As the harmful effects of human-induced climate change become more apparent, all sectors of the economy will need to make major adjustments to their business model. In a series of three reports, the ISS ESG Climate Solutions team examines the topic of Climate Stress Testing. What steps do financial institutions need to take to stay on top of climate risks?

In July, flash floods devastated parts of Germany and Belgium. Shortly thereafter, China’s Henan province faced the same fate. Hundreds of people died and many more lost their belongings. As the global climate is warming, events like these are becoming increasingly likely. The European Commission’s Joint Research Centre estimates a 6-fold increase in river flood losses alone by 2100. Other hazards such as tropical cyclones, droughts, and heat waves are also expected to become more frequent. It is therefore no surprise that governments across the world are starting to discuss climate-related policies in earnest. For many regulators, the benchmarking of greenhouse gas (GHG) emissions across industries is an important starting point.

As all sectors of the economy need to decarbonize in order to prevent dangerous climate change, the attention is not only on high-polluting industries such as the oil and gas sector. It also extends to financial services companies, even though these don’t have high direct Scope 1 or high indirect Scope 2 emissions arising from their energy consumption. However, they do provide financing for other industries, with these indirect emissions generally being categorized as Scope 3 emissions (more specifically as Scope 3, Category 15, which includes investment and lending activities as well as advisory services).

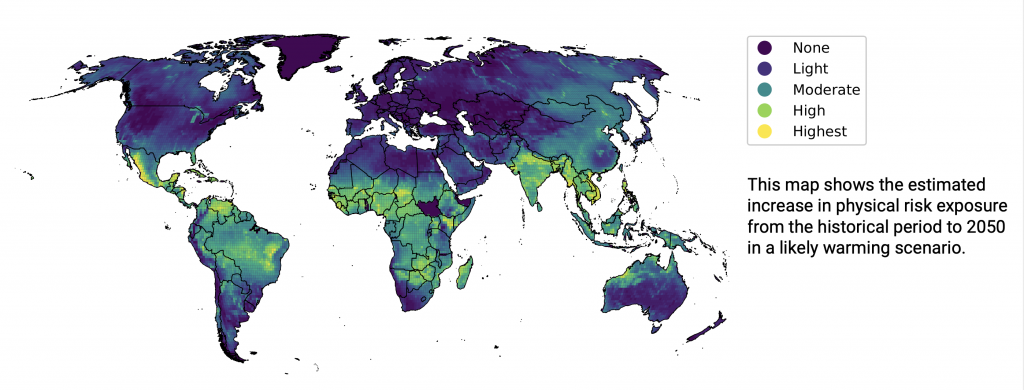

ISS ESG analysis finds that currently only about 20% of companies in the finance sector report their Scope 1 and 2 emissions to a sufficient degree. Far fewer report on their Scope 3 emissions or estimate how they or their borrowers are impacted by climate change. The risks are not uniformly distributed either, varying significantly from one location to another. As the figures below highlight, companies around the world are exposed to significant risk due to climate change by 2050. Banks that lend to these companies are therefore indirectly affected through an increased probability of default and higher losses given default. This means that a more detailed loan book analysis of climate risks can prove crucial for the financial sector.

Source: ISS ESG Climate Solutions

Why Assess GHG Emissions?

First, as alluded to above, there is an increasing regulatory push for climate-related disclosure. Disclosure of financial institutions’ GHG emissions is beginning to be mandated in several major global markets. Institutions that proactively assess their financed emissions can shape regulatory requirements and ensure that they stay in compliance with all applicable laws.

Source: ISS ESG Regulatory Solutions

Second, as climate change is gaining more and more public attention, financial institutions are attracting increased scrutiny from clients and investors alike. This goes hand in hand with greater risk of both direct and indirect litigation. The financial institutions themselves might be directly subject to regulatory action, for example due to misrepresentation of their environmental due diligence processes. In addition, their borrowers’ ability to make timely payments in full might be impaired due to issues such as breaches of existing pollution limits, thus indirectly affecting the bank as a lender. Since this poses an increasingly material risk, financial institutions can make a first assessment of their risk by estimating their GHG footprint and identifying debtor companies that emit significantly more than their peers.

How to Assess GHG Emissions?

Given the clear need for financial institutions to assess their financed emissions, several frameworks have emerged to make assessments transparent, comprehensive, and comparable. The most influential organizations are the GHG Protocol and the Partnership for Carbon Accounting Financials (PCAF). While the GHG Protocol provides broad assessment principles, PCAF builds on the GHG Protocol standard by designing additional detailed asset-level methodologies specifically for financial institutions.

The PCAF standard for financial institutions provides instructions for GHG accounting and guides the measurement of generated, avoided, and removed GHG emissions. PCAF further distinguishes financed emissions from six asset classes – listed equity and corporate bonds; business loans and unlisted equity; project finance; commercial real estate; mortgages; and motor vehicle loans – and provides financial institutions with a targeted methodology for each asset class.

ISS ESG has developed a carbon accounting methodology for financial sector clients that is fully aligned with the PCAF recommendations. Over 28,500 issuers of public and private equity and debt are evaluated in terms of their GHG emissions. All these companies are classified using the proprietary ISS ESG Carbon Industry Classification System (CICS) based on the respective company’s carbon profile.

The classification logic was built and refined over many years. An analyst team assesses the company profile and annual report when a company is classified into a sector. This classification system in combination with the large dataset of reported carbon emissions allows the creation of over 800 sector-specific carbon emission models. These models do not rely solely on revenue numbers, but also consider other financials such as the number of employees, costs of goods sold, and more.

For the analysis of private loan holdings, the same models are deployed to overcome the lack of reported GHG numbers, allowing the inclusion of all debtor companies into the analysis. On an aggregate loan portfolio level, this analysis provides estimates of financed emissions for Scope 1, 2, and 3, relative emissions exposure, and weighted average carbon intensity (WACI). Further analysis –scenario alignment as well as physical and transition risk analysis– is done on a bespoke basis for loan books.

As the risks of climate change become more apparent, financial institutions are facing pressure from both regulators and their own clients to demonstrate a proactive approach to the issue. ISS ESG provides advisory services and robust tools to enable investors and lenders to measure their exposure to climate-related risks across both equity and debt portfolios as well as loan books.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By Steffen Bixby, Head of US Climate Analytics, ISS ESG Climate Solutions. Marie Fuchs, ISS ESG Climate Solutions.