Introduction

Organizations that report on climate change have highlighted that record-setting temperatures earlier in 2023 are not “just a set of numbers,” as NASA Administrator Bill Nelson put it, but have real-world impact. A recent paper in the journal Nature Communications estimates that the annual direct impact of climate change manifested through extreme weather events is roughly $143 billion per year.

Given concerns about climate change, global climate regulation has dramatically expanded and continues to shape how the world of finance reacts to climate issues in investment processes. The Climate Policy Radar has identified over 5,000 laws and policies globally that target climate change in one form or another. Over the past year, for example, this database identified nearly a dozen new pieces of legislation that mention or address the concept of “financed emissions.” In tandem, sustainability reporting has also expanded dramatically over the past 20 years. The United Nations Conference on Trade and Development (UNCTAD) reported that by the end of 2021, 316 sustainable-finance-dedicated policy measures and regulations existed across 35 economies and country groupings, with sustainability disclosures and sector-specific measures accounting for the majority of these initiatives. Regulation in the European Union (EU) has helped to lead this trend toward greater climate-relevant financial regulation.

As a further sign of the development of climate regulation and policy, the 2023 United Nations Climate Change Conference will convene the Conference of the Parties (COP28) in Dubai in late November, for the 28th set of annual meetings on this topic. Diplomats, policymakers, regulatory bodies, and corporate representatives will meet to discuss aspects of climate change. In total, roughly 70,000 people are estimated to attend this year’s COP, including King Charles and Pope Francis. Topics for discussion include an assessment known as the “global stocktake,” a “loss and damage” climate fund, and a potential multinational climate agreement.

In the context of heightened awareness of climate change and expanding climate regulation, this review considers some of the major regulatory and disclosure developments in the EU, with a focus on the European Sustainability Reporting Standards (ESRS), followed by a review of the International Sustainability Standards Board (ISSB)’s work and finally concluding with trends in the United States.

ESRS and ISSB Analysis

The sustainability reporting landscape took a major turn this year when, in June and July, two major standards-setters published their requirements only weeks apart. In June, the International Sustainability Standards Board (ISSB) published its own Sustainability Disclosure Standards to provide a global baseline for sustainability disclosures. A few weeks later, in July, the European Commission (EC or the Commission) published the final version of the first set of sector-agnostic European Sustainability Reporting Standards (ESRS) under the new Corporate Sustainability Reporting Directive (CSRD).

ESRS

The aim of the CSRD, which has been in force since January 2023, is to bring sustainability reporting on par with financial reporting. To achieve this objective, companies must provide relevant, comparable, and reliable information on their sustainability-related impacts, risks, and opportunities.

The ESRS include detailed and standardized disclosure requirements for companies to report on Environmental, Social, and Governance (ESG) matters, with ESRS E1 focusing on climate-related disclosures. The ESRS E1 follows the Task Force on Climate-Related Financial Disclosures (TCFD) structure by including disclosure requirements across the categories of Governance, Strategy, Risk Management, and Metrics and Targets. Companies reporting against TCFD would already be prepared to some extent for such requirements. The ESRS E1 requires more detailed disclosure, which will increase the transparency of companies’ climate-related activities.

Disclosures on Transition Plans and Measurable Targets

Investors’ Net Zero strategies have evolved in recent years not only to examine companies’ Net Zero targets but also whether companies are well positioned to mitigate transition risks and to identify potential opportunities. For this reason, investors’ demand for companies to provide transition plan details has been growing.

Identifying a credible transition plan involves consideration of multiple elements such as quantitative measures for decarbonization; technology adoption and decarbonization details, which should be sector specific; and abatement costs. Disclosures of transition plans are very diverse and can be documented in many different reports (sustainability reports, TCFD reports, investors reports, etc.), often lacking comparability and most generally qualitative descriptions.

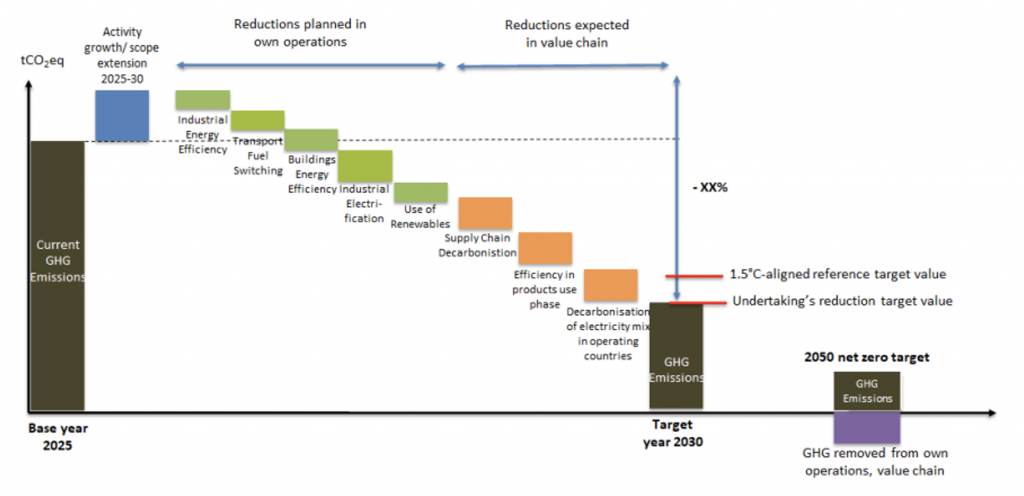

In terms of conditions, ESRS E1-1 requires the disclosure of transition plans to achieve a lower-carbon economy and limit global warming to 1.5°C in line with the Paris Agreement, as well as GHG emissions reduction targets details. The ESRS recommends companies disclose all this information together, to bridge the relationship between quantitative targets and climate mitigation actions. Figure 1 presents some possible climate mitigation actions companies might take, for each of which companies should identify the percentage GHG reduction to be achieved.

Figure 1: Targets Related to Climate Change Mitigation and Adaptation

Source: ESRS E1, Extract of ESRS E1 – Appendix A – Application requirements – Disclosure Requirement E1-4

ESRS also requires detailed quantitative information such as monetary amounts of capital expenditure (CapEx), planned CapEx, and operating expenses (OpEx), and how these amounts compare to the resources needed to implement climate mitigation actions.

Another important ESRS E1 requirement is to provide information not only on “green” CapEx, but also “brown” CapEx. Brown CapEx refers to CapEx in the current reporting year related to coal and oil, and to significant CapEx amounts invested during the reporting year related to coal, oil, and gas-related economic activities. The goal is to allow stakeholders to compare the level of potential investment in transition plans versus the expansion in fossil fuel-related activities. One without the other does not provide enough information for this analysis. For example, many companies can state a very strong qualitative transition plan, but comparing their “green” CapEx to their “brown” CapEx shows that expansion in fossil fuel-related activities is still largely predominant, which can provide additional insight into their climate commitments.

Energy Consumption and Energy Mix Requirements

For certain sectors, adequately accounting for energy consumption in climate scenario analysis requires a high level of detailed information. Such detailed disclosure, about both a company’s energy consumption and which energy sources the company uses (energy mix) is required under ESRS. Greater availability of such information because of ESRS requirements may help refine climate scenario analysis in the future. Climate scenarios models usually represent the behavior and interactions between different systems and most importantly the energy system, providing pathways for energy demand, energy transformation, and energy supply. Greater transparency on energy consumption and sources provides additional granularity and inputs to refined scenario analysis.

Adding to the importance of energy consumption and energy mix data in the transition to a low carbon future, Sultan al-Jabber, president-designate of this year’s COP28, noted that the oil and gas industry must prepare for the inevitable “phase down” of fossil fuels. At COP28, one important discussion topic has been this “phase-down” approach, which aims to gradually reduce the use of fossil fuels over time rather than simply ceasing activities in this area.

ISSB

ISSB published, on June 26, 2023, the first two Sustainability Disclosure Standards: IFRS S1 “General Requirements for the Disclosure of Sustainability-related Financial Information” and IFRS S2 “Climate-related Disclosures.”

Both S1 and S2 draw heavily on TCFD’s four core pillars requiring disclosure on Governance, Strategy, Risk Management, and defined Metrics and Targets. The IFRS S1 standard expands on TCFD, however, going beyond climate-related financial disclosures to include other sustainability-linked risks a company might be materially exposed to.

Sector-Specific Requirements

IFRS S2 is focused on climate-related disclosure and remains very much aligned with the TCFD, especially the Strategy pillar, under which climate resilience and climate scenario analysis remain a requirement, a key element of the TCFD recommendation published in 2017.

However, the ISSB goes further in developing sector-based disclosures. While the TCFD had required only specific disclosures for the financial sector, ISSB requires disclosure targets and metrics beyond the seven original TCFD cross-industry metrics, following SASB’s standard additional sectoral metrics. While these disclosures are to be assessed against materiality and usefulness to primary users, they mark an important step forward, especially for hard-to-abate sectors, due to the level of granularity required for some of the additional SASB-related metrics.

In the industry-based guidance released by ISSB, additional sector-specific, activity-related metrics are required. Figure 2 highlights the sub-industries and the metrics included in the IFRS S2 industry-based guidance for extractives and processing sub-sectors.

Figure 2: IFRS Industry-Based Guidance on IFRS S2 Climate-Related Disclosures: Extractives & Mineral Processing Sub-Sectors

| Sub-industries | Activity-related metrics | Unit |

| Coal operations | Production of thermal coal | Million metric tons (Mt) |

| Production of metallurgical coal | Million metric tons (Mt) | |

| Construction Material | Production by major product line (cement and aggregates, composites, roofing materials, fibreglass, brick and tile, or others) | Metric tons (t) |

| Iron & Steel Producers | Raw steel production, percentage from (1) basic oxygen furnace processes and (2) electric arc furnace processes | Metric tons (t), Percentage (%) |

| Total iron ore production | Metric tons (t) | |

| Total coking coal production | Metric tons (t) | |

| Metals & Mining | Production of (1) metal ores and (2) finished metal products | Metric tons (t) saleable |

| Oil & Gas – Exploration & Production | Production of: (1) oil, (2) natural gas, (3) synthetic oil, and (4) synthetic gas | Thousand barrels per day (Mbbl/day); Million standard cubic feet per day (MMscf/day) |

| Number of offshore sites/terrestrial sites | Number | |

| Oil & Gas – Midstream | Total metric ton-kilometres of: (1) natural gas, (2) crude oil, and (3) refined petroleum products transported, by mode of transport | Metric ton (t) kilometres |

| Oil & Gas – Refining & Marketing | Refining throughput of crude oil and other feedstocks | Barrels of oil equivalent (BOE) |

| Refining operating capacity | Million barrels per calendar day (MBPD) | |

| Oil & Gas – Services | Number of active rig sites | Number |

| Number of active well sites | Number | |

| Total amount of drilling performed | Metres |

Notes: “Metric ton (t) kilometres” measures the number of metric tons of oil or gas transported (by pipeline, marine shipping, etc.) per kilometre.

Source: ISSB

The IFRS S2 sector-specific, activity-related disclosure requirements are very important for multiple reasons:

- Production-level activities are more accurate and can be translated into production-related intensity metrics (e.g., tCo2e per ton of steel produced, per km of produced cars) largely independent of economic variables such as revenue, and have no market or price volatility, compared to carbon intensities based on enterprise value or revenues. These characteristics can make it easier to track the real emissions reductions in isolation, and can allow the comparison of performance between companies in the same sector.

- Net Zero frameworks and regulatory requirements: The demand for such data points has been growing among investors on the back of Net Zero frameworks recommending production-based intensity metrics related to targets. This occurs in the context of regulatory requirements, including, EBA pillar 3 – template 3 – Climate change transition risk alignment metrics. These metrics mandate institutions to disclose information on their alignment efforts with the IEA Net Zero 2050 scenario pathway on 8 key sectors: Power; Fossil fuel combustion; Automotive; Aviation; Maritime transport; Cement clinker and lime production; Iron and steel, coke and metal ore production; Chemicals. This information leverages key performance metrics on technology mix and production-based metrics.

Production-related data relevant to the transition to a low-carbon economy are still largely under-reported in certain key sectors. For example, ISS ESG currently provides production-based intensities for sectors such as Oil & Gas and power generation (see ISS ESG Energy & Extractives data set). However, disclosure requirements, which would expand data availability and increase transparency for additional high-impact sectors, such as transport or construction materials, would be valuable.

While ISSB has been setting up those sector-specific requirements, ESRS E1 under CSRD has surprisingly been focusing on greater granularity in consumption-related, rather than production-related, disclosures. Also, the EBA Pillar 3 standards for ESG climate-related disclosures require financial institutions to report on production-related key performance indicators, so as to disclose their alignment efforts with the Paris Agreement objectives.

Scenario Analysis and Climate Resilience

In contrast to the expanded sector-specific and production-related requirements, the IFRS S2 scenario-alignment requirements are quite minimal. While TCFD requirements call for alignment with the Paris agreement and limiting global warming to 1.5 °C, IFRS S2 states that an entity “shall use climate-related scenario analysis to assess its climate resilience using an approach that is commensurate with the entity’s circumstances” and shall report “whether the climate-related scenarios used for the analysis are associated with climate-related transition risks or climate-related physical risks.”

Climate Change Regulation in the United States

Securities and Exchange Commission (SEC)

The U.S. Securities and Exchange Commission (SEC) has proposed amendments to rules governing climate-related disclosures that would enhance and standardize these rules. The proposed rule amendments would require registrants to file information that includes the following disclosures:

- Climate-related risks and their material impact on business

- Governance of climate-related risks

- Greenhouse Gas emissions

- Climate-related financial statement metrics

- Information about climate-related targets and transition plans

Postponed Implementation

Across these disclosure categories, the SEC’s proposed rule was first issued in March 2022, with a stated date of implementation of 2024. At present, the proposed rule has not been adopted, suggesting that implementation will be pushed back at least an additional year. SEC Chair Gary Gensler has declined to give a timeline for when the rule may move forward. In comments given to the Senate Banking Committee in September 2023, Gensler noted that “we try not to do things against a clock.”

Some critics, including Tom Quaadman of the U.S. Chamber of Commerce, have raised concerns that the implementation period for the proposed legislation is significantly more aggressive than comparative legislation such as the CSRD. To address these and similar criticisms since the proposed rule was first issued, the SEC has held a lengthy period of public comment to solicit feedback. The SEC has received more than 16,000 comments on the proposal.

Common criticisms in the SEC’s feedback often relate to cost of compliance, overlapping and duplicative reporting regimes in multiple jurisdictions, and concerns over Scope 3 disclosure requirements. These criticisms are in spite of the current proposal including safe harbor liability for Scope 3 emissions disclosures, a later phase-in of Scope 3 reporting requirements, exemption from disclosure requirements for smaller reporting companies, and exemption from reporting Scope 3 emissions if they are deemed not material.

State-Level Divergences

The discussion around the SEC’s proposed climate rule has at times mirrored the broader regulatory discussion in the United States on sustainability, climate, and ESG. Different states have adopted different approaches to these issues. In some states, bills have been introduced to limit aspects of ESG in investment processes. Other state bills aim to encourage ESG criteria.

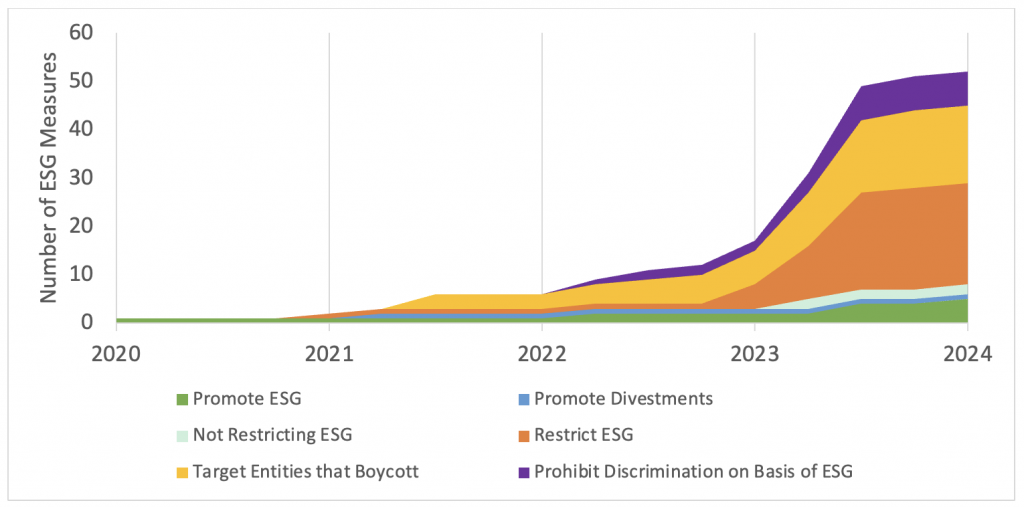

Most state-level laws relate to ESG factors being incorporated into public pension investing. These trends have accelerated since 2022, as the vast majority of bills have had effective implementation dates only over the past two years. Figure 3 highlights the growth in these trends, showing a large increase in bills that either restrict the use of ESG criteria or explicitly target entities that boycott certain sectors in their public pension investing (e.g., coal divestment policies).

Figure 3: Cumulative Number of State-Level ESG Measures in the United States

Source: Ropes & Gray

An analysis by the law firm Ropes & Gray notes that as of October 31, 2023, only three states – North Carolina, Wisconsin and Arizona – participate in multiple coalitions (e.g., coalitions of state attorneys general) that have taken both anti- or pro-ESG stances.

Climate Regulation in California

Despite the delayed adoption of the SEC’s climate rule, the U.S. mandatory disclosure landscape changed significantly this year, with two California bills being adopted into law.

Senate Bills

Senate Bill No. 253 (SB 253) is a measure that requires large corporations that do business in California to publicly disclose their greenhouse gas emissions, while Senate Bill No. 261 (SB 261) requires companies to publish a TCFD-aligned climate-related financial risk report. Both bills are scheduled to go into effect between January 1, 2026, and January 1, 2027, depending on the specific provisions of reporting, although the final implementation regulations and guidelines have not yet been determined.

Scope

Given the terms of inclusion and the legal definitions of “doing business” in California, SB 253 is estimated to impact approximately 5,000 companies, while SB 261 is estimated to impact approximately 10,000 companies. In contrast, the pending SEC climate disclosure regulations are estimated to apply to approximately 8,000 companies—although in comments at the U.S. Chamber of Commerce, SEC Chair Gensler suggested that the disclosure rules would apply for between 6,000 and 7,000 registrants.

Also in contrast with the SEC proposed rule, which applies to public registrants (in keeping with the SEC’s remit), the California legislation also applies to private companies. For example, one evaluation estimates that of the 10,000 companies with revenues of more than $500 million that do business in California and that are subject to SB 261, 80% of the covered entities are private.

Conclusion

Over the past few years, much progress has been made on climate change regulation, highlighted by the new and interesting developments found within the ESRS, ISSB, and legislation in the United States. While the application of ESG for companies and investments has often been opinionated or partisan, the general thrust of these developments has been towards increased transparency and comparability between different reporting regimes and standards. Further, the large attendance and media presence at COP28 reflects the growing global awareness and concern about climate-related risks.

Nevertheless, at COP28 this year, the global stocktake, an initiative intended to assess progress on the Paris Climate Change Agreement, notes that the world is currently not on track to limit anthropogenic warming to 1.5°C. According to the UNFCCC, what is needed is a combination of lower greenhouse gas emissions and more widely adopted climate resilience and development measures.

While COP28 intends to focus on introducing climate change discussions within countries across the globe, this review has illustrated that requirements and areas of focus vary by region. Within this context, ISS Climate Solutions and ISS ESG Regulatory Solutions can help investors to analyze climate risks and regulatory issues within their portfolios. These climate tools serve to present the data needed to analyze a portfolio’s alignment within different future climate scenarios; measure a portfolio’s Scope 1, 2, and 3 emissions exposure; analyze vulnerabilities due to increasing physical risks of climate change; and offer a host of detailed assessments measuring transition risk and opportunities.

Explore ISS ESG solutions mentioned in this report:

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Financial market participants across the world face increasing transparency and disclosure requirements regarding their investments and investment decision-making processes. Let the deep and long-standing expertise of the ISS ESG Regulatory Solutions team help you navigate the complexities of global ESG regulations.

By: Candice Coppere, Climate Analytics Head, ISS ESG

Sam Schrager, US Climate Analytics Lead, ISS ESG