This week FC Market Insights looked at how the pandemic affected inflows to healthcare and biotech funds over the course of the last year.

If there is one major bright spot from 2020, it would surely be the incredible feat achieved by the world’s scientists to produce several highly-effective vaccines against Covid-19 in under a year. BioNTech SE, the German biotechnology company that partnered with Pfizer to create the world’s first Covid-19 vaccine, and Moderna, the Boston-based biotech/pharmaceutical company that discovered the third vaccine to be approved in the UK, have seen their stock prices increase enormously over the course of 2020. More broadly, the story of how healthcare stocks, and by extension healthcare funds, performed over the last year is one worth revisiting.

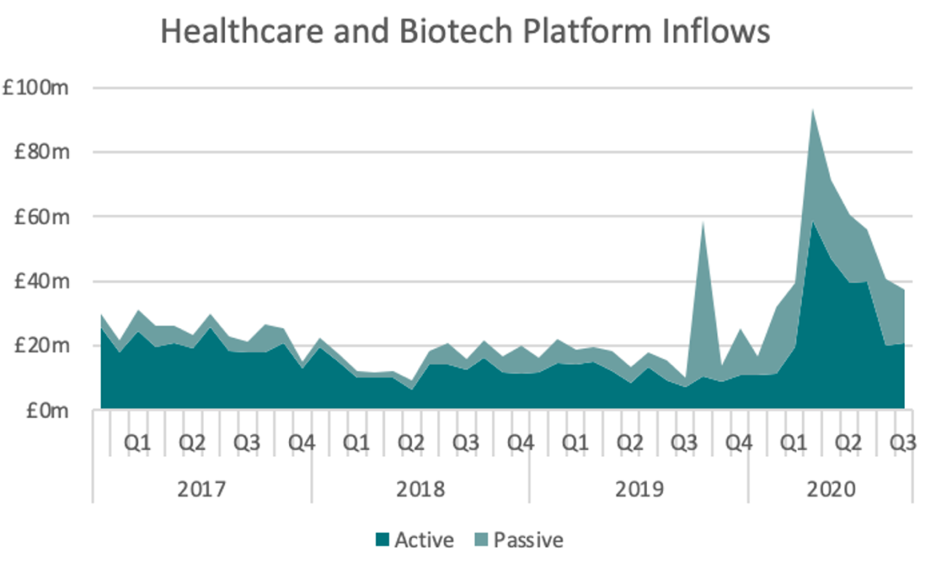

During the market sell-off in March, the S&P 500 healthcare sector outperformed the rest of the market and outpaced the market in the subsequent month’s recovery. Many investors felt that for health and biotech companies, the coronavirus offered a great opportunity for growth. British savers invested over £430bn into funds that focused on health, healthcare, and biotechnology through platforms between February and September in 2020 (see graph for definition). To put this figure in perspective, the average annual inflows to this sector between 2017 and 2019 was under £250m. Passive funds, in particular, saw a significant increase in inflows in 2020. Whereas the annual platform inflows to passive funds within the biotech/health sector from 2017 to 2019 averaged at £73m, inflows in the first 3 quarters of 2020 grew to £180m.

Though March and April proved to be good months for the healthcare sector, overall Q2 and Q3 proved to be difficult months for many health stocks compared to the rest of the market. As Covid-19 patients were prioritised, hospitals across the globe delayed elective surgical procedures and cancelled millions of medical appointments. This inevitably brought down revenues for many companies within the healthcare industry. Another significant factor is that the healthcare sector is very politically sensitive. Because most assets held in health and biotech funds are listed in the U.S., the American healthcare legislative landscape plays a big role in the performance of the sector. As election polls started to indicate potential big wins for Democrats, many investors thought that there was an increased likeliness of government price control on pharmaceutical products along with comprehensive healthcare reform. The uncertainty surrounding the election and its legislative outcomes caused some healthcare stocks to fall. The final election results meant that the risks of big overhauls to the healthcare system subsided and as a result, many health stocks bounced back.

Looking back over the year, there should be a lot of optimism surrounding the pharmaceutical and healthcare industry. The vaccines developed by scientists and researchers around the world are going to hopefully take us out of this pandemic this year. It will be interesting to see how much this optimism translates into an appetite among British investors for healthcare and biotech funds in 2021.

For More Information Contact: ISS MI Financial Clarity at sales@financial-clarity.com

By ISS MI Financial Clarity Team