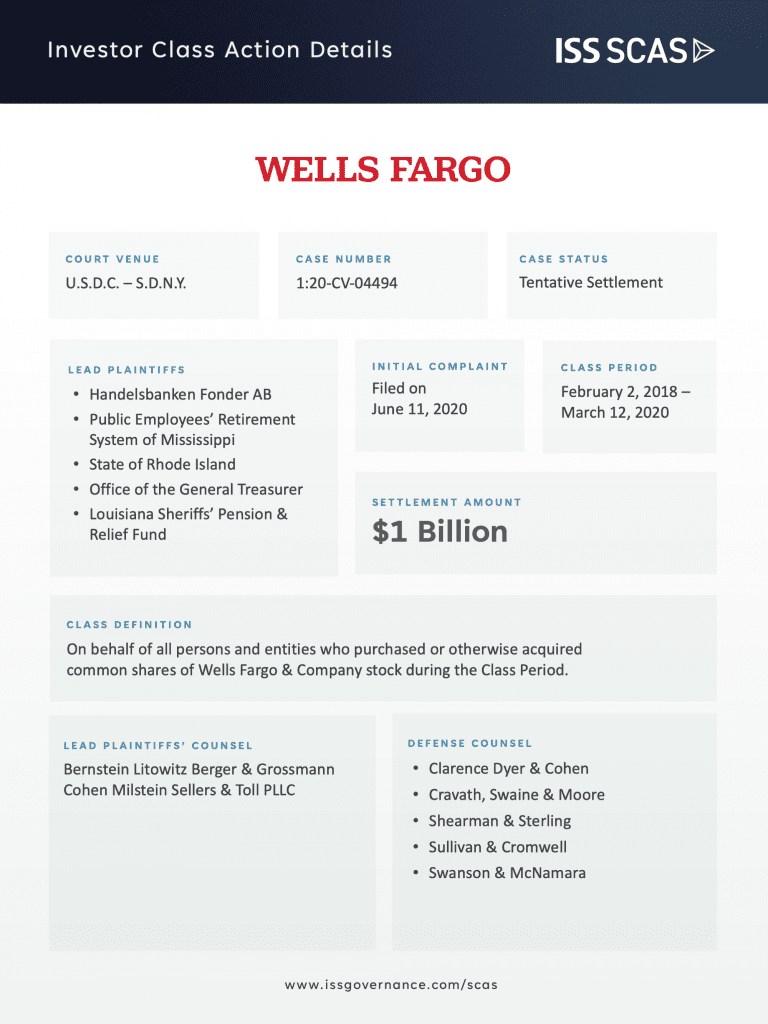

Investors’ $1 billion tentative settlement – a Top 20 settlement of all time if approved – comes in the wake of years of scandal and resolves allegations that the bank concealed its inability to clean up its act. Prior scandals that shook the company include opening of millions of unauthorized bank accounts and charging thousands of borrowers for unnecessary insurance, but this new settlement concerns what the bank allegedly did (or did not do) in the aftermath.

After a decades-long history of “reckless” and “unsound” practices, federal regulators imposed punitive consent orders on Wells Fargo, requiring the bank to implement a three-stage compliance and corporate oversight overhaul. The Federal Reserve’s consent order included an unprecedented “asset cap” that prevented Wells Fargo from growing its assets until it satisfied requirements — a punishment market commentators referred to as the “Fear of God Penalty.”

In 2018 and 2019 though, Wells Fargo allegedly misled investors about its compliance with the consent orders, conveying to the market it had passed Stage 1 and was focused on the later execution stages. In reality, Wells Fargo’s compliance overhaul allegedly failed to get off the ground and was nowhere near meeting the requirements imposed by federal regulators. Wells Fargo was also alleged to have given investors an unrealistically short timeframe for lifting the asset cap, despite knowing that the removal would be significantly delayed.

The truth was finally revealed in March 2020, when members of the U.S. House of Representatives – seemingly fed up with the bank’s alleged transgressions – convened multiple days of hearings and issued “damning” reports, totaling over 200 pages. During the hearings, members of Congress ridiculed the bank’s board for the “shameful attack” on the “trust and confidence of the American people,” and recommended criminal charges against former CEO Timothy Sloan for inaccurate and misleading statements. Current CEO Charles Scharf also admitted to the bank suffering from a “broken” culture and “flawed business” model.

As the truth was revealed, Wells Fargo’s stock plummeted, wiping out $54 billion in market capitalization, including a 22.5% stock drop following the conclusion of the congressional hearings.

Here is a closer look at the events that led to the $1 billion settlement:

- In 2016, the Consumer Financial Protection Bureau (“CFPB”) and the Office of the Comptroller of the Currency (“OCC”) fined Wells Fargo $135 million for secretly opening deposit and credit card accounts without its customers’ authorizations. In addition, the CFPB and OCC mandated that Wells Fargo enter into consent orders aimed at preventing future misconduct.

- In 2017, Wells Fargo admitted that the bank opened over 3.5 million sham bank accounts without client authorization — nearly twice as many as initially thought. News also broke that it had charged hundreds-of-thousands of borrowers for unneeded and unrequested auto-protection insurance.

- In February 2018, the Federal Reserve voted unanimously to impose its own consent order against Wells Fargo, requiring the bank to comprehensively overhaul its governance and risk management processes through the implementation of a detailed three-stage plan. The Federal Reserve’s order included an “asset cap” preventing the bank from increasing its assets beyond $2 trillion until it satisfied the requirements of the consent order.

- On April 20, 2018, the OCC and the CFPB imposed additional consent orders on the bank and fined it over $1 billion for continuing to operate in a manner that was “reckless, unsafe, or unsound” and in violation of federal banking and lending laws. The OCC and CFPB’s decrees also provided detailed three-stage “action plans” for compliance.

- On March 12, 2019, then-CEO Timothy Sloan testified before Congress, assuring House Representatives that the bank was making progress against its action plans. Sloan, however, allegedly failed to disclose that the Federal Reserve had one day earlier rejected its Stage 1 Plan for “[p]ervasive inaccuracies,” and he was ousted by the board two weeks later.

- In March 2020, the House Financial Services Committee released its findings following its year-long investigation into Wells Fargo, concluding that the action plans submitted to the bank’s regulators were “shoddy” and “incomplete,” and that its executives made a series of false and misleading statements to the public and Congress.

- At the time of the March 2020 hearings, Chairwoman Maxine Waters called on two of the bank’s board members to resign, and recommended that the U.S. Department of Justice investigate whether Sloan could be charged criminally for lying to Congress.

The class action was initially filed in June 2020, a few months after the Congressional hearings. In September 2021, the Honorable Judge Woods denied defendants’ motion to dismiss the lawsuit, except with respect to claims against current-CEO Charles Scharf. The $1 billion settlement was then reached following mediation while motions for class certification were still pending.

Once legally resolved, this shareholder class action will become tied with Dell Technologies for the seventeenth largest securities-related settlement of all-time.

This settlement adds to a litany of substantial settlements against Wells Fargo, including a $300 million tentative settlement reached earlier in the year, which ISS SCAS previously covered. That prior settlement resolved allegations regarding unnecessary auto-protection insurance charges, which in part led to the federal regulators’ consent orders.

With this newly announced settlement, Wells Fargo will have paid a total of $2.2 billion across five other securities-related class action settlements and one SEC Fair Fund from the past 12 years. Other notable payouts made by the bank include a $500 million fair fund in February 2020 and a $480 million class action settlement in December 2018.

Wells Fargo has also paid billions in fines to regulators, including most recently yet another fine from the CFPB, this time $3.7 billion for allegations of improper charges and interest on auto loans and mortgages.

ISS Securities Class Action Services will continue to monitor and file claims for this high-profile action if it progresses toward an official settlement.

By: Jarett Sena, Esq., Director of Litigation Analysis, ISS Securities Class Action Services