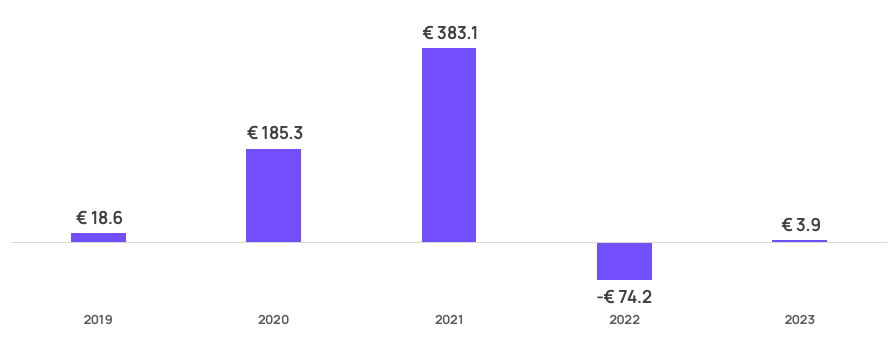

Over the past five years European-domiciled equity funds have been on quite the roller coaster ride—a ride that most recently climaxed between 2020-2022 as investor euphoria during the pandemic led to a spike in positive investment flows during 2020 and 2021. This euphoria would soon turn to a hangover as interest rates began to bite into household budgets and equity markets experienced a revaluation, with many of the pandemic’s darling stocks seeing a significant price decrease. 2022 ultimately saw an exodus from equity funds and a restrained appetite for equity funds throughout 2023.

On the surface then, the past two years do not appear to have been a fertile period in which to grow one’s equity fund business. Taking this picture at face value, however, equates to judging an iceberg based only on the visible tip. And it is fair to say that the tip of the European-domiciled equity fund iceberg is hiding much of the equity story. When diving into the equity story, one trend comes into full view: European investors and fund selectors are increasingly investing abroad in search of equity returns and are leaving their home bias at home.

Note on the methodology: In the following article, a domestic equity fund refers to a fund that is marketed in and predominately invests in securities listed in the same country. For example, in reference to the UK, domestic equity funds are referring to funds deploying a UK equity investment strategy and that have been identified as being sold primarily to UK investors.

Figure 1: Going for a ride with equity fund flows

Net flows of European-domiciled equity funds (in billions)

Source: ISS MI

Far from home

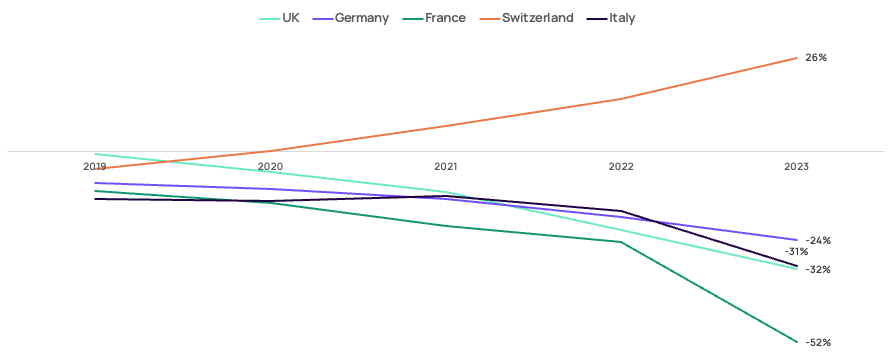

While total equity fund flows hit high notes in 2020 and 2021, this was not the case for domestic equity funds in four of five of Europe’s largest investment fund domiciles. The UK, Germany and France all experienced net outflows from domestic equity funds during 2020 and 2021, and recorded five-year cumulative net outflows of between 24% and 52% of 2018’s year-end assets under management (AUM). Italy, meanwhile, saw domestic equity fund net flows fall flat over the 2020 to 2021 period, followed by a significant uptick in net outflows of domestic equity funds beginning again in 2023. In fact, the only major market acting as a counterpoint to the argument that European investors are losing their home bias is Switzerland, where domestic equity funds continued to attract investor attention pre- and post-pandemic.

Figure 2: European fund investors fly their home coop

Cumulative net flows of domestic equity funds as a percentage of 2018 AUM (in billions)

Source: ISS MI

For those wondering how much of this activity could be related to investment performance, it is worth noting that the five-year asset-weighted cumulative total returns for the funds covered in each market ranged from 27% to 56%. French-focused funds, which saw the highest relative net outflows, returned 41% over the period, which was by no means the lowest performing of the markets—that dubious honor goes to the UK. Meanwhile, Swiss-focused funds, which saw positive net inflows throughout the examined period, produced a local currency return of 45%. No direct relationship was therefore seen between domestic equity performance and domestic equity net flows at a high level.

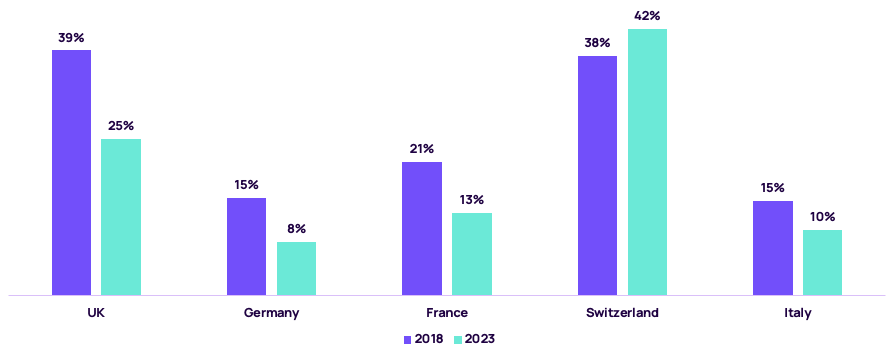

With money flowing out of domestic equity funds, such funds now account for a much smaller share of the equity fund markets in all the examined countries with the exception of Switzerland. And the below figures ignore—and therefore underplay the decline in home bias—the fact that many European investors will be accessing foreign equity markets through cross-border funds domiciled in Ireland and Luxembourg.

Domestic equity funds across the five markets now account for between 8% and 42% of equity fund assets in each country. Of the five markets, the UK has seen the largest decline, but has also had the most to lose since 2018, having had the largest share of equity funds assets in domestic equity coming into 2019. Although outflows remain high in the UK, it is worth noting that ISS MI’s dataset, which contains detailed investment fund distribution data, showed that the three UK equity IA sectors (all companies, small companies, equity income) accounted for around 20% of the new money going into equity funds in the UK’s financial advisor channel. The floor may therefore be coming into view in terms of how low UK equity funds will fall in terms of their equity share in a portfolio, at least in the retail business.

Figure 3: The incredibly shrinking home bias

Domestic equity fund AUM as a percentage of total equity fund AUM in a given market

Source: ISS MI. Only cross-border funds primarily sold into a single market are included.

Pan European funds faring no better

Expanding our analysis to look at European equity funds, excluding European country-specific equity funds, it is apparent that the above shift is also a broader European story. European equity fund net flows have remained largely flat or negative across the five major markets examined as well as Ireland and Luxembourg over the past five years. While there was a brief reprieve in net flows during the boom year of 2021 for broad European equity funds, this uptick failed to cover the losses experienced in 2020. 2022 and 2023’s outflows from domestic and European funds are therefore best viewed in the broader context—one where home bias in Europe has become increasingly passé.

Figure 4: European funds failed to capture investors’ imaginations

Cumulative net flows of European equity funds as a percentage of 2018 AUM (in billions)

Source: ISS MI

Once the equity taps turn on again and the money starts flowing back in, one should not assume that European equity funds—whether country or broadly focused—will regain their footing. The shift seen amongst equity funds may not be tactical but strategic. It should be considered that European investors’ approach to equity selection is no longer centred on their home soil. It is domestic equity funds that may now need to justify their position in a global portfolio as opposed to global funds having to justify their value over domestic funds. If this is the case, then a turnaround in the relative performance of European equity may not reverse fortunes. There is, however, much opportunity to be found within investors’ equity allocations, but for that, one must take a global perspective.

Go global, young asset manager

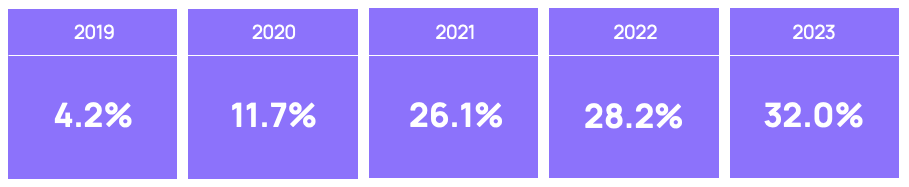

In contrast to the above story, equity funds domiciled in the five regions examined (as well as Ireland and Luxembourg) and with a geographic target outside Europe have continued to attract net inflows, even in the past two years. Net inflows as a percentage of 2018’s year-end AUM totaled 32.0% as of the end of 2023, with about 6% of that net inflow total in 2022 and 2023.

Figure 5: Non-European foreign equity funds weather the storms of 2023

Cumulative net flows of non-European foreign equity funds as a percentage of 2018 AUM (in billions)

Source: ISS MI

While net inflows into non-European foreign equity have not reached anywhere close to their pandemic levels in the past two years, there continued to be ample opportunity here to win assets. And unsurprisingly, fund launch activity—a gauge of how optimistic fund managers are about the future marketability of an investment strategy—has also increasingly been concentrated toward these funds.

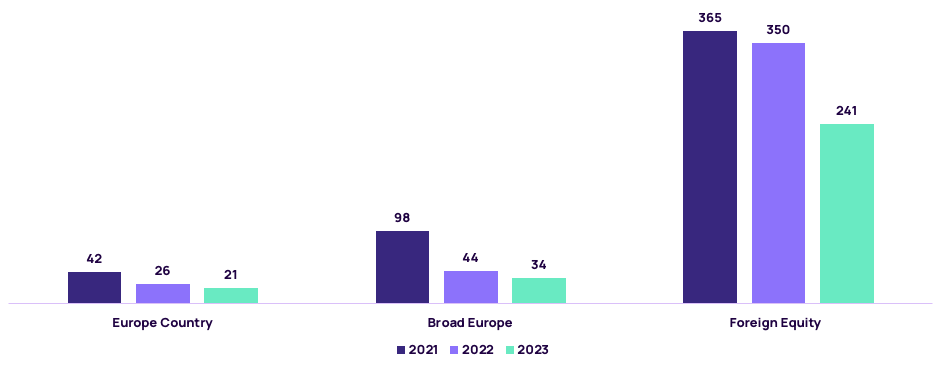

Figure 6: Fund managers see room for one more—A foreign equity fund, That is…

Number of funds launched by geographic focus

Source: ISS MI

Fund launch activity fell significantly in 2023[1] , Most heavily impacted were European country-specific and broad European strategies. Foreign equity funds were launched at an over 10:1 and 7:1 ratio compared to country-specific and European strategies—a notable increase from the 8:1 and 7:2 ratios witnessed in 2022.

Appealing to the globally minded asset allocator

The above data tells us a story—a story that seems to be a hint that in aggregate, today’s European investor is increasingly globally minded when it comes to portfolio construction. Of course, with any generalization, there is always an exception, and Switzerland appears to be that exception. That country may therefore represent a useful case study for domestically focused equity managers, who are curious as to what factors and conditions, economic, distribution and investor-behaviour related, may lead to a turnaround in their fortunes. For the rest of equity managers, the pre-eminent equity question will be, what are investors and fund selectors looking for in a foreign equity fund? A story for another time.

[1] For additional perspective, please read: https://insights.issgovernance.com/posts/the-place-to-be-identifying-your-land-of-opportunity/

Commentary by ISS Market Intelligence

By: Benjamin Reed-Hurwitz, Associate Director, EMEA Research Leader ISS Market Intelligence