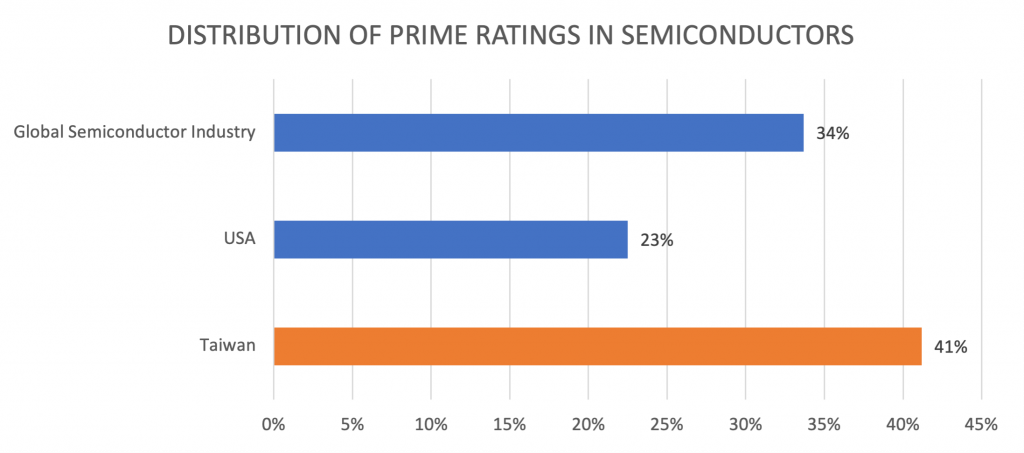

Taiwan has the highest percentage of Prime Semiconductor companies, with ISS ESG performance scores of ≥50, within the industry of any jurisdiction in the world. Within Taiwan’s Semiconductor industry, 41% of its companies are considered Prime compared to 23% within the United States. Globally the industry average is 34% (Figure 5).

Figure 5: Percentage Share of Prime-Rated Semiconductor Companies

Notes: Semiconductors: Rest of the World n=78; USA n=40; and Taiwan n=17.

Source: ISS ESG

Except for one company, every Taiwanese Semiconductor entity covered by the ISS ESG Corporate Rating was categorized as having either a “High” or “Very High” level of transparency. This percentage of >90% significantly exceeds the corresponding percentage for the United States, which stands at approximately 77%. Of Semiconductor companies that scored ‘Very High’ on ESG transparency, 30% were Taiwanese, despite Taiwanese companies representing only 18% of the total companies covered.

The enhanced ESG performance may help prepare companies for stringent disclosure regulations coming into effect across all sectors in Taiwan. The TWSE and TPEx are implementing an ESG reporting mandate for listed companies. Companies listed on both exchanges are obligated to disclose their ESG practices and development progress annually, providing relevant information to the public.

In 2020, the FSC published its Corporate Governance 3.0: Sustainable Development Roadmap, which has set out strict governance regulations that companies will have to abide by from 2024 onwards. These requirements include enterprise risk management systems and a minimum number of independent directors on the board. In January 2022, the FSC also published the Sustainable Development Roadmap for Listed Companies, aiming to strengthen ESG reporting and greenhouse gas emissions disclosure for listed companies with the largest market capitalizations. The FSC also announced the Green Finance Action Plan 3.0 to promote green and sustainable financial markets.

Taiwan-based companies may be well positioned for the upcoming regulation specifically because of their management of supply chain responsibilities. Taiwan’s dominance of the semiconductor industry means that many of their customers are multinational corporations, which may demand transparent and sustainable practices. To meet these demands and retain a competitive advantage, semiconductor makers are required to enhance their sustainability practices. Taiwanese companies have therefore leveraged sustainable practices such as resource conservation and innovative process optimisation.

Conclusion

Taiwan has a disproportionately high concentration of top ESG performers with very transparent disclosure levels in both the global Semiconductors and Commercial Banks & Capital Markets industries. With government regulation already in place and further policies in progress, Taiwanese companies are well positioned across different industries. This is particularly evident across semiconductor producers and financial institutions.

This combination of high ESG performance and transparency can mitigate future regulatory risks and can also improve companies’ positioning regarding shareholder expectations, supply chain management, and transition risks. As Taiwan pursues new sustainability strategies, it may be better positioned to tackle relevant ESG risks and opportunities. The ISS ESG Corporate Rating and ISS ESG Country Rating and ESG Sub-Sovereign Rating can help investors track Taiwanese performance in these areas.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

By: Nick van Baal, Analyst, Corporate Ratings, Financials, ISS ESG

Andres Del Gallego, Associate, Corporate Ratings, Semiconductors, ISS ESG

Gayathri Hari, Analyst, Corporate Rating, Semiconductors, ISS ESG