Historically, asset growth has been the measure by which asset managers have judged the health of their businesses. In a fee-based business model, this line of thinking makes intuitive sense. After all, assets under management (AUM) and revenues should grow hand in hand, making asset gathering a good proxy for revenue growth.

The link between asset and revenue growth has weakened in recent years, however. Asset growth has been greatest where fees are lowest: Over the past five years, index fund market share ballooned more than 10 percentage points, moving from 36.4% of long-term assets in 2017 to 47.5% in 2022. Last year, the active/passive growth gap widened dramatically: As active mutual funds suffered record redemptions totaling $1 trillion, index funds reeled in almost $530 billion in net sales. ETFs were the prime beneficiaries, soaking up nearly 90% of all passive flows in 2022.

We anticipate index funds to gain more ground in the years ahead. ISS MI’s 2023-2027 outlook, detailed in the recently published State of the Market: Future of Retail Products report, anticipates index fund market share will cross the 50% mark in 2024 and reach 55.6% of long-term assets by 2027. The report projects 3.5% annualized asset growth for active funds over the period—about half the estimated growth rate (7.1%) for long-term assets overall. Active U.S. equity mutual funds are expected to deliver more sluggish growth, with assets climbing just 0.8% annually through 2027.

Dwindling market share is hardly good news for active managers, but the economic reality tells a more favorable story. Even controlling a minority of the assets, active managers will still generate most of the fund industry’s revenue growth over the next half decade. While no longer the industry’s growth engine, active management will still be its biggest money maker.

Losing on volume, gaining on price

Like any business, asset managers prefer faster growth over slower growth. However, revenues depend on both sales volume and price. Higher priced, slower growing market segments might be more lucrative than lower priced, faster growing ones.

While active managers have lost ground on volume, they have made it up on price. Relative to passives, active funds generate more fee revenues per dollar of AUM than they did in the early 2010s. The average dollar invested in active funds generated 3.4 times as much management fee revenue than passive funds in 2012, rising to 4.5 times revenue in 2021. Active assets have become relatively more valuable because index fund fees have fallen faster; the weighted average index fund management fee is down a more than a third since 2012, versus a 10% decline for active fund fees.

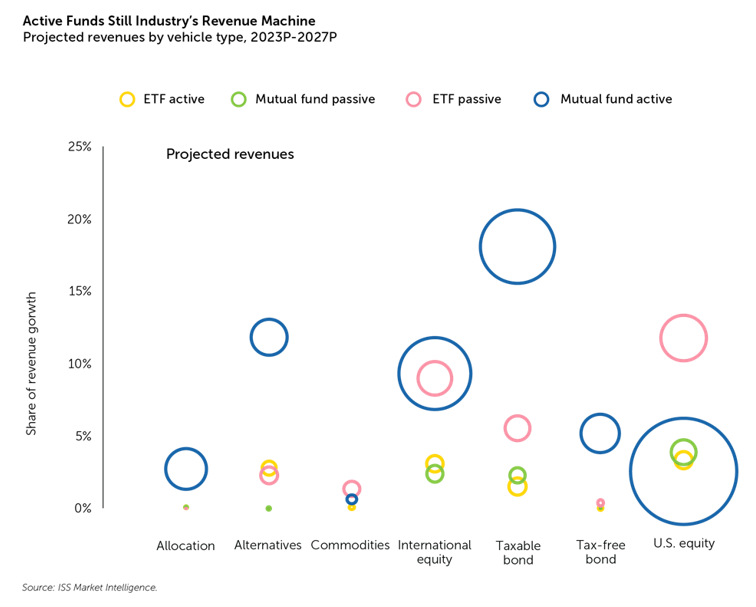

This dynamic explains why active managers’ financial fortunes are likely to be better than asset growth alone would predict. Multiplying our forecasted AUM with current average weighted expense ratios across asset classes gives us an estimate of where revenues will flow over the next five years. The results are necessarily imprecise—we do not know how much fees will change over the period—but they anticipate active mutual funds producing nearly 80% of the revenues through 2027 despite finishing the period with 42% market share.

The chart below shows the vehicle delivering an undersized share of overall AUM growth (19%) but an oversized share of revenue growth (50%). (Each circle represents the estimated total revenues in dollar terms for each group. The larger the dot, the greater the revenues. The further away the dot is from the horizontal axis, the higher the expected AUM growth rate.) Active ETFs will contribute modestly to the revenue pool over the next five years, while generating more than 10% of the revenue growth.

Clearly, active mutual funds will remain the industry’s clear revenue-generating powerhouses, if not necessarily its revenue growth engines, across asset classes over the next half decade. Not surprisingly, the taxable bond group scores well on both fronts; favorable demographics will drive market share growth, and because many large bond categories are less vulnerable to competition from passives, active managers will reap the benefits.

Perhaps less appreciated is that active international equity funds will generate about as much revenue growth as taxable bonds, even with about 30% fewer assets. In part, that is because we think they will experience weaker pressure from passives, enabling them to capture more of the active price premium. Another reason is that our forecast anticipates better returns for non-U.S. stocks.

As a niche asset class, alternatives will generate a comparatively smaller revenue pool. Most diversified asset managers should expect the alts asset class to contribute modestly to their top line. As a source of top-line growth, however, active alts promise more fertile ground. One caveat: Competition for assets could put alts pricing under pressure, but probably not enough to change asset managers’ strategic calculus. If we shrink the group’s weighted average fees by 20%, active alts’ contribution to revenue growth would fall from 15% to 12% of the total.

By contrast, active U.S. equity mutual funds will contribute little to revenue growth (2.6% of the total), while still offering the deepest revenue pool in the business (the group will be responsible for an estimated 34% of revenues from long-term funds over the next five years). While a manager seeking new product opportunities might see this mix as barren ground, others with well-established offerings may see opportunities to consolidate their positions. Modest growth can still generate plenty of cash flow at the right scale, providing capital to fund tomorrow’s winners. Moreover, relatively slow growth is not necessarily a deterrent for smaller players. Stagnant market segments may still offer attractive niches too small to entice larger managers.

Winner-take-most versus fighting over a shrinking pie

This is not to sugarcoat active managers’ challenge. There is no getting around the fact that nearly 40% of the revenue growth generated by long-term funds will end up in passive hands over the next half decade. The lion’s share of these gains will accrue to a relatively small number of giant index fund providers, leaving a much larger number of hungry active managers to fight over the remainder of the pie. Getting a piece requires not just developing a broad set of differentiated capabilities, but also new ways to distribute them. Whether through old-fashioned mutual funds, or ETFs, or other venues, tomorrow’s successes will accrue to managers that can ply their crafts across many venues all at once.

_________________

Simfund Enterprise subscribers can access the State of the Market: Future of Retail Products on the Simfund Research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Christopher Davis, Head of U.S. Fund Research, ISS Market Intelligence