From “can I afford to” to “can I afford not to”, questions over environmental, social and governance factor integration have shifted from performance concerns to prudent risk management. In making this leap, environment, social and governance (ESG) has entered the investment mainstream— whereas many observers suggest this shift occurred roughly a decade ago in the institutional asset management arena, it is now well underway in the retail arena. This shift is evidenced by the increasingly vigorous and public debate on the merits of various ESG strategies and methodologies. Such debate often arises when a fundamental shift in retail investor attitudes and demand articulates. Think active versus passive.

Whereas the active-passive debate was stuck for years in a binary debate of mutually exclusive paths, the ESG discussion has mostly advanced to arguments on what the optimal degree of ESG integration in the retail investment process is. Without digressing too far it should be noted that the ESG debate, unlike active-passive, does not question traditional revenue models and the role of fund managers in the same manner. Although significant assets and revenue will be up for grabs, the ESG debate is not juxtaposing Fund Manager as stock selector versus Fund Manager as asset allocator, a juxtaposition that would have implications for retail investor fee levels and who has rightful claim to those fees. Instead, the discussion about how to incorporate ESG factors will focus on the degree of integration, with the conversation centering on client investment objectives. Is the retail investor’s primary or secondary objective environmental or social impact, risk management or alpha generation?

As ESG socialization has occurred at different speeds among institutional and retail client types, ESG sophistication varies widely. With the shift in ESG considerations turning towards risk management post-2008, adoption naturally was higher among risk-attuned clients, with large pension plan sponsors often leading. Although sophistication on ESG tends to be highest among the largest institutional clientele, the rest of the client pool is catching on, and quickly.

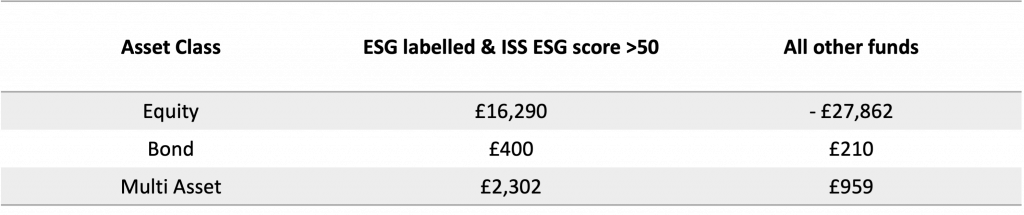

Recent evidence in the UK highlights both the growing demand for ESG among retail and institutional investors and potential differences in approach. In the trailing 12-months from June 2022, flows, into retail and institutional share classes not only streamed towards ESG-themed funds, but towards those funds with the stronger ESG credentials. Our latest ISS Market Intelligence (ISS MI) Simfund data recorded that UK-domiciled funds containing an ESG identifier in the name and scoring highly under ISS ESG’s fund performance rating system (performance score >50) attracted significantly more flows than the remainder of the field over the past 12-months. Funds with fully-fledged ESG credentials brought in £19.0 billion in flows compared to £26.5 billion in outflows for funds not meeting these criteria.

Trailing 12-month estimated new flows

June 2022

Source: ISS MI Simfund

Note: Only funds with an ISS ESG performance score are included in the analysis of this article. Over £750 billion (or approximately 55% of UK fund asset base) in UK domiciled assets were assigned performance score in June 2022.

The ISS ESG performance score is a weighted average of the fund’s underlying holdings Environmental, Social and Governance scores. Holdings with a score of 50 or greater are considered best-in-class and awarded Prime status. For more information on the ISS ESG fund score methodology, please visit: https://www.issgovernance.com/esg/fund-rating/

Equity funds saw the strongest relationship between credentials and fund flows, with funds specifically marketed with an ESG theme and a score over 50 tallying £16.3 billion in flows compared to -£11.6 billion for ISS ESG scored equity funds in general. The breadth of positive flows among funds was also impressive, with three quarters of ESG-labelled funds with a score over 50 recording positive flows. This compares to two fifths for all funds covered in the sample. Anecdotally, much of this activity is due to investors moving non-ESG investments into ESG-themed funds, providing room for ESG funds to grow even in a bearish environment.

The most recent 12-month period also highlighted that backing into a high ESG score alone, likely due to sector weightings, is not enough. Equity funds with an ISS ESG score over 50, but that are not labelled as ESG, recorded outflows of £14.3 billion.

Trailing 12-month estimated new flows (in millions) by asset class for UK-domiciled funds

June 2022

Source: ISS MI Simfund

Although the relationship between ESG credentials and flows appears fainter for mixed asset and bond funds, this has more to do with the breadth of funds meeting the high-standards set. Whereas over 65 equity funds both scored over 50 and have an ESG identifier in the name, only a combined 19 funds met such criteria in the fixed income and mixed asset categories. These 19 funds, however, more than outpaced the sales result of the remainder of funds in their respective categories. As more high-quality ESG funds enter the category, the scale will likely tilt further.

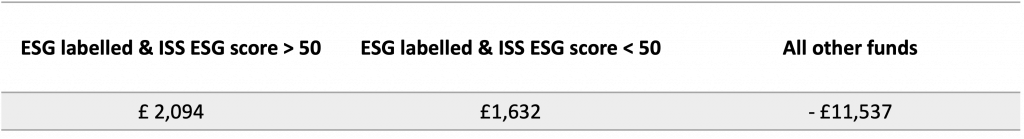

As the above analysis includes both institutional funds and share classes, it is only natural to wonder if the results will hold if narrowed to retail only. A question that ISS MI Simfund can answer. Based on evidence from the past 12 months, the results are more nuanced for the retail channel. While high scoring ESG named funds still attracted the greatest level of flows, ESG funds regardless of score saw positive flows. A result that aligns with the understanding that the retail channel is further behind on the learning curve.

Trailing 12-month estimated new flows (in millions) for UK-domiciled retail funds

June 2022

Source: ISS MI Simfund. Institutional targeted share classes were removed where identified.

When considering the recency of ESG’s rise in the retail channel and the lack of common disclosure and labelling standards, the results are also not surprising. The latter point of common standards is in fact a key focus of the Financial Conduct Authoring (FCA). Although client preferences and corresponding investment approaches are still articulating in the retail channel, a rapid ascent in sophistication with which ESG funds are selected in the retail channel cannot be discounted. Increasingly, investment decisions in the retail channel, particularly the advised channel, are being influenced by centralised investment propositions. And as centralised investment propositions grow in size, so too will they in sophistication. For those wondering what the future may look like, consider fund selection processes by large Defined Contribution plans. How ESG is embedded in these propositions may therefore take on an institutional flavour, with a focus based on the articulation of demand in the retail channel.

The message for asset managers is clear, walk the walk on ESG and do not expect to “catfish” tomorrow’s fund selector. Backing into a high ESG score and labelling funds as ESG that do not have the credentials do not appear to be winning strategies. Although this may ring truer for the institutional channel today, the retail channel is scaling the learning curve with speed. Thank the intense spotlight on ESG investing, continued outsourcing of investment propositions, and industry maturation.

Winning tomorrow’s fund sale will require asset managers to uncover and/or shape investor ESG preferences and embed ESG considerations throughout the end-to-end product design and portfolio management processes. For some asset managers, particularly active manages, unlocking the full demand potential of ESG may also require making a stronger connection between ESG and alpha generation. Regardless of ESG strategy, a significant part of differentiation will be in delivery. With many of today’s strategies, particularly those designed in response to recent EU regulatory developments, being untested throughout a full business cycle, expect client preferences to evolve with the evidence. Track records, performance and impact achievements will speak louder than words.

Next up we will see how this trend is playing out in Europe’s key cross-border fund domiciles.

Want to learn more about how your funds compare on flows? Talk to us today.

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Lead

ISS Market Intelligence