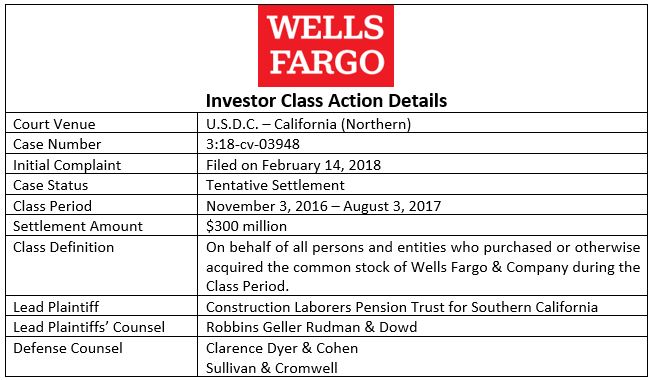

Wells Fargo & Co. has agreed to a $300 million tentative settlement, resolving allegations that the bank hid from investors that it was unnecessarily charging customers for auto-collision protection insurance.

From about 2006 to 2016, Wells Fargo was alleged to have enrolled more than 800,000 of its auto loan customers, without their knowledge, in expensive insurance they did not need or want. The alleged practices pushed approximately 274,000 of its customers into delinquency and resulted in 27,000 vehicle repossessions. The collateral protection insurance, which the bank required, was allegedly “redundant” and more expensive than the auto insurance that customers had already obtained on their own.

The consolidated complaint – filed on August 31, 2016 – alleges Wells Fargo was aware of the illicit practices by 2016. However, Wells Fargo purportedly concealed these issues from investors for more than a year, just as the company was “reeling” from the disclosure of the opening of millions of fake deposit and credit accounts in the names of its customers. When a New York Times article exposed some of the practices in July 2017, the company admitted in a press release and in a subsequent 10-Q filing with the SEC that it had been aware of the problems previously. The complaint specifically alleges:

- The company reported the problem to the Office of the Comptroller of the Currency (“OCC”) in the summer of 2016; and senior executives received a detailed 60-page report describing the illicit practices in September.

- Despite well-documented problems with its auto insurance practices, Wells Fargo repeatedly failed to disclose the practices to investors, while boasting about the strides it had made in correcting the reputational harm caused by the fake account scandal.

- Wells Fargo and Former CEO Timothy Sloan were asked whether they knew about misconduct outside of the already disclosed improper retail banking sales practices, and each time, they failed to disclose the collateral protection insurance issues.

- In a July 2017 press release, Wells Fargo disclosed that it in response to customer concerns, Wells Fargo initiated a review of the collateral protection insurance program in July 2016 and discontinued that program in September 2016.

- Sloan also stated in testimony before a U.S. Senate Committee that he had been aware of the problem “in 2016, in late August, early September.”

The $300 million settlement – representing 31% to 47% of estimated investor damages – comes after the parties began to ramp up for trial set to take place on February 27, 2023. The Court had previously granted in part and denied in part a motion to dismiss on January 10, 2020, and certified the class on August 15, 2022. Once legally resolved, this shareholder class action will become one of the Top 100 U.S. class actions of all-time, specifically placing it in at 61st largest (tied with Oxford Health Plans from 2003, DaimlerChrylser from 2004, Bristol-Myers Squibb from 2004, and General Motors from 2016). The company was also fined $500 million by the OCC and the Bureau of Consumer Financial Protection for the “unsound” practices.

In addition to this newly announced settlement, shareholders have obtained a total of $1.2 billion across four other class action settlements and one SEC Fair Fund from the past 12 years, including:

- A $480 million settlement in December 2018, resolving the infamous “fake accounts” scandal, where the bank’s alleged aggressive cross-selling mandate allowed employees to open millions of new accounts without customers’ authorization.

- A $125 million settlement in November 2011, resolving allegations the bank disregarded the underwriting guidelines set forth in its own loan origination documents.

- A $62.5 million settlement in August 2014, resolving allegations the bank did not invest collateral funds in safe, liquid, short-term investments, and instead improperly invested proceeds in high risk, long-term securities.

- A $43 million settlement in May 2019, resolving allegations that Wells Fargo as Trustee to 261 private-label Residential Mortgage-Backed Securities Trusts failed to discharge its duties and obligations to protect the Trusts, and knew the pools of loans backing the Trusts were filled with defective mortgage loans.

Furthermore, as it relates to the “fake accounts” practice, Wells Fargo agreed to a $3 billion settlement with the United States Securities and Exchange Commission, $500 million of which was earmarked to investors as part of a Fair Fund.

ISS Securities Class Action Services will continue to closely monitor this high-profile action as it progresses toward an official settlement and communicate updates to its clients and the investment community, as developments occur.

By: Jeff Lubitz, Managing Director, ISS Securities Class Action Services, and Jarett Sena, Esq., Director of Litigation Analysis, ISS Securities Class Action Services