Equity Assets Close Lower in a Quarter Defined by Volatility

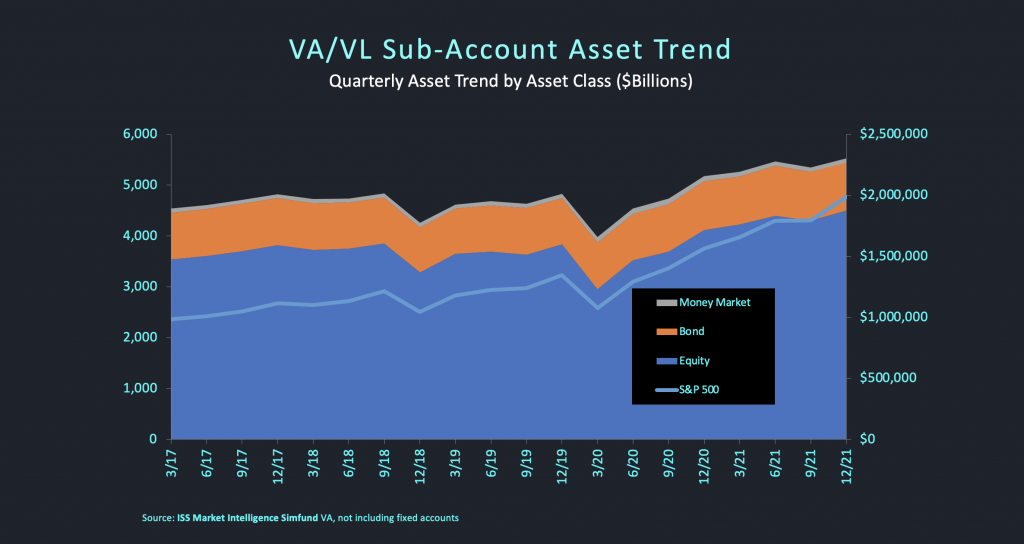

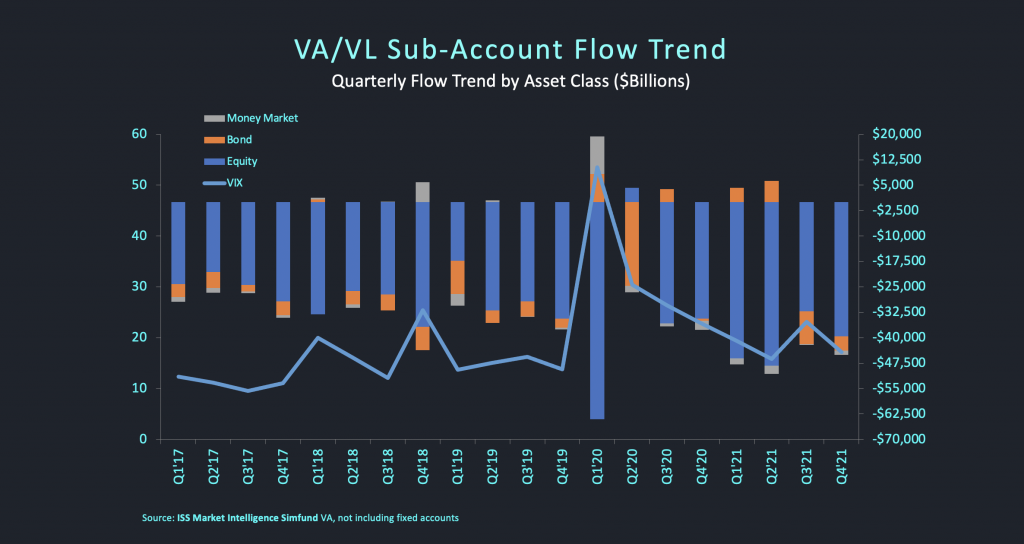

Variable account assets closed 1Q’22 at $2.13 trillion, falling 7.3% compared to 4Q’21. Equity assets shed $165 billion through February before recovering slightly in March to end the quarter down 7.8%. Similarly, after falling into correction territory, a rally to end March helped the S&P 500 to close the quarter down 4.95%. COVID related concerns have dominated market headlines but inflation, rising interest rates, and the war in Ukraine now all share that spotlight. Equity outflows decreased by 30% compared to the fourth quarter, closing the 1Q’22 with $30.2 billion in net outflows.

With higher interest rates negatively affecting returns, Bond assets were down 6.5% compared to the fourth quarter. Outflows in Bond categories increased by 29%, with $6.6 billion in net outflows. Money market assets, however, increased by 11.4%. Money Market flows also turned positive during the first quarter, closing with $3.8 billion in net new flows, a $5 billion upswing from the fourth quarter.

Volatility reached a one-year high during March before falling over 40%, as markets rebounded. The VIX ended the quarter at 20.56, a nearly 20% increase compared to the fourth quarter. With persistent volatility, insurers can look to the recent past when funds with built-in volatility controls and optional guarantees with VIX-based pricing were common. The industry-wide focus on developing less capital-intensive products should also help insulate the effects of current market volatility.

In 1Q’22, there were seven new VA fund registrations. Nationwide accounted for four of those new funds, all sub-advised by J.P. Morgan, that were added to a private-label, fee-based contract for J.P. Morgan Securities. Principal registered their first defined outcome fund that will provide returns based on the S&P 500 Price Return Index and buffer 10% of index losses during a twelve-month period. This fund will be the first “buffer fund” available as an investment option on a guaranteed lifetime withdrawal benefit.

In 1Q’22, there were fifteen new contract registrations. Eight of these contracts were RILAs, including contracts from Brighthouse that feature an integrated GLWB in both B-share and fee-based contract designs. Insurers capitalized on rising interest rates during the quarter and increased the income and growth guarantees, as well as the corresponding fees, on optional lifetime income guarantees. The reinsurance market is still highly active and presents opportunities for insurers to free up capital and to grow new businesses.

The full report is available to AnnuityInsight.com subscribers for access to a free trial please click here. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Jeff Hutton, Associate Vice President, ISS Market Intelligence AnnuityInsight.com