Flows Stay Positive in Q2 Even as Economic Clouds Grow Darker

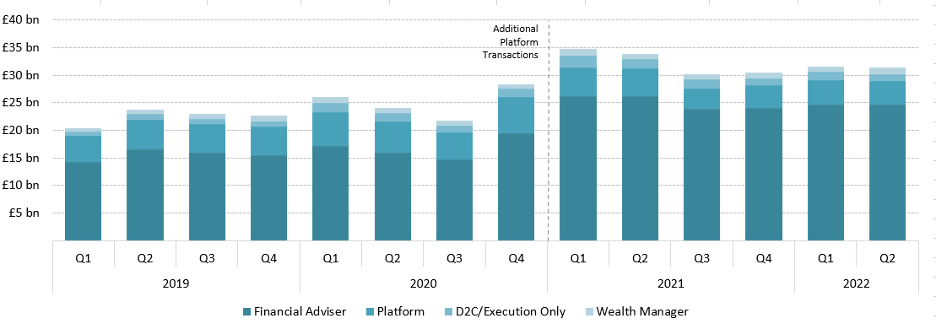

Against a backdrop of negative economic news and uneven financial markets, net flows, at £1.8bn, remained in the black in Q2. Although this represents a 48% decline compared to the Q2 average over the past three years, this result should be seen in a positive light. Turbulent economic periods can often lead to fear and/or decision-making paralysis in investors. Q2 results speak to the ability of advisors to keep clients invested even as many markets experienced price declines in Q1 and Q2. Financial Clarity data for the second quarter indicates that inflows were £31.4bn compared to £29.6bn in outflows.

*In Financial Clarity’s M07 2021 release, we improved the platform channel intermediary level fund flow data for 2021H1. This change means that platform inflows from 2021 onwards are expected to be higher.

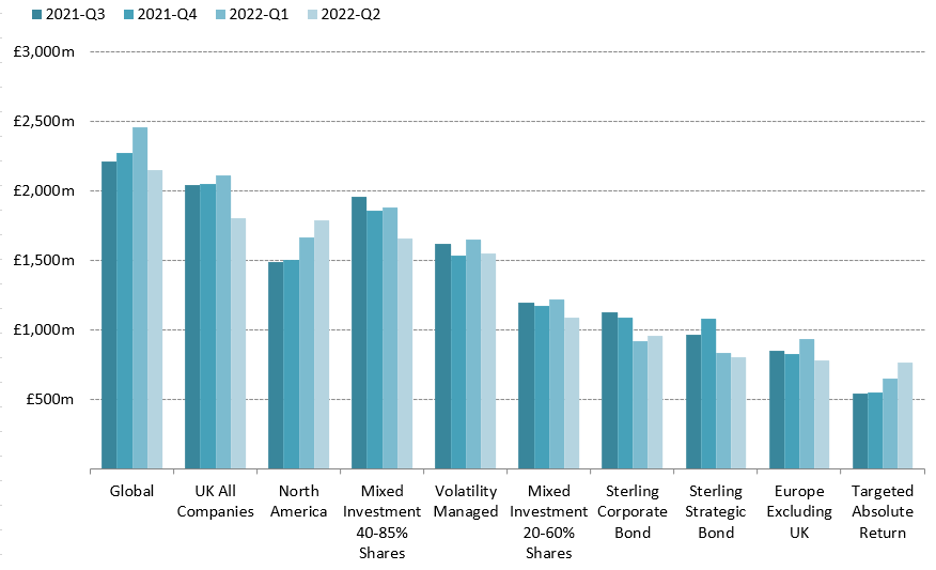

Investors Continue to Focus on Diversification

Diversification, by geography, asset class and investment style, once again was top of mind for investors in Q2. This diversification desire among investors is best highlighted by the fact that of the ten largest IA sectors for Financial Adviser platform sales, only two sectors – Sterling Corporate Bond and Target Absolute Return – saw increased inflows and net flows in the second quarter.

* IA sectors ranking in terms of gross sales excluding IA Unclassified sector.

** Sectors’ flows are dynamic, and funds that change IA sector carry their historical transactions from the previous sector to the current one. This means sector’s historical total may differ from previous reports, especially sectors with low number of funds.

Within the broader Equity sector, income funds recorded an uplift in sales and net flows, with the Global Equity Income sector posting a 32% increase in sales and a near tripling of net flows. UK Equity Income funds also benefitted to a lesser extent with net flows turning positive. This shift towards Equity Income funds likely represents a more defensive equity posturing among investment decision makers, a hypothesis further supported by a general decline in inflows and net flows for funds targeting smaller companies, technology companies, and emerging markets. A shift in investor sentiment towards value, quality and income and away from growth was to be expected, as growth companies have recently seen their values deflate as central banks raise rates and project a more hawkish tone.

Movements within investors’ fixed income allocations towards government bonds only adds to the picture of a more defensively minded investment decision maker. Q2 saw inflows for both UK Gilts and USD Government Bond sectors increase over 25%. Results for Corporate, Global and Emerging Market fixed income sectors meanwhile were mixed.

From a net flows perspective, the Mixed Investment 40-85% Shares and Volatility Managed sectors moved to the top, notching £381m and £370m respectively. As discussed in our recent article “The Floor is Lava”, mixed assets are likely to remain in favour among clients while economic uncertainty reigns. During these periods investors often put more weight on diversification and opt for broad-based stay the course solutions. The Target Absolute Return sector also appears to be benefitting from such investor sentiments, as these funds aim to deliver returns regardless of market environment. The fact that equity and fixed income sectors are being challenged by rising rates and a recessionary environment only adds to the appeal of funds offering a return in any weather conditions. Long-term flows into funds in this sector, however, will be intimately tied to whether the funds can deliver on their fund objectives.

Outside of the traditional investment sectors, there was also a noticeable increase in activity in sectors offering return diversification. After previously recording strong Q1 results, Infrastructure and Commodities & Natural Resources sectors continued the trend in Q2, posting strong inflows and flows in the quarter. The Infrastructure sector was in fact the third highest sector when ranked by net flows. It should be noted, however, that general demand for exposure to real assets was not necessarily higher, as Direct Property funds, a sector traditionally turned to for return diversification, has seen a notable sales decline. Direct Property fund sales appear to be stuck in suspended animation as investors wait for the FCA to finalise any new rules regarding notice periods for property funds.

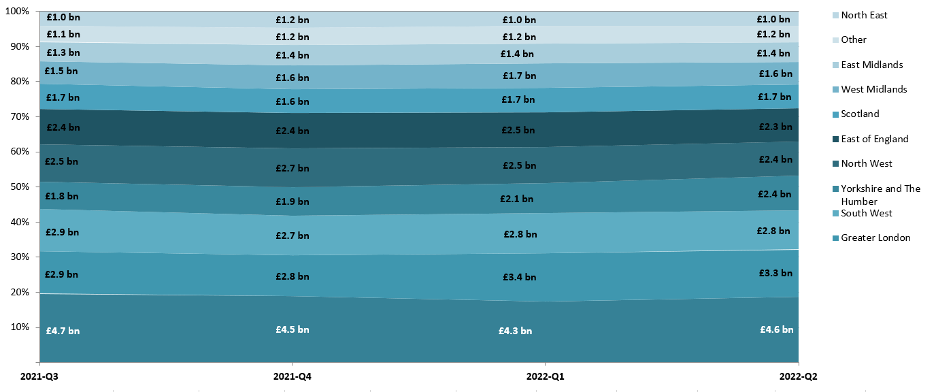

The South East Retains the Crown

The South East region, by far the largest region when measured by inflows, took the crown as the region with the largest absolute increase in quarter-over-quarter inflows. Q2 inflows increased by £388m to £4.6bn. The only other region to record significant growth in inflows was the Yorkshire and The Humber region. Inflows for that region rose to £2.4bn, moving it up to fourth in the regional inflow rankings. The rise in inflows, however, was more than offset by an increase in outflows, leading to an overall decline in net flows for the region. With inflows largely flat to declining for most regions in Q2, net flows for all but the South East and West Midlands fell compared to Q1.

By: Benjamin Reed-Hurwitz, Vice President, EMEA Research Leader, ISS Market Intelligence