Below is an excerpt from ISS-Corporate’s recently released article “Corporate Political Activity Disclosures: A Continued Priority for Investors and Companies”. The full article is available on the ISS-Corporate online library.

For much of the past two decades, transparency regarding corporate political activities has been a key issue in corporate engagements with investors. Over the past decade, shareholder proposals focused on political activity transparency have consistently ranked the highest in volume among proposals submitted at U.S. companies, outpacing all other environmental and social categories, including those related to climate change and human capital management.

As the U.S. presidential election approaches, ISS-Corporate reviewed shareholder proposals submitted to U.S. companies in the past decade, along with the latest corporate disclosure data, to assess key trends and developments in relation to engagements on this crucial topic for companies and investors.

High proposals volume, healthy support levels

The 2010 Citizens United Supreme Court decision permitted unlimited corporate and union spending in elections, classifying such activities as free speech, leading to significant changes in U.S. campaign finance dynamics. This ruling resulted in a surge of shareholder proposals in the U.S. focusing on political activity transparency, nearly doubling from 2010 (59 submitted requests) to 2012 (117). Since then, proposals seeking greater transparency in political contributions, lobbying activities, and related matters have ranked among the top issues for shareholder proponents by volume. Notably, in recent years, political activity-related proposals have gained traction among prominent individual shareholder proponents who have historically concentrated on shareholder rights issues, including John Chevedden, James McRitchie, Myra Young, and Kenneth Steiner.

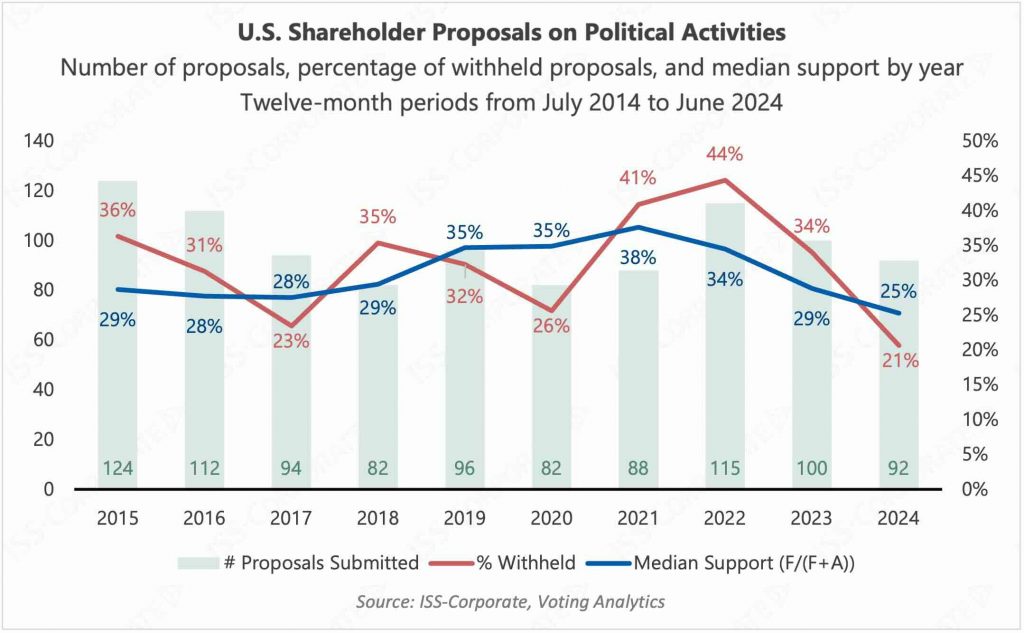

Support levels for these requests have remained high, averaging approximately 30% of votes cast over the past 10 years leading to June 30, 2024. Peak support levels were observed in 2021, similar to trends seen with other shareholder proposals focusing on environmental and social topics. In the past year, however, support levels dropped to a median of 25% of votes cast. The drop in support in 2024 can be partly explained by proposal targeting and the presence of new types of requests. Some targeted companies had previously disclosed they do not make political contributions and provided sufficient transparency around management of key risks, lending less validity to shareholder proposals seeking to change their behavior. Additionally, two new types of political activity-related requests emerged in the past two years which appeared overly prescriptive: one seeking global transparency in political spending outside the U.S., and the other asking companies to require trade associations or similar groups to disclose detailed expenditure information. Both proposal types were viewed as seeking information well beyond standard practice, resulting in lower support levels. Nevertheless, requests focusing on lobbying transparency have maintained support comparable to the 2021 peak year, receiving median support of 31% of votes cast in 2024.

A significant portion of requests have been withdrawn by proponents, signaling successful engagements with proponents and potential commitments made by companies. In the period under review, approximately 33% of submitted proposals were withdrawn by proponents, with this figure reaching record highs in 2021 and 2022. In 2024, the percentage of withdrawn proposals subsided, reflecting broader market trends in proposal withdrawals.

By:

Kosmas Papadopoulos, Head of Sustainability Advisory, Americas, ISS-Corporate