Two weeks ago, when world leaders, heads of corporations, financial institutions, industry experts, climate activists and the public congregated in Glasgow, in a state of urgency perhaps last felt during the Paris Conference of the Parties (COP21), the main goals were clear:

- To prevent global temperature rise beyond 1.5oC.

- Accelerate the phase out of coal.

- Revise 2030 national targets.

- Finalize and accelerate climate financing.

What followed has been an often predictable, sometimes surprising and a somewhat underwhelming process. As the President of COP26, Alok Sharma aptly said during the closing of the summit, “The pulse of 1.5 is weak.” But – at least it is alive.

With a deal finally being settled on in the extended hours of the conference, it is important for countries and investors to now address and understand two main questions: what have we achieved and what comes next?

Countries:

Preceding COP26, G20 countries, which include some of the largest greenhouse gas (GHG) emitters, recognized the need for stronger action, committing to achieve Net Zero by ‘mid-century’. This shift away from the more concrete 2050 goal was an indication of challenges to come. Over the course of the conference there was a slew of pledges, initiatives, and agreements, all with varying degrees of feasibility, likelihood, and opposition. In the end, with an updated deadline of 2022 for new Nationally Determined Contributions (NDCs), the possibility for 1.5oC was just about sustained.

Despite acknowledging the need for more ambitious action, what developing economies continue to advocate and what developed nations often have trouble accepting, is that while climate change is global, climate realities are not universal. For many countries already experiencing the effects of climate change, development issues hold the same level of urgency. Such nations will find it more challenging to contribute to global GHG emission reductions in the same way and to a similar extent as developed nations.

Therefore, the controversial last-minute change of wording from “phase out” to “phase down” of coal in the deal, highlighted a known yet sometimes forgotten notion – national agendas often take precedence over global goals. This holds true when it comes to climate financing as well.

Investors:

As per the International Energy Agency (IEA), an estimated $4 trillion annually is required by 2050 for an effective clean energy transition, far more than the current $100 billion agreed – and even that remains to be fulfilled. With every passing COP summit and delayed action, the cost of transition increases.

Therefore, the acknowledgement by developed countries of the $100 billion figure as being critical, and the final deal of the conference “urging developed countries to double their contributions from 2019 levels by 2025”, are important pillars in the bridge to 1.5oC – albeit one with already growing cracks.

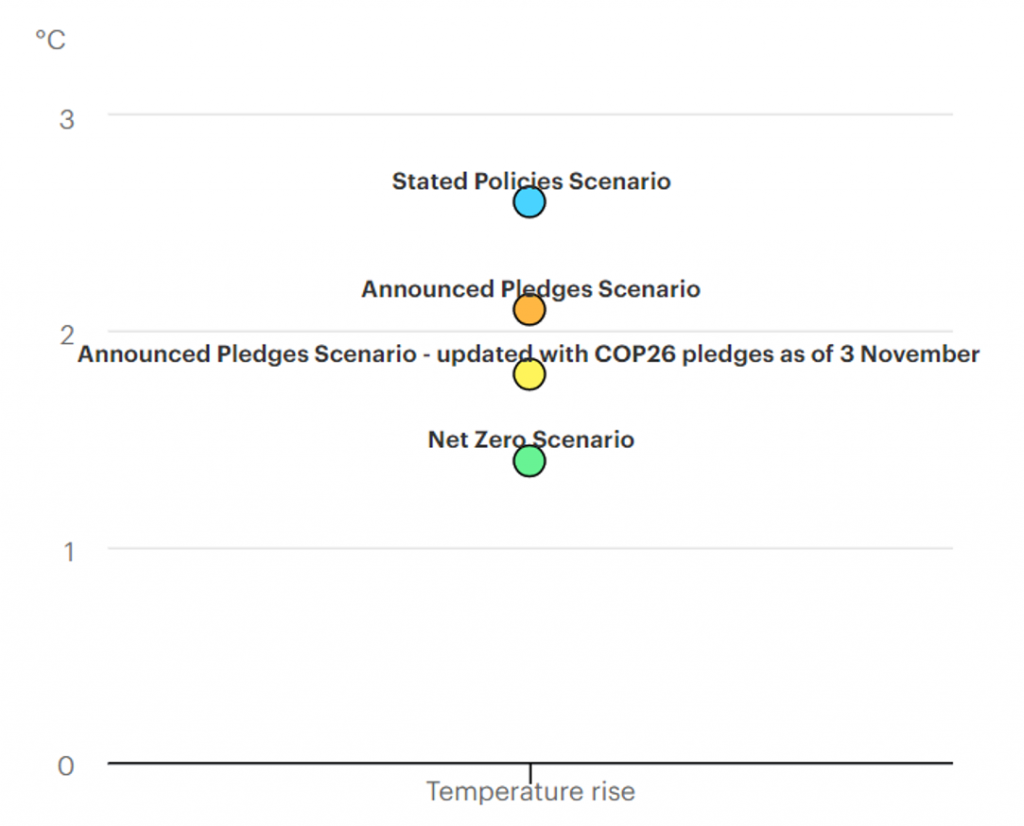

Temperature rise in 2100, by scenario:

Source: IEA, Temperature rise in 2100, by scenario, IEA, Paris https://www.iea.org/data-and-statistics/charts/temperature-rise-in-2100-by-scenario

The speed of deployment, amount of capital, and determination the climate crisis demands is at times more in line with a private sector approach, and as such enables investors to tackle the challenge in a way that national governments can’t. This indicates that investors and financial institutions can and should play a crucial role.

With the creation of the International Sustainability Standards Board announced during the conference, the ambition of global standardized disclosures can now potentially be realized. With any investment opportunity, especially one of such magnitude, comes a concomitant degree of risk. Therefore, investors require reliable and comparable data and disclosures to assess risk and investment value. While the financial requirements are substantial, so are the commercial opportunities. According to a report by the International Finance Corporation, the World Bank’s private sector arm, almost $23 trillion in potential climate related investments in emerging nations will emerge by 2030 alone.

It is not enough to simply invest, however. While announcements such as the Glasgow Financial Alliance for Net Zero (GFANZ) – a coalition of 450 global financial groups committing $130 trillion to Net Zero – are a major boost to climate mitigation efforts, what is crucial is that investors and businesses actually channel that capital towards solutions that are viable for deployment in the real economy today. Important sectors such as transportation and construction saw considerable focus, however discussions around climate technology were more fraught. For example, according to the IEA, at present only 2 out of 46 clean energy technologies are on track to be deployed at a sufficient rate to match Net Zero by 2050 ambitions. Discussions of investments during the conference often focused on technology which is still in its nascent stage or not yet scalable, however.

Conclusion:

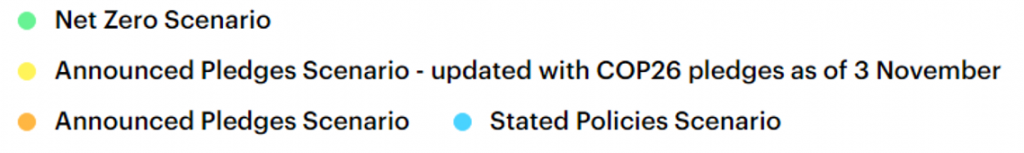

According to the World Economic Forum’s Climate Progress survey, nearly 59% of people believe that governments are not doing enough to combat climate change. It is no wonder then that the expectations of events such as COP26 will only continue to increase. However, in the end it is important to understand that no COP is ever likely to meet, let alone exceed, the expectations that surround it. With leaders already pegging COP27 and COP28 as game changers, what is required is the recalibration of how COP summits are perceived, not as monumental milestones but as essential pit stops. We must recognize that more scrutiny is needed between conferences than during them. It was perhaps with this in mind that the UN announced the creation of a Group of Experts in 2022 to better monitor the pledges of non-state actors. After all, while encouragement and celebration of pledges and initiatives is important, they must be followed up with ambitious and often difficult decisions and actions.

Laws & Regulations to Protect Environment

Source: World Economic Forum Climate Progress Survey, 2021: https://www3.weforum.org/docs/SAP_WEF_Sustainability_Report.pdf

For investors, this moment presents an opportunity to create and grow sustainable businesses and business practices. In the never-ending back and forth between governments and investors, the latter can lead and set an example for the former – creating a model that merges purpose with profitability. However, much like political will, business intent is often fickle and unpredictable. With even the current collection of commitments and pledges, from new NDCs in 2022 to other non-binding pledges such as “halting and reversing” deforestation and cutting methane emissions, we are still looking at a 1.8oC world; better than 2oC yes, but not close enough to 1.5oC. Therefore, strong investor intent in conjunction with accountability, through closely monitored and correctly implemented regulatory frameworks, and continued public awareness and pressure, all hold the key to turning the dial not just in the right direction, but also with the right speed.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

By Shagun Agarwal, Associate, Climate Solutions, ISS ESG