Ramadan Mubarak! To mark the commencement of Ramadan in 2021, ISS ESG has analyzed the performance of companies that meet our Islamic Screening criteria, with some very encouraging signals.

Ramadan is the holiest month of the calendar for Muslims, with the period being marked by fasting, prayer, celebration and acts of charity. Ramadan during the time of COVID-19 poses particular challenges, as traditional family and community gatherings are impacted by lockdowns and other health measures.

While it is probably small consolation, recent research from ISS ESG shows that Islamic investors need not worry about their returns over Ramadan, with evidence showing strong performance from a portfolio of stocks that are aligned with Islamic values, based on the ISS ESG Islamic Finance Solutions service.

With over 25 years of experience in meeting the unique responsible investing needs of the faith-based community, the ISS ESG Screening team recognizes that Muslim investors not only invest for economic gain, but also require that the issuers’ securities they buy conduct their business in a socially and environmentally responsible manner. With this in mind, ISS ESG‘s Islamic Finance screen is designed to support investors in identifying Shariah-compliant companies.

The comprehensive Islamic Finance screening package enables investors to eliminate companies that are not aligned with the requirements provided by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). This includes companies that derive revenue from haram (forbidden) sources such as alcohol, pork and riba (usury), or engage in activities that are in conflict with certain social and environmental standards.

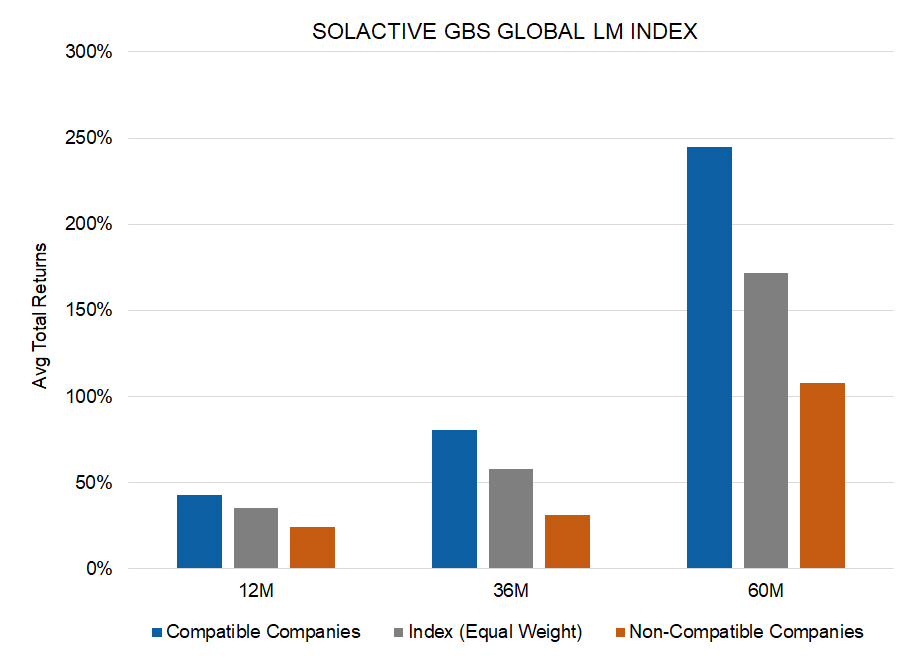

The results of an Islamic-compatible portfolio do not need to be underperformance. In Figure 1 below, the ISS EVA team maps the 12-month, 36-month, and 60-month total returns for Islamic-compatible companies, non-compatible companies, and the overall equal-weighted average for the Solactive GBS Global Index. In each time horizon, the compatible portfolio outperforms the index average (and the non-compatible firms underperform).

Figure 1

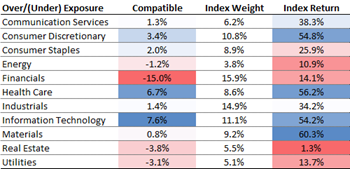

The outperformance is driven by two key factors: sector exposure and individual stock performance. In Figure 2, ISS EVA looks at the compatible portfolio’s over/(under) weight versus the index. The Information Technology (+7.6%), Health Care (+6.7%), and Consumer Discretionary (+3.4%) sectors have the highest over weights in the portfolio. The over-weighted sectors have the highest index returns (Information Technology had a 54.2% average return, Health Care had an average return of 56.2%, and Consumer Discretionary had an average return of 54.8%). Conversely, the sectors with the largest underweights tended to have the lowest returns for the index (Financials were 15% underweight and the sector only averaged a 14.1% return; Real Estate and Utilities were also under weight and had low average returns).

Figure 2

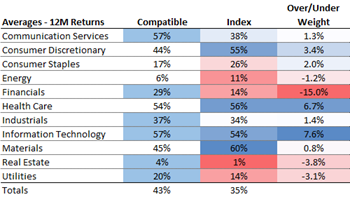

Besides limiting exposure to low-performance sectors and maximizing exposure to the high-performance sectors, the individual compatible stocks tend to have stronger performance. In Financials, the compatible names averaged a 29% return, well above the Index Financials’ average of return of 14%. Utilities in the compatible portfolio averaged 20% (vs 14% for the Index). Communication Services, which is overweight in the compatible portfolio, significantly outperformed the Index’s average (57% vs 38%). The Over/Under Weight column in Figure 3 is the same as the ‘Compatible’ column in Figure 2 above.

Figure 3

While Eid celebrations in 2021 may be tinged with a little sadness due the separation of families and restrictions on gatherings, Islamic investors may rest assured that their investment portfolios need not be underperforming the benchmark.

More information on ISS ESG’s Islamic Screening services can be found on this link.

By Casey Lea, Executive Director, ISS EVA