The Russia-Ukraine war has highlighted once more that geopolitical risks have significant impacts on the investment community, with some commentators going so far as to label them “the number one global corporate risk.” Geopolitical risks are associated with a range of international conflicts or tension.

These conflicts and tensions can also be intra-national, involving states or non-state actors – for example civil war, coups d’état, and other violent changes of government. They significantly impact global trade relations and pose major challenges to financing and conducting business in a given country or region. These risks thus threaten the financial and operational stability of companies around the world.

While for some the Russia-Ukraine war came as a ‘black swan’ event, others argue that Russia’s unlawful annexation of Crimea in 2014, as well as recent increased military exercises by NATO members and non-members in the west and Russia and Belarus in the east, could have been red flags. The Foreign Policy Research Institute noted in August 2021 that “tensions between Russia and NATO are increasing.” The present war is a reminder of the hazards of conducting business in or moving operations to at-risk countries and regions. Monitoring such risks is crucial to safeguard businesses and investors from potential financial fallout.

This paper demonstrates how a country-risk analysis using the ISS ESG Country Rating presents a new opportunity for investors to evaluate such geopolitical risks.

Geopolitical Risks and Their Impact on Financial Performance

Almost 1,000 companies and multinational corporations have already decided to curtail operations in Russia or withdraw completely from the Russian market following the country’s invasion of Ukraine. This decision has often come at a great cost to the business.

For example, Adidas reported that cutting all sales in Russia will cut 1 percent from its expected revenue growth this year, while IKEA is estimated to lose around 4 percent of its total retail sales by leaving the country. Also, McDonald’s decided to completely exit the country by selling its Russian business, which according to estimates will result in a write-off of almost $1.4 billion.

Russia is not the only current example of geopolitical events leading to financial losses. Due to the violent coup d’état in Myanmar in February 2021 and the subsequent political instability in the country, several major corporations withdrew from Myanmar. Although coups d’état often seem to occur suddenly, prior events in Myanmar could also have been interpreted as red flags. As early as a year prior to the coup, in 2020, the NGO Freedom House changed the country’s classification from “partly free” to “not free” — a category reserved for undemocratic, repressive, autocratic, and authoritarian regimes. The change was due to increased conflicts between the military and ethnic minority groups. The NGO also noted that during this year the political transition from military dictatorship to democracy stalled.

Both events provide examples of why businesses and investors may wish to monitor geopolitical events thoroughly when considering the risks associated with their countries of operation.

Conducting a Country-Risk Analysis to Avoid Potential Geopolitical Risks

Geopolitical risks often arise due to increasing political instability and a decline in commitment to the international rule of law, frequently resulting in violent conflicts. All these conditions are covered in the Governance pillar of the ISS ESG Country Rating.

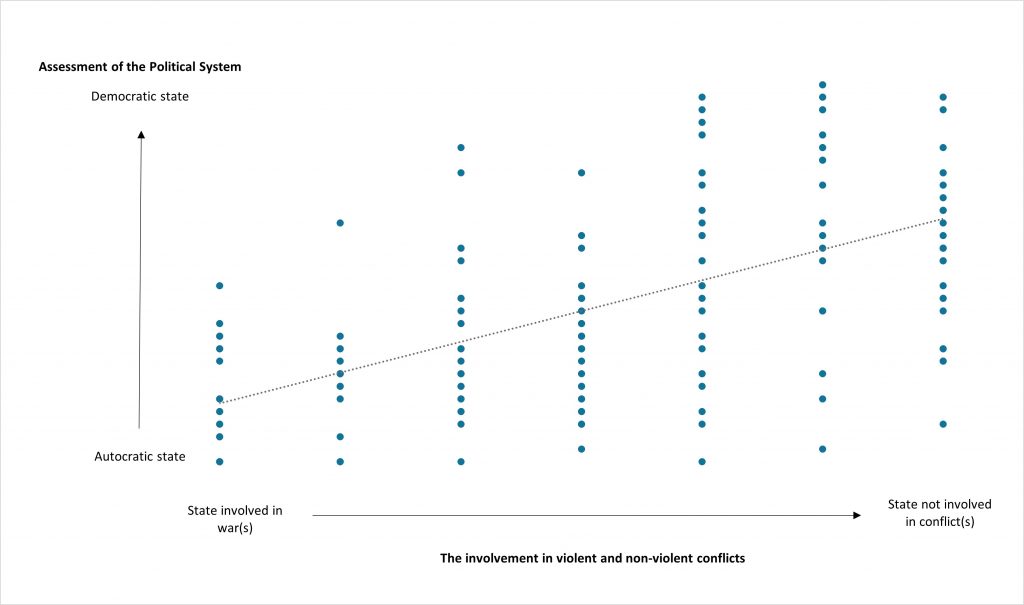

Rating results in Figure 1 demonstrate that countries with a more democratic political system are also less often involved in violent or non-violent conflicts. Such countries are thus less risky from a geopolitical perspective. The assessment of the political system of a sovereign state includes the most important good governance principles: whether a country allows free and fair elections; whether the judiciary is independent; and the level of the rule of law within a country.

Figure 1: States with Less Democratic Political Systems are More Frequently Involved in Conflict

Source: ISS ESG 2022

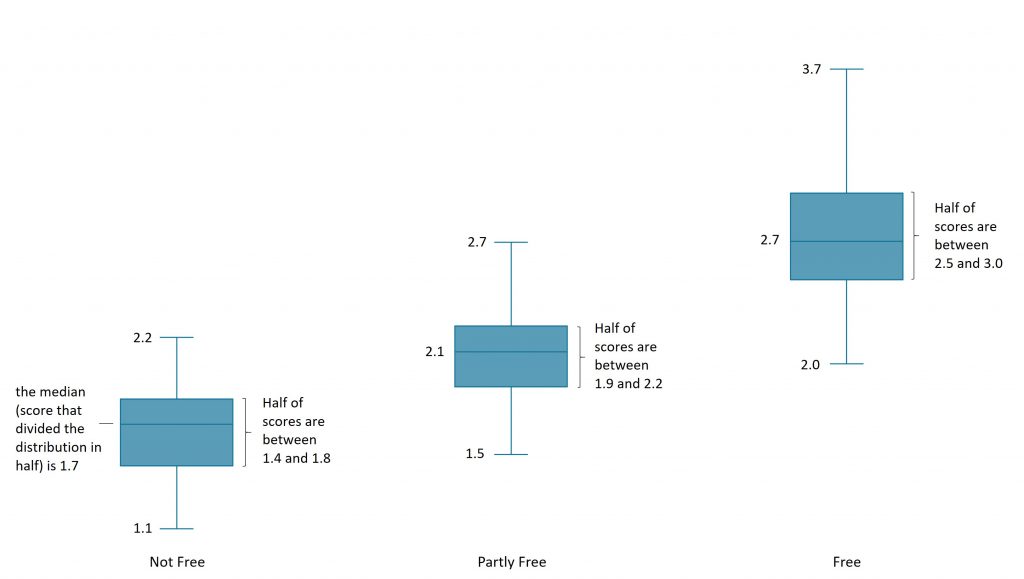

Similarly, countries categorized as “free” by Freedom House also score considerably better in the Governance pillar of the ESG Country Rating than countries categorized as “not free” or “partly free” (Figure 2). The Freedom House Index is not part of the assessment of the Governance Pillar; thus, these results are not distorted due to double counting.

Figure 2: Governance Scores of Countries Classified by Freedom House as “Not Free,” “Partly Free,” and “Free”

Source: Freedom House, ISS ESG 2022; score on a scale of 1.0 (worst grade) – 4.0 (best grade)

Minimizing geopolitical risks thus involves incorporating factors such as democracy, the rule of law, and government accountability, as well as human rights, discrimination, military expenditures, and evaluation of conflict involvement — all of which can be assessed using the ISS ESG Country Rating. Including such factors may have tempered some investor losses in Russia, and at the same time made for more ESG-oriented global portfolios.

Additionally, significantly limited or violated civil rights may well be interpreted as red flags by investors and corporations. Investors and businesses may choose to respond by introducing even higher due diligence standards to ensure the well-being of employees and local stakeholders. Conducting a thorough country-risk analysis that looks at democratic principles and the safeguarding of human rights, including protections against discrimination, can support investors and businesses in identifying problematic countries of operation. The ISS ESG Country Rating is available as a resource in conducting such analyses.

Explore ISS ESG solutions mentioned in this report:

- Access to global data on country-level ESG performance is a key element both in the management of fixed income portfolios and in understanding risks for equity investors with exposure to emerging markets. Extend your ESG intelligence using the ISS ESG Country Rating and ISS ESG Country Controversy Assessments.

By: Donald F. Grunewald, Director of Litigation Analysis, ISS SCAS