Investments in infrastructure such as transportation, sewage, or energy are crucial for a country’s development. Infrastructure investments can also form an essential part of an investor’s diversified portfolio as they are often considered comparatively stable due to their more predictable payments.

To cushion the impact of the COVID-19 pandemic, many governments tried to kick-start their economic recovery by injecting unprecedented sums into infrastructure, two examples of this being the US’ Build Back Better Framework and the Australian Infrastructure Investment Program. The World Bank reported that private investments in infrastructure increased by 49% from 2020 to 2021.

While infrastructure investments are a driver of global prosperity and can contribute to long-term economic growth, they also carry Environmental, Social and Governance (ESG) risks that responsible investors should monitor closely. What is built today will significantly shape its environment for decades to come. Consequently, incorporating environmental and social aspects into investment decisions is key to lasting positive impact and avoiding the risk of stranded assets.

ESG Risks in Infrastructure Investments

Infrastructure investments can involve three broad types of ESG risks:

- Environmental risks, such as wildfires, heatwaves, cyclones, and flooding or environmental degradation and biodiversity loss;

- Political and regulatory risks due to changes in a country’s government or legislation, as well as (geo-)political conflicts; and

- Social risks, such as negative impacts on local communities due to violations of health and safety standards or other labor rights violations, as well as the violation of indigenous rights.

Several physical risk assessment tools already exist on the market to assess the environmental risks of infrastructure projects. Only a few tools are available to monitor the potential social and political risks of infrastructure investments, however. Tools to explore the potential social risks of a project during the pre-construction phase are particularly hard to come by.

Traditional tools, such as ISS ESG’s Norms-Based Research, often flag corporate controversies ‘ex-post’, i.e. once they have already occurred. The ISS ESG Country Rating instead provides investors with a solution to conduct an ex-ante assessment of areas in which social and political ESG risks are higher.

Using Country Ratings to Conduct Ex-Ante ESG Risk Assessment

A country’s human rights record can influence an infrastructure project in a range of different ways. Following the military’s seizure of power in Myanmar in February 2021, for instance, many human rights violations, including the use of child soldiers, have been attributed to the Myanmar military (Tatmadaw). The subsequent political upheaval led to the Dawei Industrial Zone, a large-scale infrastructure project located along the Thai-Myanmar peninsula, being suspended.

The ambitious collaboration between the governments of Myanmar and Thailand includes the development of a deep seaport and an industrial estate, as well as a road and rail link between the two countries. Yet the government of Thailand has now halted all developments until a new, democratically elected government is back in place, which might take years.

Another example from the Asia-Pacific region is the breach of an auxiliary dam of the Xe-Pian Xe-Namnoy (XPXN) hydroelectric project in Laos in 2018, which left 71 people dead and thousands displaced. Following a March 2019 visit to the country, the United Nations Special Rapporteurs on extreme poverty and human rights deemed the living conditions of those affected by the collapse to be “highly unsatisfactory.”

ISS ESG Norms-Based-Research reveals that while most corporate controversies are classified as moderate, the construction and the real estate industries – both directly associated with infrastructure investments – are also involved in severe human rights (including forced labor) and environmental protection controversies (Figure 1).

Figure 1: The Construction and Real Estate Industries are Prone to Severe and Moderate Human Rights, Labor Standards, and Environmental Protection Controversies

Source: ISS ESG 2022, results as of June 10, 2022

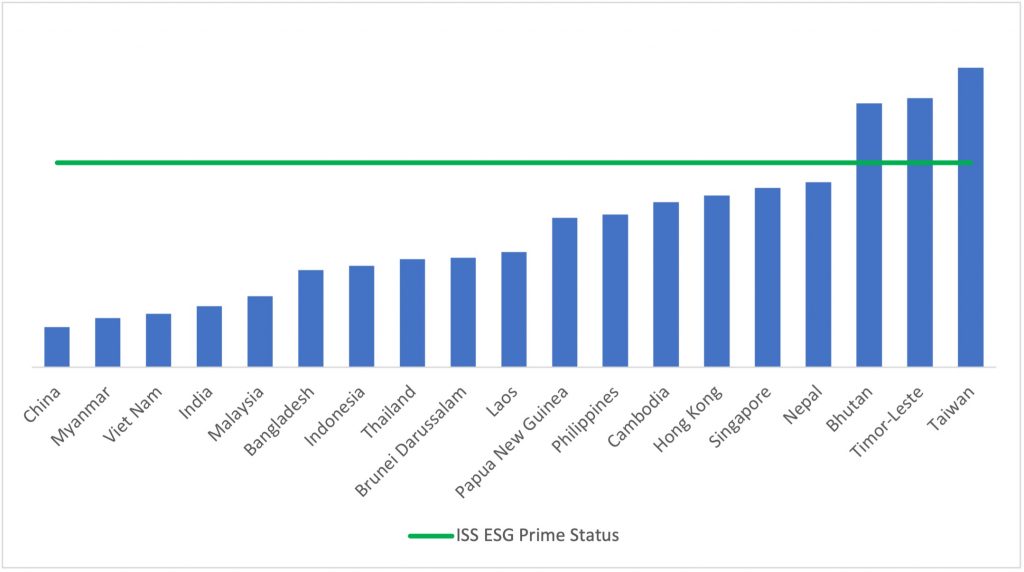

Results from the ISS ESG Country Rating show that, in a regional comparison, Myanmar scores relatively poorly in providing human rights and fundamental freedoms to its citizens (Figure 2). While Laos performs considerably better than Myanmar, it still does not reach ISS ESG Prime Status – a label attributed to countries fulfilling ambitious performance requirements, measured on an absolute scale.

Figure 2: Human Rights Violations Are an Ongoing Problem in Southeast Asia: Only Three Countries in the Region Reach the ISS ESG Prime Status

Source: ISS ESG 2022; Human Rights Topic score on a scale of 1.0 (worst grade) – 4.0 (best grade)

Thus, although country ratings cannot predict changes in government, they can be used by investors to learn about the general human rights or labor rights situation in a country and flag regions in which greater ESG risks require higher due diligence standards.

Using a Country Risk Analysis to Complement Traditional ESG Tools

The above examples illustrate the importance of not only evaluating a project’s immediate impacts, but also its broader environmental, social, and governance aspects. For instance, while hydroelectric plants are generally considered to contribute positively to climate change mitigation and thus to Sustainable Development Goal 13, the example of the plant in Laos demonstrates that such projects can also present human rights concerns.

The ISS ESG Country Rating offers a thorough analysis of the human rights situation in a country, including four individual indicators examining the level of discrimination against different vulnerable groups, including racial and ethnic minorities; people with disabilities; women; and the LGBTI community.

Responsible investors can use this broad set of factors to screen for the potential ESG risks of infrastructure projects without having to wait for an ex-post controversy evaluation. A thorough country risk analysis prior to an investment decision can complement traditional ESG tools by highlighting regions in which a higher standard of due diligence and compliance measures might save lives.

Explore ISS ESG solutions mentioned in this report:

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By: Janina Magdanz, Lead Analyst Country Ratings, ISS ESG. Punkhuri Kumar, Analyst Country Ratings, ISS ESG.