This week FCMarketInsights looked at how UK investors chose to move their holdings between active and passivefunds throughout 2019 and 2020:

The share of platform inflows directed towards passive funds has been steadily increasing for several years. In 2019, inflows to passive funds accounted for 18.0% of all platform inflows and last year this figure increased to 19.2%, but this doesn’t tell us the full story. If we look at net flows throughout 2019, we find that actively managed funds drew in £330m in aggregate flows whereas passive funds brought in £6.7bn over the same period. Passive funds are seeing a consistent influx of new money, whereas actively managed funds saw negative monthly net flows for half of 2019.

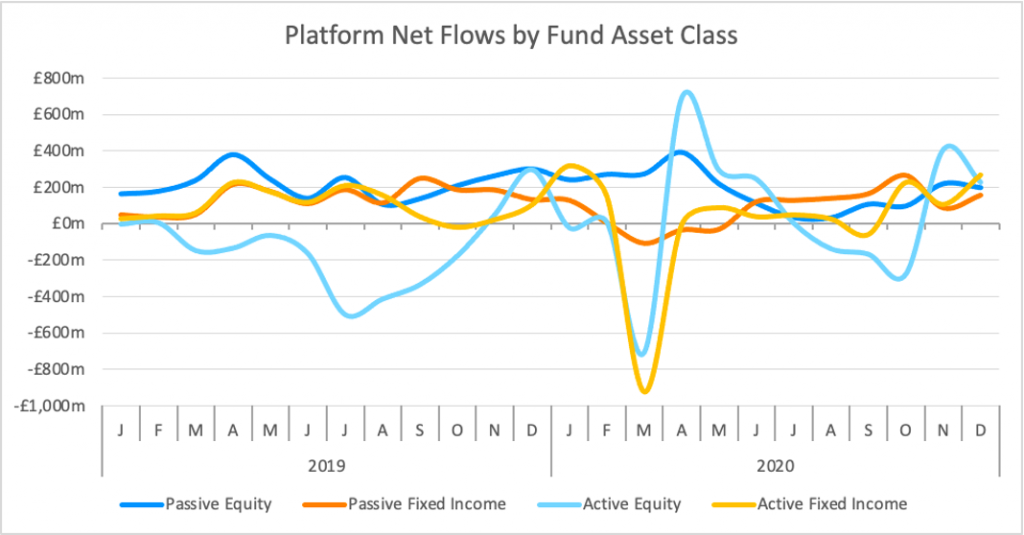

By grouping fund sectors together into asset classes, we see that there is more to these trends. Though active bond funds brought in £1.15bn in net flows 2019, £1.59bn left actively-managed equity funds that year. Meanwhile, passive equity and fixed income funds brought in £2.58bn and £1.70bn respectively in aggregate sales throughout 2019. March’s market sell-off last year caused many investors to withdraw money to protect their savings. Negative net flows to equity and bond funds via platforms plumetted to -£1.47bn in March as investors moved their investments to money-market funds and low-risk havens. Active funds suffered the brunt of the surging outflows that month as active equity funds and fixed income funds saw aggregate net flows fall to -£709m and -£926m respectively in March. Passive funds, on the other hand, were treated differently by retail investors that month. Net flows to passive bond funds did indeed fall to negative territory (-£110m), but they stayed positive for passive equity funds (£271m) and increased slightly from February.

Asset prices started to recover in April and investors moved their holdings back into funds that would give them exposure to this upturn. Both active and passive funds saw increases in net flows in the month following the announcement of lockdown restrictions, particularly active equity funds. Aggregate flows via platforms to active equity funds increased to £690m, almost entirely offsetting the previous month’s negative net flows. This can be interpreted as an endorsement of traditional stockpickers to make the right investment decisions to maximise returns during the months following the market sell-off. Bond funds did not fare out as well. The central banks of developed economies acted quickly to minimise the economic fallout of lockdowns and began purchasing fixed income products. This pushed down yields and reduced the appeal of bond funds for many investors.

After April, net flows reverted to their pre-pandemic levels for the most part. Active equity funds saw aggregate flows fall into negative territory from August to October, though this was mostly due to mounting fears of the EU and UK not being able to reach a Brexit trade deal. IA UK All Companies and IA UK Equity Income saw net flows drop to -£314m and -£363m respectively. Net flows surged again in November in the wake of the vaccine announcements as active equity funds saw an influx of £407m that month. Looking back at 2020, we see that passive equity funds saw the highest net flows (£2.17bn), followed by passive bond funds (£1.02bn), active equity funds (£557m) and active bond funds (£266m). We will be watching closely to see if active fund managers can keep investor confidence high and follow up 2020 with a second consecutive year of positive net flows.

For More Information Contact: ISS MI Financial Clarity at sales@financial-clarity.com

By ISS MI Financial Clarity Team