In the second of ISS ESG’s Climate Stress Tests, a case study based on analysis of syndicated loan portfolios demonstrates climate risk variability across loan portfolios and across time periods. This highlights the potential value for investors of doing deep dives into financial institutions’ lending practices.

In August 2021, the International Panel on Climate Change (IPCC) issued the first part of its sixth assessment report, with a focus on the expected negative impacts of climate change. The publication coincided with a series of ever more severe weather events, including floods, hurricanes, and heatwaves across the globe. If a further escalation of the frequency and severity of natural disasters is to be avoided, the IPCC notes that both corporate and governmental actors must move towards the integration of climate risks into their decision making and risk governance processes.

In the first report of this new ISS ESG series – Climate Stress Tests #1: Carbon Accounting for Loan Books – we emphasized the need for greenhouse gas emissions (GHG) accounting as a critical initial step in improving understanding of future climate risks. This holds particularly true for financial institutions, as their climate risks do not necessarily change incrementally but can be influenced significantly by every single new investment decision. Financial institutions must therefore assess investment and loan portfolios for climate risk on a routine and a regular basis.

Syndicated Loans:

One aspect of a financial institution’s loan book that can be readily assessed are syndicated loans. These syndicated loans can be used as a proxy for the overall loan book. For syndicated loans, a group of financial institutions, the syndicate, jointly extends a loan to a single borrower. These are typically large volume loans with long maturities; and data on both lenders and issuers is readily available. For this analysis Bloomberg’s league tables for US investment grade loans issued between 2017 and 2020 are used to identify the five largest lead arrangers, JP Morgan, Citi, Morgan Stanley, Goldman Sachs, and Bank of America, and to study their respective loan deals in each year. The ISS ESG Climate team’s database currently includes more than 28,500 issuers –this covers between 85% and 90% of all deals identified above.

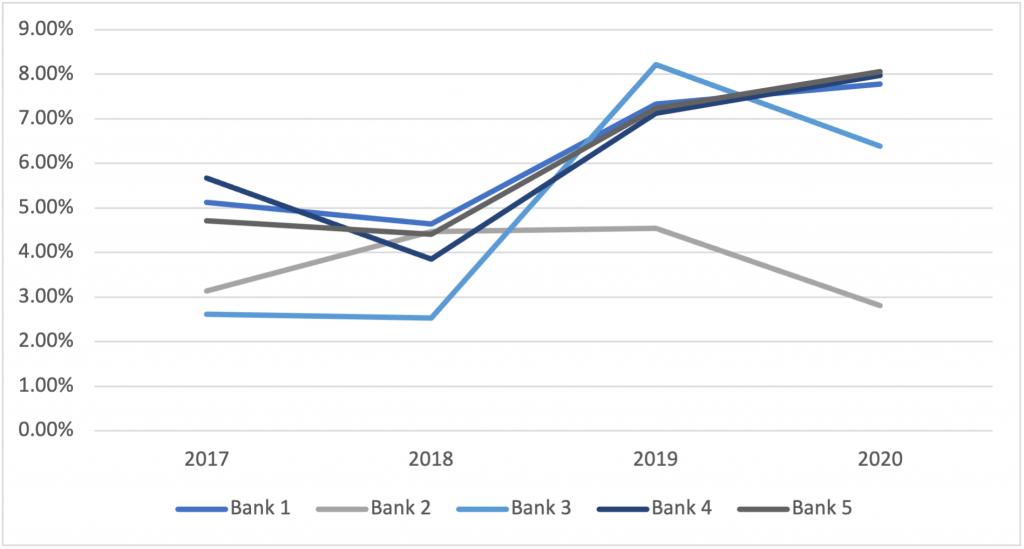

The first step is to examine exposure to controversial business practices such as arctic drilling, oil sands, shale oil and gas, and hydraulic fracturing, as a share of the banks’ overall syndicated loan portfolio. Companies that engage in these types of practices face stranded asset risk because of potential changes in legislation or consumer preferences, and can therefore be considered likely to represent a higher default risk for a lender. Figure 1 shows the distribution over time of the five borrowers identified above (anonymized) using the example of hydraulic fracturing. As becomes apparent, there is a large variability in the share of portfolio holdings, both across banks and years.

Figure 1: Borrowers Involved in Hydraulic Fracturing [% of total portfolio holdings]

Source: ISS Climate Data, Bloomberg Global Syndicated Loans League Tables

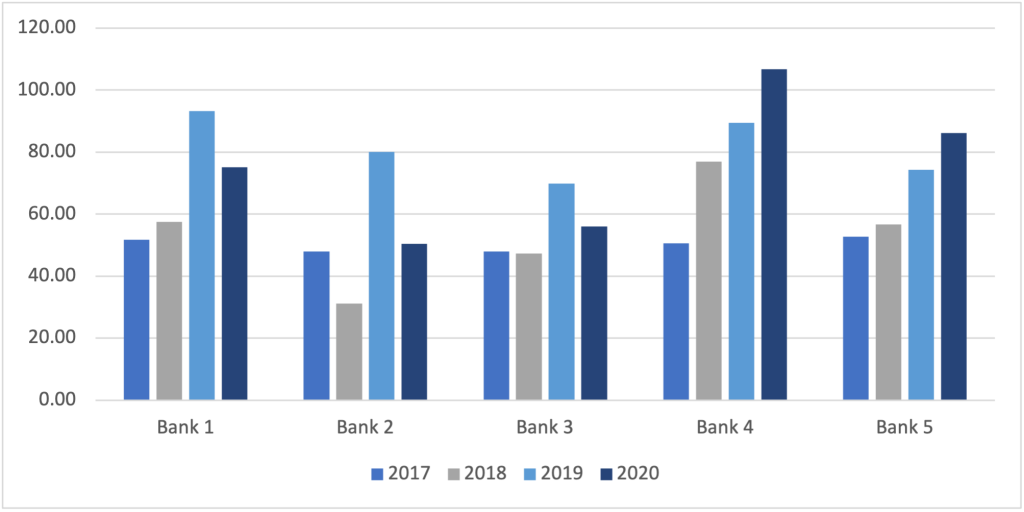

Next, the relative carbon footprint, that is the level of emissions financed per million USD of investments, is calculated for each institution and year. As illustrated in Figure 2, this metric also varies significantly both from year to year within an institution as well as between institutions. The same holds true when looking at other metrics of relative emissions exposure such as weighted average carbon intensity (WACI). Accordingly, the introduction of carbon taxation would have a different impact on different borrowing companies, highlighting the variability of climate risk across financial institutions and from one year to another.

Figure 2: Scope 1 & 2 Relative Carbon Footprint [tCO2e / $ million Invested]

Source: ISS Climate Data, Bloomberg Global Syndicated Loans League Tables

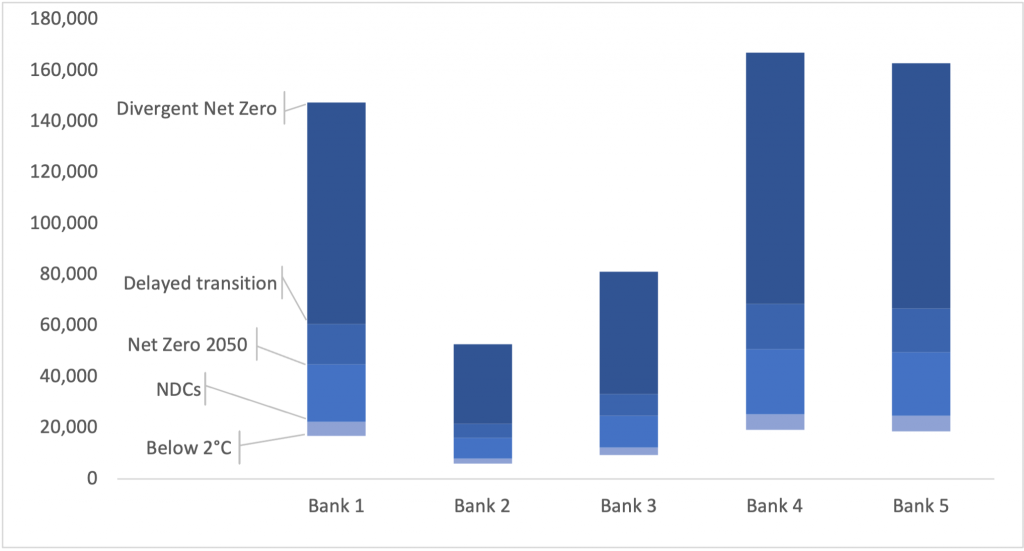

Finally, we explore the potential financial implications of the carbon emissions of the syndicated loan portfolios. Leveraging scenarios from the Network on Greening the Financial System (NGFS), which are also utilized by regulators for climate stress testing, expected costs as a result of carbon taxation in 2050 is calculated based on the 2020 composition of each bank’s portfolio and ISS ESG’s forecasts of future carbon emissions. Figure 3 outlines the range of these carbon costs, with the upper limit framed by the NGFS Divergent Net Zero scenario and the lower limit represented by the NGFS below 2°C scenario. While costs – and therefore the risks of default – are strongly dependent on the future regulatory environment, not all banks will experience the same impacts. There is a significant difference between financial institutions’ outcomes both in terms of their overall level of cost as well as in terms of the range of cost. This further emphasizes the idea that it is difficult to generalize climate risk across portfolios.

Figure 3: Total Carbon Costs Associated with Financed Emissions [$ million]

Source: ISS Climate Data, Bloomberg Global Syndicated Loans League Tables, NGFS Scenarios

These observations raise the question of why there are such stark differences between institutions and time periods. The explanation for this lies in the sectoral allocation of the loans as well as in the issuer selection within sectors, as certain industries – such as energy, utilities, and materials – are more carbon-intense than others. Banks that extend fewer loans to those sectors and/or take the relative carbon exposure of the issuer into account will face lower related risks.

Conclusion:

Financial institutions need to be mindful of climate-related credit risk. This paper assesses the actual climate exposure of five banks by looking at their syndicated loan portfolios. This leads to two important conclusions:

- It is crucial for investors to gain more granular insight into loan books to understand the financial consequences associated with loan origination. As large variations exist between portfolios and across credit cycles, regular assessments of individual portfolios are necessary for risk management purposes.

- The analysis of carbon intensity and climate risks more generally should become part of the due diligence process of bank lending.

In the future, climate risks will have an increasing impact on both credit default probability and default given loss. It is therefore only prudent to incorporate all available information when deciding on a loan request. A lack of action could lead to both higher loan portfolio losses and also reputational risks for banks and investors alike.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By Steffen Bixby, Head of US Climate Analytics, ISS ESG Climate Solutions Marie Fuchs, ISS ESG Climate Solutions Simona Cristofanelli, ISS ESG Climate Solutions.