The European Green Bond Standard (EU GBS) legislative proposal was published by the European Commission on the 6th July. Once approved, the voluntary standard will be officially adopted in all European Union member states, introducing a compliance framework for the use of the “European Green Bond” label (or “EuGB”). Given the rapid growth in European bond issuances, the new standards are likely to have ramifications for investors around the globe.

The long-awaited proposal aims to channel considerable financial flows towards the European Union’s 2030 sustainable objectives, such as the 2030 Climate Target Plan. A number of questions remain unanswered, however. Will the EU GBS help or hinder market innovation? What are the practical implications of getting an EU GBS label, and what can bond issuers do to prepare for the legislation?

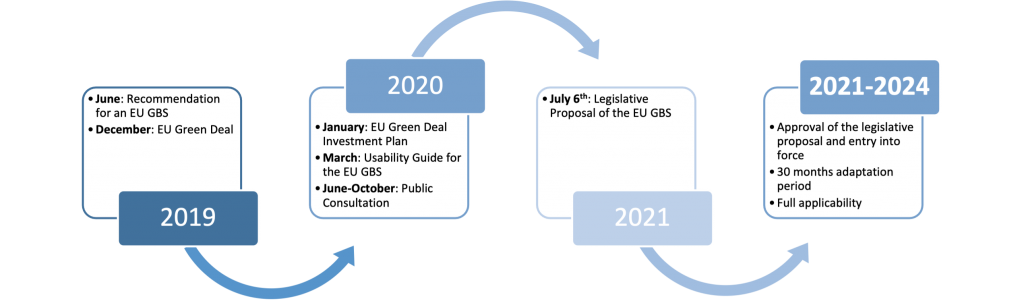

The Roadmap represents the pathway of the EU GBS proposal from its first steps to its entry into force.

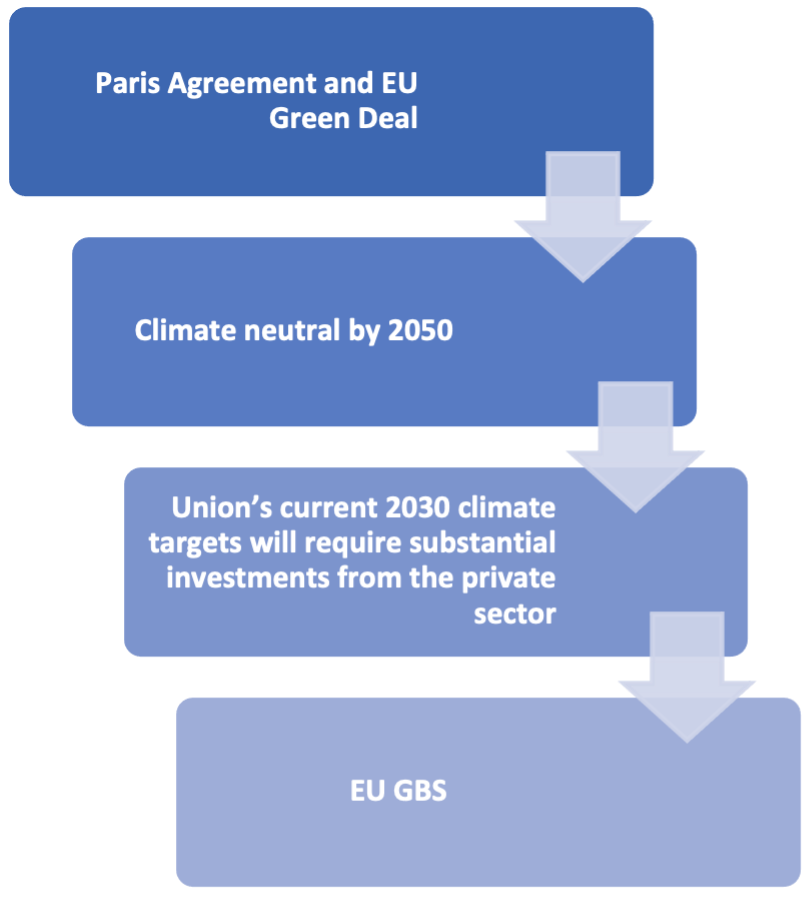

Why is the EU GBS label needed?

The European Green Deal intends that investors and companies to have a straightforward process to identify environmentally sustainable investments and ensure their credibility. The use of clear labels such as EU GBS standard is a core part of this process. The EU legislative proposal has three functions:

- Improving the ability of investors to identify and trust high quality green bonds;

- Facilitating the issuance of high-quality green bonds and reducing potential reputational risks for issuers in transitional sectors; and

- Standardising the practice of external review by introducing a registration and supervision regime.

Key elements of the new legislative proposal

The newly disclosed legislative proposal clarified six fundamental aspects:

1. The EU GBS will be a voluntary initiative. Issuers will need to adapt to the requirements only if they want to use the label “EU GBS”

2. The designation of “EuGB” shall be available to all issuers, whether within or outside the Union, that meet the requirements of the proposal.

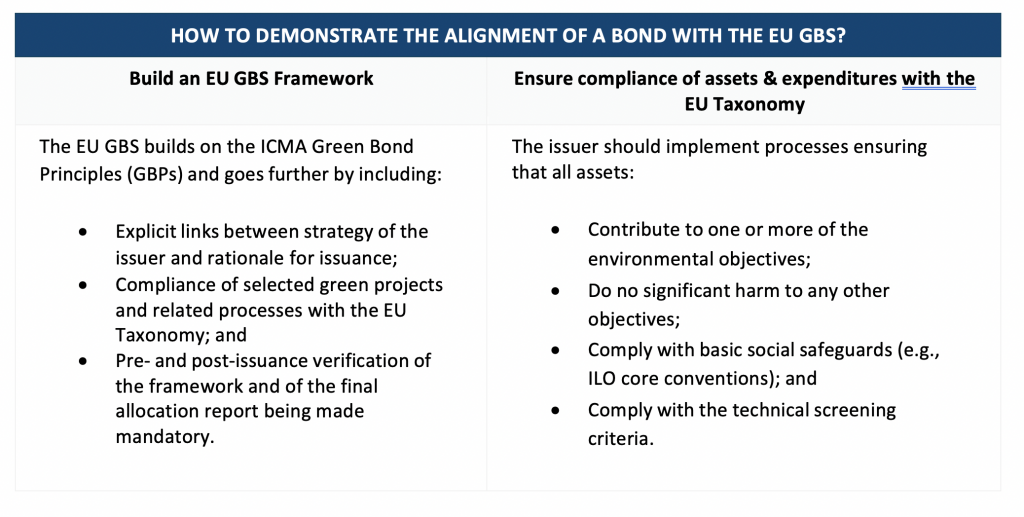

3. The proposal requires issuers of an EU GBS to ensure that the proceeds of the bond are allocated to assets (tangible, intangible and financial) and expenditures (capital or operating) in full compliance with the requirements of the Taxonomy Regulation. Sovereign issuers are afforded some flexibility with regards to the enforcement of the EuGB, but not in relation to the Taxonomy regulation. Economic activities that do not yet meet the EU Taxonomy criteria are eligible if they will be compliant within a 5-year period (extended to 10 years in certain cases).

4. Issuers of an EuGB must obtain a pre- and post- issuance review from an external reviewer registered and supervised by the European Securities and Markets Authority (ESMA). ESMA’s regulatory technical standards will be developed during a 30-month transition period.

5. There are specific disclosure obligations for issuers on allocation of proceeds and impact reports.

6. The Commission proposal will be submitted to the European Parliament and Council as part of the co-legislative procedure. Starting from the regulation’s entry into force, a 30-months transition period will follow. During this period, issuers will already be able to have their framework externally reviewed against the EU GBS.

A Usability Guide for the EU GBS was published in March 2020, and external reviewers started providing Second-Party Opinions on bond alignment with the draft EU GBS on a “best-efforts basis”. This topic is discussed in more detail in ISS ESG’s paper A Greener Yardstick?: Navigating the EU Green Bond Standard.

A thin line between transparency and obstacles to innovation

The EU GBS and the associated EU Taxonomy aspire to be key global reference points for issuers demonstrating the stringency of their sustainability approach. While this is a worthy objective, it should not come at the expense of the market’s ability to grow and innovate.

The sustainable debt market has flourished in recent years with innovative products and structures. The most recent development has been general purpose corporate bonds linked to the achievement of sustainability targets that have been issued to support the overall transition of companies. This represents a shift away from purely Use-of-Proceeds Green Bonds that the EU GBS focuses on. While those innovative debt products offer potential solutions in a world of growing inequality, they would remain out of scope of the EU GBS. To tackle the challenges posed by business transformation, the EU GBS will also be available for transition bonds, offering the prospect of funding long-term projects (up to 10 years) and other transition activities.

While additional and more innovative solutions are necessary to fully achieve a more sustainable future for all, EU GBS-aligned bonds are likely to play a key part in funding projects to shape a greener tomorrow.

ISS ESG considers it important to support innovation in the market by ensuring the transparency and stringency of new products. This holistic approach is the DNA of the ISS ESG Second Party Opinion service, and will remain key to protecting investors and issuers from risks of green-, social- or transition-washing, and building trust in the market.

Preparing for EU GBS legislation: what can bond issuers do now?

Pending the final approbation of the new regulation, issuers can already issue bonds complying with the EU GBS on a best-effort basis by implementing the requirements included in the legislative proposal in terms of the characteristics of the bonds and in respect of the EU Taxonomy.

ISS ESG has provided Second Party Opinions to verify the alignment of issuers’ bonds, getting ahead of what can be a cumbersome legislative process by aligning with the previous versions of the draft EU GBS on a best-effort basis – examples include NRW Bank, ZF Friedrichshafen AG, Landesbank Hessen-Thueringen Girozentrale, and Deutsche Kreditbank AG.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG’s Second Party Opinion (SPO) Services to provide sustainability, green and social bonds with a credible and independent assessment of their sustainability quality.

By Giorgio Teresi, ESG Consultant, ISS ESG. Mélanie Comble, Head of SPO Operations, ISS ESG.