Since the start of the century, intermediaries have witnessed dramatic changes in how they interact with clients and how they are paid. Over the period, the advisor’s primary role shifted from fund selection to portfolio building to holistic financial planning. This evolution from investment advisor to financial life coach coincided with a move from transaction-based to fee-based compensation models. Instead of earning commissions for selling funds, advisors increasingly levy a percentage fee on clients’ total assets under management (AUM).

For advice givers, the benefits of an AUM-based business models are pretty clear. Commission-based income can be erratic and may incentivize unnecessary trading, creating conflicts of interest between advisor and investor. By contrast, fee-based approaches appear better aligned with client interests and provide steadier—and potentially fatter—revenues.

Toward greater independence

Capturing a larger share of the financial benefits of the fee-based model has motivated a growing share of advisors to go independent, either as a sole proprietor or as a partner in an independent firm. Longtime advisors with large books of business have found independence especially alluring: Why work as an employee for a traditional advice provider when you can turn your AUM into a lucrative revenue stream as an independent operating your own business? (While an independent advisor might affiliate with a larger financial entity for back-office support, they are not required to use its proprietary products or meet minimum sales requirements of a larger firm.)

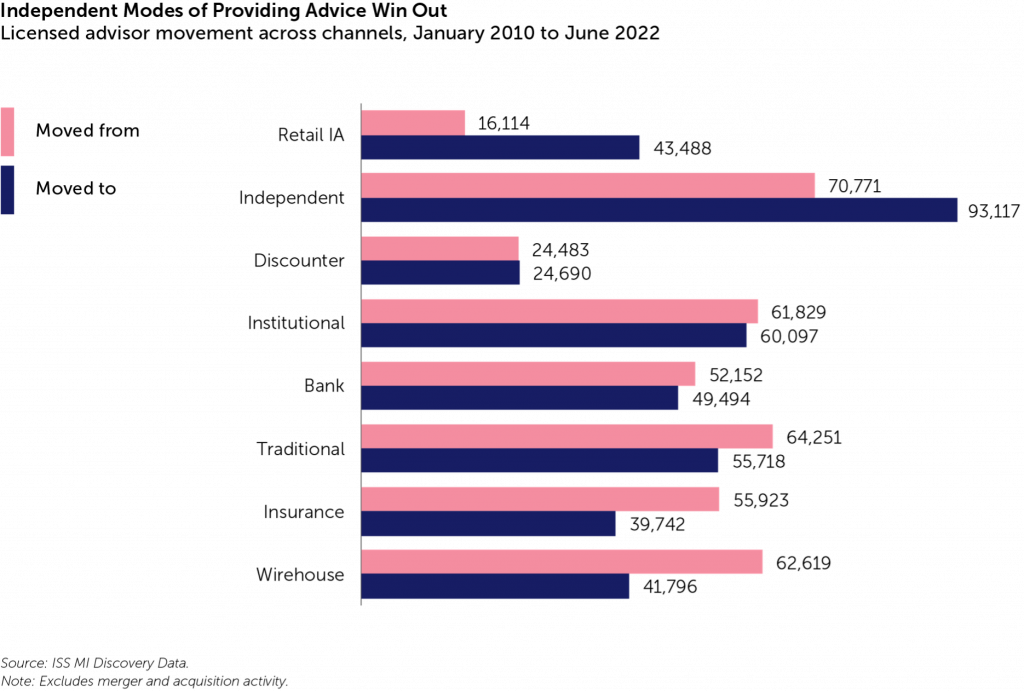

The impact of the long-running trend toward greater independence is on full display in the above figure, which uses an analysis by ISS MI Discovery Data tracking movements in advisor populations since January 2010. The data, detailed in our recently published State of the Market—Intermediary Distribution report, show that retail RIAs (“Retail IA”) were best able to lure advisors from other channels and saw new arrivals outstrip departures by the widest margin. As fiduciaries are required to put client interests first, RIAs generally enjoy more independence than any other channel. The independent broker-dealer segment (“Independent”), which is characterized by relatively limited support from the home office, also saw more advisors come aboard than leave by a significant degree.

By contrast, wirehouse firms like Merrill Lynch and Morgan Stanley lost the most advisors to competing channels over the period partly because wirehouses have pruned underperforming advisors to pursue the highest net worth clients. Independent brokers and RIAs have also attracted high-producing wirehouse teams with generous payouts and a path to a fee-based business. Despite similar efforts, traditional firms (such as Edward Jones and Stifel) witnessed more advisors leave the channel than join it, as have the more proprietary-oriented bank and insurance channels.

A challenge—and opportunity—for asset managers

No doubt, advisors’ transition to fee-based business models challenged asset managers that historically relied on commission-based sales for growth. The shift has been particularly difficult for active managers; faced with cost-conscious clients, most advisors would rather minimize expenses by choosing low-cost index funds than by cutting their own fees.

With advisors shifting from facilitating transactions to overseeing financial lives, success requires understanding clients’ goals and risk appetites and less time managing the nitty gritty of client portfolios. Developing client relationships—and building new ones—are also crucial to growing assets, the obvious lifeblood of any fee-based business. The need to spend more time with clients and prospects comes as distributors provide less support; asset managers can help pick up the slack.

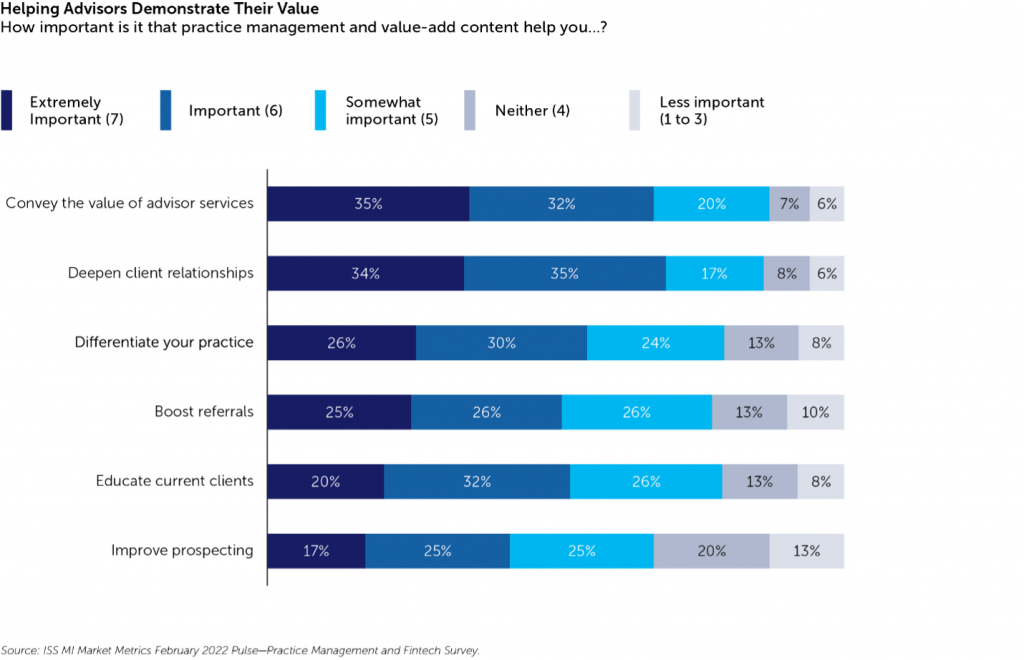

ISS MI’s Market Metrics team surveyed advisors to find out what they need from managers. The table above displays how advisors ranked various practice management and value-add content. Advisors valued most highly content that helped them make their value proposition clearer and which deepened client relationships. Nearly 70% of respondents rated the latter as “extremely important” or “important,” and the former was not far behind.

Helping advisors meet client needs requires a multi-front effort. Model portfolios provide a ready-made template asset allocation and investment selection, enabling advisors to outsource some—or all—portfolio management duties to another party. Manager-provided technology might help advisors manage risk. Education empowers advisors to make better decisions and run their practices more effectively. Managers that can deploy capabilities like these will have an advantage in the race to meet intermediaries’ evolving needs.

______________

Simfund Enterprise subscribers can access the State of the Market—Intermediary Distribution Report on the Simfund Research portal. For more information about this report, or any of ISS MI’s research offerings, please contact us.

By: Christopher Davis, Head of U.S. Fund Research, ISS Market Intelligence