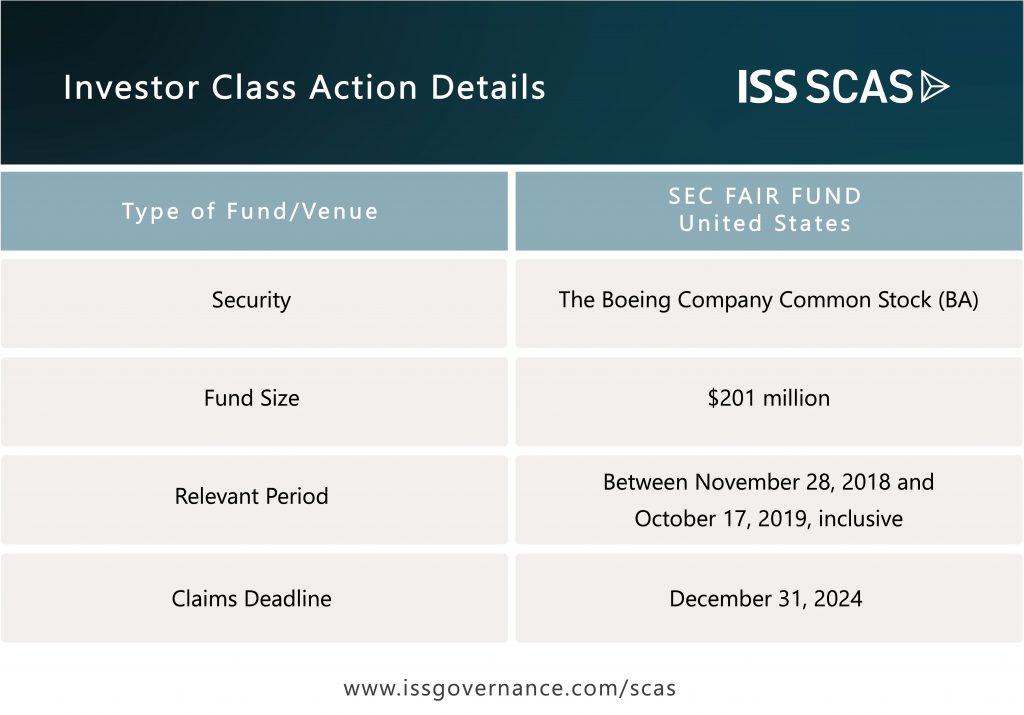

The SEC has created a $201 million Fair Fund (the “Fund”) for purchasers of The Boeing Company (“Boeing” or the “Company”) common stock during the period between November 28, 2018, and October 17, 2019, inclusive (the “Relevant Period”). Boeing paid $200 million, and its former CEO (together with Boeing the “Respondents”) paid $1 million to create the Fund, resolving cease-and-desist proceedings (the “Proceedings”)[1] against the Respondents by the SEC. The current deadline for investors to file a claim is December 31, 2024 (which was extended from an earlier deadline). Investors should assess whether they may have valid claims from the Fund, and if so, should expeditiously file their claims to best ensure recovery.

The Proceedings revolved around Boeing’s new line of aircraft, the 737 MAX. Two of these planes notoriously crashed—Lion Air flight 610 on October 29, 2018, and Ethiopian Airlines flight 302 on March 10, 2019—killing all aboard each flight. Importantly, the SEC determined that Respondents made materially misleading statements to investors in Boeing’s November 27, 2018, press release about the Lion Air crash and in public statements in April 2019 following the Ethiopian Airlines crash and ordered the cumulative payment of $201 million as a penalty.

The crashes also spawned multiple shareholder lawsuits, including a putative securities fraud class action in the U.S. District Court for the Northern District of Illinois (the “Securities Case”),[2] and a shareholder derivative case in Delaware Chancery Court (the “Derivative Case”), which settled in 2022 for $237.5 million in cash payment and corporate governance reforms, ranking it one of the ten largest such settlements ever.[3] Furthermore, the U.S. Department of Justice fined Boeing the massive sum of $2.5 billion related to 737 MAX safety issues.

The underlying alleged facts of the 737 MAX 8 situation, are out set out in great depth in the Securities Case, although the Proceedings provides detailed facts as found by the SEC. Both are informed by discovery of numerous internal documents from Boeing, although documentary evidence in the Securities Case is heavily redacted to the public.

As alleged by plaintiffs in the Securities Case, Boeing—concerned about losing market share to Airbus SE (“Airbus”)—decided to rush to market the 737 MAX, its updated version of the workhorse 737, putting pressure on employees to cut corners and ignore safety warnings. The plaintiffs alleged that instead of making structural changes to the aircraft, a new software system called MCAS, that could take control of the plane and push its nose down if it sensed that the plane was stalling, was added to compensate for the MAX 737’s larger but more fuel-efficient engines, which risked causing the plane to pitch up and stall. Boeing is alleged to have opted against making structural changes to avoid significantly increasing the time to certify the aircraft and requiring former 737 pilots to undertake costly simulator training, a major selling point for Boeing. Crucially, the plaintiffs alleged that the MCAS system malfunctioned and erroneously determined stalls in both crashes, pushing both Lion Air flight 610 and Ethiopian Airlines flight 302 into involuntary steep dives that the pilots were unable to disengage from.

The gravamen of the allegations in the Securities Case is that Boeing falsely represented to investors that the 737 MAX was safe in the wake of the crashes when the truth was in fact the exact opposite, because admitting the truth would result in additional pilot training and updates to the MCAS system and thereby slow down production and sale of the 737 MAX. The plaintiffs in the Securities Case claim that investors were harmed when the truth about the woeful 737 MAX safety problems was revealed over a series of disclosures across 2019 and that Boeing’s stock price declined 27% from its class period high to after the final alleged corrective disclosure. On September 30, 2024, the court in the Securities Case allowed the plaintiffs to proceed on a number of alleged false statements but not others. The case had already been in discovery previously, and with the decision on the latest complaint, discovery has resumed. It is likely that a settlement will be forthcoming for shareholders in this case, but it is unclear whether years more of protracted litigation will first ensue or not.

Boeing’s share price closed below $140 in November 2024, while it had closed as high as $440 days before the Ethiopian Airlines crash.

The SEC Proceedings thus are about similar alleged conduct by the Respondents regarding the safety issues regarding the 737 MAX. As noted, the SEC determined that Respondents’ statements on November 27, 2018, and in April 2019 were false and misleading and therefore constituted violations of Sections 17(a)(2) and 17(a)(3) of the Securities Act of 1933.[4] The SEC also cites documents, without redaction, that it claims support its factual determinations. For example, the SEC states that Boeing’s internal Safety Review Board had concluded that the unintended activation of the MCAS was an “airplane safety issue” that required remediation and had communicated this to Boeing’s senior management on or about November 15, 2018. Moreover, the SEC stated that on November 21st 2018, Boeing’s communications team suggested removing any discussion of the planned MCAS software redesign from the draft press release. The SEC noted that the final press release did not mention that Boeing had identified an ongoing safety issue or was planning to redesign the MCAS software. Significantly, this was more than three months before the Ethiopian Airlines crash. Claims for the Fund must, if sent by mail, be posted by, and if sent electronically, be received by December 31, 2024. Please be aware that the documentation required by the SEC in Fair Fund claims is more significant than is required in the claims process for private securities class action settlements, such as requiring proof of trade confirmations. Thus, the process can be quite onerous for institutions that do not commonly file such claims, as some of these documents may be difficult to source. So, be sure to allow enough time to properly file all claims in advance of the deadline.

[1] In the Matter of The Boeing Company, No. 3-21140, and In the Matter of Dennis A. Muilenberg, No. 3-21141.

[2] In re The Boeing Company Aircraft Securities Litigation, No. 1:19-c-v02394 (N.D. Ill.). See id., at ECF No. 278 for the most recent filed complaint, which asserts a class period of, November 7, 2018, to December 16, 2019, inclusive, that is slightly longer than the Relevant Period. Another putative securities class action is pending against the Company involving alleged continued safety issues at Boeing, exemplified by a January 2024 incident where a door blew off a plane in flight, but this is not as closely related to the Proceedings.

[3] In re The Boeing Company Derivative Litigation, No. 2019-0907-MTZ (Del. Ch.). The allegations in Derivative Case are that Boeing’s board of directors and officers breached their fiduciary duties by failing to monitor the safety of Boeing’s aircraft despite numerous red flags about safety issues. The cash in the settlement here, less attorneys’ fees and expenses, was paid directly to the Company; shareholders are not entitled to recoveries in derivative actions.

[4] Although notably, the Securities Case asserts claims under the Securities Exchange Act of 1934.

“No portion of this insight constitutes legal advice, and no attorney-client relationship is intended or is established.”

By: Donald F. Grunewald, Director of Litigation Analysis, ISS SCAS