This week, FC Market Insights investigated the latest trends for one of FC’s newest fund sectors, IA Infrastructure:

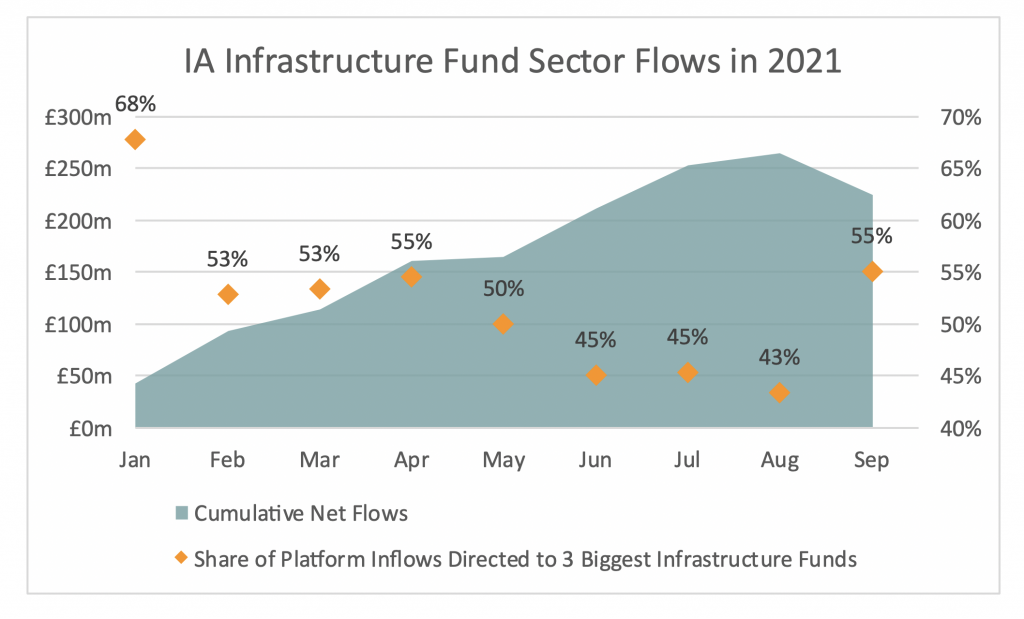

Inflation became a major concern for investors across the globe this year, and many looked to protect their investments from this risk. Securities in the infrastructure sector are often seen as a hedge against inflation as they tend to produce income streams that track inflation. Infrastructure stocks are also regarded as ‘cyclical’, that’s to say that their performance is strongly correlated with that of the broader economy. The rationale is that if the economy is doing well, more money will be directed to new infrastructure projects and to improving transportation systems. Last year infrastructure funds performed poorly compared to the rest of the market, but there’s reason to be optimistic about the sector moving forward. Since the start of 2021, investors moved over £225m into funds in the IA Infrastructure sector, which as of September, hold over £136bn in AUM. Interestingly, the concentration of platform inflows within the sector has decreased since the start of the year. 58% of sector inflows via platforms in the first quarter of the year were directed to the 3 biggest funds. This figure dropped to 49% in Q3, albeit that in September inflows to the biggest three funds jumped to 55%.

Funds within the infrastructure sector tend to be highly exposed to stocks listed in the United States. Many of these will benefit from the $1.1tn infrastructure bill that President Biden signed into law earlier this month. It will be interesting to see how the performance of infrastructure funds is affected by this bill, and how this in turn affects the appeal of infrastructure funds among UK investors. IA Infrastructure is one of the 6 new IA sectors included in the Financial Clarity release for 2021Q3. The 5 other IA sectors are as follows: Commodities & Natural Resources, Financials & Financial Innovation, Healthcare, India/Indian Subcontinent, and Latin America. FC Subscribers can now dig deep into the transaction and AUM data for these 6 sectors which have a combined AUM of £342bn.

For More Information Contact: ISS MI Financial Clarity at sales@financial-clarity.com

By ISS MI Financial Clarity Team