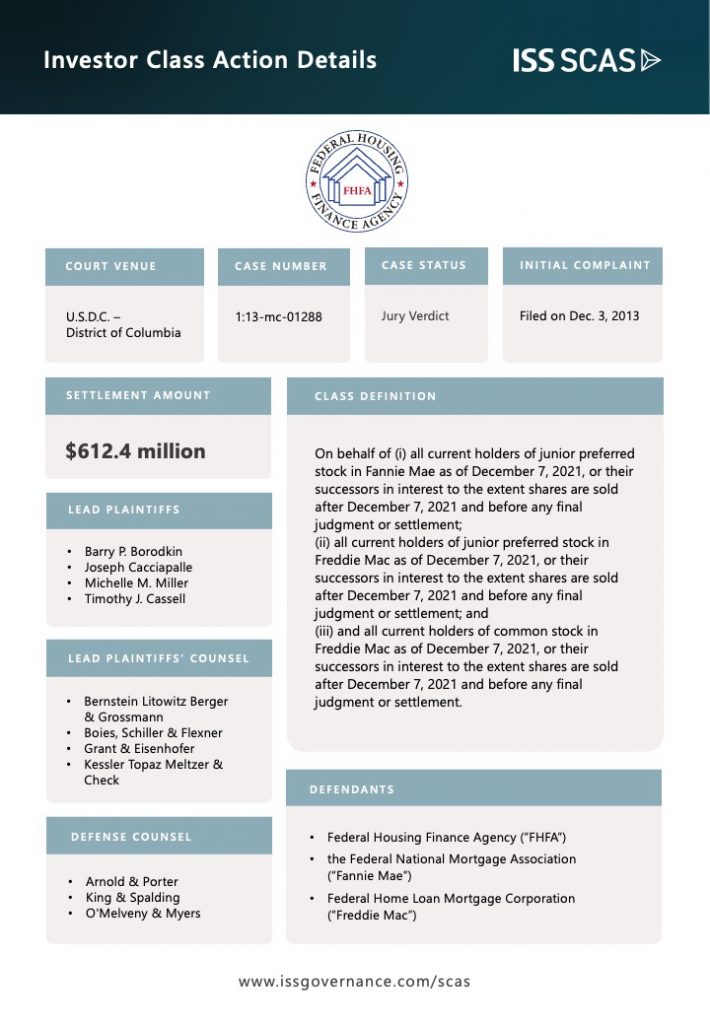

A federal jury awarded shareholders of Fannie Mae and Freddie Mac $612.4 million in a landmark jury verdict against the Federal Housing Finance Agency (FHFA) for improperly sweeping up the companies’ profits to the U.S. Treasury. In a unique class action against the federal government, the jury found unanimously that the FHFA breached the implied terms of their contracts with shareholders, causing Fannie Mae and Freddie Mac’s stock to lose significant value.

The shareholder victory resolves decade-old allegations – related to the 2008 financial crisis takeover – that the FHFA changed the terms of a stock purchase agreement to transfer the mortgage financing institutions’ profits to the U.S. Treasury. The jury determined that the FHFA acted “arbitrarily or unreasonably” in carrying out this “Net Worth Sweep” in violation of the covenant of good faith and fair dealing inherent in the companies’ stock certificates.

In September 2008, at the height of the financial crisis, the FHFA placed Fannie Mae and Freddie Mac into conservatorship, giving FHFA authority to run the companies until they were stabilized. Under the conservatorship, the Treasury bought senior preferred stock of the companies in exchange for a 10% annual dividend, as memorialized by a stock purchase agreement between the FHFA, the Treasury and each company. The Treasury ultimately invested a total of $189 billion in Fannie Mae and Freddie Mac in order to backstop the nation’s housing finance system.

Four years later, the FHFA changed the terms of the takeover agreement, allegedly sweeping Fannie Mae’s and Freddie Mac’s net profits up to the U.S. Treasury every quarter since 2012. Plaintiffs claim that the “Net Worth Sweep” – made just as the companies were returning to profitability – effectively prevented shareholders from receiving dividends or distributions of their own again. Indeed, according to shareholders, the Treasury received over $150 billion in dividends in excess of what it would have received under the original stock agreement; and the companies still remain in conservatorship – designed to be temporary – after fifteen years.

Plaintiffs specifically sought $1.6 billion in damages related to the drop in value that the stocks collectively fell on August 17, 2012 when the Net Worth Sweep was announced. Defendants countered that the decision to amend the stock purchase agreement was reasonable in light of the FHFA’s power to act in the best interest of the public and secondary mortgage market.

This case was initially tried before a jury in October 2022, but ended in a mistrial after a 4-4 “hung” jury. In a retrial, a Washington D.C. jury found in favor of shareholders and awarded them about a third of their requested damages. The jury determined Fannie Mae and Freddie Mac junior preferred shareholders should receive $299.4 million and $281.8 million, respectively. Freddie Mac common stockholders were awarded $31.2 million. It is likely that the FFHA will appeal the decision.

ISS SCAS will continue to monitor this unique, “non-traditional” class action against the government and government-sponsored entities for breach of contract, as well as pursue other non-standard recovery efforts for its clients.

Authored by:

Jarett Sena, Esq., Director of Litigation Analysis, ISS Securities Class Action Services