Below is an excerpt from ISS ESG’s recently released paper “Filling the Blank Spots on the Map: Using Country Risk Analysis to Assess ESG Risks”. The full paper is available for download from the Institutional Shareholder Services (ISS) online library.

KEY TAKEAWAYS

- While there is an established process for gathering global data on the ESG risks for listed entities, similar coverage for emerging and private markets contains significant gaps because relevant products are often still too niche.

- To bridge such gaps, a country risk analysis can function as a proxy for risk measurement across a range of asset classes.

- A high level perspective is essential to understanding the local context of a company’s operations and offers a proxy for asset classes that are less well covered by traditional ESG products.

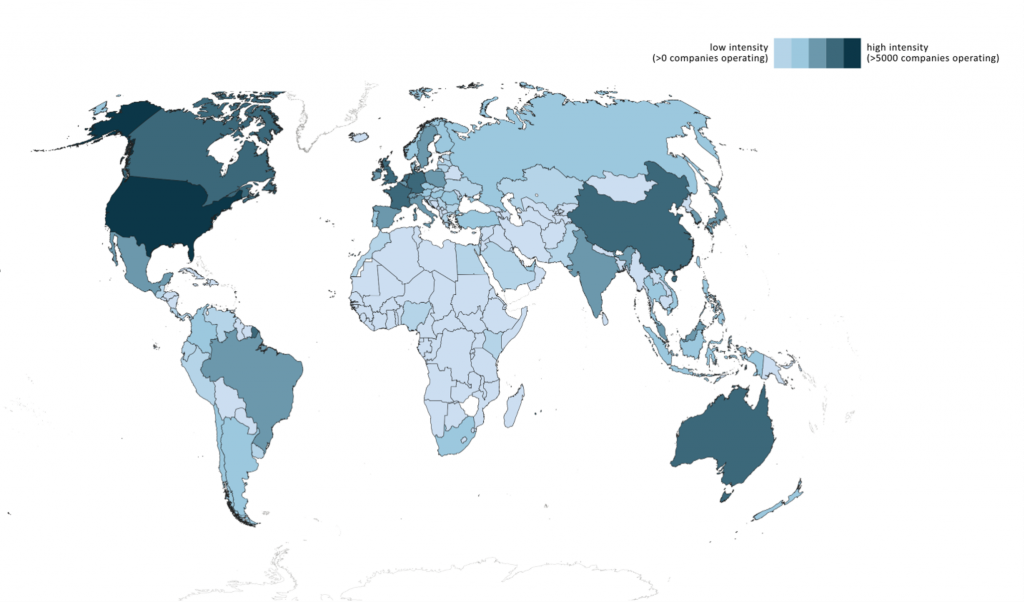

Data is supposedly the new gold. Yet traditional environmental, social, and governance (ESG) products mostly focus on listed corporations, leaving wide empty spaces on the world map, particularly in emerging and developing markets. Figure 1 (below) demonstrates this by showing the geographical distribution of companies covered by the ISS ESG Corporate Rating. While there is high intensity of coverage in the developed world, emerging markets show much less in the way of available ESG intelligence for investors. Further, ESG products concentrating on private equity and alternative assets are often still too niche and therefore also unable to fill these gaps.

Figure 1: Geographical Coverage of the Corporate Rating Universe, by Country of Operation

Source: ISS ESG 2022

Note: Data as of 6 April 2022; the darker the color, the higher the coverage of corporates

Amid increasing geopolitical tensions and volatile economic markets, operations and investments around the world are exposed to significant ESG risks. Well into the third year of the global COVID-19 pandemic, with the climate crisis in full swing, and the first European war in more than two decades being fought in Ukraine, it is more important than ever that investors are able to understand their respective risk-exposure.

This paper highlights the exposure of emerging and private market investments to various ESG risks and explains three ways the ISS ESG Country Rating can support investors, through:

- presenting a new opportunity for investors to assess prevalent risks regarding labour rights violations along a company’s supply chain;

- helping investors with a tool to evaluate global geopolitical risks; and

- promoting client understanding of ESG risks inherent in many infrastructure investments.

Explore ISS ESG solutions mentioned in this report:

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating

By: Janina Magdanz, Lead Analyst Country Ratings, ISS ESG Punkhuri Kumar, Analyst Country Ratings, ISS ESG