ETFs have in recent years made aggressive inroads into the market share previously held by active mutual funds, mainly to the benefit of passive approaches. We expect ETFs will continue to be the chief engine of future asset growth as well, with passives remaining primary beneficiaries. While shrinking market share spells trouble for active managers in aggregate, growing use of actively-managed ETFs will provide new opportunities for those managers who can thrive in the new product landscape.

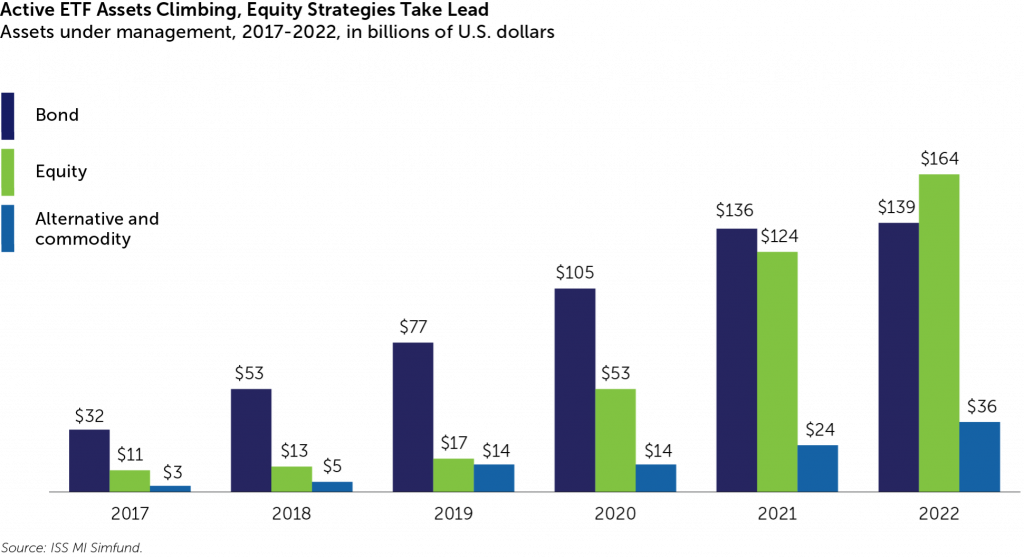

Active ETF assets under management (AUM) notched impressive growth over the past half decade, from just under $50 billion at the end of 2017 to approximately $340 billion by December 2022. As the active ETF marketplace grew, its asset mix became more diverse. As the chart below shows, a majority of active ETFs assets were held in bond funds in 2017. AUM rose sharply across asset classes over the ensuing half decade, but by 2022, stock funds controlled a majority of active ETF assets.

Mutual funds remained the dominant force in active management, however, with $11.3 trillion in AUM at the end of last year. Despite superior growth prospects, active ETFs will barely challenge such dominance in the years ahead. ISS MI’s 2023-2027 outlook, detailed in the recently published State of the Market: Future of Retail Products report, projects active ETF AUM will double to $681 billion in five years, but even with slow growth (averaging 3% annually), long-term active funds will still control an estimated $12.5 trillion by 2027.

Mutual funds have long been the default vehicle for active retail investors, thanks to the wealth of options across managers and strategies, their familiarity, and the fact that many platforms, like retirement, were built with the mutual fund in mind. These forces ensure the mutual fund’s ongoing relevance for years to come, even as fund buyers increasingly see them as one choice among many, if not inferior to ETFs. In fact, in a survey conducted by ISS MI last summer, 53% of advisors said they would choose an ETF over a mutual fund or separately managed account (SMA) if the same strategy was available across all three vehicles. (An October 2022 ISS Insights post covered this finding and others from this survey in greater depth.)

Potential Paths to Success Proliferate

The biggest surprise for some asset managers is not that active ETFs are catching on, but which ones have done so.

Historically, traditional active equity managers were concerned that the ETF’s transparency would allow competing investors to front-run their trades by buying undisclosed securities before managers could establish their positions. Managers devised various mechanisms to shield portfolios from public view, with several securing regulatory approval in 2019. Beginning in 2020, the first of these vehicles, known as semi-transparent active ETFs (STAs) because they are allowed to disclose only some holdings, went to market in 2020.

Unfortunately for STA providers, these offerings have not caught on. As of December 2022, AUM was just $4.8 billion. While their novel portfolio-shielding technologies have worked as intended, concerns over their novelty added extra hurdles to gatekeepers’ decision-making processes, limiting access to fund platforms. Additionally, these products ultimately went live amid a historic recession and an already demanding environment for new products.

The active ETF success stories have come more from the transparent realm. In addition to funds like the ARK Innovation ETF grabbing headlines, 2022 saw Capital Group’s successful launch of its fully transparent lineup (as of December, the firm had raised almost $7 billion). When one of the world’s largest asset managers embraced full transparency, it sent a loud, confident signal that the approach can work elsewhere.

Building from scratch has not been the only path to scale. Another approach, first initiated by Guinness Atkinson in March 2021, and deployed most prominently by Dimensional Fund Advisors (DFA) soon after over a much larger pool of assets, is to turn established mutual funds into ETFs. The conversions quickly turned DFA into the country’s largest active ETF manager, with seven of the firm’s offerings placing in the top 20 active ETF flow getters of 2022.

In late 2022, Fidelity announced it would join the fund-to-ETF conversion club. It had already been a player in the active ETF market, with STA versions of prominent funds like Fidelity Magellan. As large funds like Magellan with diverse constituencies would likely prove too complicated to convert, Fidelity launched new, stand-alone ETF variants for its most popular strategies. The firm’s first targets for conversion are newer, smaller, and specialized in niche industry themes, so they do not have diverse shareholder bases or legacy distribution set-ups to unwind. By further legitimizing the concept of fund-to-ETF conversions, Fidelity’s move may encourage previously reluctant large players off the sidelines.

Another path to expanded use of active ETFs may open in 2023 as Vanguard’s patent for employing the ETF as a mutual fund share class will expire. Adding an ETF share class to an existing mutual fund will allow a fund to keep its track record—a key appeal to conversions—without having to upend all existing distribution agreements. Potential hurdles from regulators and issues surrounding transparency would remain; embracing full transparency for something new is one thing, introducing it widely across legacy active products another. At this point, the idea of a semi-transparent ETF share class to an active mutual fund is purely theoretical. The active ETF competitive set would likely broaden considerably if theory became reality. For now, though, expect growth in active ETF assets to mostly come through standalone products.

ETFs will not save active managers

Active managers are right to target ETFs as a growth area, but they would be wrong to expect active ETFs to fill the mutual fund-sized hole in their businesses. Outflows from active mutual funds will far outpace inflows into active ETFs, resulting in a projected $450 billion in net redemptions over the next five years. The ETF’s potential tax and cost advantages might attract new active investors on the margin, but the vehicle’s growth will primarily come at the expense of active mutual funds.

Active ETFs that come to market will continue to face similar obstacles as actively-managed products more broadly. Active ETF managers without top-quartile long-term results and bottom-quartile fees will struggle to attract assets, just as they have in the mutual fund arena. They will also face new challenges. Competing as an ETF will make the comparison to low-cost passive ETFs even more explicit. Active managers will also face a different competitive set. For now, it means fewer players and more opportunities for growth. Over time, though, that mix is a recipe for attracting new competition. Managers launching ETFs will be aware of the heightened standards for new product adoption and will be inclined to come to market with the ideas in which they have the most conviction. Standing out as an ETF could very well become harder, not easier.

_________________

Simfund Enterprise subscribers can access the State of the Market: Future of Retail Products on the Simfund Research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Christopher Davis, Head of U.S. Fund Research, ISS Market Intelligence

Alan Hess, Associate Vice President, U.S. Fund Research, ISS Market Intelligence