Each month ISS ESG’s team of specialist analysts releases an update on the ESG risks associated with a specific industry. The InFocus reports focus on the ISS ESG Corporate Rating for companies within each sector, and also provides headline results from other ISS ESG product lines. This month, the InFocus is on: Commercial Banks & Capital Markets

KEY TAKEAWAYS

- As the world starts to look to the future, regulators, oversight authorities, and policy makers are becoming more vocal about the need for greater business adoption of Environmental, Social and Governance (ESG) practices, especially in the Commercial Banks & Capital Markets industry.

- The industry must prioritize sustainable investment criteria, improve positive impacts, and mitigate negative ones through their lending products.

- The Commercial Banks & Capital Markets industry has a slightly larger share of Prime companies than the broader ISS ESG ratings universe. While the creditworthiness of a financial institution remains a key consideration for investors today, exposure to climate risk is playing an increasing role in these decisions.

- There is a growing perception that banks are not doing enough to avoid the unintended consequences of providing capital to entities that are contributing to the externalities caused by climate change.

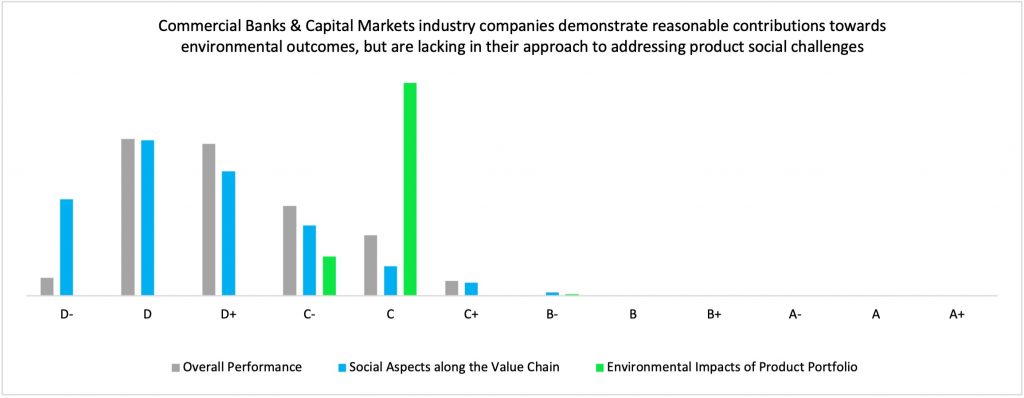

- ISS ESG data shows that most of the Commercial Banks & Capital Markets industry obstructs the achievement of the SDGs. With a major focus still on environmental aspects, low-to-mediocre performance in the social aspects of the rating is dragging the industry’s overall results down.

- The demand for greater disclosure is being embraced as one of the many tools to support the development and execution of sustainable business practices. Capital will likely flow toward businesses that are supporting sustainable endeavors, while capital will be increasingly costly for those that do harm.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

- Use ISS ESG Climate Solutions to help you gain a better understanding of your exposure to climate-related risks and use the insights to safeguard your investment portfolios.

- Assess companies’ adherence to international norms on human rights, labor standards, environmental protection and anti-corruption using ISS ESG Norm-Based Research.

- Understand the impacts of your investments and how they support the UN Sustainable Development Goals with the ISS ESG SDG Solutions Assessment and SDG Impact Rating.

- Understand the F in ESGF using the ISS EVA solution.

- Use ISS ESG Sector-Based Screening to assess companies’ involvement in a wide range of products and services such as alcohol, animal welfare, cannabis, for-profit correctional facilities, gambling, pornography, tobacco and more.

By Gaurav Jagarwal, Associate – Research, ISS ESG. Victoria Nguyen, ESG Analyst, ISS ESG. Dietrich Wild, Vice President – Research, ISS ESG. Roberto Lampl, Executive Director – Sector Head Financials & Real Estate, ISS ESG.