As the collective effort to tackle potential conflict of interest between minority and majority shareholders intensified, the Korean government endeavored for the first time in February 2024 to address the longstanding ‘governance’ discount associated with controlled companies. This set an anticipatory tone heading into the 2024 proxy season. With high hopes, various governance topics were eagerly brought into focus; yet, Korea continued to show meager progress, particularly in disclosure practices. Not unlike previous years, the intense concentration of meetings in the last week of March continued, while most companies persistently disclosed only the minimum information guided by a dated standard.

Key trends

While some of the major companies embarked this season on making governance improvements, concerns regarding many boards’ fundamental perspective of their fiduciary duties generally remained unaddressed. For example, many boards continued to nominate incumbent directors who have records of material governance failures, in many cases related to bribery and corruption. Perhaps the glacial pace of governance improvement coupled with the explosive growth of retail investors explains surging shareholder activism.

In early May, the Financial Supervisory Service (FSS) revealed further details of the Governance Value-Up initiative, which aims to encourage corporate issuers to address corporate governance discounts and thereby, receive a fair valuation from the market. Specifically, the FSS shared a guideline for corporate issuers to disclose detailed plans to enhance corporate value on a voluntary basis. The soft start fell short of many investors’ expectations, especially in terms of enforcement. Nevertheless, the guideline appears to establish for the first time a linkage between (weak) corporate governance and (negative) economic value in Korea.

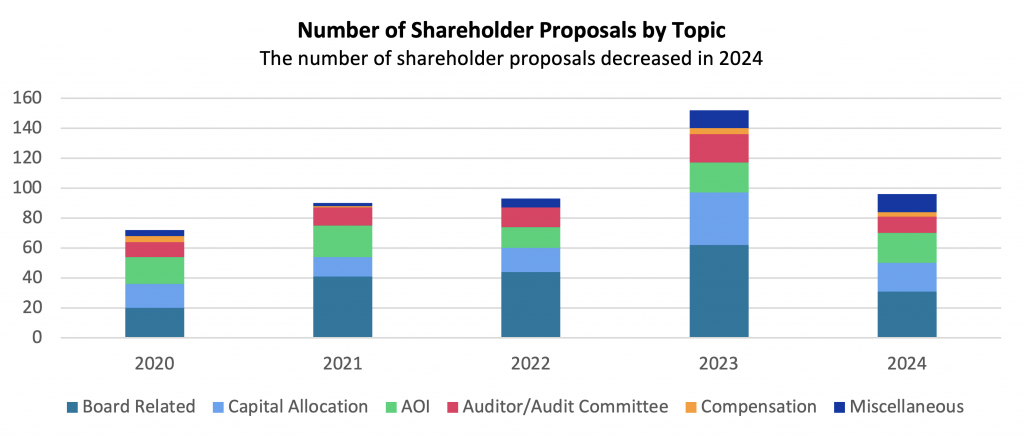

In the lead-up to the 2024 proxy season, given the abundance of news articles regarding potential activist campaigns, we had anticipated an uptick in shareholder activism. However, the number of companies that ultimately received shareholder proposals decreased by approximately 40 percent.

Source: ISS Governance Research & Voting

While minority shareholders have been more vocal and active in recent years, it seemed that both issuers and investors strived to find a middle ground through engagement efforts.

Of those that ultimately resulted in shareholder proposals this season, besides contested director elections, the debate over capital allocation continued to attract significant attention. But even on the capital allocation front, more companies had proactively announced share repurchase plans and cancellations of treasury shares throughout 2023 which impacted the numbers of shareholder proposals seen on the topic in 2024.

Gender diversity and E&S proposals in Korea

On the E&S front, there has been an increase in sustainability committees on Korean corporate boards in recent years. The number of companies establishing sustainability committees increased substantially since 2016. Currently, 14 percent of Korean companies in the ISS coverage universe have sustainability committees. Most of these committees are based on the existing governance committee with the addition of an E&S oversight function.

On the E&S shareholder proposal front, no E&S shareholder proposal was submitted this year (or looking back at previous years). This is the case for Korea and for most of the rest of the Asia ex-Japan region. This is not entirely surprising, as the main focus for the majority of shareholders is still on fundamental corporate governance issues.

In terms of board gender diversity, however, there have been visible improvements among large-size Korean companies. This is mainly driven by regulatory requirements, resulting in the number of female directors in the ISS Korea coverage universe almost tripling compared to 2021. Close to 34 percent of companies in our universe have at least one female director, which is a marked improvement compared to 8 percent in 2016. It is worth noting that smaller companies are still not legally required to have any women on their boards.

###

We empower investors and companies to build for long-term and sustainable growth by providing high-quality data, analytics, and insight.

GET STARTED WITH ISS SOLUTIONS

Email sales@iss-stoxx.com or visit issgovernance.com for more information.

This report and all of the information contained in it, including without limitation all text, data, graphs and charts, is the property of ISS STOXX and/or its licensors and is provided for informational purposes only. The information may not be modified, reverse-engineered, reproduced or disseminated, in whole or in part, without prior written permission from ISS STOXX.

The user of this report assumes all risks of any use that it may make or permit to be made of the information. While ISS STOXX exercised due care in compiling this report, ISS STOXX makes no express or implied warranties or representations with respect to the information in, or any results to be obtained by the use of, the report. ISS STOXX shall not be liable for any losses or damages arising from or in connection with the information contained herein or the use of, reliance on, or inability to use any such information.

The Information has not been submitted to, nor received approval from, the United States Securities and Exchange Commission or any other regulatory body. None of the Information constitutes an offer to sell (or a solicitation of an offer to buy), or a promotion or recommendation of, any security, financial product or other investment vehicle or any trading strategy, and ISS does not endorse, approve, or otherwise express any opinion regarding any issuer, securities, financial products or instruments or trading strategies.

© 2024 | Institutional Shareholder Services Inc. and/or its subsidiaries (“ISS STOXX”)

By: Candice Kim, Korea Research, ISS Governance